Life insurance is a financial safety net that provides peace of mind and financial security for individuals and their loved ones. The primary purpose of life insurance is to offer financial protection and support in the event of the insured's death. It ensures that beneficiaries receive a lump sum payment or regular income, known as the death benefit, which can help cover expenses, pay off debts, and provide for the financial needs of the family. This insurance product is a crucial tool for risk management, allowing individuals to plan for the future and protect their loved ones from potential financial hardships.

What You'll Learn

- Financial Security: Life insurance provides a safety net for loved ones in the event of death

- Debt Management: Proceeds can help pay off debts, reducing financial burden

- Education Funding: Insurance money can be used to fund a child's education

- Business Continuity: It ensures business operations can continue after owner's passing

- Legacy Planning: Life insurance can be part of a strategy to leave a financial legacy

Financial Security: Life insurance provides a safety net for loved ones in the event of death

Life insurance is a financial tool that plays a crucial role in ensuring the financial security of individuals and their families. Its primary purpose is to provide a safety net and financial protection for loved ones in the event of the insured's death. This safety net is an essential aspect of financial planning, offering peace of mind and stability during challenging times.

When an individual purchases life insurance, they essentially enter into a contract with an insurance company. In this contract, the individual agrees to pay regular premiums in exchange for a financial benefit upon their passing. The key benefit is the death benefit, which is a lump sum payment made to the designated beneficiaries upon the insured's death. This death benefit is a vital source of financial security for the family and can help cover various expenses that may arise after the insured's passing.

The primary purpose of this financial security is to provide for the basic needs and long-term goals of the family. It can cover essential costs such as funeral expenses, outstanding debts, mortgage payments, or rent, and daily living expenses. For example, if a family's primary income earner dies, the life insurance payout can ensure that the family can maintain their standard of living, cover daily expenses, and potentially provide for the children's education or other future financial goals. This financial support can significantly reduce the financial burden on the surviving family members, allowing them to grieve and make important decisions without the added stress of financial instability.

Moreover, life insurance can also be used to secure the family's long-term financial future. The death benefit can be invested or used to purchase an annuity, which provides a steady income stream for the beneficiaries. This ensures that the family can maintain their financial stability and potentially build wealth over time. By providing this financial security, life insurance empowers individuals to protect their loved ones and ensure that their financial goals and obligations are met, even in the face of unexpected death.

In summary, the primary purpose of life insurance is to offer financial security and peace of mind to individuals and their families. It serves as a safety net, providing the necessary funds to cover essential expenses and maintain the family's standard of living. Additionally, life insurance can secure long-term financial goals, ensuring that the family's future is protected. Understanding and utilizing life insurance can be a powerful way to demonstrate the importance of financial planning and care for one's loved ones.

Finding Life Insurance to Cover Your Mortgage

You may want to see also

Debt Management: Proceeds can help pay off debts, reducing financial burden

Life insurance is a financial tool that provides a safety net for individuals and their families, and one of its primary purposes is to manage and reduce financial burdens, especially in the event of an untimely death. When someone purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a lump sum payment, known as a death benefit, to the policyholder's beneficiaries upon their passing. This death benefit can be a powerful resource for debt management and financial stability.

Debt is a common financial burden that many individuals and families face, and it can become a significant challenge when a primary income earner is no longer around. Credit card debt, mortgages, student loans, and personal loans are just a few examples of debts that can accumulate over time. When a person dies, their outstanding debts often remain, and the surviving family members may struggle to meet these financial obligations. This is where life insurance proceeds can play a crucial role in debt management.

The death benefit from a life insurance policy can be utilized to settle these debts, providing much-needed relief to the family. For instance, if a policyholder has a substantial mortgage, the life insurance money can be used to pay off the remaining balance, preventing the family from inheriting a large debt. Similarly, credit card debt can be eliminated, and the financial burden on the beneficiaries can be significantly reduced. By addressing these debts promptly, the family can avoid the long-term financial strain and potential negative impact on their credit scores.

In addition to immediate debt repayment, life insurance proceeds can also be strategically invested to generate additional income. This could involve purchasing assets like real estate, starting a business, or investing in stocks and bonds. The returns from these investments can then be used to further reduce debt or even build a savings fund for future financial security. Effective debt management through life insurance can empower individuals to take control of their financial situation and ensure a more stable future for their loved ones.

It is essential to carefully plan and consider the best use of life insurance money to manage debts effectively. Consulting with financial advisors or insurance professionals can provide valuable guidance in making informed decisions about debt repayment strategies. By utilizing the death benefit wisely, individuals can ensure that their financial legacy supports their family's well-being and long-term financial health.

