The suicide clause in life insurance is a provision that can significantly impact the validity of a policy. It states that if the insured individual commits suicide within a specified period after the policy's inception, the insurance company may not be obligated to pay the death benefit. This clause is often a point of contention among policyholders, as it can affect the financial security of beneficiaries. Understanding the terms and conditions of your life insurance policy, including the suicide clause, is crucial to ensure you and your loved ones are adequately protected.

What You'll Learn

- Legal Definition: The clause allowing insurers to terminate a policy if the insured dies by suicide within a specified period

- Policy Exclusion: Suicide is often excluded from coverage, triggering the clause if the insured commits suicide

- Waiting Period: Some policies have a suicide clause with a waiting period before coverage is voided

- Financial Implications: The clause can result in the return of premiums paid minus any claims paid

- Regulatory Oversight: Insurance regulators monitor the clause to ensure fair treatment of policyholders

Legal Definition: The clause allowing insurers to terminate a policy if the insured dies by suicide within a specified period

The suicide clause in life insurance is a specific provision within a life insurance policy that addresses the circumstances under which the policy may be terminated. This clause is designed to protect the insurance company's financial interests and manage the risk associated with insuring individuals who may have a higher propensity for suicide. Here's a detailed explanation of the legal definition and implications of this clause:

When an individual takes out a life insurance policy, they agree to certain terms and conditions, including the potential inclusion of a suicide clause. This clause typically states that if the insured person dies by suicide within a specified period after the policy's inception, the insurance company reserves the right to terminate the policy and deny any death benefit payments. The specified period can vary, often ranging from one to two years from the date the policy was issued. During this time, the insurer considers the initial risk associated with the insured's decision to purchase the policy.

The legal definition of the suicide clause is a contractual provision that outlines the insurer's right to cancel the policy and withhold benefits if the insured's death is caused by suicide. This clause is a standard feature in many life insurance policies, especially those with higher coverage amounts or those deemed to be higher-risk cases. It is important to note that the specific terms and conditions of the clause can vary between different insurance providers and policies.

In the event of a suicide within the specified period, the insurance company will typically investigate the circumstances surrounding the death. If the investigation confirms that the death was indeed caused by suicide, the policy may be terminated, and any payments made to beneficiaries or the insured's estate will be subject to cancellation. This clause provides a mechanism for insurers to manage the risk and ensure that the policy remains financially viable.

It is essential for individuals to understand the implications of this clause when purchasing life insurance. While it may seem harsh, the suicide clause is a standard industry practice and is designed to protect both the insurer and the policyholder. Insurers must balance the need to provide financial security with the potential risks associated with insuring individuals who may have a history of or propensity for self-harm.

Life Insurance and Suicide in Arizona: What's Covered?

You may want to see also

Policy Exclusion: Suicide is often excluded from coverage, triggering the clause if the insured commits suicide

The 'Suicide Clause' is a critical aspect of life insurance policies, and understanding its implications is essential for both insurers and policyholders. This clause is a provision in life insurance contracts that specifically addresses the issue of suicide, which is often a sensitive and complex topic in the insurance industry.

In the context of life insurance, the suicide clause is a policy exclusion, meaning that certain events, in this case, suicide, are explicitly not covered by the policy. If the insured individual takes their own life, the insurance company will not pay out the death benefit as per the policy terms. This exclusion is a standard feature in many life insurance policies and is designed to manage the risks associated with insuring individuals with a history of mental health issues or those who may be at a higher risk of self-harm.

The primary purpose of this clause is to protect the insurance company from potential fraud and to ensure that the policy remains financially viable. By excluding suicide from coverage, insurers can maintain the integrity of the policy and prevent potential financial losses. It is important to note that the specific terms and conditions regarding the suicide clause can vary between different insurance providers and policies. Some policies may have a waiting period before the clause takes effect, while others might have specific requirements or exclusions based on the insured's medical history.

When considering life insurance, it is crucial for individuals to carefully review the policy documents and understand the implications of the suicide clause. This awareness ensures that policyholders are well-informed about their coverage and any limitations. Additionally, individuals with a history of mental health struggles or those who have previously attempted suicide should be transparent with their insurers to assess their eligibility for coverage and to potentially explore alternative insurance options that may better suit their needs.

In summary, the suicide clause is a policy exclusion that safeguards the interests of both the insurance company and the policyholder. It is a standard practice in the life insurance industry and highlights the importance of thorough policy review and understanding. By being aware of this clause, individuals can make informed decisions regarding their insurance coverage and take appropriate steps to ensure their financial security and peace of mind.

HIV Testing: A Prerequisite for Life Insurance?

