Term life insurance is a type of coverage that provides a death benefit for a specified period, known as the term. It is a popular and affordable way to protect your loved ones financially during a specific time frame, such as when you have a mortgage or children's education expenses. When considering the least expensive term life insurance, it's essential to understand that the cost can vary significantly based on several factors, including age, health, lifestyle, and the desired coverage amount. This paragraph aims to explore the factors influencing the price of term life insurance and provide insights into finding the most cost-effective options for individuals seeking temporary coverage.

What You'll Learn

- Affordable Options: Compare rates from various insurers to find the cheapest coverage

- Term Lengths: Longer terms often cost less, but shorter terms may be more affordable initially

- Health Factors: Good health can lead to lower premiums, as insurers consider risk

- Age and Gender: Younger, non-smoking individuals typically pay less for term life insurance

- Online Quotes: Utilize online tools to quickly get quotes and compare prices

Affordable Options: Compare rates from various insurers to find the cheapest coverage

When searching for the least expensive term life insurance, it's essential to understand that the cost can vary significantly depending on several factors. The first step is to research and compare rates from multiple insurers. Online resources and insurance comparison websites can be invaluable tools in this process. These platforms often allow you to input your personal and health-related details, such as age, gender, smoking status, and medical history, to receive tailored quotes. By gathering quotes from various companies, you can identify the insurers offering the most competitive rates for your specific needs.

Age and gender play a crucial role in determining the cost of term life insurance. Generally, younger individuals, particularly those in their 20s and 30s, tend to secure lower premiums. This is because younger people are considered less risky to insure due to their longer life expectancy and lower likelihood of developing health issues. Additionally, men often pay less for term life insurance than women, as statistical data suggests that men have a slightly higher life expectancy.

Smoking status is another critical factor affecting insurance rates. Non-smokers typically enjoy more affordable premiums compared to smokers. Insurers consider smoking a significant health risk, and quitting smoking can lead to substantial savings on your life insurance policy. It's worth noting that some insurers may offer incentives for non-smokers or provide discounts for those who quit smoking, further reducing the overall cost.

Medical history and overall health are also taken into account when calculating insurance premiums. Individuals with a history of chronic illnesses or those who have recently undergone major surgeries may face higher costs. Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can contribute to better overall health and potentially lower insurance rates.

Lastly, the amount of coverage you choose will impact the price. Term life insurance policies typically offer coverage for a specified period, such as 10, 20, or 30 years. The more coverage you require, the higher the premium will be. It's essential to strike a balance between the desired level of protection and your budget. Comparing quotes for different coverage amounts will help you find the most affordable option that still meets your needs.

Who Can Cash a Life Insurance Check?

You may want to see also

Term Lengths: Longer terms often cost less, but shorter terms may be more affordable initially

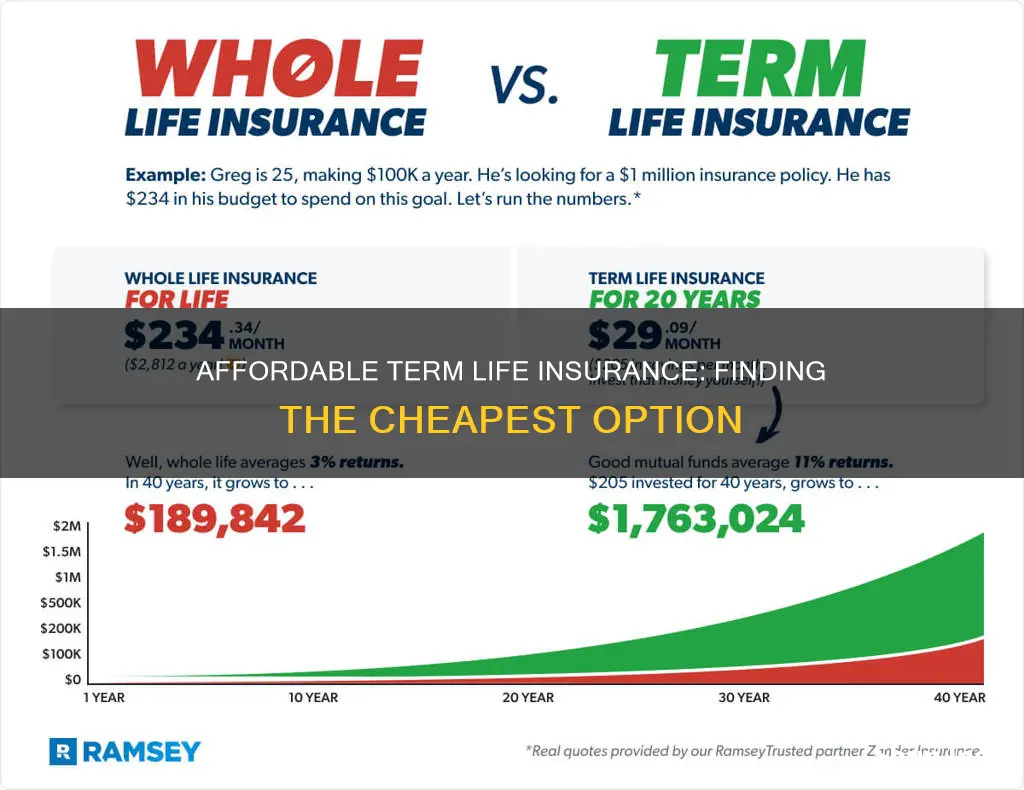

When considering term life insurance, one of the key factors that can significantly impact the cost is the term length. The term length refers to the duration for which the insurance policy is in effect. It is essential to understand that longer-term policies generally offer more affordable premiums, but there are trade-offs to consider.

