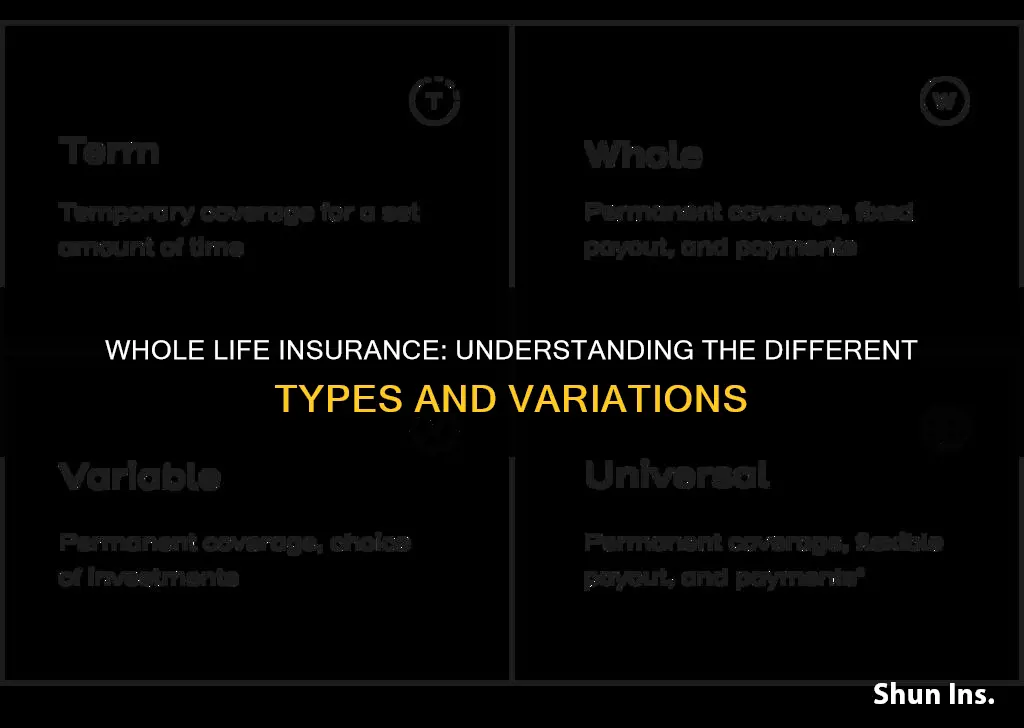

There are several types of whole life insurance policies, which is one of the two primary types of life insurance, the other being term life insurance. Whole life insurance provides coverage for an individual's entire life, as opposed to term life insurance, which is only for a specific amount of years. Whole life insurance policies can be categorised based on how premiums are paid, with level payment, single premium, limited payment, and modified whole life insurance being some of the most common types. Whole life insurance also includes variations such as traditional, variable, and universal whole life, each offering different levels of flexibility and investment options.

| Characteristics | Values |

|---|---|

| Coverage | Lifelong |

| Premium | Fixed |

| Death benefit | Guaranteed |

| Investment account | Yes |

| Tax treatment | Tax-deferred |

| Dividends | Yes |

| Premium options | Level, single, limited |

| Policy type | Traditional, variable, universal, final expense, survivorship, no-exam |

What You'll Learn

Whole life insurance vs. term life insurance

There are five main types of life insurance: term life insurance, whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Each type varies in coverage length, complexity, coverage amount, cash value, and other features. Whole life insurance is one of several types of permanent life insurance, meaning it covers the insured for their entire life. Other types of permanent life insurance include universal life, indexed universal life, and variable universal life.

Whole life insurance and term life insurance are two of the most common types of life insurance. Whole life insurance provides coverage for the entirety of the insured person's life, whereas term life insurance is only for a specific number of years. Whole life insurance policies are therefore permanent, while term life insurance is temporary.

Whole life insurance policies have level premiums, meaning the amount paid each month remains the same. Term life insurance premiums, on the other hand, increase with each renewal as the insured person ages. Whole life insurance also has a cash savings component, which the policyholder can draw on or borrow from. This is not the case with term life insurance.

Whole life insurance policies are more expensive than term life insurance policies. This is because whole life insurance accumulates cash value and covers the insured for their whole life. Term life insurance, on the other hand, only pays out a death benefit.

Whole life insurance is a more straightforward option than term life insurance. It is also a more comprehensive option, as it covers the insured for their entire life. However, term life insurance is a more affordable option for those who only need coverage for a certain number of years.

Variable vs Term Life Insurance: What's the Difference?

You may want to see also

Whole life insurance premiums

There are several types of whole life insurance policies, categorised based on how premiums are paid. The most common type is level payment, where premiums remain unchanged throughout the duration of the policy. Single premium policies involve a one-time large premium payment that funds the policy for life. Limited payment policies involve higher premiums paid for a certain number of years. Modified whole life insurance offers lower premiums in the first few years, followed by higher-than-standard premiums in subsequent years.

