Whole life insurance is a long-term financial product that provides coverage for the entire life of the insured individual. One of the key features of this type of insurance is the guaranteed payout, which is a fixed amount of money paid out to the policyholder's beneficiaries upon the insured's death. The payout amount is typically determined by the policy's cash value, which grows over time through regular premium payments and investment returns. Understanding the payout for whole life insurance is essential for individuals seeking to secure financial protection for their loved ones and achieve long-term financial goals.

What You'll Learn

- Premiums: Whole life insurance requires regular premium payments, which determine the payout amount

- Death Benefit: The payout is a fixed amount upon the insured's death, typically the policy's face value

- Accumulates Cash Value: Premiums build cash value, which can be borrowed against or withdrawn

- Tax-Free Payout: The death benefit is generally tax-free, providing a financial benefit to beneficiaries

- Guaranteed Payout: Whole life offers a guaranteed payout, ensuring financial security for beneficiaries regardless of market fluctuations

Premiums: Whole life insurance requires regular premium payments, which determine the payout amount

Whole life insurance is a long-term financial commitment that offers a guaranteed death benefit to the policyholder's beneficiaries. One of the key aspects of this type of insurance is the premium payment structure, which is crucial to understanding the payout process. When you purchase a whole life insurance policy, you are required to make regular premium payments, typically on a monthly, quarterly, or annual basis. These premiums are a significant factor in determining the overall payout amount that your beneficiaries will receive upon your passing.

The amount you pay in premiums directly influences the policy's cash value and the eventual death benefit. As you make these regular payments, the insurance company invests a portion of the premium in various investment options, such as stocks, bonds, or mutual funds. This investment component is what allows the policy to accumulate cash value over time. The cash value grows at a fixed rate, which is predetermined by the insurance company and is typically higher than the interest rates offered by traditional savings accounts.

The premiums are structured in a way that ensures the insurance company can pay out the promised death benefit when the time comes. The regular payments create a fund that the insurer uses to cover the costs of administration, investment management, and the guaranteed payout. As the policyholder, you have the flexibility to choose the frequency and amount of your premium payments, ensuring that you can manage the financial commitment according to your preferences and financial situation.

It's important to note that the premium payments are not just about the immediate payout; they also contribute to the long-term financial security of your beneficiaries. By consistently paying premiums, you build a substantial cash value in the policy, which can be borrowed against or withdrawn in certain circumstances. This feature provides policyholders with a financial safety net and can be particularly valuable during challenging economic times.

In summary, whole life insurance premiums are a vital component of the policy, as they directly impact the payout amount and the overall financial security of your loved ones. Understanding the premium payment structure and its relationship to the death benefit is essential for making informed decisions about your insurance coverage.

Life Insurance: O'Reilly Auto Parts' Employee Benefits

You may want to see also

Death Benefit: The payout is a fixed amount upon the insured's death, typically the policy's face value

When it comes to whole life insurance, the death benefit is a crucial aspect that determines the payout to the beneficiaries upon the insured individual's passing. This benefit is a fundamental feature of the policy and is designed to provide financial security and peace of mind to the policyholder's loved ones.

The death benefit is typically the face value or the amount stated on the insurance policy. It is a fixed sum that the insurance company agrees to pay out when the insured person dies, provided the policy is in force. This payout is a guaranteed amount, ensuring that the beneficiaries receive the intended financial support during a challenging time. The face value of the policy is often determined during the initial application process and can vary depending on the policyholder's preferences, age, health, and other factors.

Upon the insured's death, the beneficiaries named in the policy will receive this fixed amount. The payout can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or to provide financial support to dependents. It is a critical financial safety net, ensuring that the insured's family or designated recipients have the necessary resources to manage their affairs and maintain their standard of living after the insured's passing.

