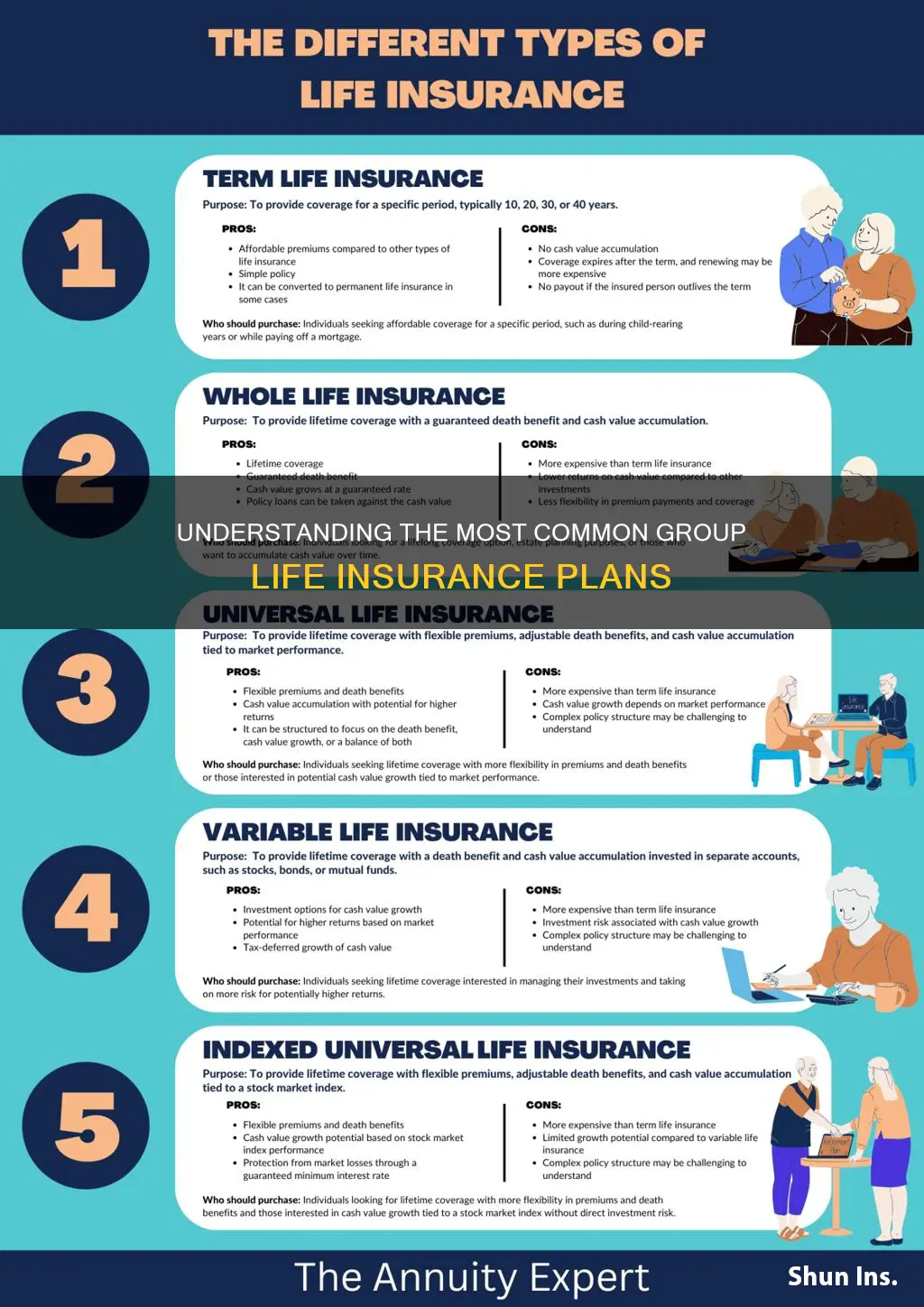

Group life insurance is a type of coverage that provides financial protection for employees and their beneficiaries in the event of the insured individual's death. It is a popular benefit offered by employers to their workforce, offering a safety net for employees and their families. The most common type of group life insurance is typically term life insurance, which provides coverage for a specific period, often the duration of the employee's employment. This type of insurance is straightforward and cost-effective, making it a preferred choice for many employers and employees alike.

What You'll Learn

- Definition: Group life insurance is a policy covering multiple individuals, typically employees, with a single contract

- Benefits: It offers coverage at a lower cost compared to individual policies due to shared risk

- Coverage Levels: Policies can vary, with options for different death benefit amounts

- Employer-Sponsored: Most commonly provided by employers as a benefit to employees

- Affordability: Group plans are often more affordable due to economies of scale

Definition: Group life insurance is a policy covering multiple individuals, typically employees, with a single contract

Group life insurance is a type of coverage designed to protect a group of people, often employees of a company, under a single insurance policy. This approach is different from individual life insurance, where each person has their own policy. With group life insurance, the insurance company agrees to pay out a death benefit to the beneficiaries of the covered individuals in the event of their passing. The key aspect here is the collective nature of the policy, which simplifies the process for both the employer and the employees.

