Life insurance is often seen as a crucial financial tool for protecting one's family and assets, but there are those who argue that it is not essential for everyone. Some may believe that life insurance is unnecessary if one has a robust financial plan, sufficient savings, and a supportive network of family and friends. Critics of life insurance suggest that the premiums can be costly and may not provide the expected value, especially if one's financial situation is stable and secure. This perspective challenges the conventional wisdom that life insurance is a must-have for all, prompting a discussion on the potential benefits and drawbacks of this financial product.

What You'll Learn

- Longevity: People live longer, reducing the need for immediate financial support

- Alternative Savings: Investing in stocks, bonds, or real estate can offer better returns

- Debt Management: Effective debt management can provide financial security without insurance

- Health Focus: Prioritizing health and wellness may be more beneficial than insurance

- Risk Assessment: Understanding personal risks can lead to more tailored financial strategies

Longevity: People live longer, reducing the need for immediate financial support

The concept of life insurance has been a cornerstone of financial planning for centuries, but in an era where longevity is increasing, its relevance is being questioned. As medical advancements and improved lifestyles contribute to longer life expectancies, the traditional reasons for purchasing life insurance are being re-evaluated. One of the primary arguments for life insurance is the provision of financial security for loved ones in the event of the insured's death. However, with people living longer, the need for immediate financial support from life insurance policies is diminishing.

In the past, life insurance was crucial to provide for families who might otherwise struggle financially if the primary breadwinner were to pass away. The typical life insurance policy would ensure a lump sum payment or regular income to cover essential expenses, such as mortgage payments, education costs, or daily living expenses, during the bereaved period. But with extended life spans, the likelihood of needing such immediate financial assistance decreases. Older individuals are more likely to have accumulated sufficient assets, savings, or retirement plans to sustain themselves and their families over the long term.

Moreover, the nature of retirement and post-retirement life has evolved. Modern retirement plans often include a mix of pensions, social security benefits, and personal savings, providing a more comprehensive financial safety net. This shift in retirement planning means that individuals are less dependent on the financial windfall that a life insurance policy might provide. As a result, the urgency for immediate financial support is reduced, making the traditional role of life insurance less critical.

Additionally, the increasing prevalence of chronic illnesses and the associated healthcare costs can be managed more effectively through advanced planning and medical advancements. With proper healthcare management and a focus on preventive care, individuals can maintain their health and independence for longer periods, reducing the need for life insurance as a primary source of financial security. This shift in healthcare trends further emphasizes the changing dynamics of financial planning and the potential obsolescence of certain insurance products.

In conclusion, the increasing longevity of individuals is a significant factor in questioning the importance of life insurance. As people live longer and healthier lives, the need for immediate financial support from insurance policies diminishes. This shift in demographics and financial planning strategies highlights the evolving nature of insurance needs and the potential for re-evaluating traditional insurance products to better suit the changing demands of a longer-living society.

Navigating Legal Life Changes: Insurance Implications Unveiled

You may want to see also

Alternative Savings: Investing in stocks, bonds, or real estate can offer better returns

Life insurance is often seen as a necessary safeguard, but it may not be the best financial decision for everyone. While it can provide financial security for your loved ones in the event of your passing, it's important to consider alternative savings and investment options that can offer more significant long-term benefits. Here's why investing in stocks, bonds, or real estate might be a better choice for your financial future:

Higher Returns: One of the primary reasons to consider alternative savings methods is the potential for higher returns. Stocks, bonds, and real estate have historically provided more substantial long-term gains compared to the relatively low-interest rates often associated with life insurance policies. For instance, the stock market has consistently demonstrated the ability to beat inflation over extended periods, offering investors the opportunity to grow their wealth significantly.

Flexibility and Control: Investing in stocks, bonds, or real estate provides you with a higher degree of flexibility and control over your financial decisions. When you invest in the stock market, you can choose specific companies or sectors that align with your financial goals and risk tolerance. Similarly, with real estate, you can decide whether to buy, rent, or flip properties, allowing for a more personalized investment strategy. This level of control is often lacking in traditional life insurance products.

Long-Term Wealth Building: Life insurance, while providing a financial safety net, is typically a short-term commitment. In contrast, investing in stocks, bonds, or real estate is a long-term strategy that can build substantial wealth over time. For example, investing in the stock market allows you to benefit from compound interest, where your initial investment, along with the accumulated earnings, grows exponentially. This can lead to a more substantial financial cushion for your retirement or other long-term goals.

Diversification and Risk Management: Diversifying your investment portfolio is a key strategy to manage risk effectively. By investing in a mix of stocks, bonds, and real estate, you can spread your financial resources across various assets, reducing the impact of any single investment's performance. This diversification can provide a more stable and secure financial future, which is often not the primary focus of life insurance policies.

In summary, while life insurance has its place in financial planning, exploring alternative savings and investment options like stocks, bonds, and real estate can offer more substantial returns, flexibility, and long-term wealth-building opportunities. It's essential to carefully consider your financial goals, risk tolerance, and the time horizon for your investments to make informed decisions that align with your overall financial strategy.