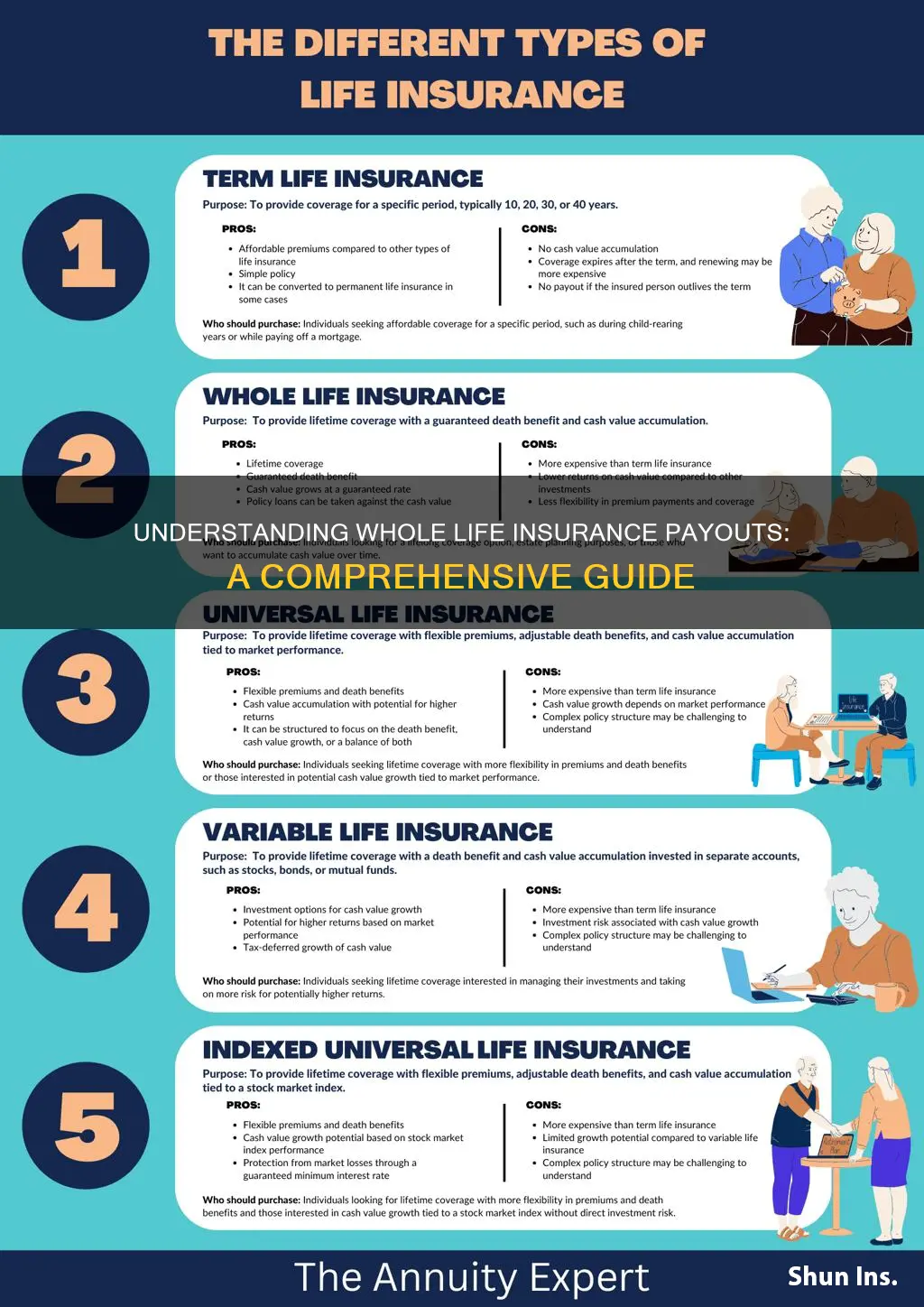

It's important to note that the death benefit is a key differentiator between different types of life insurance policies. While term life insurance provides coverage for a specific period, whole life insurance offers permanent coverage for the insured's entire life, ensuring a death benefit is paid out regardless of when the insured passes away. This feature provides long-term financial security and peace of mind, knowing that the beneficiaries will receive a predetermined amount when the insured is no longer around.

Understanding the death benefit and its payout is essential for anyone considering whole life insurance. It ensures that the policyholder's intentions are met, and the financial needs of their loved ones are addressed. By knowing the fixed amount that will be paid out, individuals can make informed decisions about their insurance coverage and ensure their family's financial well-being.

Variable Life Insurance: Permanent or Temporary Solution?

You may want to see also

Accumulates Cash Value: Premiums build cash value, which can be borrowed against or withdrawn

When considering whole life insurance, it's important to understand the concept of cash value accumulation, which is a key feature of this type of policy. Over time, the regular premiums you pay into your whole life insurance policy contribute to the growth of a cash value reserve. This cash value is essentially the investment component of your insurance, and it can grow tax-deferred, allowing your money to work harder for you.

The cash value in your policy grows through various investment options offered by the insurance company. These investments are typically diversified portfolios designed to provide a steady return. As the cash value accumulates, it becomes a valuable asset that you can utilize in several ways. One option is to borrow against this cash value, allowing you to access funds without disrupting your insurance coverage. This can be particularly useful if you need immediate financial resources for any purpose, such as home improvements, education expenses, or business ventures.

Additionally, the accumulated cash value can be withdrawn as needed. This provides you with a level of financial flexibility, enabling you to access your money when required. Withdrawals can be made in various amounts, and the policy will continue to provide coverage based on the remaining cash value. This feature is especially beneficial if you anticipate future financial needs or want to ensure your loved ones' financial security in the event of your passing.

It's worth noting that borrowing against or withdrawing from the cash value may result in a reduction of the death benefit, which is the primary purpose of the insurance. Therefore, it's essential to carefully consider your financial needs and consult with a financial advisor to determine the best course of action. Whole life insurance with cash value accumulation offers a unique blend of insurance protection and investment potential, providing a safety net for your loved ones while also growing your wealth over time.

Who Owns Your Life Insurance Policy?

