When it comes to life insurance, the question of when to start investing in a policy is an important one. Many people wonder if they should begin protecting their loved ones and assets as soon as they start earning an income or if there's a specific age or life stage that makes the most sense. The answer is that it depends on your individual circumstances and financial goals. Generally, it's a good idea to start considering life insurance in your 20s or 30s when you're establishing your career and family. This is a time when you're likely to have a growing income and increasing responsibilities, making it a prime moment to secure your loved ones' financial future. However, it's also important to assess your current financial situation, including your debt, savings, and other insurance coverage, to determine the best time to invest in life insurance.

What You'll Learn

- Age and Life Stage: Consider starting early, especially in your 20s, to build long-term coverage

- Financial Goals: Assess your financial needs and goals to determine the right time to invest

- Health and Medical History: Evaluate your health and any pre-existing conditions to understand eligibility

- Budget and Affordability: Ensure you can afford premiums without compromising your financial stability

- Professional Advice: Consult a financial advisor to tailor a plan based on your unique circumstances

Age and Life Stage: Consider starting early, especially in your 20s, to build long-term coverage

When it comes to life insurance, timing is crucial, and starting early can be a strategic move, especially for those in their 20s. This age group often finds themselves at a pivotal point in life, with numerous milestones and responsibilities on the horizon. By initiating life insurance coverage during this decade, individuals can secure their financial future and that of their loved ones.

The 20s are typically characterized by a relatively stable income, fewer financial commitments, and a lower risk profile. This makes it an ideal time to purchase life insurance, as premiums are generally more affordable. Young adults often have fewer dependents and may not yet have established a substantial estate, which can make the process of securing coverage more manageable. Starting early allows individuals to build a solid foundation for their financial security, ensuring that they have a safety net in place for the long term.

One of the key advantages of early investment in life insurance is the opportunity to lock in lower premiums. Insurance companies often offer more competitive rates to younger individuals, as they are considered less risky. This is because younger people are generally healthier and have a longer life expectancy, which translates to lower expected costs for the insurance provider. As a result, young adults can benefit from more affordable coverage, allowing them to allocate their resources efficiently and potentially save for other financial goals.

Furthermore, starting life insurance in one's 20s provides the advantage of long-term coverage. This is particularly important as it allows individuals to build a comprehensive policy that can adapt to their changing needs over time. As people progress through life, their financial goals and responsibilities evolve. Early investment enables individuals to gradually increase their coverage, ensuring that they have adequate protection as their family grows and their financial obligations expand. This long-term approach to life insurance can provide peace of mind and financial security for the future.

In summary, the 20s are an opportune time to begin investing in life insurance. It allows individuals to take advantage of lower premiums, build long-term coverage, and secure their financial future. By starting early, young adults can make informed decisions about their insurance needs, ensuring that they have a reliable safety net in place for the years ahead. This proactive approach to life insurance planning can significantly contribute to overall financial well-being.

Contacting American Amicable Life Insurance: A Step-by-Step Guide

You may want to see also

Financial Goals: Assess your financial needs and goals to determine the right time to invest

Assessing your financial goals is a crucial step in determining when to invest in life insurance. This process involves a deep understanding of your current and future financial needs, which will help you make an informed decision about insurance coverage. Here's a breakdown of how to approach this:

Evaluate Your Current Financial Situation: Start by taking an honest look at your current financial health. Calculate your net worth by listing your assets (cash, investments, property, etc.) and liabilities (debts, loans). This snapshot will give you a clear idea of your financial standing and any potential gaps in coverage. For instance, if you have a substantial amount of debt or rely on a single income, life insurance might be a priority to protect your loved ones in the event of your passing.

Identify Short-Term and Long-Term Goals: Break down your financial aspirations into short-term and long-term categories. Short-term goals could include saving for a down payment on a house, funding your child's education, or building an emergency fund. Long-term goals might involve retirement planning, saving for your child's future, or investing for wealth accumulation. Understanding these goals will help you prioritize and determine the appropriate level of life insurance coverage to support them.

Consider Your Family's Needs: Your family's financial needs should be a significant factor in your decision-making process. If you have a spouse or children who depend on your income, life insurance can provide financial security for their future. It can help cover essential expenses, such as mortgage payments, education costs, or daily living expenses, ensuring your family's well-being in your absence.

