Whole life insurance is a permanent life insurance policy that covers the insured for their entire life. It is more expensive than term life insurance because it insures the policyholder for their entire life, and the cost of insuring someone increases with age. Whole life insurance policies typically have level premiums, meaning the amount paid every month stays the same. However, the cash value of a whole life insurance policy, which can be withdrawn or borrowed against, grows more slowly as the insured gets older due to higher risks associated with age.

| Characteristics | Values |

|---|---|

| Whole life insurance coverage | Lasts for the entire life of the insured |

| Whole life insurance premium | Typically remains the same throughout the duration of the policy |

| Whole life insurance death benefit | Remains the same, no matter how long the insured lives |

| Whole life insurance cash value | Can be withdrawn in the form of a loan or used to cover insurance premiums |

| Whole life insurance cash value tax | Tax-free withdrawals up to the value of the total premiums paid |

| Whole life insurance loan | Must be repaid before the insured passes away, otherwise deducted from the policy's death benefit |

| Whole life insurance surrender | The policy can be surrendered in exchange for the cash value |

| Whole life insurance loan interest | Charged at a rate that is generally lower than that of a personal loan or home equity loan |

| Whole life insurance loan vs. withdrawal | Withdrawals are preferred over loans as they do not incur interest |

| Whole life insurance cost | More expensive than term life insurance |

| Whole life insurance premium factors | Age, health, gender, occupation, hobbies, and smoking status |

What You'll Learn

- Whole life insurance is a permanent policy that offers lifelong coverage

- Whole life insurance policies have a cash value that can be withdrawn or borrowed against

- Whole life insurance premiums are typically higher than term life insurance due to lifelong coverage and cash value

- Whole life insurance is a good option for those with long-term financial needs or those who want coverage for their entire life

- Whole life insurance policies mature at age 100, after which the insurance company may pay the full cash value to the policyholder

Whole life insurance is a permanent policy that offers lifelong coverage

Whole life insurance is a permanent policy that offers coverage for your entire life. Unlike term life insurance, which covers you for a specific number of years, whole life insurance lasts until you pass away, as long as you pay the premiums. This type of insurance provides a guaranteed death benefit, meaning your beneficiaries will receive a payout when you die. The premium amount typically remains the same throughout the duration of the policy and does not increase with age.

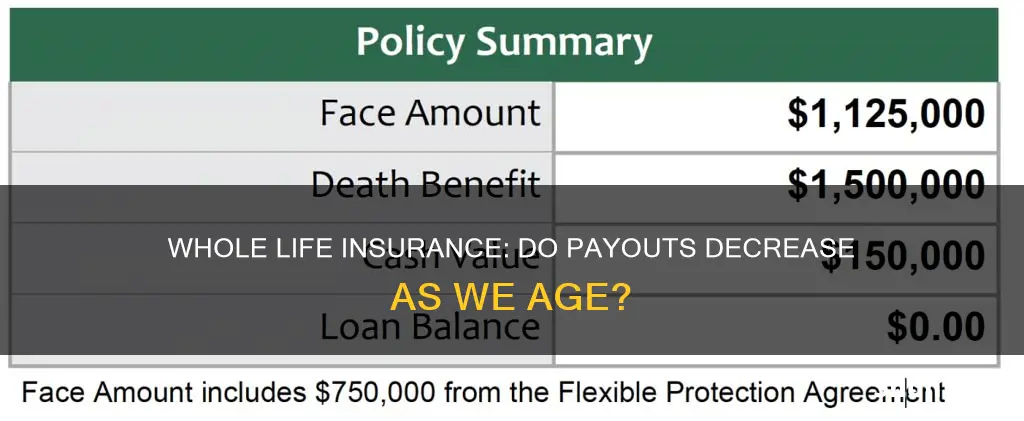

Whole life insurance also has a savings component known as the cash value, which the policyholder can access during their lifetime. This cash value accumulates over time as you pay your premiums, and you can withdraw it in the form of a loan or use it to cover your insurance premiums. However, withdrawals and outstanding loan balances will reduce the death benefit. The cash value typically grows more slowly as the insured gets older due to the higher risks associated with age.

