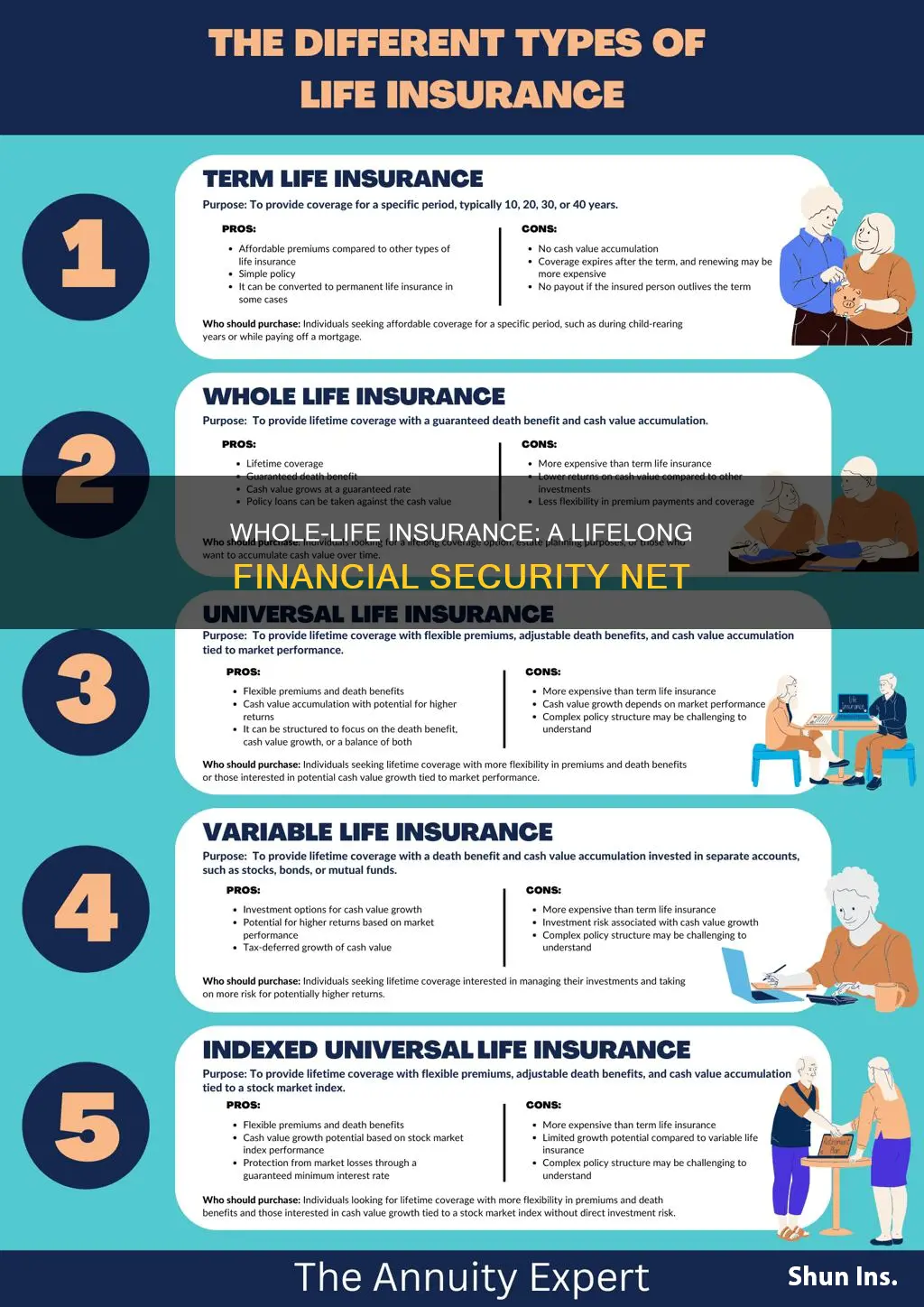

Whole-life insurance offers a range of benefits that make it an attractive financial tool for individuals and families. One of the key advantages is the guaranteed death benefit, which provides a fixed amount of money to the policyholder's beneficiaries upon their passing. This financial security can help cover final expenses, such as funeral costs and outstanding debts, ensuring that loved ones are protected even in the face of tragedy. Additionally, whole-life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn, providing a source of funds for various financial needs, including education expenses or business investments. The cash value also grows tax-deferred, allowing it to accumulate significantly over the policy's lifetime. This feature makes whole-life insurance a valuable long-term financial strategy, offering both protection and the potential for wealth accumulation.