Longer-term life insurance policies typically provide coverage for an extended period, often ranging from 10 to 30 years or even longer. By extending the coverage period, insurance companies can assess the risk over a more extended timeframe. As a result, they may offer lower premiums as they account for a more comprehensive risk assessment. For example, a 30-year term life insurance policy might have lower monthly premiums compared to a 10-year term policy, as the longer term allows the insurer to factor in potential changes in health and lifestyle over time.

On the other hand, shorter-term life insurance policies, such as 5-year or 10-year terms, can be more affordable in the initial stages. These shorter terms are often chosen by individuals who want coverage for a specific period, such as a mortgage term or a business venture. The lower initial cost of shorter-term policies can be advantageous for those who prefer flexibility and don't want to commit to long-term financial obligations. However, it's important to note that the premiums for shorter terms may increase as the policy approaches maturity, as the risk to the insurer increases over time.

The decision between longer and shorter term lengths should be based on individual circumstances and financial goals. Longer-term policies provide long-term security and peace of mind, ensuring that your loved ones are protected for an extended period. This is particularly beneficial for those with long-term financial commitments or families who want comprehensive coverage. On the other hand, shorter-term policies can be a strategic choice for those seeking temporary coverage or wanting to manage their insurance costs more flexibly.

In summary, when exploring the least expensive term life insurance options, it is crucial to consider the term length. Longer-term policies often provide more affordable premiums due to extended risk assessment, while shorter terms may offer lower initial costs. Assessing your personal needs, financial situation, and future plans will help you make an informed decision regarding the term length that best suits your requirements.

Universal Life Insurance Cash: Taxable or Not?

You may want to see also

Health Factors: Good health can lead to lower premiums, as insurers consider risk

Good health is a significant factor when it comes to obtaining affordable term life insurance. Insurers are primarily interested in assessing the risk associated with insuring an individual, and one's health status plays a crucial role in this evaluation. Here's how maintaining a healthy lifestyle can lead to lower premiums:

A healthy body often indicates a reduced likelihood of developing serious health conditions that could lead to premature death. Insurers consider factors such as blood pressure, cholesterol levels, and body mass index (BMI). For instance, individuals with high blood pressure or cholesterol levels may be considered higher-risk candidates for life insurance. By maintaining a healthy weight, exercising regularly, and managing stress, you can improve these health markers and potentially qualify for more competitive rates.

Additionally, avoiding or managing chronic diseases is essential. Conditions like diabetes, heart disease, or certain types of cancer can significantly impact insurance premiums. Insurers may offer lower rates to individuals who have successfully managed these conditions through medication, lifestyle changes, or regular medical care. It's important to note that disclosing pre-existing health conditions to insurance providers is essential, as it allows them to provide accurate quotes and ensure you receive the appropriate coverage.

Engaging in healthy habits can also contribute to lower premiums. Quitting smoking, for example, can result in substantial savings over time. Insurers often view non-smokers as lower-risk individuals, as smoking is associated with numerous health issues, including lung cancer, heart disease, and respiratory problems. Similarly, maintaining a healthy diet, exercising regularly, and getting adequate sleep can all contribute to a healthier profile, making you an attractive candidate for insurers.

Furthermore, regular health check-ups and screenings can help identify potential health issues early on. By proactively managing your health, you can prevent minor concerns from becoming major problems. This proactive approach can lead to better overall health and, consequently, more affordable life insurance premiums.

In summary, good health is a powerful tool when seeking affordable term life insurance. Insurers consider health factors as a critical risk assessment component, and individuals who prioritize their well-being may find themselves with lower premiums. A healthy lifestyle not only benefits your overall quality of life but also positions you favorably in the eyes of insurance providers.

Contract Fund Basics: Life Insurance Explained

You may want to see also

Age and Gender: Younger, non-smoking individuals typically pay less for term life insurance

When it comes to finding the least expensive term life insurance, age and gender play a significant role in determining the cost. Younger, non-smoking individuals often benefit from lower premiums due to their reduced risk profile. This is because insurance companies consider younger people to be healthier and less likely to develop serious health conditions that could lead to early death. As a result, they are seen as lower-risk policyholders, which translates to more affordable insurance rates.

