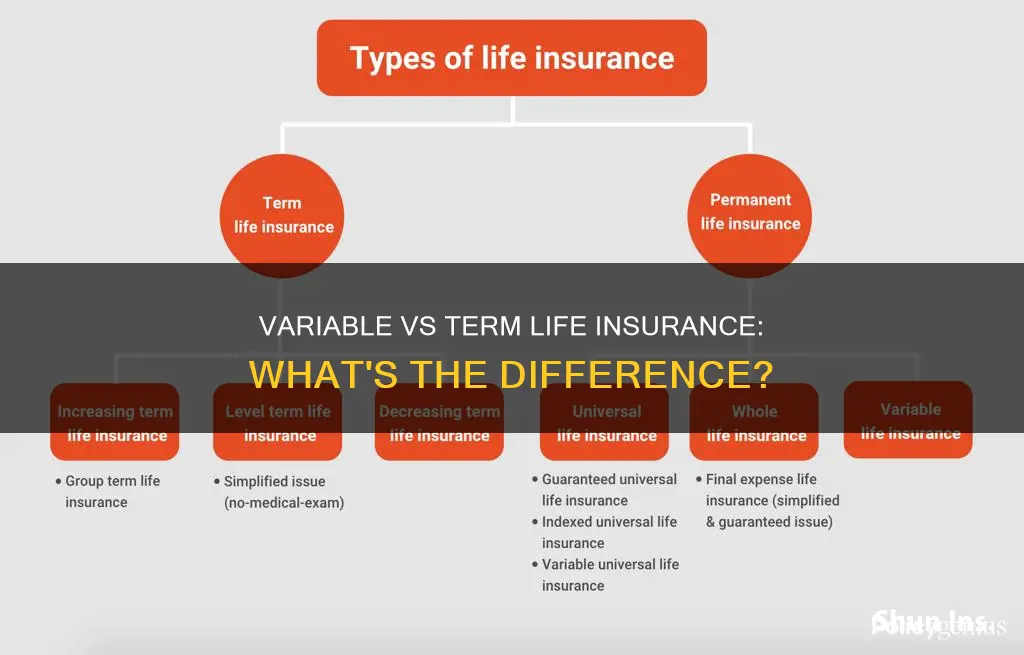

Variable life insurance and term life insurance are two different types of life insurance policies. Term life insurance is the simplest form of life insurance, where the policyholder is covered only for a specific period, usually from one to 30 years. On the other hand, variable life insurance is a permanent life insurance policy, which means it is designed to last for the entirety of the policyholder's life. Variable life insurance policies also have an investment component, which is absent in term life insurance policies.

| Characteristics | Values |

|---|---|

| Type | Variable life insurance is a type of permanent life insurance. |

| Length of coverage | Variable life insurance provides coverage for the entirety of the policyholder's life. |

| Cash value | Variable life insurance includes a cash value component that can be invested in stocks, bonds, mutual funds, etc. |

| Death benefit | Variable life insurance provides a death benefit to beneficiaries when the policyholder dies. |

| Premium | Variable life insurance premiums are fixed throughout the length of the policy. |

| Risk | Variable life insurance carries more risk compared to other life insurance policies as the cash value component is influenced by the performance of the market. |

What You'll Learn

- Variable life insurance policies are permanent, while term life insurance covers a specific period

- Variable life insurance policies have a higher earning potential than term life insurance

- Variable life insurance policies carry more risk than term life insurance

- Variable life insurance policies have a cash value account, while term life insurance does not

- Variable life insurance policies have fixed premiums, while term life insurance premiums may increase

Variable life insurance policies are permanent, while term life insurance covers a specific period

Variable life insurance is a form of permanent life insurance, which means it is designed to last for the entirety of the insured person's lifetime. In contrast, term life insurance covers a specific period, usually ranging from one to 30 years, and pays out only if death occurs during the term of the policy.