What You'll Learn

- Long-Term Financial Security: Whole-life insurance provides a steady income stream for beneficiaries over the policyholder's lifetime

- Tax-Advantaged Growth: Accumulation accounts in whole-life policies grow tax-deferred, offering potential for significant savings

- Death Benefit Guarantee: A fixed death benefit is guaranteed, ensuring a specific payout upon the insured's passing

- Flexible Premiums: Policyholders can choose payment schedules, allowing for customization based on financial needs and preferences

- Investment Opportunities: Some whole-life policies offer investment options, allowing policyholders to grow their money beyond the death benefit

Long-Term Financial Security: Whole-life insurance provides a steady income stream for beneficiaries over the policyholder's lifetime

Whole-life insurance offers a unique and valuable benefit that sets it apart from other insurance types: long-term financial security. This type of insurance provides a steady and reliable income stream for the beneficiaries throughout the policyholder's entire lifetime. Unlike term life insurance, which provides coverage for a specific period, whole-life insurance offers permanent coverage, ensuring that the beneficiaries receive financial support whenever the policyholder passes away.

The financial security provided by whole-life insurance is a significant advantage, especially for those who want to ensure their loved ones' financial well-being in the long term. With this insurance, the policyholder's beneficiaries can rely on a consistent income, which can help cover various expenses, such as living costs, education fees, mortgage payments, or any other financial obligations. This steady income stream can provide peace of mind, knowing that the family's financial needs will be met even if the primary breadwinner is no longer present.

One of the key advantages of whole-life insurance is its guaranteed payout. Once the policy is in force, the insurance company is committed to paying out the death benefit to the designated beneficiaries. This guarantee ensures that the financial support will continue as long as the policyholder is alive, providing a stable foundation for the beneficiaries' financial future. The steady income stream can be particularly beneficial for families with young children, elderly parents, or other dependents who require long-term financial support.

Moreover, the long-term nature of whole-life insurance allows for potential investment opportunities. The policyholder can choose to invest a portion of the death benefit in various investment options offered by the insurance company. These investments can grow over time, providing additional financial benefits for the beneficiaries. The combination of a guaranteed income stream and potential investment growth makes whole-life insurance a powerful tool for long-term financial planning.

In summary, whole-life insurance provides a steady income stream for beneficiaries over the policyholder's lifetime, offering long-term financial security. This benefit ensures that the beneficiaries can rely on a consistent financial support system, even in the absence of the primary income earner. With its guaranteed payout and potential investment opportunities, whole-life insurance is an excellent choice for those seeking to secure their loved ones' financial future.

Term Life Insurance: Convertible, Flexible Protection for Your Future

You may want to see also

Tax-Advantaged Growth: Accumulation accounts in whole-life policies grow tax-deferred, offering potential for significant savings

Whole-life insurance offers a unique advantage in the form of tax-advantaged growth through accumulation accounts. These accounts are a key feature of whole-life policies, providing policyholders with a way to build substantial savings over time. Here's how it works and why it's beneficial:

When you invest in an accumulation account within a whole-life insurance policy, your money can grow tax-deferred. This means that any earnings or interest generated on your investments are not subject to annual income tax. Typically, traditional savings accounts or investments are taxed on the interest earned each year, reducing your overall returns. However, with whole-life insurance, the earnings compound, allowing your money to grow faster. This tax-deferred status can result in significant savings over the long term, as your money has the potential to accumulate substantial value without the immediate tax burden.