The reason for this pricing structure lies in the statistics and data collected by insurance providers. Younger individuals generally have a longer life expectancy, and the likelihood of them outliving the term of the policy is higher. This means that the insurance company is taking on less risk by insuring a younger person, as they are less likely to make a claim during the specified period. Additionally, younger individuals might not have accumulated significant financial responsibilities or dependents, making the potential impact of their death less severe in the long term.

Gender also influences the cost of term life insurance. Historically, women have been offered lower premiums compared to men, especially for younger individuals. This is because women tend to have lower mortality rates and are generally considered to have a healthier lifestyle. However, it's important to note that these gender-based differences are becoming less common as insurance companies move towards more standardized pricing structures.

Non-smokers are another group that insurance companies prefer to insure. Smoking is a significant risk factor for various health issues, including heart disease, lung cancer, and respiratory problems. By avoiding smoking, individuals significantly reduce their chances of developing these health conditions, making them more attractive to insurance providers. The lack of smoking history contributes to a lower risk assessment, resulting in more competitive pricing for term life insurance.

In summary, younger, non-smoking individuals typically pay less for term life insurance due to their reduced risk profile. Insurance companies consider their longer life expectancy, lower likelihood of health issues, and reduced financial impact of their death. Additionally, gender and smoking status are factors that influence pricing, with women and non-smokers often benefiting from more affordable rates. Understanding these factors can help individuals make informed decisions when comparing term life insurance options.

Understanding the Core: What is an Insuring Agreement in Life Insurance?

You may want to see also

Online Quotes: Utilize online tools to quickly get quotes and compare prices

When it comes to finding the least expensive term life insurance, utilizing online tools can be an efficient and effective strategy. The internet provides a wealth of resources that can help you quickly obtain quotes from various insurance providers and compare their prices. Here's a step-by-step guide on how to make the most of these online tools:

- Identify Reputable Websites: Start by visiting well-known and trusted websites that offer insurance comparison services. These platforms often have partnerships with multiple insurance companies, allowing them to provide a wide range of quotes. Look for websites that are secure, user-friendly, and have positive reviews from previous customers. Some popular options include insurance comparison sites or financial advisor websites.

- Input Your Information: These online tools typically require you to input specific details to generate accurate quotes. This information usually includes your age, gender, health status, desired coverage amount, and the term length (e.g., 10, 20, or 30 years). Be as precise as possible when entering your data to ensure the quotes you receive are tailored to your needs.

- Request Quotes: After providing the necessary details, click the button to request quotes. This action will prompt the online tool to connect with the associated insurance providers and retrieve their offers. The process is often quick, and you may receive multiple quotes within a few seconds or minutes.

- Compare and Analyze: Once you have a list of quotes, carefully compare the prices, coverage options, and terms offered by each insurance company. Pay attention to the following:

- Premium Cost: Look for the annual or monthly premium charges for each quote. The lowest premium might not always be the best option, as it could indicate lower coverage or less favorable terms.

- Coverage Amount: Ensure that the coverage amount aligns with your needs. Consider your financial obligations and the number of dependents you have to determine the appropriate amount.

- Term Length: Evaluate the term length options provided. Longer terms often result in lower monthly premiums but may not be necessary if you plan to cover a specific period.

- Additional Benefits: Some insurance policies offer additional features like waiver of premium or accelerated death benefits. Assess if these extras are valuable to you.

Consider Your Specific Needs: Remember that the cheapest option might not always be the most suitable. Evaluate the quotes based on your individual circumstances and preferences. For example, if you have an existing health condition, you might find that certain insurers offer more competitive rates despite your health status.

By following these steps and utilizing online tools effectively, you can quickly gather and compare term life insurance quotes, increasing your chances of finding the least expensive option that meets your requirements.

Life Insurance Exam: How Difficult Is It?

You may want to see also

Frequently asked questions

The least expensive term life insurance is typically a 10-year term policy. This type of insurance is designed to provide coverage for a specific period, offering a cost-effective solution for individuals who need temporary protection. The premiums are generally lower compared to longer-term policies because the risk of death is considered lower over a shorter period.

Selecting the appropriate term length depends on your personal and financial goals. If you need coverage for a specific period, such as while your children are young or until a mortgage is paid off, a 10-year term is often a good starting point. For those seeking long-term protection, a 20-year or 30-year term policy might be more suitable. It's essential to evaluate your needs and consider consulting a financial advisor to determine the best term length for your situation.

Yes, several factors influence the price of term life insurance. Age is a significant determinant, as younger individuals generally pay lower premiums due to a longer life expectancy. The amount of coverage you choose will also impact the cost. Additionally, your health, lifestyle, and family medical history can affect the insurance company's assessment of risk. Non-smokers and individuals with a healthy lifestyle may qualify for lower rates.

Yes, some term life insurance policies offer no-exam options, especially for shorter-term coverage. These policies are often referred to as "simplified issue" or "speed issue" plans. They may require a basic health questionnaire and sometimes a small blood pressure check, but they bypass the need for a full medical exam. This process can be quicker and more convenient, making it an attractive choice for those seeking immediate coverage.