You may want to see also

Waiting Period: Some policies have a suicide clause with a waiting period before coverage is voided

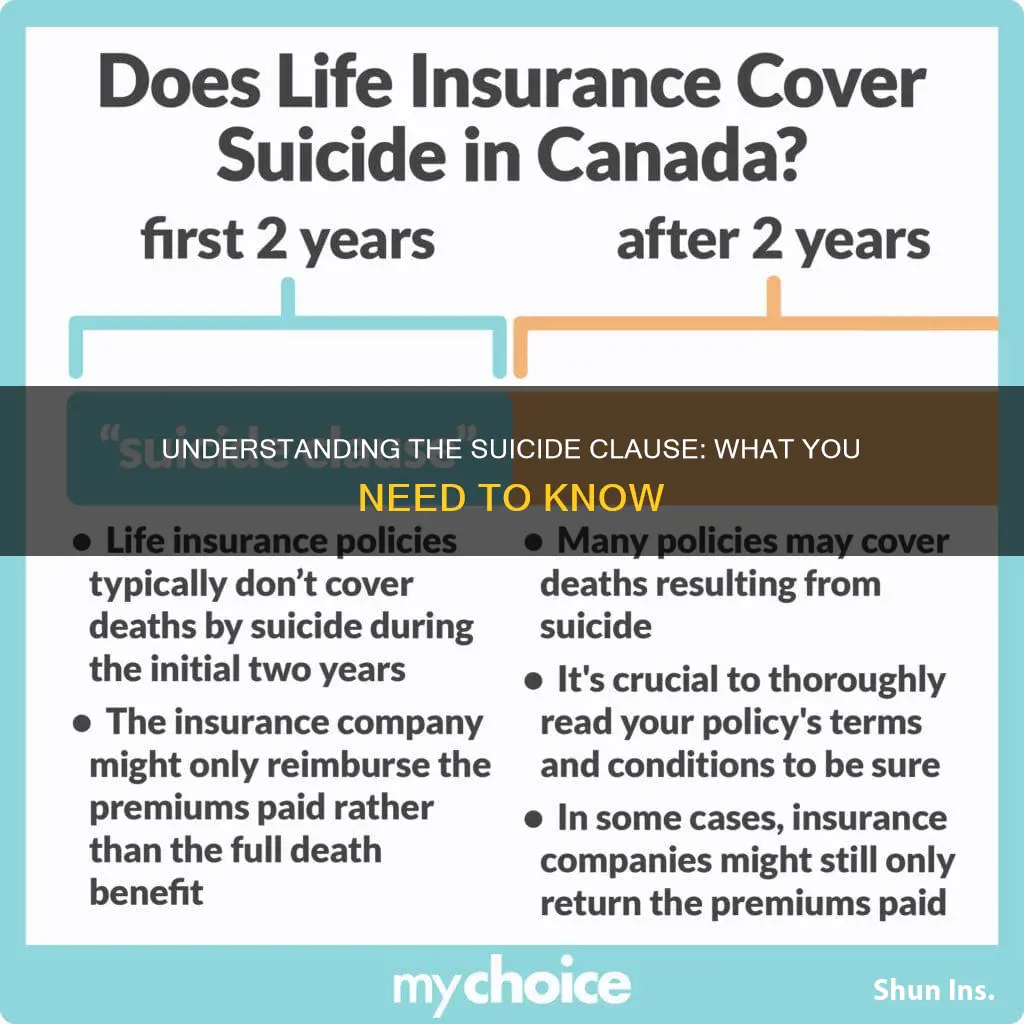

The suicide clause is a specific provision in life insurance policies that can have significant implications for policyholders. When an individual takes their own life, the insurance company may have the right to deny the claim, especially if the policy includes this clause. However, there is often a waiting period associated with the suicide clause, which is a crucial aspect to understand.

During this waiting period, which can vary from policy to policy, the insurance company typically waits for a certain amount of time before it can void the coverage if the insured person commits suicide. This waiting period is designed to protect the policyholder and provide a safety net. For instance, if a policy has a 2-year waiting period, the insurance company will not void the policy and deny the claim if the insured person dies by suicide within those 2 years. After this period, the policy becomes void, and any subsequent suicides would not be covered.

This waiting period is essential because it allows the insurance company to assess the insured's mental health and stability. It provides a chance to identify any potential risks or concerns before the policy is voided. During this time, the insurance provider may investigate the insured's medical history, conduct interviews, or require a psychological evaluation to determine if the suicide was a pre-existing condition or a result of unforeseen circumstances.

For policyholders, understanding the waiting period is crucial. It means that if they take their own life within the specified time frame, the insurance company may still honor the policy, providing financial security to their beneficiaries. However, if the suicide occurs after the waiting period, the policy becomes void, and the insurance company may refuse to pay out the death benefit. This waiting period is a critical aspect of the suicide clause, ensuring that the insurance company and the policyholder are protected while also providing a fair and transparent process.

Life Insurance: What's Not Covered and Why

You may want to see also

Financial Implications: The clause can result in the return of premiums paid minus any claims paid

The suicide clause in life insurance is a provision that can significantly impact the financial outcome for policyholders and their beneficiaries. When an insured individual commits suicide, the insurance company may have the right to deny the claim, and this is where the clause comes into play. The financial implications of this clause can be substantial, especially for those who have already paid significant premiums over the life of the policy.