Review and Adjust Regularly: Financial goals are not set in stone and should be reviewed periodically. Life events, such as marriage, the birth of a child, or a significant career advancement, can impact your financial needs. Regularly assessing your goals and adjusting your life insurance coverage accordingly will ensure that you are adequately prepared for any eventuality.

By carefully evaluating your financial goals and needs, you can make a well-informed decision about investing in life insurance. This process empowers you to take control of your financial future and provide the necessary protection for your loved ones. Remember, starting early and regularly reviewing your coverage can offer significant benefits, ensuring a more secure and stable financial future.

Flex Life Insurance: Smart Investment or Risky Business?

You may want to see also

Health and Medical History: Evaluate your health and any pre-existing conditions to understand eligibility

When considering life insurance, evaluating your health and medical history is a crucial step to ensure you make an informed decision. This process involves a comprehensive assessment of your overall well-being and any pre-existing medical conditions you may have. Here's a detailed guide on how to approach this aspect:

Understanding Your Health Status: Begin by taking an honest look at your current health. Consider factors such as age, weight, height, and any recent medical diagnoses or treatments. For instance, if you have a chronic condition like diabetes, hypertension, or heart disease, it's essential to disclose this information. Insurance companies often use medical history to determine eligibility and set premiums, so transparency is key.

Medical Records and Reports: Gather your medical records and reports, including any lab results, imaging scans, and doctor's notes. These documents provide a comprehensive overview of your health. Make sure to include information about past surgeries, hospitalizations, and any ongoing treatments. If you have a history of serious illnesses or chronic diseases, it's crucial to provide detailed records to the insurance provider.

Pre-existing Conditions and Their Impact: Pre-existing conditions can significantly influence your life insurance eligibility and costs. These may include conditions like asthma, cancer, kidney disease, or any other chronic illnesses. It's important to understand how these conditions might affect your insurance options. Some insurers may offer specialized policies or provide coverage with certain exclusions or limitations.

Lifestyle Factors: In addition to medical history, consider lifestyle factors that could impact your health. Smoking, excessive alcohol consumption, drug use, and a sedentary lifestyle can all contribute to health risks. Insurance companies often take these factors into account when assessing risk. Quitting smoking, for example, can lead to improved health and potentially lower insurance premiums over time.

Consulting a Healthcare Professional: If you have any concerns or questions about your health and its impact on life insurance, consult a healthcare professional. They can provide valuable insights and guidance. A doctor or a medical advisor can help you understand how your health status might affect your insurance options and recommend any necessary steps to improve your overall well-being.

By thoroughly evaluating your health and medical history, you can make a well-informed decision about life insurance. This process ensures that you choose the right coverage and understand the associated costs. Remember, being transparent and accurate in your medical disclosures is essential for a smooth insurance application process.

Weight's Impact: Life Insurance Premiums and Health

You may want to see also

Budget and Affordability: Ensure you can afford premiums without compromising your financial stability

When considering life insurance, one of the most crucial aspects to evaluate is your budget and affordability. It's essential to ensure that you can comfortably afford the premiums without sacrificing your financial stability or future goals. Here's a detailed guide to help you navigate this important decision:

Assess Your Financial Situation: Begin by evaluating your current financial health. Calculate your monthly income and expenses to determine how much you can allocate towards insurance premiums. Consider your other financial commitments, such as mortgage payments, car loans, or student loans. It's important to strike a balance between covering your essential expenses and allocating a portion of your income for insurance. Remember, life insurance is a long-term commitment, and you want to ensure that you can consistently meet the premium payments without falling into financial strain.

Evaluate Your Risk Profile: Different types of life insurance policies offer varying levels of coverage and costs. Understanding your risk profile is key to making an informed decision. Younger individuals often benefit from term life insurance, which provides coverage for a specified period at a lower cost. As you age, you might consider permanent life insurance, which offers lifelong coverage and potential investment components. Assess your health, lifestyle, and any existing medical conditions to determine the type of policy that aligns with your needs and budget.