Domestic Life Insurance: What You Need to Know

You may want to see also

Education Funding: Insurance money can be used to fund a child's education

Life insurance is a financial tool that provides a safety net for individuals and their families, ensuring financial security during unforeseen circumstances. While the primary purpose of life insurance is to offer financial protection and peace of mind, it can also be a valuable asset for long-term financial planning, particularly when it comes to funding a child's education.

When a life insurance policy is in place, the beneficiary (often the insured individual's family) receives a death benefit upon the insured's passing. This financial payout can be a significant source of funds for various financial goals, including education expenses. By utilizing the proceeds from a life insurance policy, parents can strategically plan for their child's future education, ensuring that the money is allocated efficiently and effectively.

One approach to funding education is to use the life insurance money to pay for college or university tuition. Many educational institutions offer high-cost programs, and the death benefit from a life insurance policy can provide the necessary financial support to cover these expenses. This ensures that the child has access to quality education without incurring substantial debt or relying heavily on student loans.

Additionally, life insurance proceeds can be invested in various ways to grow the funds over time. This strategy allows the money to accumulate and potentially provide a larger sum for the child's education in the future. Parents can work with financial advisors to determine the best investment options, considering factors such as risk tolerance, time horizon, and potential returns. This approach not only funds the education but also teaches the child about financial responsibility and the value of long-term planning.

Furthermore, life insurance money can be used to establish a dedicated education savings account. This account can be set up specifically for the child's future educational needs, allowing parents to regularly contribute and watch the savings grow. By doing so, parents can ensure that the funds are directly allocated for education, providing a sense of security and financial control. This strategy also encourages a disciplined savings mindset, which can benefit the child throughout their financial journey.

Life Insurance License: Easy Exam or Tough Test?

You may want to see also

Business Continuity: It ensures business operations can continue after owner's passing

Life insurance is a financial tool that plays a crucial role in ensuring the stability and continuity of a business, especially in the event of the owner's passing. The primary purpose of life insurance, in the context of business operations, is to provide a safety net and financial security, allowing the business to continue its activities without interruption. This is particularly important for small and medium-sized enterprises (SMEs) that may have limited resources and rely heavily on the owner's involvement and leadership.

When an owner's life is insured, the policy's death benefit can be utilized to cover various aspects of the business's continuity. Firstly, it provides financial support to cover immediate expenses, such as funeral costs, which can be a significant burden on the family and the business during a difficult time. This ensures that the business is not immediately disrupted by the loss of its primary decision-maker. Secondly, the death benefit can be used to appoint a new owner or partner, ensuring a smooth transition in leadership and minimizing the impact on day-to-day operations. This is especially crucial in businesses where the owner's unique skills and knowledge are integral to the company's success.

Moreover, life insurance can facilitate the process of selling the business or transferring ownership. In the event of the owner's passing, the insurance payout can be used to settle any outstanding debts or loans, making the business more attractive to potential buyers. It also provides the necessary financial resources to train and mentor a replacement, ensuring that the business's operations and knowledge base are preserved. By having a life insurance policy in place, business owners can provide peace of mind, knowing that their enterprise is protected and their legacy will live on through the continued success of the company.

In summary, the primary purpose of life insurance in the context of business continuity is to safeguard the enterprise's operations and ensure its longevity beyond the owner's lifetime. It provides the necessary financial resources to cover immediate expenses, facilitate leadership transitions, and support the sale or transfer of ownership. By implementing this strategy, business owners can protect their enterprise, provide for their families, and leave a lasting impact on their industry.

High-Income Earners: Is Whole Life Insurance a Smart Choice?

You may want to see also

Legacy Planning: Life insurance can be part of a strategy to leave a financial legacy

Life insurance is a powerful tool for legacy planning, allowing individuals to ensure their loved ones are financially secure even after their passing. The primary purpose of life insurance is to provide financial protection and peace of mind, but it can also be a crucial component of a comprehensive estate plan. By incorporating life insurance into your legacy strategy, you can achieve several important goals.

One key aspect of legacy planning is the transfer of wealth to future generations. Life insurance can facilitate this process by providing a tax-free death benefit that can be passed on to beneficiaries. This benefit can be used to cover various expenses, such as educational costs, mortgage payments, or even the day-to-day living expenses of your heirs. By utilizing life insurance in this way, you can ensure that your family's financial stability is maintained and that your legacy is preserved.

