A buyers guide to life insurance is an essential resource for individuals seeking to understand the various aspects of life insurance and make informed decisions about their coverage. This guide aims to provide a comprehensive overview of life insurance, its types, benefits, and the process of selecting the right policy. By exploring the different options available, such as term life, whole life, and universal life insurance, individuals can gain a clear understanding of how these policies work and how they can provide financial security for themselves and their loved ones. The guide will also highlight the importance of considering personal needs, financial goals, and risk factors when choosing a life insurance plan, ensuring that individuals can make the best choices to protect their future and the well-being of their families.

What You'll Learn

- Understanding Needs: Identify personal and financial goals to determine insurance coverage

- Policy Comparison: Evaluate different plans based on coverage, costs, and provider reputation

- Risk Assessment: Assess health, lifestyle, and family history to choose suitable coverage

- Long-Term Benefits: Consider future needs like education, retirement, and estate planning

- Financial Planning: Integrate insurance into broader financial strategy for optimal wealth management

Understanding Needs: Identify personal and financial goals to determine insurance coverage

When considering life insurance, it's crucial to understand your personal and financial goals to ensure you choose the right coverage. This process involves a deep dive into your current and future needs, allowing you to make informed decisions about your insurance policy. Here's a guide to help you navigate this important step:

Assess Your Current Situation: Begin by evaluating your current financial standing and personal circumstances. Consider your age, health, income, and assets. For instance, if you have a young family, your primary goal might be to provide financial security for their future. This could include covering education expenses, mortgage payments, or ensuring their well-being in your absence. Understanding these factors will help you determine the amount of coverage you need.

Define Your Financial Goals: Identify your short-term and long-term financial objectives. Short-term goals might include building an emergency fund, saving for a down payment on a house, or funding your child's education. Long-term goals could involve retirement planning, ensuring your spouse's financial stability, or leaving an inheritance for your children. Each goal will influence the type and extent of life insurance you require. For example, if your long-term goal is to retire comfortably, you might need a policy that provides a substantial death benefit to cover retirement expenses.

Evaluate Risk Factors: Consider any unique risk factors that may impact your insurance needs. This includes health conditions, hobbies, or occupations that could affect your insurability. For instance, if you have a pre-existing health condition, you might need to choose a policy with a guaranteed acceptance period or explore specialized insurance options. Similarly, if you engage in high-risk activities like skydiving or racing cars, you may need to adjust your coverage to account for the increased likelihood of claims.

Consider Future Uncertainties: Life is unpredictable, and future events can significantly impact your insurance needs. For example, getting married or starting a family might increase your desire to ensure their financial security. Conversely, a career change or a significant financial windfall could reduce your need for extensive coverage. Regularly reviewing and adjusting your policy as your life circumstances change is essential to maintaining appropriate coverage.

By thoroughly understanding your personal and financial goals, you can make informed decisions about life insurance. This process ensures that the policy you choose aligns with your current and future needs, providing the necessary financial protection for yourself and your loved ones. It's a proactive approach that empowers you to take control of your financial well-being and peace of mind.

Understanding Second-to-Die Life Insurance Policies

You may want to see also

Policy Comparison: Evaluate different plans based on coverage, costs, and provider reputation

When considering life insurance, a buyers guide can be an invaluable tool to navigate the complex world of policy options. The primary purpose of such a guide is to empower individuals to make informed decisions about their life insurance needs. It provides a comprehensive overview of various plans, ensuring that buyers understand the key features and benefits of each. This is crucial, as life insurance policies can vary significantly in terms of coverage, costs, and provider reputation.

In the context of policy comparison, several critical factors come into play. Firstly, coverage is a fundamental aspect. It refers to the financial protection offered by the insurance policy. Different plans may provide varying levels of coverage, such as term life, whole life, or universal life insurance. Term life insurance, for instance, offers coverage for a specified period, while whole life provides lifelong coverage with an investment component. Understanding the coverage options and their suitability for your specific needs is essential.

