Overfunding your life insurance policy can be a great way to grow and protect your wealth, but it's not the right strategy for everyone. It involves paying more in premiums than is required, which boosts the cash value of your policy. This can be particularly effective with whole life insurance, which offers guaranteed growth, stability, and additional benefits. Overfunding can provide tax advantages, access to cash, and increased financial flexibility. However, it's important to be cautious of the downsides, including the risk of reclassification by the IRS as a Modified Endowment Contract (MEC), which has different tax implications. It's essential to consult financial and tax professionals to understand the implications and decide if overfunding aligns with your financial goals and obligations.

What You'll Learn

It can help you grow wealth faster

Overfunding your life insurance can help you grow wealth faster in several ways. Firstly, it increases the cash value of your policy, which can be accessed during your lifetime through withdrawals or loans. This provides a pool of tax-advantaged money that can be used for various financial goals, such as funding personal loans, business capital, or retirement income. The cash value grows tax-deferred, and withdrawals or loans from this value are typically not subject to income tax, providing an opportunity for tax-free or tax-reduced wealth accumulation.

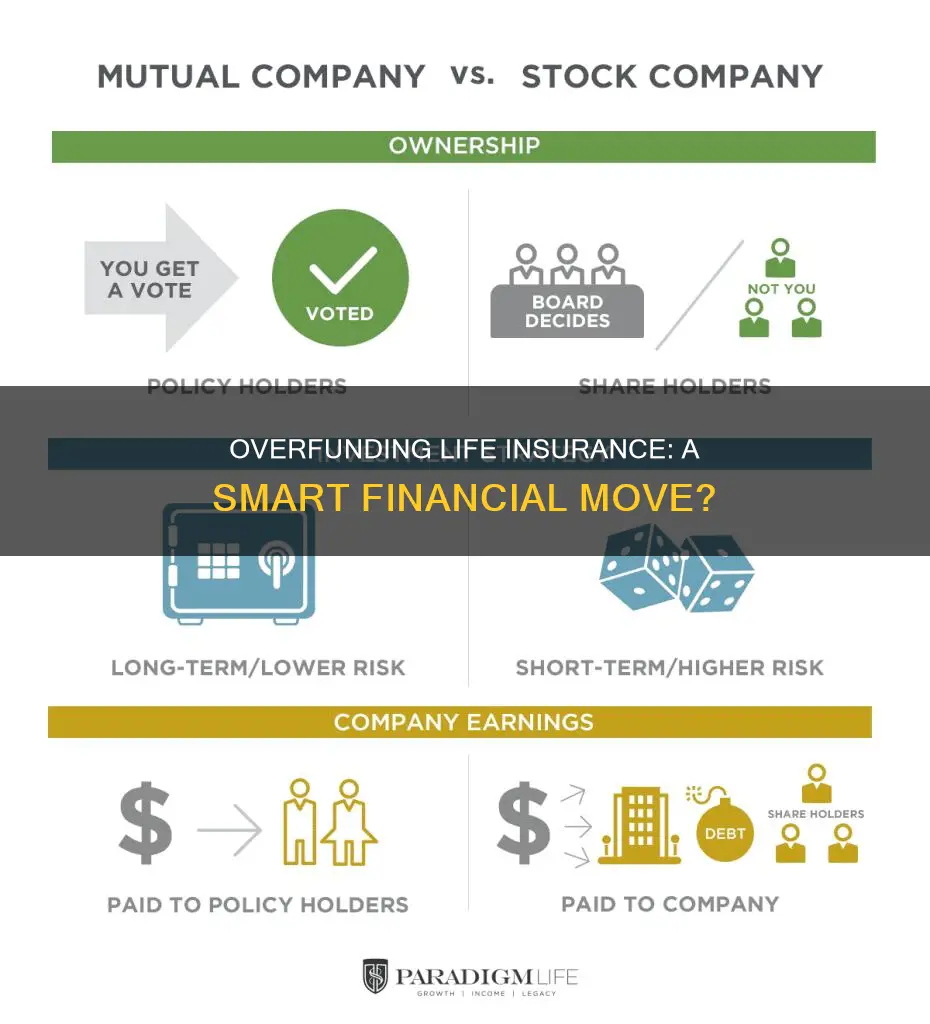

Secondly, overfunding your life insurance can lead to faster compound growth of your wealth over time. By paying more than the required premiums, you can accumulate cash value more quickly, and this value can be invested to generate returns. This is especially beneficial if you choose a whole life insurance policy, which offers guaranteed growth and additional benefits like dividends from mutual insurance companies. The cash value in these policies is also protected from market declines, ensuring stable growth.

Additionally, overfunded life insurance can provide access to tax-free or low-interest loans. The cash value in your policy can be borrowed against, often with flexible payback options and potentially lower interest rates than traditional loans. This can be advantageous for managing cash flow or seizing investment opportunities.

It is important to note that overfunding your life insurance may not be suitable for everyone. It requires careful consideration of your financial goals, budget, and tax implications. There is also a risk of the policy being reclassified as a Modified Endowment Contract (MEC) if certain contribution limits are exceeded, which can result in adverse tax consequences. Consulting with a financial representative and tax professional is crucial to understanding if overfunding aligns with your specific circumstances and goals.

HIV and Life Insurance: What Are Your Options?

You may want to see also

It can provide financial flexibility

Overfunding your life insurance can provide financial flexibility in several ways. Firstly, it can help you grow your wealth and build up a substantial amount of funds over time. This is achieved by contributing more to the cash value component of your policy, which boosts its growth potential. This increased cash value can then be utilised for various purposes, such as funding personal loans, investing in business opportunities, or supplementing retirement income.

