Life insurance is a financial asset that can be used in long-term financial planning. It is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. In the US, life insurance is also offered as a government benefit to those in need. Welfare, or federal government-sponsored assistance programs, are typically funded through federal taxation. These programs are designed to support individuals and families in maintaining a healthy standard of living. Eligibility for welfare benefits is based on income levels, family size, and financial status. While life insurance can be an important safety net for many, it is essential to understand how it may impact eligibility for welfare programs such as Medicaid.

| Characteristics | Values |

|---|---|

| Welfare definition | Government programs that provide financial or other aid to individuals or groups |

| Welfare funding | Federal taxation |

| Welfare payment frequency | Biweekly or monthly |

| Welfare eligibility | Based on income levels, family size, financial status, disability, and state poverty line |

| Welfare benefits | SNAP payments, housing assistance, healthcare, unemployment compensation, childcare assistance, etc. |

| Welfare qualification requirements | Annual income below the federal poverty level, legal citizenship or permanent residency, valid Social Security Number, state-specific requirements |

| Welfare programs | Temporary Assistance for Needy Families (TANF), Medicaid, Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), Children's Health Insurance Program (CHIP), Earned Income Tax Credit (EITC) |

What You'll Learn

Life insurance and Medicaid eligibility

Life insurance policies can impact Medicaid eligibility, depending on the type of policy and its value. Medicaid has an asset limit, which varies by state, and certain life insurance policies may cause an applicant to exceed this limit.

Term life insurance does not impact Medicaid eligibility as it does not accumulate a cash value and therefore cannot be cashed out. Whole life insurance, on the other hand, can impact eligibility. Whole life insurance accrues a cash value that policyholders can borrow against or cash out. This means that whole life insurance policies are considered assets and can cause Medicaid ineligibility if their value exceeds the limit. Burial insurance, a type of whole life insurance, does not impact eligibility as it is reserved specifically for burial expenses.

Most states have an asset limit of $2,000, but this can vary. For example, New York's limit is $31,175, while New Hampshire's is $2,500. California does not have an asset limit.

If a life insurance policy may disqualify someone from Medicaid, there are several options to consider. These include cancelling the policy and spending the cash value, transferring ownership of the policy, or taking out a loan against the cash value. Consulting a professional is recommended to navigate the complexities of Medicaid eligibility and life insurance.

Who Can Be Your Life Insurance Nominee?

You may want to see also

Welfare benefits and eligibility

Welfare benefits are typically funded through federal taxation. Eligibility for benefits is based on income levels, family size, and financial status. Welfare beneficiaries receive monthly SNAP payments as direct payments to an EBT card.

The federal government gives grant money to each state through the Temporary Assistance for Needy Families (TANF) program. This program was created to prevent welfare recipients from abusing the system by mandating that all recipients find employment within two years or risk losing their benefits. The government provides an annual welfare grant of $16.5 billion to all states.

The 2024 poverty guideline is $15,060 for one person and $31,200 for a family of four. The government requires that individuals or families seeking assistance prove that their annual income falls below the federal poverty level (FPL). Qualification depends on the poverty line in a particular state and allows for adjustments based on the cost of living.

Subsidized programs are only available to legal citizens and permanent residents of the United States. Federal law bans states from using grants to assist most legal immigrants unless they have resided in the country for five years or more. A valid Social Security Number (SSN) is required to obtain welfare.

Some states require that the applicant be a resident of that state and live there continuously. Individuals applying for welfare must meet their state's requirements and rules imposed by the federal government.

Welfare benefits include:

- Medicaid: A health insurance program for those below federal poverty standards. Pregnant women, children, people with disabilities, and aging adults who fall below a certain income threshold are guaranteed coverage under the Medicaid program.

- Supplemental Security Income (SSI): A program administered by the Social Security Administration (SSA) that provides public assistance to children and adults with disabilities like blindness, neurological challenges, respiratory disease, and failure to thrive.

- Supplemental Nutrition Assistance Program (SNAP): Administered by each U.S. state, SNAP provides vouchers to low-income households to buy nutritious and low-cost foods.