Compare Premiums and Coverage: Research and compare different insurance providers and their offerings. Obtain quotes for various coverage amounts and policy types to understand the premium variations. Keep in mind that higher coverage amounts typically result in higher premiums. Evaluate the terms and conditions of each policy, including any exclusions or limitations. Look for policies that offer flexibility in premium payments, such as annual, semi-annual, or monthly options, to find a payment schedule that suits your budget.

Consider Long-Term Financial Goals: Aligning your life insurance purchase with your long-term financial objectives is essential. If you have a growing family, a mortgage, or significant financial responsibilities, life insurance can provide a safety net. Ensure that the policy's coverage amount is sufficient to meet your family's needs and cover any outstanding debts. Additionally, consider the potential investment component of certain life insurance policies, which can help grow your money over time, providing both insurance protection and financial benefits.

Review and Adjust Regularly: Life insurance needs may change over time due to various life events, such as marriage, the birth of children, or career advancements. Regularly review your policy to ensure it still meets your requirements. As your financial situation improves, you might be able to increase your coverage or explore more comprehensive policies. Conversely, if your circumstances change and you no longer require extensive coverage, adjusting your policy accordingly can help optimize your budget.

By carefully considering your budget and affordability, you can make an informed decision about when and how to start investing in life insurance. It's a long-term commitment, so ensuring financial stability and regular policy reviews are essential to making the most of this important financial decision.

Life Insurance Exam: Florida's Question Marathon

You may want to see also

Professional Advice: Consult a financial advisor to tailor a plan based on your unique circumstances

When it comes to life insurance, seeking professional advice is an essential step to ensure you make informed decisions about your financial future. Consulting a financial advisor is a wise choice, as they can provide tailored guidance based on your specific needs and goals. Here's why this step is crucial:

Financial advisors are experts in assessing an individual's financial situation and offering personalized recommendations. They will consider various factors unique to your life, such as your age, health, income, family status, and long-term objectives. For instance, a young professional might focus on building a comprehensive financial plan that includes life insurance to secure their family's future in case of an untimely demise. In contrast, an older individual might prioritize long-term care insurance to cover potential healthcare expenses. By understanding your circumstances, advisors can help you determine the appropriate type and amount of life insurance coverage.