When purchasing whole life insurance, your premium is calculated based on your age, gender, and health. Older individuals can expect to pay higher premiums than younger ones, as the cost of insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. Additionally, factors such as health, smoking status, occupation, and participation in risky activities can also influence the premium amount.

Whole life insurance is ideal for individuals who want lifelong coverage and are willing to pay higher premiums for it. It can also be a good option for those with long-term financial needs, such as business owners or those with defined benefit pension plans. If you're considering whole life insurance, it's important to compare quotes from multiple companies, as rates can vary significantly, and choose a policy that meets your specific coverage needs.

Life Insurance and COVID: What Cover Does Your Term Offer?

You may want to see also

Whole life insurance policies have a cash value that can be withdrawn or borrowed against

The cash value of a whole life policy increases over time. This is because part of each premium payment is deposited into a separate account controlled by the insurance company. This account functions as a tax-deferred savings or investment account. As the investments made by the insurance company pay off and more premium payments are made, the cash value grows.

There are several ways to access the cash value of a whole life insurance policy:

- Withdrawals: The policyholder can withdraw a portion of the cash value. However, the amount withdrawn will be deducted from the death benefit.

- Loans: The policyholder can borrow against the cash value and pay back the loan with interest. If the loan is not fully repaid before the insured’s death, the insurance company will deduct the remaining balance from the death benefit.

- Paying premiums: The policyholder can use the cash value to pay the premiums, reducing or eliminating the out-of-pocket cost of maintaining the policy.

- Surrendering the policy: The policyholder can choose to surrender the policy in exchange for a cash payout. The cash surrender value will increase as the policy ages.

It is important to note that withdrawals and outstanding loan balances will reduce the death benefit.

Living Benefits: Mortgage Protection and Life Insurance

You may want to see also

Whole life insurance premiums are typically higher than term life insurance due to lifelong coverage and cash value

Whole life insurance is a permanent life insurance policy that provides coverage for the entire life of the insured. It is more expensive than term life insurance due to lifelong coverage and the inclusion of a cash value component.

Lifelong Coverage

Whole life insurance policies offer coverage for the entire life of the insured, whereas term life insurance policies only provide coverage for a specific number of years. This means that whole life insurance policies are riskier for insurers, which is reflected in the higher premiums.

Cash Value Component

Whole life insurance policies also include a cash value component, which allows the policy to double as a savings or investment tool. This cash value accumulates over time as the policyholder pays their premiums, and it can be accessed in several ways, such as through withdrawals, loans, or by using it to pay premiums. The inclusion of this additional benefit further increases the cost of whole life insurance compared to term life insurance.

Age and Premiums

It is important to note that age is a significant factor in determining life insurance premiums. Older individuals will pay higher premiums than younger ones, as the likelihood of illness or death increases with age. This applies to both whole life and term life insurance policies, but the impact on whole life insurance premiums may be greater due to the lifelong coverage.

Other Factors Affecting Premiums

In addition to age, there are several other factors that can influence life insurance premiums, such as health, gender, smoking status, occupation, and hobbies. These factors can affect the likelihood of illness or death and are therefore taken into consideration when determining the cost of coverage.

Choosing Between Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, individuals should consider their financial obligations, goals, and budget. Whole life insurance offers more benefits, including lifelong coverage, a guaranteed death benefit, and a cash value component. However, term life insurance is more affordable and may be a better option for those with a tight budget or those who only need coverage for a limited period.

ERISA and Life Insurance: What's the Connection?