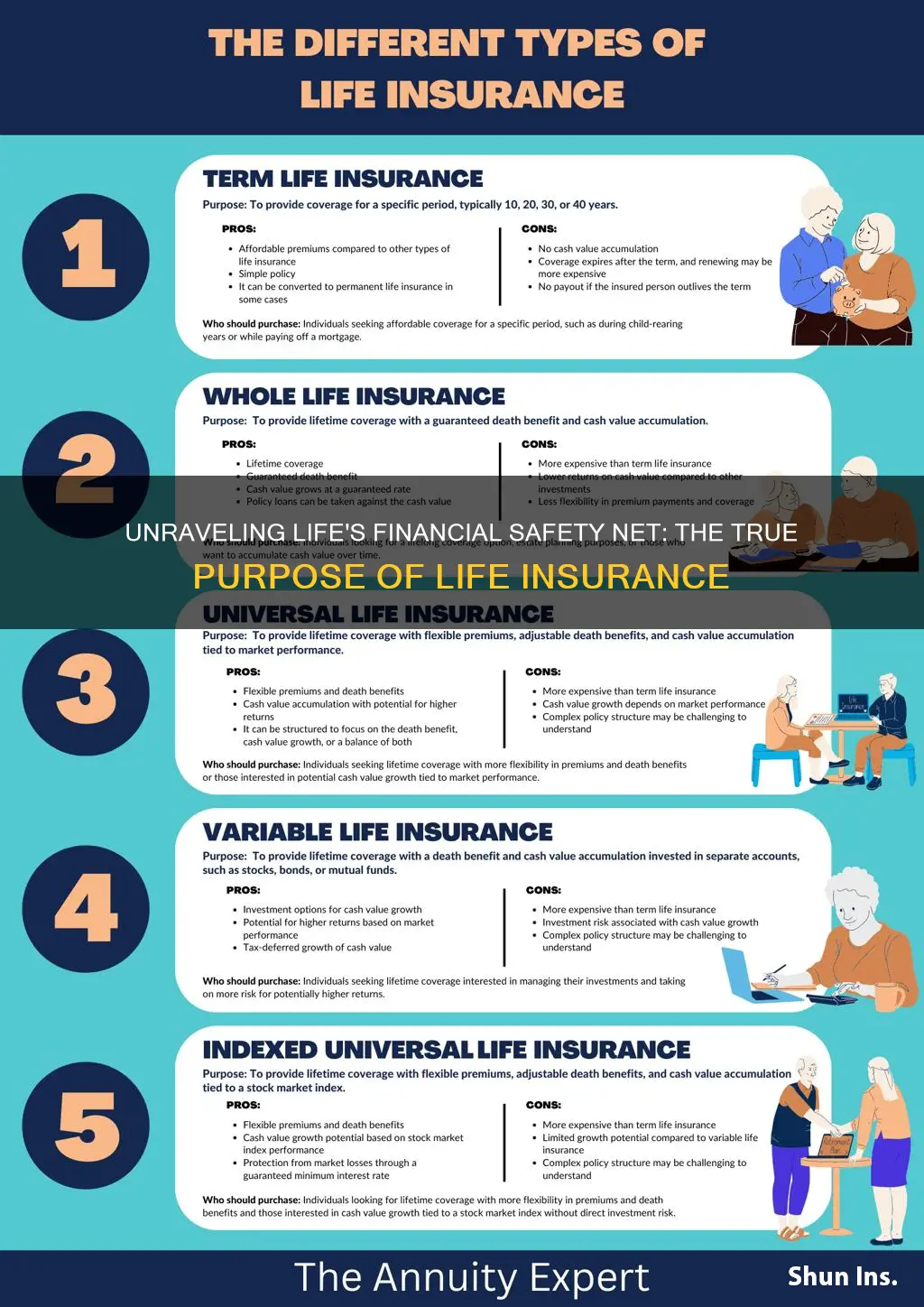

Additionally, life insurance can be structured to align with your specific legacy goals. For instance, you can choose between different types of policies, such as term life insurance, which provides coverage for a specified period, or permanent life insurance, which offers lifelong coverage and a cash value component. Permanent life insurance, in particular, can serve as an asset that can be borrowed against or withdrawn to provide financial support during your lifetime, ensuring that your legacy plan remains flexible and adaptable.

Another advantage of using life insurance for legacy planning is the potential tax benefits. Proceeds from life insurance policies are generally not subject to income tax, and they can be exempt from estate taxes, depending on the jurisdiction. This tax efficiency can result in a more substantial legacy for your beneficiaries, allowing them to inherit a larger sum without incurring significant tax liabilities.

Furthermore, life insurance can be a strategic tool for charitable giving. You can designate a portion of the death benefit to a charitable organization or set up a trust to support a cause close to your heart. This approach not only ensures that your legacy includes a charitable component but also provides a meaningful impact on the lives of others.

In summary, life insurance is a versatile and essential tool for legacy planning. It enables individuals to provide financial security for their loved ones, transfer wealth effectively, and potentially benefit from tax advantages. By incorporating life insurance into your estate plan, you can create a lasting legacy that aligns with your values and ensures the financial well-being of your beneficiaries.

Globe Life: Whole Life Insurance Options and Benefits

You may want to see also