Secondly, costs are a significant consideration. Life insurance premiums can vary widely depending on the policy's features and the insurance provider. Factors such as age, health, lifestyle, and the amount of coverage required influence the cost. For example, a younger, healthier individual may secure a more affordable policy compared to an older person with pre-existing health conditions. It is crucial to compare the premiums, fees, and any additional costs associated with each plan to ensure you get the best value for your money.

Provider reputation is another critical element in policy comparison. The financial stability and reliability of the insurance company can significantly impact the overall experience of being an insured individual. Researching the financial strength and ratings of different providers can help assess their ability to honor claims and maintain policy benefits over time. A reputable provider with a strong financial standing is more likely to provide reliable service and support when needed.

By carefully evaluating these aspects, you can make a well-informed decision. It is recommended to compare multiple policies from different providers to identify the best fit. This process involves assessing the coverage limits, understanding the terms and conditions, and evaluating the overall cost-effectiveness of each plan. Additionally, seeking professional advice from insurance brokers or financial advisors can provide valuable insights and ensure you make the right choice for your life insurance needs.

Life Insurance Tax: Voluntary Benefits and Implications

You may want to see also

Risk Assessment: Assess health, lifestyle, and family history to choose suitable coverage

When considering life insurance, a buyers guide emphasizes the importance of risk assessment as a critical step in choosing the right coverage. This process involves evaluating various factors that can influence the likelihood and impact of potential risks, ensuring that the chosen insurance policy aligns with the individual's needs and circumstances. Here's a detailed breakdown of how to approach this assessment:

Health Evaluation: Start by examining your overall health. This includes assessing any pre-existing medical conditions, chronic illnesses, or recent health concerns. For instance, individuals with a history of heart disease, diabetes, or cancer may face higher insurance premiums or be deemed high-risk candidates. Providing accurate and up-to-date medical information is essential for insurers to calculate the appropriate coverage and premiums. It's advisable to consult with a healthcare professional to understand your health status and any potential risks associated with it.

Lifestyle Factors: Your lifestyle choices play a significant role in risk assessment. Smoking, excessive alcohol consumption, and an inactive lifestyle can all contribute to increased health risks. Insurers often consider these factors when determining policy terms. For example, a non-smoker with a healthy diet and regular exercise routine may be offered more competitive rates. Disclosing accurate lifestyle information is crucial to ensure the insurance company can provide an accurate assessment and offer suitable coverage.

Family Medical History: Delve into your family's medical background. Certain medical conditions or diseases can have a genetic predisposition, and insurers take these into account. For instance, a family history of early-onset heart disease or certain types of cancer may impact the assessment. Understanding your family's medical history can help identify potential risks and allow for more informed decision-making when selecting life insurance coverage.

By thoroughly assessing these aspects, individuals can make more informed choices about their life insurance policies. It empowers them to select coverage that is not only suitable but also cost-effective, ensuring financial security for themselves and their loved ones. This risk assessment process is a fundamental aspect of a buyers guide, enabling individuals to navigate the complex world of life insurance with confidence.

Understanding Group Universal Life Cash Accumulation: A Comprehensive Guide

You may want to see also

Long-Term Benefits: Consider future needs like education, retirement, and estate planning

When considering life insurance, it's essential to think beyond the immediate coverage and explore the long-term benefits it can provide. A buyers guide to life insurance should emphasize the importance of planning for the future, ensuring that your loved ones are protected and your financial goals are met over an extended period. Here's a detailed look at why long-term benefits are a crucial aspect of life insurance:

Education and Future Expenses: One of the most significant long-term benefits of life insurance is its ability to secure your family's financial future. Life insurance can be a powerful tool to fund your child's education. With the rising costs of higher education, having a financial safety net in place can ensure that your child's academic goals are achieved without incurring substantial debt. Additionally, life insurance can cover other future expenses, such as starting a business, purchasing a home, or funding a comfortable retirement for yourself and your spouse. By planning ahead, you can provide a secure financial foundation for your family's long-term aspirations.

