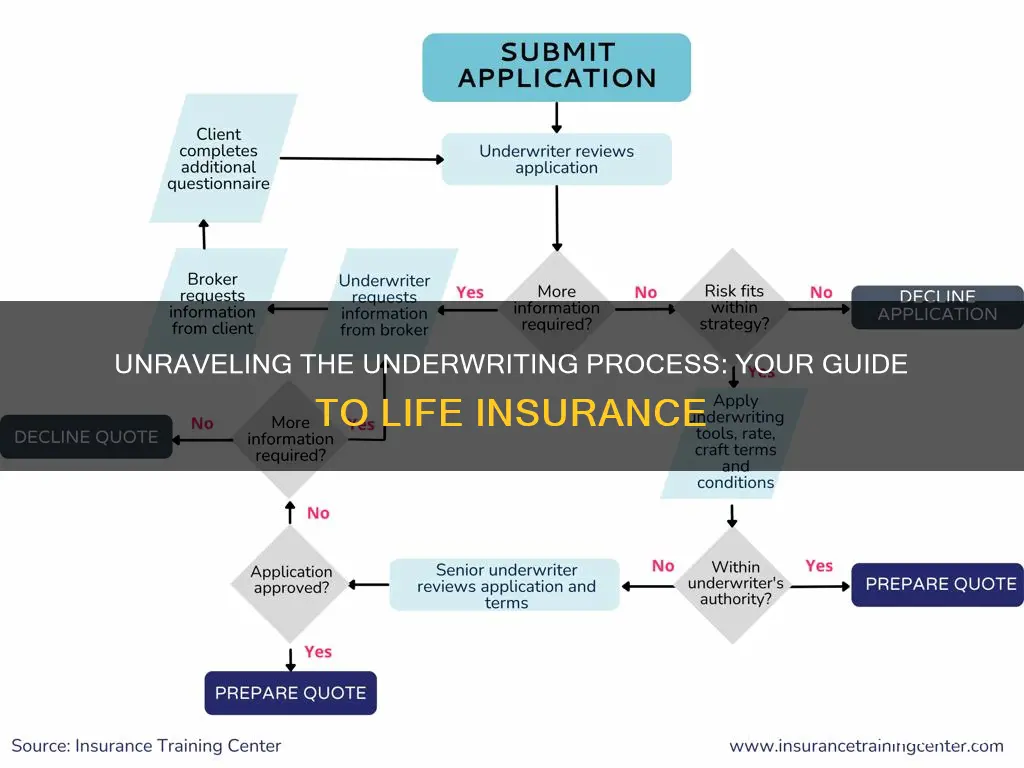

The underwriting process for life insurance is a critical step in securing a life insurance policy. It involves a thorough evaluation of the applicant's health, lifestyle, and financial situation to determine the risk associated with insuring their life. Underwriters assess the likelihood of the insured individual's death or disability and use this information to set the terms and premiums of the policy. This process can include medical exams, financial assessments, and a review of the applicant's medical history and lifestyle choices. The underwriting process aims to ensure that the insurance company can accurately predict and manage the risks associated with the policy, ultimately providing the right coverage to the policyholder.

What You'll Learn

Underwriting Basics: Understanding the Initial Screening and Assessment

The underwriting process for life insurance is a critical step in securing a policy and ensuring that the insurer can provide coverage to the policyholder. It involves a comprehensive evaluation of the applicant's health, lifestyle, and financial situation to determine the risk associated with insuring their life. This initial screening and assessment phase is designed to identify potential risks and make informed decisions about policy acceptance, premium rates, and coverage terms.

During the initial screening, underwriters review the basic information provided by the applicant, including personal details, medical history, lifestyle choices, and financial assets. This step is crucial as it helps identify any immediate red flags or concerns. For instance, a history of severe health conditions, such as heart disease or cancer, may require further investigation and potentially lead to a higher risk assessment. Similarly, lifestyle factors like smoking, excessive alcohol consumption, or extreme sports participation can significantly impact the underwriting decision. Underwriters often use standardized questionnaires or health assessments to gather this information efficiently.

The assessment phase delves deeper into the applicant's profile, focusing on specific areas of risk. Medical records are scrutinized to identify any pre-existing conditions, recent illnesses, or surgeries. Underwriters may request additional medical information or consult with medical professionals to gain a comprehensive understanding of the applicant's health status. This thorough evaluation ensures that the insurer can accurately assess the potential risks associated with insuring the individual.

In addition to medical factors, underwriters also consider financial aspects. They review the applicant's credit history, employment status, and income stability. A poor credit score or a history of financial instability may indicate a higher risk profile, potentially affecting the underwriting decision. Underwriters aim to assess the applicant's ability to meet their financial obligations and the likelihood of timely premium payments.

The initial screening and assessment process is a complex and nuanced task, requiring a meticulous approach. Underwriters must carefully analyze each piece of information, considering both quantitative and qualitative factors. This process ensures that the insurer can make informed decisions, providing appropriate coverage while managing potential risks. It also allows for personalized policy offerings, catering to the specific needs of each applicant.