Another way overfunding your life insurance provides financial flexibility is by offering tax advantages. The funds in the cash value account of an overfunded life insurance policy grow income tax-free, allowing you to accumulate a larger sum compared to taxable accounts. Additionally, withdrawals and loans from the policy's cash value are typically not subject to income tax, providing further financial flexibility. However, it is crucial to be mindful of the Modified Endowment Contract (MEC) restrictions to avoid adverse tax consequences.

The financial flexibility of overfunded life insurance also extends to its ability to provide tax-advantaged death benefits. By minimising the death benefit and maximising the cash value, you can leverage the accumulated funds for policy loans or other financial needs during your lifetime. This aspect of overfunded life insurance offers a unique advantage, as you can access and utilise the funds while you are still alive, rather than solely providing a death benefit to your beneficiaries.

Furthermore, overfunding your life insurance can provide financial flexibility by serving as a wealth-building vehicle. The accumulated cash value within the policy can be utilised for various investment opportunities, such as moving funds into sub-accounts linked to stock market indices or investing directly in stocks and other securities. This allows you to diversify your investments and potentially increase your overall wealth. Additionally, certain types of overfunded life insurance policies, such as whole life insurance, offer guaranteed growth and stability, providing a reliable foundation for your financial plans.

It is important to note that while overfunding your life insurance can provide significant financial flexibility, it may not be the right strategy for everyone. It is essential to carefully consider your financial goals, budget, and tax implications before deciding to overfund your life insurance policy. Consulting with a financial representative and tax professional can help you understand the potential benefits and risks involved.

Whole Life Insurance: Do Payouts Decrease as We Age?

You may want to see also

It can be used as a tax-advantaged savings vehicle

Overfunding your life insurance policy can be a great way to build wealth and financial flexibility. It involves paying more premiums on a policy than required to grow the cash value faster. This cash value growth component offers permanent life insurance policyholders a way to combine financial protection for loved ones with additional wealth-building opportunities.

The funds in the cash value account of an overfunded life insurance policy grow income-tax-free, enabling you to build up a larger amount of funds in such accounts for long-term savings goals. This is because cash value grows tax-deferred, and withdrawals and loans from your policy's cash value are not subject to income tax. Thus, overfunding your life insurance can provide a pool of tax-advantaged money that you can access during your lifetime through withdrawals or loans.