You may want to see also

Tax-Free Payout: The death benefit is generally tax-free, providing a financial benefit to beneficiaries

When it comes to whole life insurance, one of the key advantages is the tax-free payout that beneficiaries receive upon the insured individual's death. This feature ensures that the entire death benefit amount is paid out to the designated recipients without any tax implications. Unlike other forms of insurance, where payouts may be subject to income tax, whole life insurance offers a significant financial benefit to the beneficiaries.

The tax-free nature of the death benefit is a result of the insurance policy being considered a "qualified" or "tax-deferred" investment. This means that the growth and accumulation of the cash value within the policy are not taxed during the insured's lifetime. As a result, when the insured passes away, the entire death benefit can be paid out tax-free, allowing the beneficiaries to receive the full amount without any deductions.

This tax advantage is particularly valuable as it provides a substantial financial windfall to the beneficiaries. It can help cover various expenses, such as funeral costs, outstanding debts, or even provide a lump sum for future financial goals. The tax-free payout ensures that the intended recipients can access the funds without the burden of paying taxes, making it a significant benefit of whole life insurance.

Furthermore, the tax-free payout also ensures that the beneficiaries can make use of the funds immediately, without having to worry about potential tax liabilities. This flexibility allows them to utilize the death benefit for immediate needs or long-term financial planning, providing a sense of security and peace of mind during a difficult time.

In summary, the tax-free payout of whole life insurance is a crucial aspect that sets it apart from other insurance products. It ensures that the death benefit is received tax-free, providing a substantial financial benefit to the beneficiaries. This feature, combined with the long-term financial security it offers, makes whole life insurance an attractive option for those seeking a comprehensive and tax-efficient way to protect their loved ones' financial future.

Life Insurance for Children: Is Term Coverage an Option?

You may want to see also

Guaranteed Payout: Whole life offers a guaranteed payout, ensuring financial security for beneficiaries regardless of market fluctuations

Whole life insurance is a type of permanent life insurance that provides a guaranteed payout to the policy's beneficiaries upon the insured individual's death. This feature is a cornerstone of whole life insurance and sets it apart from other life insurance policies. The guaranteed payout is a fixed amount that the insurance company promises to pay out, and it is typically determined at the time the policy is issued. This guarantee is a significant advantage, offering financial security and peace of mind to both the insured and their loved ones.

When you purchase a whole life insurance policy, you pay a set premium over a specified period, often the entire lifetime of the insured. The insurance company then invests a portion of these premiums to grow the policy's cash value. This investment component is what allows whole life insurance to offer a guaranteed payout. As the policyholder, you have the option to borrow against the cash value or withdraw funds, but these actions do not affect the guaranteed death benefit. The insurance company's commitment to paying out the full amount, regardless of market performance, is a key selling point.

The guaranteed payout is a fixed sum, and it is not subject to the volatility of the financial markets. This means that even if the insurance company's investment portfolio experiences losses, the beneficiaries will still receive the promised amount. For example, if the insured person passes away, the beneficiaries will receive the death benefit, which could be used to cover funeral expenses, outstanding debts, or provide financial support to dependents. This level of security is particularly valuable for those who want to ensure their family's financial well-being in the long term.

One of the primary benefits of whole life insurance is the predictability it offers. Policyholders and their families can plan and budget with confidence, knowing that a specific amount will be available when needed. This predictability is a stark contrast to term life insurance, where the payout is only valid for a specified period. With whole life, the guaranteed payout is a long-term commitment, providing financial protection throughout the insured's life.

In summary, the guaranteed payout is a defining feature of whole life insurance, offering financial security and peace of mind. It ensures that beneficiaries receive a fixed amount, regardless of market conditions, providing a reliable source of financial support during challenging times. This aspect of whole life insurance makes it an attractive option for those seeking long-term financial protection and stability.

Quicken Loans: Mortgage Life Insurance Options Explained

You may want to see also

Frequently asked questions

The payout amount for whole life insurance is typically the death benefit, which is the amount the insurance company pays to the policyholder's beneficiaries upon the insured individual's death. This death benefit is usually the sum of the policy's cash value and any outstanding loans or withdrawals.

Yes, the death benefit of whole life insurance is generally tax-free. It is considered a form of life insurance proceeds, which are typically exempt from income tax when received by the beneficiaries.

Yes, one of the key features of whole life insurance is the accumulation of cash value over time. Policyholders can access this cash value through policy loans or by taking withdrawals. The cash value can be used for various purposes, such as funding education expenses, starting a business, or supplementing retirement income.

Whole life insurance provides coverage for the entire lifetime of the insured individual, so even if you outlive the initial term of the policy, the coverage remains in effect. The death benefit will still be paid out to the beneficiaries when you pass away, provided the policy is in force.

While there may be some fees associated with policy loans or withdrawals, such as interest charges, there are generally no significant penalties for accessing the cash value. However, it's important to review the policy terms and conditions to understand any specific fees or restrictions.