Universal group life insurance is a type of life insurance policy offered to employees by their employers as part of a group benefit package. It provides financial protection to the policyholder and their beneficiaries in the event of the insured's death. This type of insurance is typically more affordable and accessible to a larger group of people compared to individual life insurance policies, making it an attractive option for employers to offer to their workforce. The coverage amount is usually predetermined and can vary based on the employee's age, health, and other factors. Universal group life insurance policies often have simplified underwriting processes, making it easier for employers to provide this valuable benefit to their employees.

What You'll Learn

- Definition: Universal group life insurance is a policy offered to employees by an employer, providing coverage to all members of a group

- Benefits: It offers financial protection to beneficiaries in the event of the insured's death

- Coverage: The policy typically covers a set amount, often with adjustable benefits based on group size

- Employer-Sponsored: Employers pay premiums, making it affordable and accessible to employees

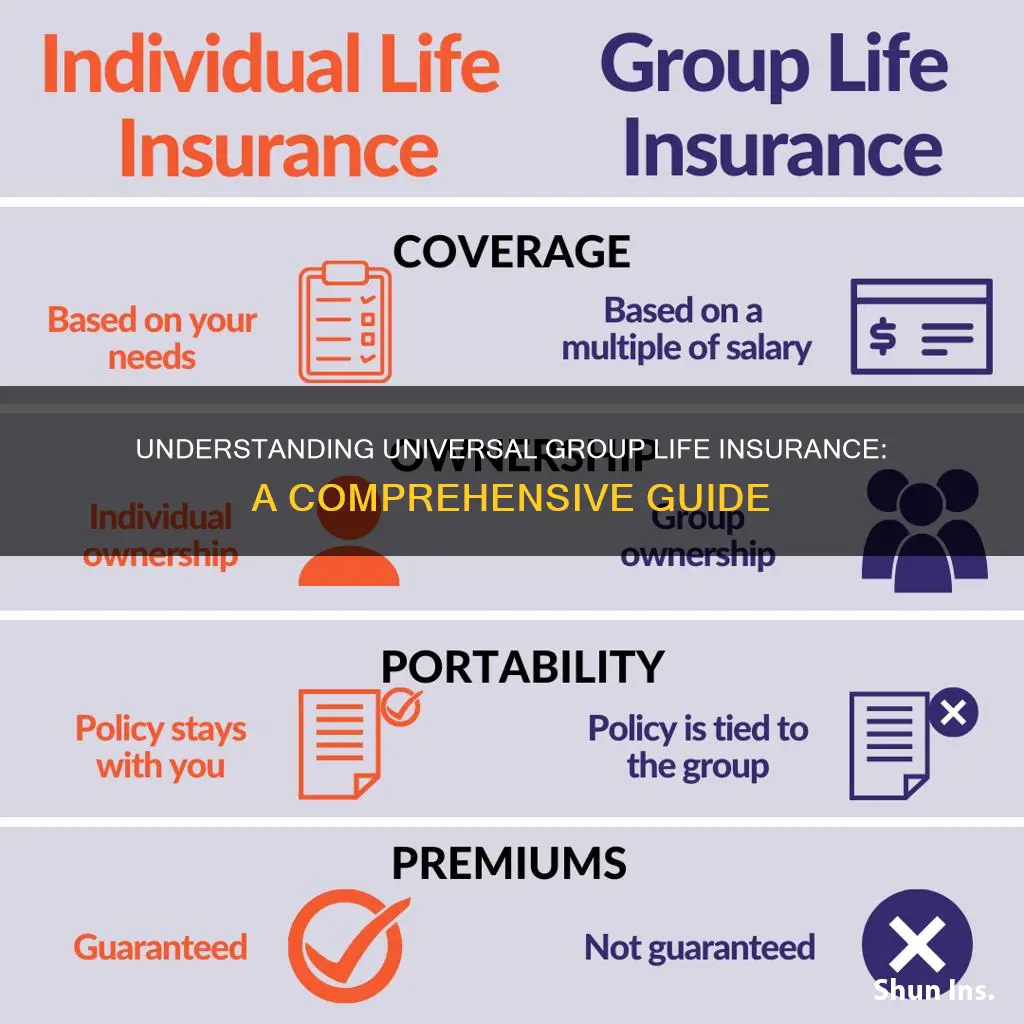

- Portability: This insurance can be transferred to new employers, maintaining coverage continuity

Definition: Universal group life insurance is a policy offered to employees by an employer, providing coverage to all members of a group

Universal group life insurance is a type of life insurance policy that is designed to provide financial protection and peace of mind to employees within a specific group or organization. This insurance is typically offered as a benefit by employers to their workforce, ensuring that all members of the group are covered under the same policy. The primary purpose of universal group life insurance is to offer a convenient and cost-effective way to secure life insurance for a large number of individuals, often at a lower premium compared to individual policies.