It is important to note that overfunding your life insurance can have adverse tax consequences if certain limits are exceeded, including turning the policy into a Modified Endowment Contract (MEC). Each policy has a different limit, but if exceeded, the policy becomes a MEC, which has much fewer tax benefits. You can avoid this by maintaining the minimum required ratio of death benefit to cash value, ensuring your policy passes the 7-pay test and avoids becoming a MEC.

Overfunding your life insurance can be a great strategy to build wealth and access tax-advantaged funds, but it is important to consult a financial representative and tax professional to understand the implications and decide if it aligns with your financial goals and long-term needs.

MetLife Insurance: Suicide Coverage and Exclusions

You may want to see also

It can be used to take out loans with lower interest rates

Overfunding your life insurance policy can be a great way to grow your wealth and achieve financial flexibility. It involves paying more premiums into a permanent life insurance policy than is required, thus boosting its cash value. This increased cash value can then be used to take out loans with lower interest rates, providing you with financial liquidity when needed.

When you overfund your life insurance, the majority of the premium payment goes towards the cash value component rather than the death benefit. This means that you can accumulate cash value more quickly and take advantage of the tax benefits associated with these policies. The funds in the cash value account grow income tax-free, allowing you to build up a larger sum over time compared to taxable accounts. This strategy is particularly effective with whole life insurance and universal life insurance policies, which offer guaranteed growth and additional benefits.

By overfunding your life insurance, you can access tax-free loans from your savings. The interest rates on these loans can be lower than traditional loans, depending on the insurance company, and the payback terms can be more flexible and tailored to your needs. This makes overfunded life insurance an attractive option for those seeking financial independence and the ability to borrow funds at favourable rates.

It is important to note that overfunding your life insurance may not be suitable for everyone. It requires larger premium payments and higher fees, so it is essential to consider your budget and ensure that it does not compromise your other financial obligations. Additionally, there are potential tax implications to consider, such as the risk of the policy being reclassified as a Modified Endowment Contract (MEC) if certain contribution limits are exceeded.

To summarise, overfunding your life insurance can be a powerful tool for growing your wealth and achieving financial flexibility. It enables you to build up a substantial cash value component, which can then be leveraged to take out loans with lower interest rates. However, it is important to carefully consider your financial situation, budget, and potential tax implications before deciding if overfunding your life insurance is the right strategy for you.

Texas Teachers: Health and Life Insurance Benefits Explained

You may want to see also

It can provide death benefits to your loved ones

Overfunding your life insurance policy can be a great way to provide death benefits to your loved ones. While the primary benefit of any life insurance policy is the death benefit, there are other ways that a policy can help you work towards your financial goals. Overfunding your life insurance policy can help you grow your wealth and provide tax benefits, which can be beneficial for your loved ones after you pass away.

When you overfund your life insurance, you pay more premiums into the policy than are required. This extra money goes towards the cash value of the policy, which can grow tax-deferred. This means that the cash value of the policy can accumulate compound interest over time, resulting in a larger payout to your beneficiaries in the event of your death.

Additionally, overfunding your life insurance policy can provide tax advantages. Withdrawals and loans from the policy's cash value are typically not subject to income tax. This means that your beneficiaries can access the funds in the policy without having to pay additional taxes, which can be a significant benefit during a difficult time.

It's important to note that there are also risks associated with overfunding your life insurance. If your contributions exceed certain limits, your policy may be reclassified as a Modified Endowment Contract (MEC) by the IRS. This can result in additional taxes and penalties on withdrawals and loans from the policy. Therefore, it's crucial to carefully consider your financial situation and consult with a financial professional before deciding to overfund your life insurance policy.

Overall, overfunding your life insurance policy can be a powerful tool to provide death benefits to your loved ones. By boosting the cash value of the policy and taking advantage of tax benefits, you can ensure that your beneficiaries receive a substantial payout that can help secure their financial future. However, it's important to carefully weigh the risks and benefits before making any decisions.

Term Life Insurance: Understanding the Contractual Basics

You may want to see also