Variable life insurance is a type of permanent life insurance policy, meaning that coverage will remain in place for the policyholder's lifetime as long as premiums are paid. Variable life insurance policies are permanent life insurance policies that have a higher potential of earning cash compared to traditional policies. This is because, with variable life insurance, the policyholder gets to decide how to invest the cash value. However, variable life insurance policies are complex, require more hands-on attention, come with risk, and typically have higher premiums than other cash value life insurance policies.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Coverage | Lifelong |

| Death benefit | Variable |

| Premium | Variable |

| Cash value | Variable |

| Investment options | Mutual funds, index funds, equities, bonds, money market funds, fixed interest investment |

| Death benefit options | Level death benefit, face amount plus cash value, face amount plus premium payments |

| Pros | Lifelong coverage, higher potential of earning cash, multiple investment options, greater cash value accumulation, tax-deferred growth, adjustable death benefit, flexible premiums |

| Cons | Complex, high-risk, high premiums, high fees, capped returns, limited investment options |

What You'll Learn

Variable life insurance provides lifelong coverage

Variable life insurance is a type of permanent life insurance policy that provides coverage for the entirety of the policyholder's life. This means that as long as premiums are paid, the policy does not expire and will pay out a death benefit to the policyholder's beneficiaries when they pass away.

Variable life insurance policies have two main components: a life insurance death benefit and a cash value account. A portion of the premiums paid by the policyholder goes towards the death benefit, while the rest goes into the cash value account. The cash value account is essentially an investment account that the policyholder can choose how to invest. The cash value can be invested in various funds, usually mutual funds, but also potentially index funds, equities, bonds, or money market funds.

The cash value account offers the potential for significant gains if the investments perform well. The policyholder can use the profits to increase the death benefit, withdraw the money as cash, or use it as collateral for a loan. However, there is also the risk of investment losses, which could decrease the cash value and the death benefit. Variable life insurance policies also tend to have higher premiums and fees than other types of life insurance.

Variable universal life insurance is a type of variable life insurance policy that combines the features of variable and universal life insurance. It offers the investment risks and rewards of variable life insurance, along with the ability to adjust premiums and the death benefit, which is characteristic of universal life insurance.

Life Term Insurance: Gaining Cash Value?

You may want to see also

It has a higher earning potential than traditional policies

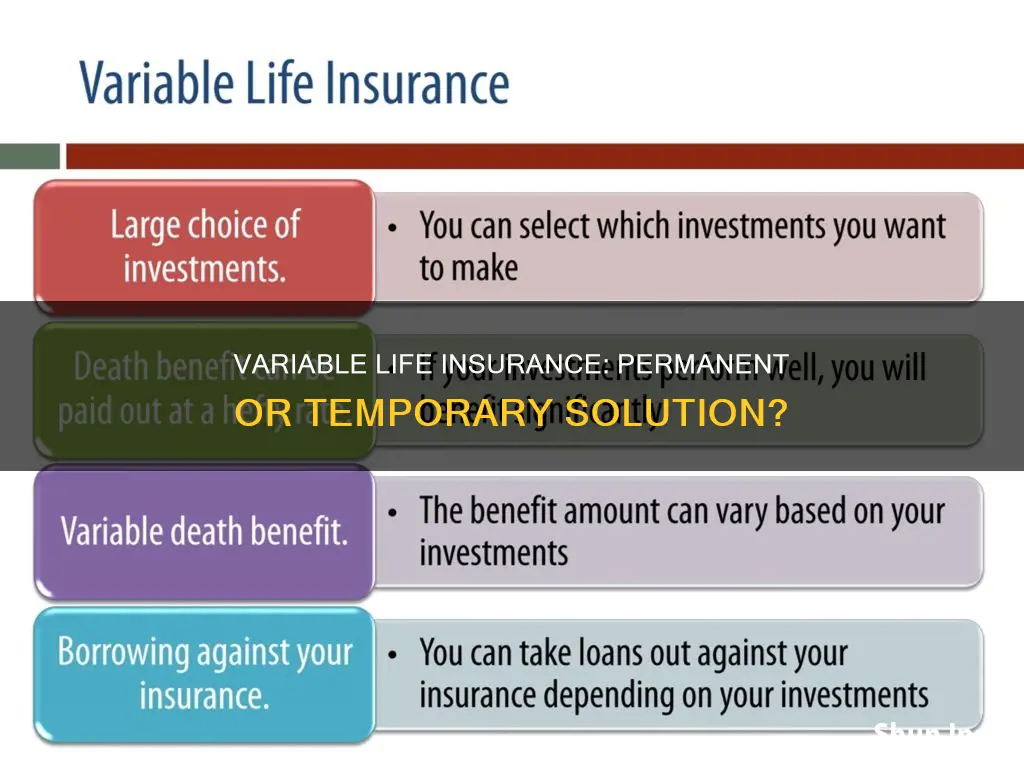

Variable life insurance policies have a higher earning potential than traditional policies. This is because they allow you to decide how to invest the cash value, which can be placed in a variety of investment options, including stocks, mutual funds, bonds, and money market funds. This flexibility means that, compared to traditional whole life insurance, variable life insurance can potentially accumulate more cash.

Variable life insurance policies also offer the opportunity to raise the death benefit by increasing premiums. This means that, in addition to the face value of the policy, the death benefit can be increased to include the accumulated cash value. This ensures that your beneficiaries will receive the face value of the policy, plus whatever you have earned in investments.