Retirement Planning: As you age, retirement planning becomes increasingly vital. Life insurance can play a pivotal role in this aspect. Term life insurance, for instance, can provide a substantial financial cushion during retirement years when income sources may be limited. This long-term coverage ensures that your retirement savings and investments are protected, allowing you to maintain your desired standard of living. Moreover, the death benefit from a life insurance policy can be used to cover retirement expenses, such as travel, healthcare, and daily living costs, ensuring a financially stable retirement.

Estate Planning and Legacy: Life insurance is a valuable tool for estate planning, which involves ensuring a smooth transition of assets to beneficiaries and minimizing tax implications. The death benefit from a life insurance policy can be used to pay off debts, cover funeral expenses, and provide an inheritance for your heirs. By including life insurance in your estate plan, you can protect your assets and ensure that your legacy is passed on according to your wishes. This long-term benefit allows you to leave a financial legacy for future generations, providing them with financial security and the means to achieve their goals.

In summary, a buyers guide to life insurance should highlight the long-term advantages of this financial product. From securing your family's future expenses to facilitating retirement planning and estate management, life insurance offers a comprehensive solution for long-term financial security. By considering these future needs, individuals can make informed decisions about life insurance, ensuring that their loved ones are protected and their financial goals are achieved over the long haul. It is a proactive approach to financial planning that can provide peace of mind and a secure future for those who rely on it.

Alcoholics and Life Insurance: Is Coverage Possible?

You may want to see also

Financial Planning: Integrate insurance into broader financial strategy for optimal wealth management

Integrating insurance into your financial strategy is a crucial step towards achieving optimal wealth management and ensuring the financial security of your loved ones. While life insurance is often seen as a means to provide financial support in the event of an untimely death, its role extends far beyond that. A buyers guide to life insurance can help you understand its various purposes and how it fits into the broader context of financial planning.

Risk Mitigation and Asset Protection:

Life insurance is a powerful tool for risk management. It provides a safety net by mitigating the financial impact of unexpected events. When you purchase life insurance, you're essentially transferring the risk of financial loss due to your death to the insurance company. This ensures that your family or beneficiaries are protected from the financial strain of losing your income, especially if you were the primary breadwinner. The policy can cover various expenses, including mortgage payments, children's education, daily living costs, and even provide a lump sum for future investments or business ventures. By integrating life insurance into your financial plan, you create a robust asset protection strategy, safeguarding your wealth and providing peace of mind.

Wealth Transfer and Succession Planning:

Insurance can also play a vital role in wealth transfer and succession planning. As you build and accumulate wealth, it's essential to consider how that wealth will be distributed according to your wishes. Life insurance can be a strategic tool to facilitate this process. For instance, you can use life insurance proceeds to fund a trust, which can then be used to provide financial support to beneficiaries over time. This approach ensures that your wealth is transferred efficiently, minimizing potential tax implications and providing a steady stream of income for your heirs. By integrating insurance into your broader financial strategy, you can create a seamless transition of assets, ensuring your legacy is protected and managed according to your specifications.

Income Generation and Investment Opportunities:

Beyond its protective nature, life insurance can also serve as a source of income generation and investment. Certain types of policies, such as whole life or universal life insurance, offer cash value accumulation over time. This means that in addition to the death benefit, you can access a portion of the policy's value as a loan or withdraw it as cash value. This feature can be utilized for various financial goals, such as funding retirement, starting a business, or investing in other assets. By integrating insurance with your investment strategy, you can leverage its long-term growth potential while still benefiting from the financial security it provides.

Long-Term Financial Security:

Incorporating insurance into your financial plan is about ensuring long-term financial security. It allows you to create a comprehensive strategy that addresses various life events and financial goals. For example, term life insurance provides coverage for a specific period, which can be tailored to align with major financial commitments like a mortgage or children's education. Permanent life insurance, on the other hand, offers lifelong coverage and a cash value component, providing financial security and flexibility. By integrating insurance into your broader financial strategy, you can create a well-rounded approach that adapts to your changing needs and goals, ensuring your financial plan remains robust and effective over time.

