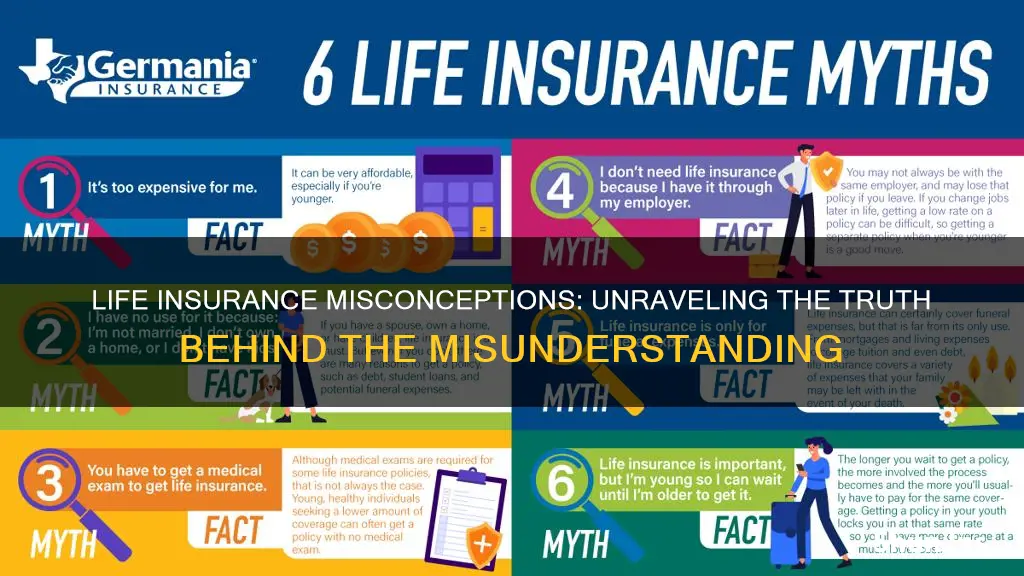

Many people often have misconceptions about life insurance, which can lead to confusion and hesitation when making important financial decisions. Despite being a crucial tool for financial security, life insurance is frequently misunderstood due to a lack of awareness and education. Common misconceptions include the belief that life insurance is only for the wealthy, that it's a one-size-fits-all product, or that it's too complex to understand. This paragraph aims to explore these misunderstandings and shed light on the importance of life insurance, highlighting why it's a valuable asset for everyone, regardless of their financial status or age.

What You'll Learn

Misconception: Life insurance is only for the wealthy

The idea that life insurance is a luxury or a necessity solely for the wealthy is a common misconception that often deters people from considering it as an essential part of their financial planning. This notion is deeply ingrained in popular culture, where the association of life insurance with affluence is often portrayed in media and advertising. However, this misconception is far from the truth and can lead to significant financial vulnerabilities for many.

Firstly, life insurance is a tool to secure one's family's financial future, not just a privilege for the rich. It provides a safety net for loved ones in the event of the insured's death, ensuring that they are financially protected. The primary purpose of life insurance is to offer financial security, which is a fundamental need for everyone, regardless of their economic status. For instance, a middle-class family with a modest income can still benefit immensely from life insurance, as it can cover essential expenses like mortgage payments, children's education, and daily living costs, providing peace of mind and financial stability.

Another aspect to consider is that life insurance is affordable for a wide range of individuals. With various types of policies available, such as term life insurance, whole life insurance, and universal life insurance, there are options to suit different budgets and needs. Term life insurance, for instance, offers coverage for a specific period, often at lower premiums, making it an excellent choice for those seeking temporary financial protection. Moreover, the cost of life insurance is not solely determined by income; factors like age, health, lifestyle, and the amount of coverage required also play a significant role in determining the premium.

Furthermore, life insurance can be a powerful tool for building wealth. Certain types of policies, like whole life insurance, accumulate cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. This aspect of life insurance can be particularly beneficial for those who want to invest in their future or have specific financial goals, such as starting a business or saving for retirement. By dispelling the myth that life insurance is exclusively for the wealthy, more people can recognize its potential to enhance financial security and achieve their long-term objectives.

In summary, life insurance is not a luxury but a practical and affordable way to ensure financial security for oneself and one's family. It is accessible to people from all walks of life, offering protection and peace of mind. Understanding this misconception is crucial in encouraging more individuals to take control of their financial future and make informed decisions about their insurance needs.

Life Insurance: A Must-Have for SBA Loans?

You may want to see also

Misunderstanding: Term insurance is the same as whole life

Many people often equate term insurance with whole life insurance, mistaking one for the other due to a lack of understanding of the fundamental differences between the two. This misunderstanding can lead to poor financial decisions and an inadequate level of protection for one's loved ones. It is crucial to clarify that term insurance and whole life insurance serve distinct purposes and offer different benefits.