- Children's Health Insurance Program (CHIP): A program administered by the U.S. Department of Health and Human Services (HHS) that provides low-cost health care to children in households that don't qualify for Medicaid.

- Housing Assistance: The housing choice voucher program helps families below federal poverty standards, people with disabilities, and aging adults access affordable and livable rental homes in safe neighborhoods.

- Earned Income Tax Credit (EITC): The EITC helps low to moderate-income individuals and families get a tax break.

Kroger Life Insurance: What You Need to Know

You may want to see also

Types of life insurance

There are several types of life insurance policies available, each with its own unique features, benefits, and drawbacks. Here is an overview of the most common types of life insurance:

Term Life Insurance

Term life insurance is a popular option for those seeking coverage for a specific number of years. It is generally more affordable than permanent life insurance and provides coverage for a set period, such as 10, 15, 20, or 30 years. Term life insurance is ideal for individuals who want coverage during their prime working years or while their children are young. It offers a death benefit that is paid out if the insured person passes away within the specified term. However, if the policyholder outlives the term, there is no payout. Term life insurance does not accumulate a cash value, and you cannot borrow against the death benefit.

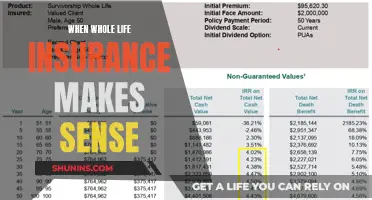

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. It includes a savings component, known as the cash value, which grows over time at a fixed interest rate. The cash value can be borrowed against, but if not repaid, it will reduce the death benefit. Whole life insurance premiums are typically higher than term life insurance due to the lifelong coverage and the savings component.

Universal Life Insurance

Universal life insurance is another form of permanent life insurance that offers flexibility. It allows the policyholder to adjust the death benefit and premiums within certain limits. Similar to whole life insurance, universal life insurance has a savings component that grows over time. However, the interest rate for universal life insurance is not fixed and can change based on market conditions. Universal life insurance can eventually become a zero-cost policy if the cash value grows large enough to cover the premiums.

Variable Life Insurance

Variable life insurance is a riskier form of permanent life insurance that ties the cash value to investment accounts such as bonds and mutual funds. The cash value can rise or fall depending on the performance of the selected investments. Variable life insurance offers the potential for significant gains but also carries higher risk, fees, and costs than other types of permanent life insurance.

Final Expense Life Insurance

Also known as burial or funeral insurance, final expense life insurance is a type of whole life insurance with a smaller death benefit designed to cover end-of-life expenses such as funeral costs, medical bills, and outstanding debt. It is easier for older individuals or those with pre-existing health conditions to qualify for this type of insurance. The cash value in final expense life insurance operates similarly to whole life insurance, building value at a fixed rate over time.

In addition to these main types of life insurance, there are also other variations, such as indexed universal life insurance, simplified issue life insurance, guaranteed life insurance, supplemental life insurance, and survivorship life insurance. The best type of life insurance depends on an individual's specific needs, budget, and long-term financial goals.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Medicaid and life insurance

Life insurance policies can impact Medicaid eligibility, depending on the type of policy and its value. While Medicaid requires you to be under a certain income threshold, certain life insurance policies have a minimum income requirement. If you have a life insurance policy with a cash value component, you might not qualify for Medicaid as the investment could put you over the asset threshold.

Term Life Insurance and Medicaid Eligibility

Term life insurance does not impact Medicaid eligibility. It is not counted towards the asset limit. It provides coverage for a limited time, which may be as short as one year and as long as 30 years. If the policyholder dies within the designated coverage period, a death benefit will be paid out to the beneficiaries. If the policyholder does not pass away while the policy is in effect, the policy expires and no benefit is paid out. Term life insurance does not accumulate a cash value, which means the policy cannot be cashed out and has no value to the policyholder.