Whole life insurance policies can also be categorised as participating or non-participating plans. Participating plans pay dividends, which can be used to reduce premiums or increase policy coverage limits. Non-participating plans do not pay dividends, and any excess of premiums over payouts becomes profit for the insurer.

Life Insurance Benefits: Florida's Public Record Law Explained

You may want to see also

Whole life insurance cash value

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person. It is designed for those who need straightforward, lifelong coverage. It also includes a savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest.

The cash value of whole life insurance can still grow with potential tax savings, and the death benefit is guaranteed, as long as the premiums are paid. The premiums in this type of plan are usually fixed. Whole life insurance is believed to be one of the most popular choices in the life insurance market.

The cash value portion of this life insurance plan can be particularly appealing because you may be able to access the money early. This can be done by taking out a loan against the policy, surrendering the policy, or making a withdrawal. However, withdrawals and outstanding loan balances reduce death benefits.

Whole life insurance is different from term life insurance, which only provides coverage for a certain number of years and does not have a cash savings component. Whole life insurance is also more expensive than term life insurance.

Cigna's Nicotine Testing for Life Insurance

You may want to see also

Whole life insurance benefits

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, paying your benefit no matter when you pass away, as long as you keep paying your premiums. Here are some detailed benefits of whole life insurance:

Guaranteed lifelong coverage

Whole life insurance provides coverage throughout the life of the insured person. It lasts for an insured's lifetime, unlike term life insurance, which is for a specific number of years. As long as you continue to pay your premiums, which are typically level premiums (meaning they stay the same), you will be covered for life. This makes whole life insurance a good option for those seeking lifelong coverage and long-term financial security.

Death benefit

Whole life insurance guarantees payment of a death benefit to beneficiaries. This benefit amount is established when you sign up for the policy and remains the same as long as the policy is active. The death benefit is tax-free for the beneficiary and can provide financial security for loved ones or be used to cover end-of-life expenses such as funeral costs.

Cash value

Whole life insurance has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. This cash value grows over time, with interest accruing on a tax-deferred basis. The cash value can be used for loans, withdrawals, or premium payments. It can also be used to supplement retirement income or make large purchases.

Predictable premium payments

Whole life insurance typically features level premiums, meaning the amount you pay every month will not change. This makes budgeting easier and more predictable.

Tax benefits

The cash value of a whole life insurance policy grows on a tax-deferred basis. Withdrawals are tax-free up to the value of the total premiums paid. Additionally, the death benefit paid to beneficiaries is also tax-free.

Investment opportunities

The cash value of a whole life insurance policy can be used for investments. Policy dividends can be reinvested into the cash value to earn interest or used to purchase additional coverage. Some companies may also offer dividend payments, which can be used to increase the death benefit or reduce premiums.

Term-Life Insurance: Facts and Fiction

You may want to see also

Types of whole life insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, unlike term life insurance, which is only in effect for a specific number of years. Whole life insurance policies also include a savings component that accumulates cash value over time. This cash value can be withdrawn or borrowed against by the policyholder.

There are several types of whole life insurance policies, which can be categorised based on how premiums are paid. Here are some of the most common types:

- Level Payment: This is the most common type of whole life insurance, where premiums remain unchanged throughout the duration of the policy.

- Single Premium: The insured pays a one-time large premium, which funds the policy for life. However, this type of policy is usually a modified endowment contract with tax consequences.

- Limited Payment: You pay a limited number of premiums, which are higher than level-payment policies, but only for a certain number of years.

- Modified Whole Life Insurance: This policy offers lower premiums than standard policies in the first two to three years, and higher premiums in the later years, making it more expensive in the long run.

Whole life insurance policies can also be categorised as either participating or non-participating plans. With a non-participating policy, any excess of premiums over payouts becomes profit for the insurer, whereas with a participating policy, this excess is redistributed to the insured as a dividend.

Whole Life Insurance: A Smart Move for 50-Year-Olds?

You may want to see also

Frequently asked questions

There are several types of whole life insurance, including traditional, variable, and universal whole life insurance. Each type offers different levels of flexibility and investment options.

Traditional whole life insurance is a basic form of whole life insurance that provides lifelong coverage, a guaranteed death benefit, and a tax-deferred cash value component. Variable whole life insurance is similar but offers flexible premium payments and death benefit amounts, and the cash value is tied to the performance of investments chosen by the policyholder. Universal whole life insurance is another form of permanent life insurance that allows the policyholder to adjust the death benefit and premium payments and has a cash value component that grows based on market interest rates.

Whole life insurance provides lifelong coverage and a guaranteed death benefit. It also has a tax-deferred cash value component that can be used for loans or to enhance the policy. Whole life insurance can help ease the financial burden on loved ones in the event of the policyholder's death and allow them to focus on healing.