In a typical group life insurance policy, the employer pays a premium to the insurance company, which then covers the lives of the employees listed on the policy. The coverage amount, or death benefit, is usually a set amount per employee, and this benefit is paid out to the designated beneficiaries upon the death of the insured individual. This type of insurance is often offered as a benefit to employees, providing financial security for their families in the event of unforeseen circumstances.

The primary advantage of group life insurance is its cost-effectiveness. Since the risk is spread across multiple individuals, the premium per person is generally lower compared to individual policies. This makes it an attractive option for employers who want to provide a valuable benefit to their employees without incurring high costs. Additionally, group policies often offer more comprehensive coverage options, allowing employers to customize the policy to better suit their workforce's needs.

When an employee joins a company, they are typically automatically enrolled in the group life insurance plan, ensuring that they are protected from the start. This simplicity in enrollment and management is a significant benefit, especially for large organizations with numerous employees. The employer's role is to provide the necessary information and ensure that the policy is in place, offering peace of mind to both the company and its employees.

In summary, group life insurance is a convenient and cost-efficient way to provide financial protection to a group of individuals, usually employees, through a single insurance contract. It offers a practical solution for employers to support their workforce and provides employees with a valuable benefit, ensuring their families are cared for in the event of their passing.

Life Insurance 101: Understanding Term Policies

You may want to see also

Benefits: It offers coverage at a lower cost compared to individual policies due to shared risk

Group life insurance is a popular and cost-effective way to provide coverage for employees and their families. One of its key advantages is the ability to offer insurance at a lower cost compared to individual policies. This is primarily due to the shared risk principle, which is a fundamental concept in group insurance.

When individuals purchase life insurance on their own, the insurance company assesses their personal risk factors, such as age, health, lifestyle, and family medical history. This assessment helps determine the premium rate, which can vary significantly from person to person. As a result, individual policies tend to be more expensive, especially for those with higher-risk profiles.

In contrast, group life insurance takes a different approach. Instead of evaluating individual risks, the insurance company focuses on the group as a whole. By pooling the risks of multiple individuals, the insurance provider can offer coverage at a lower cost to each member of the group. This is because the shared risk principle allows the insurer to spread the potential financial burden across a larger number of people, reducing the overall cost per person.

The shared risk aspect of group life insurance is particularly beneficial for employers who want to provide insurance to their employees. By offering group coverage, employers can extend the financial security of life insurance to their workforce at a more affordable price. This not only demonstrates a commitment to employee well-being but also serves as a valuable benefit that can enhance employee satisfaction and retention.

Furthermore, group life insurance often includes additional features and benefits that further enhance its value. These may include options for term life, permanent life, or a combination of both, allowing employees to choose the level of coverage that best suits their needs. Additionally, group policies can sometimes offer higher death benefits, providing a more substantial financial safety net for the employee's loved ones.

Life Insurance Agent: Strategies to Maximize Your Earnings

You may want to see also

Coverage Levels: Policies can vary, with options for different death benefit amounts

When it comes to group life insurance, one of the key aspects to consider is the coverage level, which refers to the amount of death benefit provided by the policy. This is a crucial factor as it determines the financial support that will be available to the policyholder's beneficiaries in the event of their passing. The coverage level can vary significantly between different policies, offering a range of options to suit various needs and circumstances.

Group life insurance policies typically offer a standard set of coverage options, but the specific amounts can be customized to fit the requirements of the employer or organization offering the policy. These policies often provide a certain amount of coverage per employee, and this amount can vary depending on the industry, job role, and the employer's preferences. For instance, a common coverage range might be between $50,000 and $500,000 per employee, but this can go higher or lower based on individual factors.

The flexibility in coverage levels is a significant advantage of group life insurance. It allows employers to tailor the policy to their workforce's demographics and risk profiles. For example, a company with a higher-risk job sector might opt for a higher coverage amount to provide more financial security to their employees' families. Conversely, a lower coverage amount might be sufficient for a less hazardous profession. This customization ensures that the insurance policy is not a one-size-fits-all solution but rather a tailored financial safety net.

Furthermore, the coverage options can also be adjusted over time. As employees progress in their careers or their personal circumstances change, the coverage amount can be increased or decreased accordingly. This adaptability is particularly useful for organizations that want to provide ongoing support to their employees throughout their careers. It also ensures that the insurance policy remains relevant and beneficial to the policyholders.

In summary, the coverage levels in group life insurance policies offer a wide range of options, allowing for customization based on individual and organizational needs. This flexibility ensures that the policy provides adequate financial protection without being overly burdensome or unnecessary. By understanding the various coverage amounts available, employers and employees can make informed decisions to secure the right level of financial support for the future.

Credit Life Insurance: Cash Value or Not?

You may want to see also

Employer-Sponsored: Most commonly provided by employers as a benefit to employees

Employer-Sponsored Group Life Insurance: A Common Benefit

Many employers offer group life insurance as a valuable benefit to their employees, providing financial security and peace of mind. This type of coverage is a popular choice for companies as it offers a cost-effective way to provide a crucial safety net for their workforce. When an employer sponsors a group life insurance policy, it means that the insurance company agrees to pay a predetermined amount of death benefit to the policyholder's beneficiaries in the event of the insured individual's passing. This benefit is typically provided at no cost or at a significantly reduced cost to the employee, making it an attractive addition to any employee benefits package.