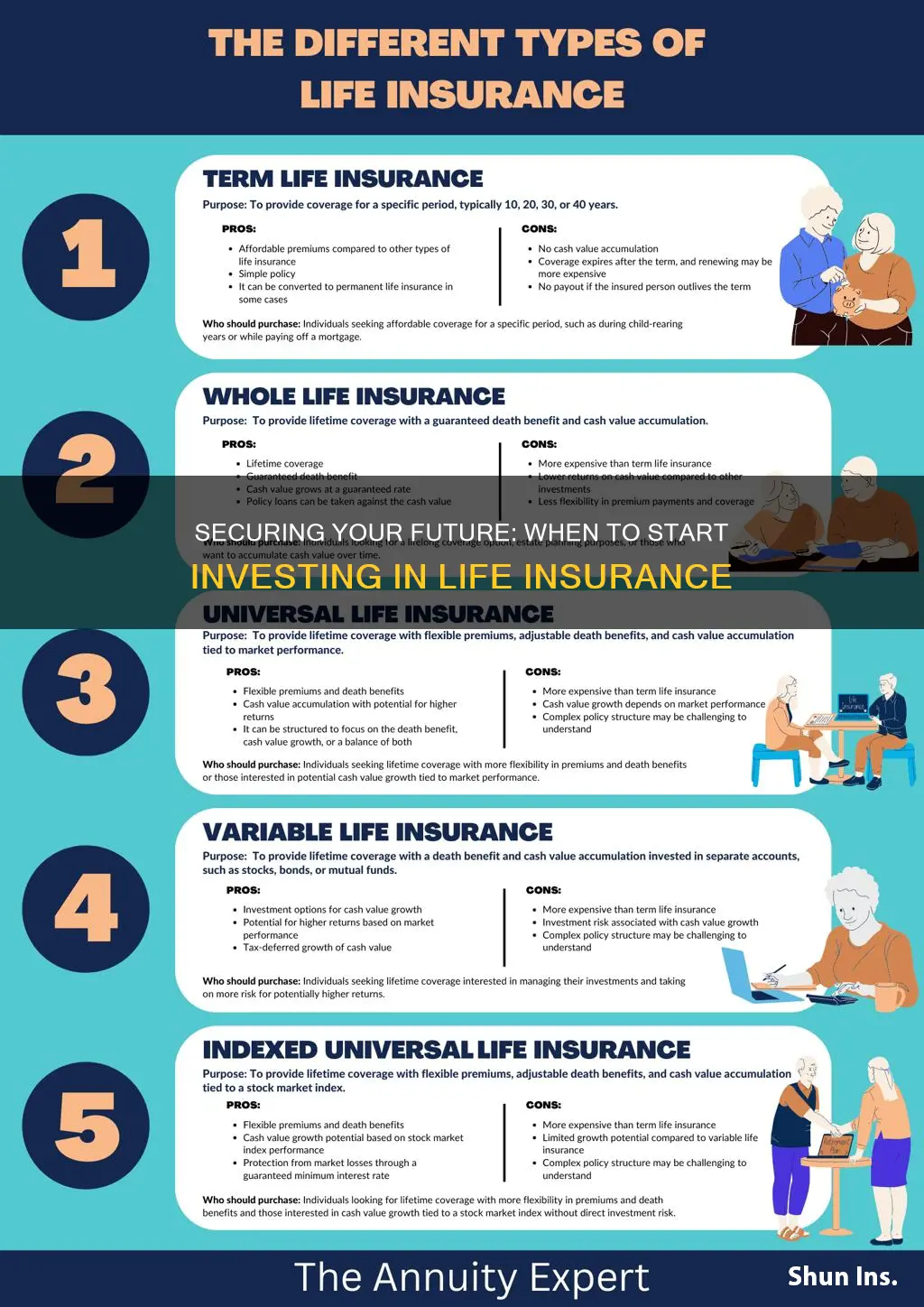

The complexity of life insurance options can be overwhelming. There are different types of policies, including term life, whole life, universal life, and more, each with its own advantages and disadvantages. A financial advisor can simplify this process by explaining the various policy features, benefits, and potential pitfalls. They can also help you understand the tax implications and long-term financial impact of your decisions, ensuring you make choices that align with your best interests.

Moreover, advisors can assist in creating a comprehensive financial strategy that incorporates life insurance as a vital component. They can integrate life insurance with other financial tools like retirement plans, investment portfolios, and estate planning to provide a holistic approach to wealth management. This integrated strategy ensures that your life insurance serves as a powerful tool to achieve your financial objectives while also protecting your loved ones.

In summary, consulting a financial advisor is a critical step in the decision-making process regarding life insurance. Their expertise allows them to provide customized advice, ensuring you select the right type of coverage that suits your unique circumstances. By seeking their guidance, you can make informed choices, protect your loved ones, and secure your financial future with confidence. Remember, a financial advisor's role is to educate and empower you to make the best decisions for your long-term well-being.

Life Insurance: Protecting Students and Their Families

You may want to see also

Frequently asked questions

The ideal time to begin considering life insurance is when you have financial responsibilities or dependents, as it provides a safety net for your loved ones in the event of your passing. This typically aligns with major life milestones such as getting married, having children, or purchasing a home.

Yes, life insurance is not solely for the elderly or those with pre-existing health conditions. Young and healthy individuals can still benefit from life insurance as it ensures financial security for their families during unforeseen circumstances. Term life insurance, which provides coverage for a specific period, is often a popular choice for young families.

Determining the right amount of life insurance depends on various factors, including your income, debts, mortgage or rent, dependents' needs, and future financial goals. A common rule of thumb is to ensure your life insurance coverage is equal to 10-15 times your annual income. It's best to consult with a financial advisor to assess your unique situation.

Yes, having a pre-existing medical condition doesn't automatically disqualify you from getting life insurance. Insurers may offer different types of policies or charge higher premiums based on the severity of the condition. It's advisable to disclose all medical information accurately during the application process to ensure proper coverage and avoid potential issues.

There are several types of life insurance policies, including Term Life, Whole Life, Universal Life, and Variable Life. Term life insurance provides coverage for a specific period, while whole life offers lifelong coverage with an accumulation of cash value. Universal life allows flexibility in premium payments and investment options. It's essential to understand the features and benefits of each type to make an informed decision based on your long-term financial goals.