In this arrangement, the employer acts as the sponsor or administrator, managing the policy on behalf of the group. They may choose to cover the entire group or select specific subgroups, such as full-time employees, part-time staff, or management. The coverage amount can vary depending on the employer's preferences and the needs of the group members. It is a popular choice for employers as it simplifies the process of providing life insurance benefits to their employees, often at a more affordable rate than individual plans.

When an employee joins the group, they automatically become a part of the universal group life insurance policy. This means that they are covered for a predetermined amount of life insurance, which can be adjusted or increased over time based on the employer's discretion. The policy typically remains in effect as long as the employee is a part of the group, providing continuous protection. This type of coverage is particularly beneficial for employees who may not have access to individual life insurance or prefer the simplicity and convenience of group coverage.

One of the key advantages of universal group life insurance is the ease of administration. Since the policy is managed by the employer, employees do not need to go through a lengthy application process or provide extensive personal and medical information. The coverage is often automatically enrolled, and any changes or updates can be made through the employer's human resources department. This streamlined process ensures that the insurance remains accessible and efficient for both the employer and the employees.

In summary, universal group life insurance is a convenient and cost-effective way for employers to provide life insurance coverage to their employees. It offers a standardized and simplified approach to securing life insurance for a group of individuals, often at a lower premium. By enrolling in this type of policy, employees can benefit from the financial protection and peace of mind that comes with knowing they are covered under a comprehensive life insurance plan.

Pregnant and Want Life Insurance? Here's What You Need to Know

You may want to see also

Benefits: It offers financial protection to beneficiaries in the event of the insured's death

Universal Group Life Insurance is a comprehensive life insurance policy designed to provide financial security and peace of mind to both employees and their designated beneficiaries. This type of insurance is typically offered as a group benefit through employers, making it accessible and affordable for a large number of individuals. The primary advantage of universal group life insurance is its ability to offer financial protection to the beneficiaries in the unfortunate event of the insured's death.

When an individual is insured under this policy, their beneficiaries are guaranteed a death benefit, which is a lump sum payment or an income stream provided upon their passing. This financial protection is crucial as it ensures that the dependents of the insured person, such as spouse, children, or other family members, receive the necessary financial support to maintain their standard of living and cover essential expenses. The death benefit can be used to cover various costs, including mortgage payments, education fees, funeral expenses, and daily living expenses, providing a safety net during a challenging time.

One of the key benefits of universal group life insurance is its simplicity and ease of administration. Since the policy is typically part of a group plan, the employer or the insurance company manages the overall process, making it convenient for employees to enroll and manage their coverage. This group approach often results in lower premiums compared to individual life insurance policies, making it an attractive option for both employers and employees.

Moreover, this type of insurance often provides a guaranteed acceptance, meaning that as long as the insured individual meets the initial eligibility criteria, they are guaranteed coverage without the need for a medical examination or answering health-related questions. This feature makes it accessible to a broader range of individuals, including those with pre-existing health conditions or those who may not qualify for standard life insurance policies.

In summary, universal group life insurance is a valuable benefit that offers financial security and protection to employees and their beneficiaries. Its group approach, simplicity, and guaranteed acceptance make it an attractive and accessible option for providing peace of mind and financial stability in the event of the insured's death.

Navigating Life Insurance: Declining Regal Cinemas Benefits

You may want to see also

Coverage: The policy typically covers a set amount, often with adjustable benefits based on group size

Universal Group Life Insurance is a comprehensive life insurance policy designed to provide financial protection for a group of individuals, typically employees of a company or organization. This type of insurance offers a structured approach to coverage, ensuring that a predetermined amount of financial support is available to the beneficiaries in the event of a covered individual's death. The key feature that sets Universal Group Life Insurance apart is its ability to offer adjustable benefits based on the size of the group.

In this policy, the coverage amount is typically set at a fixed value, which can be tailored to the specific needs of the group. This flexibility allows employers to choose a coverage level that suits their budget and the desired level of protection for their employees. For instance, a company might opt for a higher coverage amount if they want to provide extensive financial security to their workforce, ensuring that the beneficiaries receive a substantial sum in the event of a tragic loss.