The power of tax-deferred growth becomes especially evident when considering the long-term nature of whole-life insurance. Policyholders can contribute to their accumulation account regularly, allowing their investments to benefit from compound interest. Over time, this can lead to a substantial nest egg, providing financial security and peace of mind. This is particularly attractive for those seeking a long-term savings strategy, as it offers a way to build wealth without the frequent tax adjustments associated with other investment vehicles.

Furthermore, the tax-advantaged nature of these accumulation accounts can be a significant advantage for high-income earners or those in higher tax brackets. By investing in a whole-life policy, they can potentially save more on their taxes, as the earnings within the policy grow tax-free. This can be a strategic move for individuals looking to optimize their savings and minimize their tax liability.

In summary, the accumulation accounts within whole-life insurance policies provide a powerful tool for tax-advantaged growth. By offering tax-deferred earnings, these policies enable policyholders to build significant savings over time, making whole-life insurance an attractive option for those seeking a comprehensive financial strategy. This benefit highlights the potential for whole-life insurance to provide both insurance protection and a robust savings plan.

Collateral Assignment: Life Insurance Contract Flexibility

You may want to see also

Death Benefit Guarantee: A fixed death benefit is guaranteed, ensuring a specific payout upon the insured's passing

Whole-life insurance offers a unique and valuable feature that sets it apart from other insurance policies: the death benefit guarantee. This guarantee is a cornerstone of whole-life insurance and provides a sense of security and financial protection for the insured and their beneficiaries. When an individual purchases a whole-life insurance policy, they are essentially entering into a long-term contract with the insurance company. This contract promises a fixed death benefit, which is a predetermined amount of money that will be paid out to the designated beneficiaries upon the insured's passing.

The death benefit guarantee is a critical aspect of whole-life insurance as it ensures financial security for the insured's loved ones during a difficult time. It provides a sense of peace of mind, knowing that a specific amount of money is assured to be available to cover various expenses and provide financial support. This guarantee is particularly important as it offers a level of certainty that is often lacking in other forms of insurance. With whole-life insurance, the insured can rest assured that their beneficiaries will receive the agreed-upon amount, regardless of market fluctuations or changes in the insurance company's financial status.

The fixed nature of the death benefit is a key advantage. It means that the payout is not subject to the volatility of the financial markets, unlike some other investment-based insurance products. This guarantee is especially beneficial for long-term financial planning, as it allows individuals to rely on a consistent and predictable source of funds. For example, the death benefit can be used to cover funeral expenses, outstanding debts, mortgage payments, or even provide a lump sum for the beneficiaries to use as they see fit.

Furthermore, the death benefit guarantee is a powerful tool for estate planning. It enables individuals to ensure that their assets are distributed according to their wishes, providing a clear and defined path for the transfer of wealth. This feature is particularly attractive to those who want to provide financial security for their families and ensure that their legacy is protected. By guaranteeing a specific payout, whole-life insurance offers a reliable mechanism to achieve these estate planning goals.

In summary, the death benefit guarantee is a significant advantage of whole-life insurance. It provides a fixed and assured payout upon the insured's death, offering financial security and peace of mind. This guarantee is a unique feature that sets whole-life insurance apart, making it an attractive option for those seeking long-term financial protection and a reliable source of funds for their beneficiaries. Understanding this benefit is essential for anyone considering whole-life insurance as a part of their financial strategy.

Life Insurance: A Necessary Safety Net for Families

You may want to see also

Flexible Premiums: Policyholders can choose payment schedules, allowing for customization based on financial needs and preferences

Whole-life insurance offers a unique advantage to policyholders in the form of flexible premium payments. This feature provides individuals with the autonomy to tailor their insurance plans according to their financial circumstances and goals. One of the key benefits is the ability to choose payment schedules, which can be a significant advantage for those seeking financial flexibility.

When purchasing whole-life insurance, policyholders can decide on the frequency and amount of their premium payments. This customization allows individuals to align their insurance costs with their financial capabilities. For instance, a policyholder might opt for higher monthly payments during their early years of employment, ensuring that their insurance coverage remains active and comprehensive. As their financial situation improves, they can adjust the payments to a more manageable level, perhaps even making bi-annual or annual payments if it suits their budget. This flexibility is particularly beneficial for those who experience fluctuations in income or prefer a more personalized approach to their insurance expenses.