Borrowing from Life Insurance: Genworth's Policy Loan Option

You may want to see also

Debt Management: Effective debt management can provide financial security without insurance

Effective debt management is a powerful tool that can significantly enhance your financial well-being and provide a sense of security, often surpassing the benefits of traditional life insurance. While life insurance is commonly associated with protecting loved ones in the event of an untimely death, it may not be the best approach for everyone. Here's why debt management could be a more comprehensive and relevant strategy for many individuals:

Understanding Debt Management: Debt management involves a strategic approach to handling financial obligations. It focuses on organizing and prioritizing debts to ensure timely payments and minimize interest accumulation. This process often includes creating a budget, prioritizing high-interest debts, and exploring options like debt consolidation or refinancing. By taking control of your debt, you can reduce financial stress and build a more stable financial future.

Financial Security Through Debt Management: Effective debt management offers a unique form of financial security. It empowers individuals to take charge of their financial responsibilities, ensuring that debts are managed efficiently. This proactive approach can lead to several advantages. Firstly, it helps individuals avoid the pitfalls of high-interest debt, which can quickly spiral out of control. Secondly, it provides a sense of control and confidence, knowing that financial obligations are being met consistently. This sense of security can be particularly valuable for those who want to focus on building wealth and achieving financial goals.

Tailored Solutions: One of the strengths of debt management is its adaptability. It allows individuals to create personalized strategies based on their unique financial situations. For instance, those with multiple debts can prioritize paying off high-interest debts first, while also exploring options like debt snowball or avalanche methods. This tailored approach ensures that financial resources are allocated efficiently, providing a more customized path to financial security.

Long-Term Benefits: Unlike life insurance, which provides a one-time payout, debt management offers long-term advantages. By managing debt effectively, individuals can improve their credit scores, making it easier to access loans with favorable terms in the future. This can be crucial for significant financial decisions, such as purchasing a home or starting a business. Additionally, successful debt management can lead to increased financial flexibility, allowing individuals to save for emergencies, invest in assets, or plan for retirement without the burden of overwhelming debt.

In summary, debt management is a powerful strategy that can provide financial security and peace of mind. It empowers individuals to take control of their financial obligations, offering a more sustainable and adaptable approach compared to traditional life insurance. By prioritizing debt management, people can build a robust financial foundation, ensuring a more secure and prosperous future for themselves and their loved ones. This method is particularly relevant for those seeking a comprehensive financial strategy that goes beyond the scope of life insurance.

Fixed Life Insurance: What You Need to Know

You may want to see also

Health Focus: Prioritizing health and wellness may be more beneficial than insurance

In today's world, where financial security is often emphasized, it's easy to overlook the importance of health and wellness. While life insurance is a popular choice for many, prioritizing health and wellness can be a more effective and sustainable way to ensure a secure future. Here's why:

Health and wellness encompass a holistic approach to living, focusing on physical, mental, and emotional well-being. By investing time and effort into maintaining a healthy lifestyle, individuals can significantly reduce the risk of various diseases and illnesses. Regular exercise, a balanced diet, adequate sleep, and stress management techniques are all essential components of a healthy lifestyle. These practices not only improve overall health but also contribute to increased energy levels, better mood, and enhanced cognitive function.

One of the key benefits of prioritizing health is the potential to avoid or manage chronic conditions. Many serious illnesses, such as heart disease, diabetes, and certain cancers, can be prevented or controlled through lifestyle modifications. For instance, maintaining a healthy weight and engaging in regular physical activity can significantly reduce the risk of cardiovascular diseases. Similarly, managing stress and adopting healthy eating habits can help prevent or manage diabetes. By taking proactive measures, individuals can avoid the financial burden and emotional toll associated with long-term illnesses.

Furthermore, a healthy lifestyle can lead to increased longevity and improved quality of life. People who prioritize their health often experience a higher level of vitality and independence as they age. They are more likely to engage in activities they enjoy, maintain social connections, and have a more positive outlook on life. This sense of well-being can be a powerful motivator, encouraging individuals to continue making healthy choices and contributing to their overall happiness.

In contrast, life insurance, while providing financial security, may not offer the same level of long-term benefits. It primarily serves as a financial safety net in the event of death, which is a relatively rare occurrence. The focus on insurance may shift the attention away from the more immediate and impactful aspects of health and wellness. Additionally, life insurance policies often come with various exclusions and limitations, and the financial value of the policy may not always be sufficient to cover all expenses, especially in the long run.

In summary, while life insurance has its place in financial planning, prioritizing health and wellness should be a fundamental aspect of a secure and fulfilling life. By investing in our physical and mental well-being, we can take control of our health, reduce the risk of illnesses, and enjoy a higher quality of life. This proactive approach to health not only benefits individuals but also has the potential to create a positive ripple effect, impacting families, communities, and society as a whole.

California's Life Insurance Tracking System: Does It Exist?