The adjustability of benefits is a significant advantage, as it allows for customization based on the group's characteristics. Factors such as the number of employees, their age distribution, and the overall risk profile of the group can influence the final coverage amount. By considering these variables, insurers can provide a more accurate and personalized policy, ensuring that the financial protection aligns with the specific needs of the group members.

This type of insurance often provides a sense of security and peace of mind to both the employees and the employer. Employees know that they have a safety net in place, which can be crucial during challenging times, while employers can demonstrate their commitment to the well-being of their staff. The adjustable nature of the coverage ensures that the policy remains relevant and effective as the group's circumstances change over time.

In summary, Universal Group Life Insurance offers a tailored approach to life coverage, providing a set amount of financial protection with the flexibility to adjust benefits based on group size and characteristics. This policy is an essential tool for employers to demonstrate their care for employees and to provide a valuable safety net for the workforce.

Get a Life Insurance License: Nevada Requirements

You may want to see also

Employer-Sponsored: Employers pay premiums, making it affordable and accessible to employees

Universal Group Life Insurance is a comprehensive life insurance policy designed to provide financial protection for a group of employees within a company or organization. This type of insurance is an essential benefit for employers to offer to their workforce, ensuring that their employees and their families are financially secure in the event of unforeseen circumstances.

In this arrangement, the employer takes on the role of the policyholder, which means they are responsible for paying the premiums. By doing so, employers can make this valuable insurance coverage more affordable and accessible to their employees. The premiums are typically deducted from the employees' paychecks, making the payment process seamless and convenient. This structured approach ensures that the cost of the insurance is shared among the group, making it a more manageable and cost-effective solution for both the employer and the employees.

When an employer sponsors a universal group life insurance policy, they are providing a safety net for their employees and their dependents. This type of insurance offers a fixed death benefit, which is a predetermined amount of money paid out to the beneficiaries upon the insured individual's death. The benefit amount is usually based on the employee's salary and the number of years they have been with the company, ensuring that the coverage is proportional to their contribution to the organization.

One of the key advantages of employer-sponsored universal group life insurance is the ease of administration. Employers can work with insurance providers to set up the policy, ensuring that the coverage is tailored to their workforce's needs. This includes the ability to customize the benefit amounts, coverage periods, and other terms to fit the specific requirements of the company and its employees. As a result, the process becomes more streamlined, and the insurance becomes a valuable addition to the overall employee benefits package.

By offering this type of insurance, employers demonstrate their commitment to the well-being of their employees and their families. It provides peace of mind, knowing that financial security is in place should any unfortunate events occur. Additionally, it can enhance employee satisfaction and loyalty, as this benefit is often highly valued by workers, making it a powerful tool for attracting and retaining talent.

Lincoln Heritage Life Insurance: Is It Worth the Cost?

You may want to see also

Portability: This insurance can be transferred to new employers, maintaining coverage continuity

Universal Group Life Insurance is a valuable benefit that offers employees a sense of security and peace of mind. One of its key advantages is the portability it provides, ensuring that coverage remains intact even when an individual changes employers. This feature is particularly beneficial in today's dynamic work environment, where job transitions are common.

When an employee leaves one company and joins another, the portability of universal group life insurance allows them to seamlessly transfer their existing coverage. This means that the new employer can easily recognize and continue the insurance policy, providing the same level of financial protection to the employee and their beneficiaries. Portability ensures that the individual doesn't have to start the insurance process from scratch, saving time and potentially money.

The process of transferring the insurance is often straightforward. The new employer typically works with the insurance provider to facilitate the transfer, ensuring that the coverage is not interrupted. This continuity is crucial, especially in cases where the individual's health status or lifestyle hasn't changed significantly, as it maintains the integrity of the insurance plan.

For employees, this portability feature offers a sense of stability and financial security. It means that life insurance coverage, which provides financial protection in the event of death, remains consistent, even if the individual's employment situation changes. This is particularly important for those with dependents or financial commitments who rely on this insurance for their well-being.

In summary, the portability aspect of universal group life insurance is a significant advantage, allowing employees to maintain their insurance coverage across different employers. This feature ensures that individuals can continue to protect their loved ones and manage their financial obligations without the added stress of insurance transitions. It is a valuable benefit that contributes to the overall well-being and security of employees in a rapidly changing work landscape.

Life Insurance Scams: Targeting the Elderly and How to Stop Them

You may want to see also