The most common type of employer-sponsored group life insurance is term life insurance. Term life insurance provides coverage for a specific period, often 10, 20, or 30 years, and is generally more affordable than permanent life insurance. During the term, the policy remains in force, and if the insured individual passes away, the death benefit is paid out. This type of coverage is ideal for employees who want a straightforward, cost-effective solution to protect their loved ones without the complexity of permanent life insurance.

Employers often choose to offer term life insurance because it provides a substantial benefit at a relatively low cost. The premium for group term life insurance is typically calculated based on the number of employees, their age, and the amount of coverage each individual selects. By pooling the risk among a large group, employers can offer competitive rates, making it an accessible and essential part of an employee's benefits package.

In addition to the financial protection it offers, employer-sponsored group life insurance can also enhance employee satisfaction and retention. Employees appreciate the sense of security and the knowledge that their families will be taken care of in the event of their untimely passing. This benefit can contribute to a positive work environment and demonstrate the employer's commitment to the well-being of their workforce.

When considering employer-sponsored group life insurance, employees should review the policy details, including the coverage amount, term length, and any exclusions or limitations. It is essential to understand the terms and conditions to ensure that the coverage meets individual needs. Many employers provide resources and guidance to help employees make informed decisions about their insurance benefits, ensuring they receive the most suitable coverage for their circumstances.

Understanding Standard Status: Life Insurance Simplified

You may want to see also

Affordability: Group plans are often more affordable due to economies of scale

Group life insurance plans are a popular and cost-effective way to provide coverage to employees and their families. One of the key advantages of group insurance is its affordability, which is primarily attributed to economies of scale. When an insurance company offers a plan to a group of individuals, such as an entire company's workforce, they can negotiate more favorable rates with the insurance carriers. This is because the larger the group, the lower the risk for the insurer, as the potential payouts are spread across more people. As a result, the insurance company can pass on these cost savings to the group members in the form of lower premiums.

In a group insurance setting, the cost per individual is significantly reduced compared to individual policies. This is because the insurance provider can offer a standardized plan with pre-set benefits and coverage levels, which may not be as tailored to the needs of a single person. By standardizing the policy, the insurer can streamline the underwriting process, reducing administrative costs and, consequently, the overall price of the insurance. This standardization also allows for a more efficient claims process, as the insurance company can quickly assess and settle claims for the entire group, further reducing operational expenses.

The concept of economies of scale is particularly beneficial for small businesses or startups that might not have the financial resources to provide individual life insurance policies for their employees. By opting for a group plan, these companies can offer a valuable benefit to their staff without incurring substantial costs. This not only helps in attracting and retaining talent but also demonstrates a commitment to employee welfare, which can boost morale and productivity.

Moreover, the affordability of group life insurance extends beyond the initial cost savings. Over time, as the group grows and the insurer continues to benefit from the economies of scale, the premiums may even decrease further. This long-term cost-effectiveness is a significant advantage, ensuring that the insurance remains accessible and affordable for the entire duration of the group's membership.

In summary, group life insurance plans are often more affordable due to the power of economies of scale. This affordability factor makes group insurance an attractive option for both employers and employees, providing a valuable safety net without placing a significant financial burden on any single individual or organization. It is a practical and cost-efficient way to secure life insurance coverage for a group, making it a common choice in various industries.

Haven Life Insurance: A Symbol of Trust and Protection

You may want to see also

Frequently asked questions

Group life insurance is a type of life insurance policy offered to a group of people, typically by an employer, as a benefit to its employees. It provides financial protection to the group members and their beneficiaries in the event of the insured individual's death.

In a group life insurance plan, the employer pays a premium to the insurance company on behalf of the employees. The insurance company then provides a death benefit to the designated beneficiaries of the insured individuals if they pass away while the policy is in effect. The terms, coverage amounts, and eligibility criteria may vary depending on the employer's plan and the insurance provider.

Eligibility for group life insurance is usually determined by the employer's policies. It is commonly offered to full-time employees, but some employers may also extend coverage to part-time workers, retirees, or other specified groups. The specific eligibility criteria can vary, and some plans may require a medical examination or health questionnaire to assess the risk of insuring each individual.

Group life insurance offers several advantages. Firstly, it provides financial security to the insured individuals' families, ensuring they receive a lump sum or regular payments in the event of the insured's death. Secondly, group plans often have lower premiums compared to individual policies because the risk is spread across a larger group. Additionally, group life insurance may offer flexible coverage options, allowing employees to choose the level of protection that suits their needs.

In some cases, group life insurance can be converted to an individual policy. This option allows employees to continue their coverage even after leaving the employer's group plan. However, conversion may be subject to certain conditions, such as the insured individual's health status and age at the time of conversion. It's important to review the terms and conditions of the specific group plan to understand the conversion process and any associated requirements.