You may want to see also

Whole life insurance is a good option for those with long-term financial needs or those who want coverage for their entire life

Whole life insurance is a good option for those who want coverage for their entire life and don't want to worry about their policy expiring. Unlike term life insurance, whole life insurance is a permanent policy that covers you for your entire life, as long as you pay your premiums. This means that you'll never have to reapply for coverage or worry about increasing premiums due to age.

Whole life insurance is also a good option for those with long-term financial needs. It offers a savings component, known as the cash value, which can be used to supplement retirement income, pay for children's education, or grow a business. The cash value grows over time and can be accessed through withdrawals, loans, or by surrendering the policy. This makes whole life insurance a good choice for those who want the added benefit of a tax-advantaged savings or investment tool.

Another advantage of whole life insurance is that it provides a guaranteed death benefit. This means that your beneficiaries will receive a payout when you pass away, regardless of your age. This can be especially important for those with dependents who will always require financial assistance or for business owners who want to ensure their business is protected in the event of their death.

However, it's important to note that whole life insurance typically comes with higher premiums than term life insurance due to the lifelong coverage and the addition of a cash value component. The cost of whole life insurance can also be affected by factors such as age, health, gender, and occupation. Nonetheless, whole life insurance can be a good option for those who want the peace of mind that comes with knowing their loved ones will be financially protected, no matter when they die.

HSBC Life Insurance: What You Need to Know

You may want to see also

Whole life insurance policies mature at age 100, after which the insurance company may pay the full cash value to the policyholder

Whole life insurance is a permanent life insurance policy. It provides coverage for the entire life of the insured, as long as the premiums are paid. Whole life insurance policies are often more expensive than term life insurance policies because they insure the policyholder for their entire life, and the policy typically includes a cash value component. The premium amount is calculated based on the age, gender, and health of the policyholder.

Whole life insurance policies mature at age 100. When a policyholder outlives the policy, the insurance company has a few options. In some cases, the insurance company may pay the full cash value to the policyholder (which equals the coverage amount) and close the policy. Alternatively, the insurance company may grant an extension to the policyholder, allowing them to continue paying premiums until their death. In other cases, the insurance company may stop collecting premiums but keep the policy active until it is needed.

The cash value of a whole life insurance policy is a savings component that the policy owner can draw on or borrow from. This cash value typically earns a fixed rate of interest, and the policyholder can withdraw a portion of the cash value or borrow against it. However, withdrawals and outstanding loan balances will reduce the death benefit.

Whole life insurance policies offer several benefits, including a guaranteed death benefit, a cash value that can be used during the lifetime of the policyholder, and predictable premium payments. However, whole life insurance is generally more expensive than term life insurance, and the cash value may grow slower than with other policies. Additionally, whole life policies offer limited flexibility in adjusting the premium or death benefit.

Life Insurance and Pregnancy Loss: What Coverage is Offered?

You may want to see also

Frequently asked questions

No, the payout does not decrease with age. Whole life insurance is a permanent life insurance policy that covers the insured for their entire life. The death benefit that beneficiaries receive upon the insured's death remains the same, regardless of how long they live.

Whole life insurance is a permanent policy that offers lifelong coverage. Typically, the premium remains the same for the duration of the policy, and the death benefit that beneficiaries receive upon the insured's death also stays the same. Whole life insurance policies may also build cash value, which can be withdrawn or borrowed against by the policyholder.

Whole life insurance and term life insurance are the two main types of life insurance policies. Whole life insurance offers lifelong coverage, while term life insurance only covers a specific term, such as 10 or 20 years. Whole life insurance typically has higher premiums than term life insurance because of the difference in cash value and policy length.

The cost of whole life insurance depends on various factors, including age, health, gender, and the type of policy chosen. For example, a $500,000 whole life insurance policy for a 30-year-old non-smoker in good health costs an average of $451 per month.

Whole life insurance offers several benefits, including a guaranteed death benefit, a cash value that can be used during the policyholder's lifetime, and tax advantages. It is a good option for those who want lifelong coverage and the ability to build a tax-deferred savings or investment account.