Term insurance, as the name suggests, provides coverage for a specific period, typically 10, 20, or 30 years. It is a pure insurance product designed to offer protection during a defined term. The primary purpose of term insurance is to provide financial security to your family in the event of your untimely death. It is an affordable and straightforward way to ensure that your loved ones are financially protected during the years when they might need it the most, such as covering mortgage payments, children's education, or other long-term financial commitments. During the term, the policyholder pays regular premiums, and in return, the insurance company promises to pay a death benefit to the beneficiaries if the insured person passes away within the specified period. Once the term ends, the policy typically expires, and no further coverage is provided unless the policy is renewed or converted to a different type of insurance.

On the other hand, whole life insurance is a permanent insurance policy that provides lifelong coverage. It offers a combination of insurance and savings components. With whole life, the policyholder pays premiums over the entire term of the policy, and in return, the insurance company guarantees to pay a death benefit to the beneficiaries upon the insured's death. Additionally, a portion of the premium goes into a cash value account, which grows tax-free and can be borrowed against or withdrawn. This feature makes whole life insurance a valuable financial tool, as it provides both insurance coverage and a long-term savings plan. The cash value can be used to pay for future expenses, provide a financial cushion, or even be used to pay off the policy's premiums over time.

The key difference lies in their longevity and flexibility. Term insurance is a temporary solution, offering protection for a specific period, while whole life insurance provides lifelong coverage. Term policies are generally more affordable and straightforward, making them suitable for short-term needs or those on a budget. In contrast, whole life insurance is more comprehensive and provides long-term financial security, including the potential for tax-free growth of the cash value. Understanding this distinction is essential for individuals to make informed decisions about their insurance needs and ensure they have the appropriate level of coverage for their specific circumstances.

In summary, term insurance and whole life insurance are not the same. Term insurance is a temporary solution for specific coverage needs, while whole life insurance offers lifelong protection and savings. Recognizing this difference is vital for individuals to choose the right insurance product that aligns with their financial goals and provides the necessary security for their loved ones.

Securing Your Future: When to Start Investing in Life Insurance

You may want to see also

Misinterpretation: Premiums are too high for low earners

The misconception that life insurance premiums are prohibitively expensive for low-income earners is a common misunderstanding in the insurance industry. This idea often stems from the belief that life insurance is a luxury rather than a necessity, and that only those with substantial financial resources can afford it. However, this notion is far from the truth and can lead to a significant oversight in personal financial planning.

Low-income earners often face unique financial challenges, and it is understandable why they might perceive life insurance as an unnecessary expense. The primary concern for many in this demographic is making ends meet and ensuring financial stability for their families. As a result, they may prioritize immediate needs over long-term financial planning, including life insurance. However, this perspective fails to recognize the long-term benefits and security that life insurance can provide, especially for those with limited financial means.

The cost of life insurance premiums can vary significantly depending on several factors, including age, health, lifestyle, and the amount of coverage desired. For low-income individuals, the perception of high premiums might be influenced by their current financial situation, which may not allow for additional expenses. Yet, it is essential to understand that life insurance is not a one-size-fits-all product. There are various types of policies, such as term life insurance, which offers coverage for a specified period, and whole life insurance, which provides lifelong coverage with an investment component. These options can be tailored to fit different budgets and needs.

Moreover, the idea that life insurance is too expensive for low earners can be dispelled by exploring the concept of term life insurance. This type of policy is generally more affordable, especially for younger individuals, as it focuses on providing coverage for a specific period, typically 10, 20, or 30 years. During this time, it ensures financial protection for loved ones, covering essential expenses like mortgage payments, children's education, or daily living costs. After the term ends, the policy can be renewed, or alternative coverage options can be explored, ensuring long-term financial security without the burden of high premiums.

In conclusion, the misinterpretation of life insurance premiums being too high for low earners can lead to a missed opportunity for financial protection. By understanding the various policy types and their associated costs, individuals can make informed decisions about their insurance needs. It is a common misconception that can be addressed through education and awareness, ensuring that everyone, regardless of their income level, can benefit from the security and peace of mind that life insurance provides.

Unraveling the Mystery: Understanding Flexible Variable Life Insurance

You may want to see also

Misconception: It's a one-time purchase, not a long-term investment

The misconception that life insurance is a one-time purchase rather than a long-term financial strategy is a common error many people make. This misunderstanding often stems from a lack of comprehensive knowledge about the various types of life insurance policies and their potential benefits over time. When individuals view life insurance solely as a one-time transaction, they miss out on the opportunity to build a robust financial safety net for themselves and their loved ones.

Life insurance is designed to provide financial security and peace of mind for the long term. It is not just about covering immediate expenses after an unfortunate event; it is a tool for long-term financial planning. Term life insurance, for instance, offers coverage for a specified period, typically 10, 20, or 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company provides a death benefit to the policyholder's beneficiaries if they pass away during that period. This type of policy is ideal for those who want to ensure their family's financial stability during a specific life stage, such as when they have children or a mortgage.

The beauty of life insurance lies in its ability to adapt to changing circumstances. As individuals progress through life, their financial needs evolve. For example, a young family might require life insurance to cover mortgage payments and provide for their children's education. As they grow older and their financial situation improves, they may consider converting their term policy into a permanent life insurance plan, such as whole life or universal life insurance. These permanent policies offer lifelong coverage and accumulate cash value over time, which can be borrowed against or withdrawn to meet various financial goals.