Amica's Life Insurance: What You Need to Know

You may want to see also

Health Questionnaires: How They Impact Underwriting Decisions

Health questionnaires are a critical component of the life insurance underwriting process, providing insurers with valuable insights into an individual's health status and potential risk factors. These questionnaires are designed to gather detailed information about an applicant's medical history, current health, and lifestyle choices, which can significantly influence the underwriting decision. When an individual applies for life insurance, the insurer will typically request a health questionnaire to assess the risk associated with insuring that particular person.

The impact of health questionnaires on underwriting decisions is profound. Insurers use the information provided to evaluate the likelihood of future health issues and potential claims. For instance, questions may include medical history, such as previous diagnoses, surgeries, or ongoing treatments. They might also inquire about current health conditions, chronic illnesses, or any recent health scares. Additionally, lifestyle factors like smoking, alcohol consumption, exercise habits, and dietary choices are often addressed, as these can significantly impact an individual's overall health and longevity.

By analyzing the responses to these questionnaires, underwriters can make informed decisions about premium rates, policy coverage, and even whether to approve or deny the application. For example, a person with a history of smoking and obesity may be considered a higher-risk candidate, potentially leading to higher premiums or a more limited policy offer. Conversely, a non-smoker with a healthy weight and no significant medical history might be viewed as a lower-risk individual, resulting in more favorable underwriting terms.

In some cases, health questionnaires may also prompt further medical investigations or consultations. If an applicant's responses indicate potential health concerns, the insurer might request additional medical records, lab results, or even a medical examination to verify the information provided. This ensures that the underwriting process is thorough and accurate, allowing insurers to make well-informed decisions.

In summary, health questionnaires play a pivotal role in the life insurance underwriting process, enabling insurers to assess risk and make appropriate decisions. They provide a structured way to gather essential health information, allowing underwriters to evaluate applicants' health status and make informed choices regarding policy terms and premiums. This process ensures that both the insurer and the policyholder are protected, fostering a fair and sustainable insurance environment.

Kotak Mahindra Life Insurance: What's the Deal?

You may want to see also

Medical History Review: A Crucial Step in Underwriting

The underwriting process for life insurance is a comprehensive evaluation that ensures the insurer can provide the appropriate coverage to the policyholder. One of the most critical components of this process is the medical history review, which involves a detailed examination of the applicant's medical records and personal health information. This step is essential as it helps underwriters assess the risk associated with insuring an individual and make informed decisions regarding policy terms and premiums.

During the medical history review, underwriters scrutinize the applicant's past and present health conditions, medications, surgeries, and any relevant medical procedures. They look for patterns, trends, and potential risk factors that could impact the insured's future health and longevity. This includes reviewing medical records for chronic illnesses, such as diabetes, heart disease, or cancer, as well as mental health disorders, allergies, and any previous injuries or accidents. The goal is to identify any pre-existing conditions or health issues that might affect the policyholder's ability to meet the insurance company's health requirements.

A thorough medical history review also involves assessing the applicant's lifestyle choices and habits. Underwriters consider factors such as smoking status, alcohol consumption, diet, exercise routines, and any recreational activities that may pose health risks. For instance, a heavy smoker or someone with a sedentary lifestyle may be considered higher-risk, which could influence the insurance company's decision on the type and extent of coverage offered.

Furthermore, the medical history review extends beyond the individual's current health. Underwriters may request additional information, such as family medical history, to identify potential genetic predispositions to certain diseases. This comprehensive approach allows underwriters to make more accurate risk assessments and tailor the insurance policy accordingly. By carefully evaluating medical records and health-related factors, underwriters can ensure that the policyholder receives appropriate coverage while also managing the insurer's risk exposure.

In summary, the medical history review is a vital part of the underwriting process for life insurance. It enables underwriters to make well-informed decisions by considering an individual's health status, lifestyle, and potential risk factors. This step ensures that the insurance company can provide suitable coverage while also protecting its interests and those of the policyholders. A meticulous medical history review contributes to the overall integrity and success of the life insurance underwriting process.

Life Insurance Payouts: Gifts or Not?

You may want to see also

Risk Assessment: Determining Premium Rates and Coverage

The underwriting process for life insurance involves a comprehensive risk assessment to determine the premium rates and coverage for an individual. This assessment is a critical step in evaluating the insurability of a potential policyholder and ensuring the financial stability of the insurance company. Here's an overview of the key aspects:

Risk Factors Evaluation: Underwriters meticulously analyze various risk factors associated with the applicant's health, lifestyle, and medical history. This includes assessing the individual's age, gender, smoking status, alcohol consumption, and any pre-existing medical conditions. For instance, older applicants may face higher premiums due to the increased risk of mortality, while smokers might be considered higher-risk cases, leading to elevated premium rates.