Variable universal life insurance, which combines variable and universal life insurance, offers additional flexibility in how much of a premium you pay. You can choose to pay a portion of the premiums, not pay them at all if your cash value is large enough, or pay more than the target premium to build up investment gains more quickly.

However, it is important to note that, while variable life insurance policies have higher earning potential, they also come with higher risks and typically have higher premiums than other cash value life insurance policies. The cash value of these policies can decrease if the market underperforms, and there is usually no guaranteed rate of return.

Transferring Your Life Insurance: Is It Possible?

You may want to see also

It is a permanent policy

Variable life insurance is a type of permanent life insurance policy, meaning coverage will remain in place for your lifetime, as long as premiums are paid. Variable life insurance policies are permanent life insurance policies that have a higher potential of earning cash compared to traditional policies. That's because with variable life insurance, you get to decide how to invest the cash value.

Variable life insurance policies include a cash value component on top of the traditional death benefit portion. This cash value comes from a part of your premiums and is invested into a stock market fund managed by the insurance company or a company hired by them. While variable life insurance may have the potential for significant gains, it can also be one of the riskier types of life insurance.

Variable life insurance policies have three primary components: a death benefit, fees and expenses, and the performance of a menu of investment options. The death benefit is what is left to your beneficiaries. Every time you make a premium payment, a portion of it goes toward the cost of insurance and the fees of the insurer who is keeping the death benefit in place. The remainder of the premium goes toward the policy's cash value, which is similar in structure to a brokerage account. The cash value can be invested in certain securities (often called subaccounts), which resemble mutual funds.

If the cash value performs well, it can be used to increase the death benefit, withdrawn as cash, or used as collateral for a loan. The cash value is also the amount of money you would receive if you decided to give up (or surrender) your coverage to the insurer.

Variable universal life insurance policies have the cash value structure of variable life insurance, but you can use the cash value to pay premiums. You can also pay a larger amount in premiums if you choose to do so. Therefore, these policies are sometimes referred to as flexible premium variable life insurance.

Life Insurance and Taxes: What's the Deal?

You may want to see also

It has a cash value account

Variable life insurance policies are permanent life insurance policies that have a higher potential of earning cash compared to traditional policies. This is because they have a cash value account that you get to decide how to invest. The cash value can be invested in certain securities (often called subaccounts), which resemble mutual funds.

The cash value account is similar in structure to a brokerage account. When you purchase a variable life insurance policy, you'll receive a prospectus with all of your investing options. The cash value can be invested in numerous ways, but the most common way is to invest in mutual funds. You may also be able to invest in index funds, equities, bonds or money market funds.

If your cash value investment does well, you have several options. You can use the money to increase the death benefit, withdraw the money as cash or use the funds as collateral for a loan. However, most insurance companies put a cap on the maximum rate of return, so your earning potential isn’t endless. You’ll also have to pay management fees based on how your cash value is invested.

Variable life insurance policies are complex and require more hands-on attention. They come with risk and they typically have higher premiums than other cash value life insurance policies.

Life Insurance for My Drug-Addicted Sister: Is It Possible?

You may want to see also

It is complex and requires hands-on attention

Variable life insurance is a complex product that requires hands-on attention. It is a permanent life insurance policy, which means it is designed to last for the entirety of the policyholder's life. It guarantees a payout to beneficiaries as long as the premiums are paid and the terms of the policy are met.

Variable life insurance is distinguished by its adjustable death benefit and premiums, making it one of the more flexible life insurance policies available. It also includes a cash value component, which is invested in various funds, usually mutual funds. The cash value can be invested in index funds, equities, bonds, or money market funds. This gives policyholders the opportunity to benefit from strong market performance, but it also means they are exposed to market risk.

The complexity of variable life insurance lies in its multiple components and the need for active management. Firstly, a portion of the premium is kept by the insurance company for account maintenance and fees, and another portion goes towards the death benefit. The policyholder then needs to decide how to invest the remaining cash value. This requires an understanding of the various investment options and their associated risks and potential returns.

The cash value can be used to increase the death benefit, withdrawn as cash, or used as collateral for a loan. Each of these options has different implications for the policy and the policyholder's beneficiaries. For example, withdrawing cash will reduce the death benefit, while using it to increase the death benefit will provide a larger payout to beneficiaries.

Variable life insurance policies also tend to have higher fees than other types of life insurance. These fees include mortality and expense risk charges, sales and administrative fees, investment management fees, policy loan interest, and surrender charges. Understanding and managing these fees is an important part of maintaining a variable life insurance policy.

Overall, variable life insurance offers flexibility and the potential for strong returns, but it requires active management and a good understanding of the various components and options. It is a complex product that requires hands-on attention to ensure it meets the policyholder's needs and objectives.

Whole Life Insurance: Impact on Your SSI Check?

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance policy, meaning coverage will remain in place for your lifetime, so long as premiums are paid. Variable life insurance policies have a higher potential of earning cash compared to traditional policies as they include a cash value component on top of the traditional death benefit portion.

Variable life insurance includes two components: a life insurance death benefit and a cash value account that is invested in various funds, usually mutual funds. The money from your insurance premium is used for account maintenance and fees, the death benefit, and the policy's cash value.

Variable life insurance offers financial protection for your family, the potential for an increased death benefit, and flexibility and choice. However, there are high premiums, capped returns, and limited investment options associated with variable life insurance policies.

Term life insurance, whole life insurance, universal life insurance, guaranteed life insurance, and final expense insurance are all alternatives to variable life insurance. These options offer varying levels of flexibility, investment opportunities, and permanent coverage.