Becoming a Life Insurance Producer: Steps to Success

You may want to see also

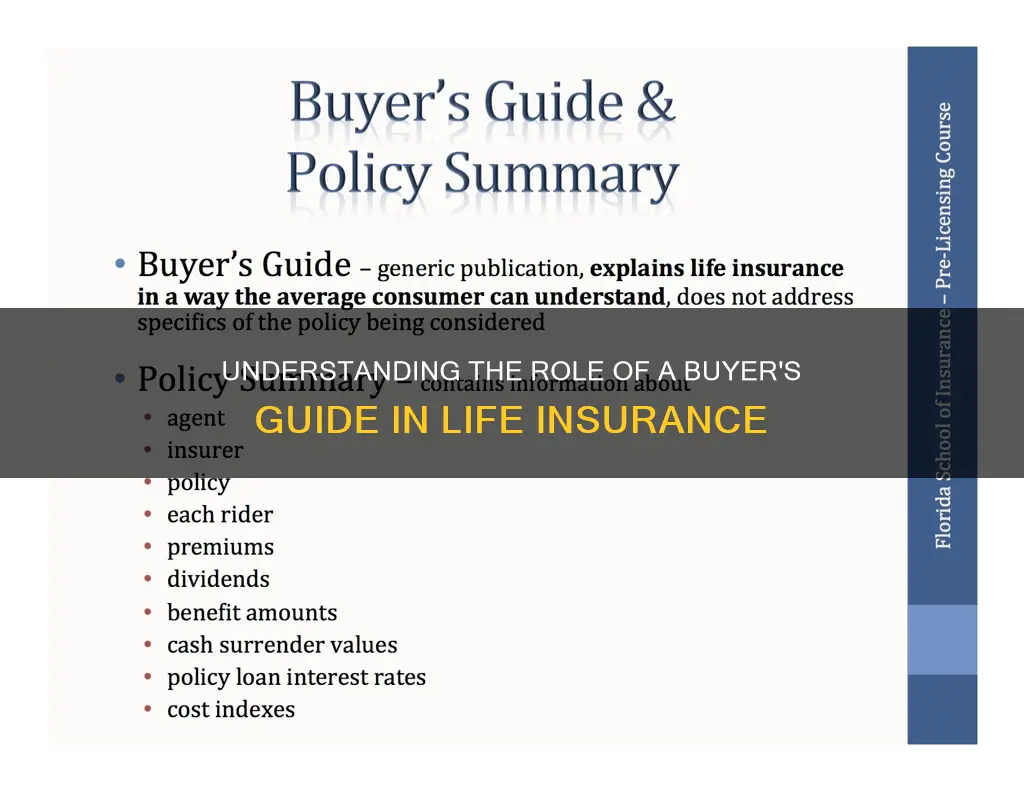

Frequently asked questions

A buyer's guide for life insurance serves as a comprehensive resource to help individuals understand the various types of life insurance policies available and make informed decisions about their coverage. It provides an overview of the different insurance options, their features, benefits, and how they can be tailored to meet specific financial goals and needs.

The guide offers detailed explanations of different life insurance products, such as term life, whole life, and universal life insurance. It helps buyers compare coverage options, death benefits, premiums, and policy terms. By providing clear comparisons and insights, the guide enables individuals to select a policy that aligns with their financial situation, risk tolerance, and long-term objectives.

Absolutely. The guide highlights the advantages of life insurance, including financial security for loved ones, debt repayment, education funding, and income replacement. It explains how life insurance can provide peace of mind, knowing that your family or beneficiaries will be financially protected in the event of your passing.

Yes, a comprehensive buyer's guide should include sections on policy customization, rider options, and additional benefits. It should also provide information on policy conversion rights, guaranteed death benefits, and any unique features offered by different insurance companies. These details are crucial for buyers to make informed choices.

By comparing various insurance providers and their offerings, the guide helps buyers identify the most competitive rates and policy features. It may also offer tips on negotiating with insurance companies and provide insights into the factors that influence premium costs. Ultimately, the guide empowers individuals to make cost-effective decisions while ensuring adequate coverage.