Medical History and Examinations: Obtaining detailed medical records and, in some cases, conducting medical examinations is essential. Underwriters review past and present health issues, surgeries, medications, and family medical history. For instance, a history of heart disease or diabetes may result in higher premiums or specific policy exclusions. In some instances, underwriters may request additional tests, such as blood pressure checks or cholesterol tests, to further assess the applicant's health status.

Lifestyle and Occupational Hazards: Lifestyle choices and occupation play a significant role in risk assessment. Underwriters consider factors like driving record, hobbies, and travel plans. For example, extreme sports enthusiasts might be charged higher premiums due to the perceived increased risk of injury. Similarly, occupations with higher risk profiles, such as construction or emergency services, may impact premium rates.

Financial and Credit Analysis: Financial stability and creditworthiness are also evaluated. Underwriters review income, assets, and debt obligations. A strong financial position may indicate a lower risk for the insurance company. Additionally, credit scores are considered, as they can provide insights into an individual's financial responsibility and management of debt.

Determining Premium Rates: Based on the risk assessment, underwriters calculate the premium rates. This involves applying statistical data and actuarial tables to determine the expected payout for the policy. The assessment helps in setting the premium to ensure the insurance company can cover potential claims and maintain profitability.

Coverage Customization: The underwriting process also involves tailoring the coverage to the individual's needs. This includes selecting the appropriate death benefit amount, which is the payout the beneficiary receives upon the insured's death. Underwriters may offer different coverage options, allowing applicants to choose the level of protection that suits their requirements and budget.

Understanding the Most Common Group Life Insurance Plans

You may want to see also

Policy Approval: Finalizing the Life Insurance Contract

The underwriting process for life insurance is a critical phase that determines whether an individual qualifies for a policy and at what cost. Once the initial application is submitted, the underwriter takes over, reviewing the applicant's health, lifestyle, and financial information to assess risk. This involves a thorough investigation into the applicant's medical history, including any pre-existing conditions, medications, and recent health screenings. Underwriters may also consider the applicant's lifestyle factors such as smoking, alcohol consumption, and physical activity, as these can significantly impact longevity and insurance risk.

During this stage, underwriters might request additional medical information, such as lab results, medical records, or even a medical examination, to verify the accuracy of the applicant's disclosures. This process ensures that the insurance company has a comprehensive understanding of the individual's health status and potential risks. For instance, a 40-year-old non-smoker with a healthy BMI and no significant medical history may be considered a low-risk candidate, while a 55-year-old with a history of smoking and diabetes might be deemed high-risk.

Once the underwriting review is complete, the underwriter will make a decision regarding the policy approval. This decision can be categorized into several outcomes: full approval, partial approval, or denial. Full approval means the policy is accepted as proposed, with no changes or adjustments. Partial approval indicates that the insurer is willing to offer a policy but with certain conditions or limitations, such as a reduced death benefit or an increased premium. Denial, on the other hand, means the insurer will not provide the policy as requested.

In cases of partial approval or denial, the underwriter will communicate the reasons for the decision to the applicant. This transparency ensures that the applicant understands the factors influencing the insurer's choice. For instance, if an applicant is denied coverage due to a pre-existing condition, the underwriter will explain how this condition increases the risk associated with the policy. Similarly, if the insurer offers a policy with specific conditions, they will outline the benefits and potential drawbacks of these terms.

After the decision is made, the insurance company will finalize the life insurance contract. This document outlines the terms and conditions of the policy, including the coverage amount, premium payments, policy duration, and any exclusions or limitations. The applicant will receive a copy of the contract, which they should carefully review to ensure they understand their rights and obligations as the policyholder. Once the applicant has accepted the terms, the policy becomes officially active, providing financial protection for the insured individual or their beneficiaries.

Universal Variable Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The underwriting process is a crucial step in obtaining life insurance coverage. It involves a series of assessments and evaluations to determine the risk associated with insuring an individual. Underwriters review various factors such as age, health, medical history, lifestyle, and financial information to make an informed decision about the policy.

Underwriters follow a structured process, starting with a thorough review of the applicant's personal and medical history. They may request medical exams, ask for detailed health reports, and even conduct background checks. The goal is to identify any potential risks or health issues that could impact the insured's life expectancy.

Underwriters consider multiple factors, including age, which typically influences premium rates. They also assess overall health, including any pre-existing conditions, recent illnesses, or surgeries. Lifestyle choices like smoking, alcohol consumption, and physical activity are evaluated. Additionally, financial information, occupation, and family medical history play a significant role in the underwriting decision.

Yes, it is possible to obtain life insurance with a pre-existing health condition. However, the underwriting process may be more rigorous, and the terms and rates could vary. Underwriters will carefully review the condition and its impact on the individual's health. In some cases, additional medical tests or consultations may be required to make an accurate assessment.

The duration of the underwriting process can vary depending on the insurance company and the complexity of the case. It may take anywhere from a few days to several weeks. Standard underwriting involves a more straightforward review, while complex cases or those with pre-existing conditions might require more time for thorough evaluation and medical assessments.