The ability to customize payment schedules can also be advantageous for long-term financial planning. Policyholders can strategically plan their insurance payments to align with significant life events or financial milestones. For example, someone saving for a child's education might choose to increase their insurance premiums during their peak earning years, ensuring a substantial payout when the child is ready for college. Alternatively, a retiree might opt for lower monthly payments, knowing that their insurance coverage will still be in place during their retirement years.

Furthermore, this flexibility can provide peace of mind and reduce financial stress. By tailoring the payment schedule, individuals can ensure that their insurance remains affordable and manageable, even during periods of financial strain. This level of customization empowers policyholders to make informed decisions about their insurance coverage, allowing them to focus on other financial priorities without compromising their protection.

In summary, the option to choose payment schedules is a valuable aspect of whole-life insurance, offering policyholders the freedom to customize their insurance plans. This flexibility enables individuals to align their insurance costs with their financial needs, providing a sense of security and control over their long-term financial well-being.

Understanding Life Insurance: Securing Your Future and Legacy

You may want to see also

Investment Opportunities: Some whole-life policies offer investment options, allowing policyholders to grow their money beyond the death benefit

Whole-life insurance is a comprehensive financial product that provides long-term coverage and offers a range of benefits, one of which is the potential for investment growth. This feature is particularly appealing to those seeking to maximize their financial resources and build a more secure future.

Some whole-life insurance policies incorporate investment components, allowing policyholders to take advantage of various investment options. These investment opportunities can be structured in different ways, often involving a combination of fixed and variable components. Policyholders can choose to allocate a portion of their premiums to investment accounts, which are managed by the insurance company or an affiliated investment manager. This approach enables individuals to potentially grow their money over time, providing an additional layer of financial security.

The investment aspect of whole-life insurance can be a powerful tool for those who want to make the most of their premiums. Policyholders can select from a variety of investment options, such as stocks, bonds, or mutual funds, depending on their risk tolerance and financial goals. By diversifying their investments, individuals can potentially increase their returns while also benefiting from the insurance coverage provided by the policy. This dual advantage can be especially valuable for long-term financial planning.

One of the key advantages of this investment feature is that it allows policyholders to potentially accumulate wealth beyond the death benefit of the insurance policy. The investment growth can provide a substantial sum that can be used for various purposes, such as retirement planning, education funding, or even as an inheritance for beneficiaries. This aspect of whole-life insurance can be particularly attractive to those who want to ensure a more secure financial future for themselves and their loved ones.

When considering the investment opportunities within whole-life policies, it is essential to carefully review the terms and conditions of the specific policy. Different insurance providers may offer varying investment strategies and associated risks. Policyholders should also be aware of any fees or charges associated with the investment options to ensure they align with their financial objectives. By understanding these details, individuals can make informed decisions about utilizing the investment potential of their whole-life insurance policies.

Affordable Term Life Insurance: Finding the Cheapest Option

You may want to see also

Frequently asked questions

Whole-life insurance offers a guaranteed death benefit, meaning the insurance company will pay out a predetermined amount to the policyholder's beneficiaries upon the insured individual's death. This provides financial security and peace of mind, ensuring that loved ones are taken care of even if the primary breadwinner passes away.

Whole-life insurance policies typically include an investment component, where a portion of the premium paid by the policyholder is invested in a separate account. This investment grows tax-deferred, and the earnings can be used to build cash value within the policy. Over time, the cash value can be borrowed against or withdrawn, providing a source of funds for various financial needs, such as education expenses or business ventures.

Absolutely! Whole-life insurance can be an excellent tool for retirement planning. The cash value accumulated within the policy can be used to make regular premium payments, ensuring the policy remains in force. Additionally, the death benefit can provide a substantial payout to the policyholder or their beneficiaries during retirement, offering financial support and potentially helping to cover living expenses. This feature makes whole-life insurance a valuable long-term financial strategy.