When a life insurance policy includes a suicide clause, it typically means that if the insured person takes their own life within a specified period after the policy's inception, the insurance company may not be obligated to pay the death benefit. This clause is often in place to mitigate the risk associated with insuring individuals who may have a higher propensity for suicide. As a result, the financial impact on the policyholder can be twofold. Firstly, the policyholder may not receive any financial benefit from the insurance policy, which could have been intended to provide financial security for their loved ones. Secondly, and perhaps more significantly, the policyholder may be required to return any premiums paid minus any claims made.

The return of premiums paid is a critical financial consideration. Over the course of a life insurance policy, especially those with longer terms, policyholders can pay substantial amounts in premiums. If the suicide clause is invoked, the insurance company may reclaim these premiums, leaving the policyholder with no financial return on their investment. This can be particularly challenging for those who relied on the insurance policy for financial planning, retirement savings, or other long-term financial goals.

Furthermore, the clause's impact on any claims paid is another layer of financial complexity. If a claim has already been made and the death benefit has been received, the insurance company may still have the right to reclaim those funds. This could potentially result in the policyholder having to return the death benefit amount, which may have been a crucial source of financial support for the beneficiary. The financial implications of the suicide clause, therefore, extend beyond the initial premium payments and can affect the overall financial health of the policyholder and their beneficiaries.

In summary, the suicide clause in life insurance has significant financial implications. It can result in the return of premiums paid, minus any claims made, which may leave policyholders with no financial benefit from their insurance investment. This clause is a critical consideration for anyone purchasing life insurance, especially those with a history of mental health issues or a family history of suicide. Understanding the potential financial impact is essential to making informed decisions about insurance coverage.

Listing Trusts as Life Insurance Beneficiaries: Is It Possible?

You may want to see also

Regulatory Oversight: Insurance regulators monitor the clause to ensure fair treatment of policyholders

The suicide clause in life insurance is a provision that can significantly impact policyholders and their beneficiaries. It is a clause that has sparked debates and raised concerns among consumers and industry experts alike. This clause typically states that if the insured individual commits suicide within a specified period after the policy's inception, the insurance company may not be obligated to pay the death benefit to the policyholder or their beneficiaries.

Insurance regulators play a crucial role in overseeing and monitoring the implementation of the suicide clause to ensure fair treatment of policyholders. These regulators are responsible for setting and enforcing rules and guidelines to protect the interests of insurance consumers. When it comes to the suicide clause, regulators have the authority to review and approve the terms and conditions of life insurance policies, including the specific provisions related to suicide.

One of the primary objectives of regulatory oversight is to prevent insurance companies from exploiting policyholders. The suicide clause, in particular, has been a subject of scrutiny due to its potential to deny benefits to those who may be in vulnerable situations. Regulators aim to strike a balance between protecting the insurance company's interests and ensuring that policyholders are not unfairly penalized. They review the clause to ensure that it is not used as a means to avoid paying out valid claims, especially in cases where the insured individual's mental health or well-being may have been a factor.

Insurance regulators often require insurance companies to provide detailed justifications and explanations for the inclusion of the suicide clause in their policies. This includes disclosing the specific time periods during which the clause applies and any exceptions or limitations. By doing so, regulators can assess whether the clause is fair and reasonable, considering factors such as the insured individual's pre-existing conditions, mental health history, and any relevant medical advice.

Furthermore, regulatory bodies may impose restrictions on the amount of time an individual must wait before the suicide clause takes effect. This waiting period ensures that the insured person has had an opportunity to fully understand the policy and make informed decisions. Regulators also monitor the overall impact of the clause on policyholders, especially those with pre-existing mental health conditions, to ensure that the insurance company does not unduly influence or pressure individuals into making decisions that could be detrimental to their well-being.

Life Insurance and COVID-19: What You Need to Know

You may want to see also

Frequently asked questions

The suicide clause is a provision in life insurance policies that can affect the validity of the policy if the insured individual commits suicide within a specified period after the policy is taken out. Typically, life insurance companies will not pay out the death benefit if the insured person dies by suicide within the first two years of the policy. This clause is in place to mitigate the risk associated with insuring individuals who may have a higher likelihood of suicide, such as those with a history of mental health issues or substance abuse.

If you have a life insurance policy with a suicide clause, it's important to understand the terms and conditions. The clause usually states that the policy will be void and no death benefit will be paid if the insured person dies by suicide within the specified period. However, the impact can vary depending on the jurisdiction and the specific policy terms. Some policies may have a waiting period, after which the suicide clause no longer applies, while others might provide an option to opt-out of this clause by paying an additional premium.

Yes, there are ways to potentially avoid the suicide clause or minimize its impact. One approach is to disclose any pre-existing mental health conditions or history of substance abuse to the insurance company during the application process. This transparency can help the insurer assess the risk more accurately and may result in a more favorable policy offer. Additionally, some insurance providers offer policies specifically designed for individuals with mental health concerns, which may have different terms and conditions regarding the suicide clause.