You may want to see also

Risk Assessment: Understanding personal risks can lead to more tailored financial strategies

Understanding personal risks is a crucial step towards creating a robust financial strategy, and it often leads to a reevaluation of traditional financial products, such as life insurance. While life insurance has its benefits, many individuals are discovering that it might not be as essential as once thought, especially when tailored financial strategies are considered. This shift in perspective is empowering people to make more informed decisions about their financial future.

Personal risks encompass a wide range of potential threats to an individual's financial well-being. These risks can be categorized into several key areas: health, income, and longevity. For instance, health risks include the potential for unexpected medical expenses, chronic illnesses, or accidents that could lead to long-term care needs. Income risks involve the uncertainty of employment, the possibility of job loss, or the impact of inflation on purchasing power. Longevity risks, on the other hand, relate to the likelihood of outliving one's financial resources and the potential for long-term care costs as life expectancy increases.

Assessing these personal risks requires a comprehensive approach. It involves evaluating one's health status, employment situation, and financial goals. For example, a young, healthy individual with a stable job and a secure income might have different financial priorities compared to someone with a chronic illness, an unstable job, or a family history of longevity-related issues. By understanding these unique circumstances, individuals can tailor their financial strategies to address specific risks.

For instance, a risk assessment might reveal that an individual's primary concern is the potential loss of income due to job instability. In this case, instead of relying heavily on life insurance, they could focus on building an emergency fund, exploring income protection insurance, and diversifying their investment portfolio to ensure financial security. Similarly, someone with a family history of chronic illnesses might prioritize health savings accounts and long-term care insurance to manage potential medical expenses.

The key to a successful financial strategy is customization. By thoroughly understanding personal risks, individuals can make informed choices about insurance coverage, investment options, and savings plans. This approach ensures that financial decisions are aligned with one's unique circumstances, goals, and risk tolerance. It empowers individuals to take control of their financial future, making life insurance, or any financial product, a more conscious and intentional part of their overall strategy.

Life Insurance: Covering Adult Children Under Your Policy

You may want to see also

Frequently asked questions

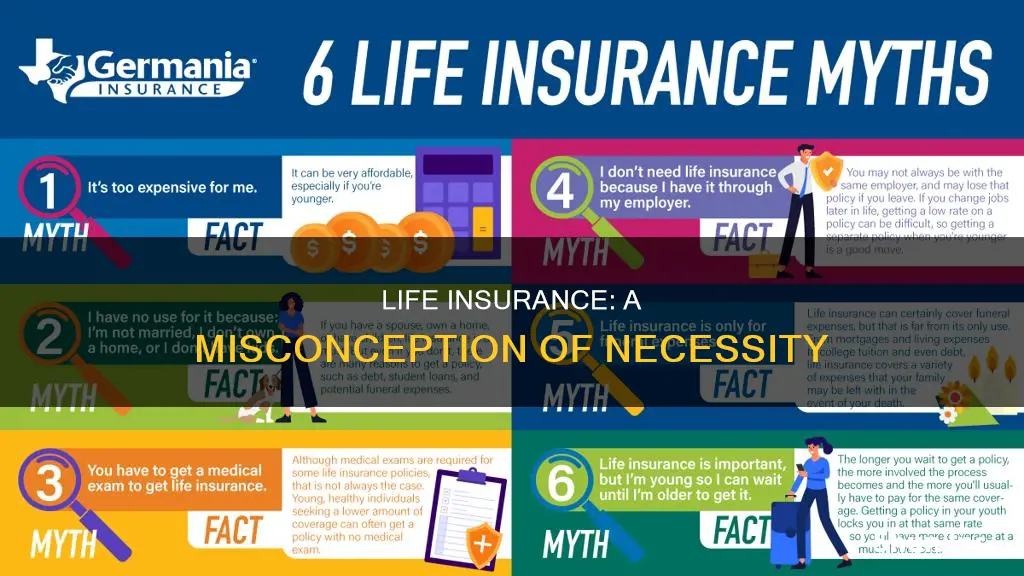

While it's true that young and healthy individuals may not see an immediate need for life insurance, it's important to consider the long-term benefits. Life insurance provides financial security for your loved ones in the event of your untimely passing. It ensures that your family can maintain their standard of living, cover funeral expenses, and potentially secure their future goals, even if you're no longer around.

Relying solely on your savings or investments might not be sufficient. Life insurance offers a guaranteed payout, which can provide a much-needed financial cushion for your family when unexpected events occur. It ensures that your loved ones receive a tax-free sum, which can be used to cover immediate expenses and long-term financial obligations, such as mortgage payments, children's education, or daily living costs.

Even if you have a small family or no immediate dependents, life insurance can still be valuable. It can help cover final expenses, such as funeral costs and outstanding debts, which can be a financial burden for your loved ones. Additionally, life insurance can provide financial support if you have long-term care needs or if you want to leave a legacy for your children or beneficiaries.

While employer-provided group life insurance can offer some coverage, it may not be comprehensive enough to meet your family's needs. Group policies often have limitations, such as lower coverage amounts or restrictions on eligibility. Additionally, group life insurance may not provide the same level of flexibility and customization as individual policies, allowing you to tailor the coverage to your specific circumstances and financial goals.