Whole Life Insurance and Medicaid Eligibility

Whole life insurance can impact Medicaid eligibility. This type of permanent life insurance policy provides coverage for the entirety of a person's life and pays out a death benefit to the beneficiaries when the policyholder passes away. With whole life insurance policies, a cash value is accrued. This means that policyholders can take out a loan against the cash value or terminate their policy and collect the cash surrender value. Since policyholders can take cash from their existing policy, it is not exempt from Medicaid's asset limit. However, whole life insurance policies are exempt up to a certain face value, which is state-specific. Depending on the face value of one's whole life insurance policy, it can cause Medicaid ineligibility.

Burial Insurance and Medicaid Eligibility

Burial insurance, also called final expense insurance or funeral insurance, does not impact Medicaid eligibility. It is a type of whole life insurance policy that covers burial/cremation costs and funeral arrangements. Life insurance that is reserved specifically for burial expenses, where the funds can only be used for this purpose, is exempt from Medicaid's asset limit.

Medicaid's Asset Limit

Medicaid has an asset limit, which varies by the state in which one lives. For example, for single applicants, the following states have the following asset limits: New York ($31,175), Illinois ($17,500), New Hampshire ($2,500), and Connecticut ($1,600). Generally speaking, most states have an asset limit of $2,000. California is the only state without an asset limit. Some assets are not counted towards the asset limit; they are exempt. This generally includes one's primary home, household items, a vehicle, and personal items. Furthermore, not all life insurance policies are counted as assets, and those that are countable are exempt up to a certain cash surrender value.

Canceling Globe Life Insurance: A Step-by-Step Guide

You may want to see also

Life insurance and Medicaid spend-down

Life insurance and Medicaid eligibility

When applying for Medicaid assistance, it is important to consider any life insurance policies you have, as they can affect your eligibility for benefits. This is because, depending on the type of life insurance and the value of the policy, it may count as an asset.

Medicaid has an asset limit, which varies depending on the state in which you live and whether you are applying as a single person or a couple. For example, for single applicants, New York has an asset limit of $31,175, Illinois allows $17,500, New Hampshire $2,500, and Connecticut $1,600. Generally, most states have an asset limit of $2,000, and California is the only state without an asset limit.

Life insurance policies are usually either term life insurance or whole life insurance. Term life insurance does not count as an asset and will not affect your eligibility for Medicaid as it does not accumulate a cash value. Whole life insurance, on the other hand, does accumulate a cash value that the owner can access and is, therefore, counted as an asset.

However, small whole life insurance policies are exempt from the calculation of assets. If the policy's face value (also known as the death benefit) is less than $1,500, then it won't count as an asset. If the policy's face value is more than $1,500, the cash surrender value (the amount the policyholder would receive for "cashing out" their policy) becomes an available asset.

If you have a life insurance policy that may disqualify you from Medicaid, you have several options:

- Surrender the policy and spend down the cash value.

- Transfer ownership of the policy to your spouse or to a special needs trust.

- Transfer ownership of the policy to a funeral home to pay for funeral expenses, which is an exempt asset.

- Take out a loan on the cash value; this reduces the cash value and the death benefit but keeps the policy in place.

Medicaid spend-down

If the total face values of an elder’s life insurance policies exceed $1,500 and their countable assets put them over the limit to qualify for Medicaid, they will need to carefully devise and follow a Medicaid spend-down strategy. In some cases, it could be a good idea for a family member (usually an adult child) to purchase the life insurance policy from the senior and keep it in effect by paying the annual premiums.

Another option is to transfer ownership of the policy. However, this counts as a gift and may trigger a penalty period during which the elder cannot qualify for Medicaid. In many cases, this is not the best solution but could make sense as part of an overall spend-down plan that includes other types of gifting.

Medicaid planning is a complex process, and financial eligibility requirements vary by state. Mistakes can have costly long-term consequences, so it is generally wise to seek at least an initial consultation with an elder law attorney who specializes in Medicaid planning and spend-down strategies before juggling any assets or filing an application.

Calculating Life Insurance: The Essential Guide for Beginners

You may want to see also