Furthermore, life insurance can be a valuable long-term investment strategy. Some policies, like whole life insurance, come with an investment component, allowing policyholders to build a cash value that can be used for various purposes. This feature enables individuals to grow their money tax-free and potentially earn interest, providing a financial cushion for the future. By understanding the long-term nature of life insurance, individuals can make informed decisions about their coverage, ensuring they have adequate protection throughout their lives and beyond.

In summary, life insurance is not a one-time purchase but a dynamic financial tool that adapts to an individual's changing needs. It provides long-term security and can be tailored to meet specific financial goals. By dispelling the misconception that it is a one-time transaction, people can make more informed choices, ensuring they and their families are protected financially for years to come.

Whole Life Insurance: Understanding the Different Types and Variations

You may want to see also

Misunderstanding: Life insurance is a luxury, not a necessity

The notion that life insurance is a luxury rather than a necessity is a common misconception that can have serious financial consequences. This misunderstanding often stems from a lack of comprehensive understanding of the various types of life insurance and their potential benefits. Here's an exploration of why this belief is incorrect and why life insurance is, in fact, a crucial financial tool.

Firstly, let's clarify the difference between a luxury and a necessity. A luxury is typically an item or service that provides pleasure or comfort but is not essential for daily living. In contrast, a necessity is something fundamental and required for survival or well-being. Life insurance, in its core function, is designed to provide financial security and peace of mind, which are essential for the well-being of individuals and their families. It is not an optional extra but a vital component of a comprehensive financial plan.

The misconception that life insurance is a luxury often arises from the idea that it is only for the wealthy. However, this couldn't be further from the truth. Life insurance is available in various forms, from term life insurance, which provides coverage for a specific period, to permanent life insurance, which offers lifelong coverage. The cost and benefits of life insurance policies can be tailored to fit different budgets and needs. For instance, a young, healthy individual might opt for a term life policy to cover a mortgage or provide for their children's education, while an older person might choose a permanent policy to ensure their family's financial security in the long term.

Another reason why life insurance is often seen as a luxury is the misunderstanding of its primary purpose. Some people believe that life insurance is only necessary if one has a large family or significant financial obligations. However, this is not the case. Life insurance is essential for anyone who has people or assets that they wish to protect. It can provide financial support to your loved ones in the event of your death, covering expenses such as funeral costs, outstanding debts, mortgage payments, or even everyday living expenses. This financial safety net can significantly reduce the burden on your family during a difficult time.

Furthermore, life insurance offers a range of other benefits that go beyond financial protection. It can be a valuable tool for wealth creation, with some policies offering investment components that can grow over time. Additionally, life insurance can provide tax advantages, with proceeds often being tax-free, and certain policies can even offer income tax relief. These additional benefits further emphasize the necessity of life insurance in a comprehensive financial strategy.

In conclusion, the idea that life insurance is a luxury is a dangerous misconception. It is a necessity that provides financial security, peace of mind, and a range of additional benefits. Understanding the various types of life insurance and their potential applications is crucial in making informed financial decisions. By recognizing the true value of life insurance, individuals can ensure that they and their loved ones are protected, no matter what life may bring.

Understanding the Cost: Why Guardian Life Insurance is Expensive

You may want to see also

Frequently asked questions

Life insurance and health insurance are distinct financial products. Life insurance provides a financial benefit to beneficiaries upon the insured individual's death, offering financial security to loved ones. Health insurance, on the other hand, covers medical expenses and healthcare costs, ensuring access to medical treatment. While both are essential, they serve different purposes and are often confused due to the similar nature of protecting one's well-being.

Life insurance is sometimes perceived as an optional extra, a luxury item, especially in cultures where saving for the future is not a priority. However, it is a necessity for most people. It ensures financial security for dependents, covers funeral expenses, and provides financial support during challenging times. Misunderstanding it as a luxury can lead to people neglecting to purchase it, leaving their loved ones vulnerable.

The misconception that life insurance is exclusively for the wealthy can stem from the association of high-value policies with affluence. In reality, life insurance is accessible to people of all income levels. There are various types of policies, including term life insurance, whole life insurance, and universal life insurance, each with different features and cost structures. Anyone can find a suitable plan that fits their budget and needs.

Life insurance policies can be intricate and filled with technical jargon, making them difficult for the average person to understand. Misinterpretations may arise due to complex terms, riders, and exclusions. It is crucial for consumers to read and comprehend their policies or seek professional advice to ensure they know what they are purchasing and what coverage they receive.

There is a common misconception that life insurance is primarily for the elderly, which is not accurate. Life insurance is designed to provide financial security for loved ones, and it is most valuable when purchased at a younger age. Younger individuals often have more years of coverage needed, and premiums are typically lower when you're younger and healthier. Delaying purchase until later in life may result in higher premiums and reduced coverage options.