Variable life insurance policies carry an investment component, known as the cash value, in addition to the death benefit. The cash value can be invested, typically in mutual funds, giving policyholders the opportunity to benefit from market gains. However, it is important to note that the returns are not guaranteed, and the policy carries more risk compared to other types of life insurance. The cash value of a variable life insurance policy can increase or decrease based on market performance, and there may be fees and charges associated with the investment component.

On the other hand, term life insurance is the simplest form of life insurance. It does not have an investment component and generally offers larger insurance protection for the premium paid. Term life insurance policies are typically cheaper than variable life insurance policies because they are temporary and do not build cash value.

While variable life insurance provides permanent coverage and the potential for greater returns, it also comes with higher premiums and more risk. Term life insurance, on the other hand, offers fixed coverage for a specific period and is more affordable, making it a popular choice for individuals who want coverage for a certain period or those who cannot afford the higher premiums of permanent life insurance.

Ultimately, the decision between variable and term life insurance depends on an individual's financial situation, risk tolerance, and coverage needs. Variable life insurance may be suitable for those seeking permanent coverage, willing to take on more risk, and interested in the potential for higher returns. Term life insurance, on the other hand, is often sufficient for most individuals who want coverage for a specific period or are looking for the most affordable option.

Welfare Recipients: Can They Access Life Insurance?

You may want to see also

Variable life insurance policies have a higher earning potential than term life insurance

Variable life insurance policies combine a life insurance death benefit with a cash value account that can be invested in stocks, bonds, mutual funds, or other assets. The policyholder can choose how to allocate the cash value across these investment options, providing the potential for higher returns compared to other types of permanent life insurance. However, it's important to note that variable life insurance policies also carry more risk, as the returns are dependent on the performance of the underlying investments.

In contrast, term life insurance policies do not have an investment component and only provide a death benefit if the insured person passes away during the term of the policy. While term life insurance is generally more affordable, it does not offer the same earning potential as variable life insurance.

Variable life insurance policies also offer flexibility in terms of premium payments and death benefits. Policyholders can adjust their premiums if they have sufficient funds in their cash value account. Additionally, they may have the option to increase the death benefit by converting their cash value. However, it's important to note that variable life insurance policies tend to have higher premiums and may include various fees associated with the investment component.

Overall, variable life insurance policies provide the opportunity for higher earnings compared to term life insurance, but they also come with increased risk and complexity.

Spousal Life Insurance: Protecting Your Partner's Future

You may want to see also

Variable life insurance policies carry more risk than term life insurance

Variable life insurance policies are considered more volatile than standard life insurance policies. The major risk of variable life insurance is that the investments can lose money. Unlike other types of insurance policies, the insurance company does not guarantee a rate of return. If the market is doing poorly, the policy's cash value could suffer. This means that variable life insurance policies carry more risk if the market is performing poorly. While there may be a floor to protect against negative returns, there is no guarantee of positive returns.

Variable life insurance policies also tend to have higher premiums and fees than term life insurance policies. The premiums for variable life are generally higher due to the added investment component. Additionally, there are various fees associated with the policy's investment component, such as investment management fees and sales and administrative fees. These fees can be quite high, especially if the money is being actively invested.

Overall, variable life insurance policies carry more risk than term life insurance due to the potential for investment losses, higher premiums, and additional fees. While variable life insurance offers the potential for greater returns, it also comes with the possibility of losing money, which is not a risk associated with term life insurance.

Life Insurance Options Post-Lyme Diagnosis

You may want to see also

Variable life insurance policies have a cash value account, while term life insurance does not

Variable life insurance and term life insurance are two distinct types of insurance policies with different features and benefits. Understanding these differences is crucial for making informed decisions about financial planning and protection.

Variable life insurance policies, also known as variable appreciable life insurance, are a type of permanent life insurance. They offer lifelong coverage and provide a cash value account that the policyholder can invest in various options, such as stocks, bonds, mutual funds, or other securities. This feature sets variable life insurance apart from term life insurance, as it allows policyholders to potentially grow their cash value over time. On the other hand, term life insurance is the simplest form of life insurance and does not include a cash value component.

The cash value in a variable life insurance policy acts as an investment, giving it the potential to earn higher returns than traditional policies. Policyholders have the flexibility to decide how to allocate their premiums between the insurance component and the cash value account. This customization allows them to balance their risk tolerance and financial goals. However, it's important to remember that the cash value of a variable life insurance policy is subject to market risks, and there is no guaranteed rate of return. The value of the investments can fluctuate, leading to potential gains or losses.

In contrast, term life insurance provides coverage for a specific period, typically ranging from one to 30 years. It is designed to pay out a benefit only if death occurs during the term of the policy. Most term policies have no other benefit provisions, making them a more straightforward and affordable option for those seeking basic financial protection. Term life insurance premiums are generally lower than those of permanent life insurance products, including variable life insurance, due to the lack of an investment component.

While variable life insurance offers the advantage of a cash value account, it also carries more risk and complexity. The performance of the underlying investments can impact the value of the policy, and there may be fees associated with managing the investment component. On the other hand, term life insurance provides guaranteed coverage during the specified term, offering peace of mind without the need for active management.

In summary, variable life insurance policies provide a cash value account that can be invested, offering the potential for greater returns. However, term life insurance does not include this feature, focusing solely on providing a death benefit during the policy term. When considering which type of insurance to choose, it's important to assess individual needs, financial goals, and risk tolerance to make the most suitable decision.

Becoming a Life Insurance Agent: New York Requirements

You may want to see also

Variable life insurance policies have fixed premiums, while term life insurance premiums may increase

Variable life insurance and term life insurance are two different types of insurance policies with distinct features and benefits. Variable life insurance is a form of permanent life insurance, which means it is designed to last for the insured person's entire life. On the other hand, term life insurance is a simpler form of insurance that provides coverage for a specified term, typically ranging from 10 to 30 years.

One key difference between these two types of policies lies in their premium structures. Variable life insurance policies have fixed premiums throughout the duration of the policy. This means that the premium amount remains unchanged, providing stability for the policyholder. In contrast, term life insurance premiums may remain the same every year or increase annually, depending on the specific type of term life insurance chosen.

With term life insurance, there are two main types: level term and annually renewable term. Level term life insurance locks in the premium rate, ensuring that the policyholder pays the same amount every month throughout the term. This can be an attractive option as it offers high-quality coverage at an affordable price, especially when compared to the increasing premiums of annually renewable term life insurance.

However, it is important to note that term life insurance premiums are generally lower than those of variable life insurance. Term life insurance offers larger insurance protection for the premium paid due to the lack of an investment component. Variable life insurance, on the other hand, includes an investment component, allowing policyholders to invest the cash value of their policy in various investment vehicles. This introduces an element of risk, as the policy's cash value can increase or decrease based on market performance, but it also offers the potential for greater returns.

While variable life insurance policies offer fixed premiums, term life insurance premiums may increase over time as the policyholder ages. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of death within the policy term. As individuals age, the probability of dying during the coverage period increases, leading to higher premiums. Therefore, it is advisable to purchase life insurance at a younger age to secure lower rates.

Life Insurance for Your Partner: What You Need to Know

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance policy, meaning coverage will remain in place for your lifetime, as long as premiums are paid. Variable life insurance policies have a higher potential for earning cash compared to traditional policies because you get to decide how to invest the cash value.

Term life insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. Term life insurance is often the most affordable type of life insurance because it's temporary and has no cash value.

Variable life insurance is a permanent policy, while term life insurance is temporary. Variable life insurance policies have a higher earning potential than term life insurance policies because they allow the policyholder to decide how to invest the cash value. Variable life insurance policies are also more complex and require more hands-on attention than term life insurance policies.

The best type of life insurance depends on your needs and budget. Generally, term life insurance is sufficient for most people as it's cheaper and offers coverage for a specific period. Variable life insurance may be a better option if you want coverage for your entire life and are willing to take on more risk with the potential for higher returns.