Globe Life Insurance offers a range of term life insurance policies, which provide coverage for a specific period, typically 10, 15, 20, or 30 years. These policies are designed to offer financial protection to individuals and their families during a defined term, ensuring that beneficiaries receive a lump sum payment if the insured individual passes away within the specified period. The term of the policy is a critical factor in determining the cost and coverage amount, as it directly impacts the risk assessment and the overall insurance premium. Understanding the term of a life insurance policy is essential for individuals to choose the right coverage that aligns with their financial goals and needs.

What You'll Learn

- Definition: Globe Life Insurance offers term life coverage, providing financial protection for a specified period

- Types: Term life insurance includes level, decreasing, and increasing coverage options

- Benefits: Policyholders receive death benefits, ensuring financial security for beneficiaries during the term

- Premiums: Regular payments are made to maintain coverage until the term ends

- Renewal: Some policies allow renewal, extending coverage beyond the initial term

Definition: Globe Life Insurance offers term life coverage, providing financial protection for a specified period

The term "Globe Life Insurance" refers to a specific type of life insurance policy that provides financial protection for a defined period. This type of insurance is designed to offer coverage for a set duration, often referred to as the "term." When you purchase a term life insurance policy, you agree to pay a premium for a predetermined period, and in return, the insurance company promises to pay a death benefit to your designated beneficiaries if you pass away during that term.

The beauty of term life insurance is its simplicity and affordability. It is a straightforward way to secure financial protection for your loved ones during a specific period, such as when you have a mortgage, children's education expenses, or other financial commitments that require coverage. The term length can vary, typically ranging from 10 to 30 years, and sometimes even longer. During this term, the policyholder's life is insured, and if anything happens, the insurance company pays out the agreed-upon amount.

One of the key advantages of term life insurance is its cost-effectiveness compared to permanent life insurance. Since the coverage is limited to a specific term, the premiums are generally lower, making it an attractive option for those seeking affordable insurance without the need for lifelong coverage. When the term ends, policyholders have the option to renew the policy, convert it to a permanent plan, or simply let it lapse if their needs have changed.

It's important to understand that the term of the policy is a critical aspect of this insurance. The term length determines the duration of the coverage and the associated costs. Longer terms provide more extended protection but come with higher premiums. Conversely, shorter terms offer lower premiums but may not cover as long a period. Policyholders should carefully consider their financial obligations and future needs when choosing the term length to ensure they have adequate coverage without overpaying.

In summary, Globe Life Insurance, or term life insurance, is a powerful tool for managing financial risks. It offers a straightforward and affordable way to protect your loved ones during a specific period, providing peace of mind and financial security. Understanding the term of the policy is essential to making informed decisions about your insurance coverage.

Life Insurance and Illness: Can My Policy Be Cancelled?

You may want to see also

Types: Term life insurance includes level, decreasing, and increasing coverage options

Term life insurance is a type of coverage that provides a specific period of protection, offering a straightforward and flexible way to secure financial stability for loved ones. This insurance is designed to offer a temporary safety net, ensuring that your family is financially protected during a defined term, such as 10, 20, or 30 years. It is a popular choice for those seeking affordable and customizable insurance solutions.

The beauty of term life insurance lies in its simplicity. It guarantees a fixed premium for the entire term, providing peace of mind without the complexity of permanent life insurance policies. This type of insurance is particularly attractive to individuals who want to cover specific financial obligations, such as mortgage payments, children's education, or business debts, during a particular period.

Now, let's explore the different coverage options within term life insurance:

- Level Term Life Insurance: This option provides a consistent death benefit throughout the entire term. The premium remains the same, ensuring that the coverage amount stays the same over the policy's duration. Level term life insurance is ideal for those who want a stable and predictable financial plan, especially if they have long-term financial goals that require consistent protection. For example, if you take out a 20-year level term policy, the death benefit and premium will remain unchanged for the entire 20 years, providing a reliable safety net for your family.

- Decreasing Term Life Insurance: As the name suggests, this type of coverage decreases over time. The death benefit and, consequently, the premium, typically decrease annually or at regular intervals. This option is often chosen by individuals who want to gradually reduce their insurance needs as their financial obligations change. For instance, a young couple with a mortgage might opt for a 20-year decreasing term policy, starting with a higher death benefit to cover the mortgage, and then reducing it as the mortgage is paid off.

- Increasing Term Life Insurance: In contrast to decreasing coverage, increasing term life insurance provides a death benefit that grows over time. The premium may also increase, but the benefit amount rises annually or at predetermined intervals. This type of policy is suitable for those who anticipate their financial needs growing in the future. For example, a family with a young child and a growing business might choose an increasing term policy, ensuring that the coverage keeps pace with their expanding financial responsibilities.

Understanding these coverage options allows individuals to tailor their term life insurance to their specific needs and financial goals. Whether it's the stability of level coverage, the flexibility of decreasing terms, or the future-proofing of increasing benefits, term life insurance offers a range of choices to suit different life stages and financial requirements.

Life Term Insurance: What You Need to Know

You may want to see also

Benefits: Policyholders receive death benefits, ensuring financial security for beneficiaries during the term

When considering life insurance, it's essential to understand the different types of policies available, and one such option is term life insurance. This type of insurance provides coverage for a specific period, known as the "term." During this term, the policyholder pays regular premiums, and in return, the insurance company offers a death benefit to the designated beneficiaries if the insured individual passes away within that term.

The primary benefit of term life insurance is its simplicity and cost-effectiveness. It is a straightforward way to secure financial protection for your loved ones during a particular period. For example, if you have a term of 10 years, your beneficiaries will receive the death benefit if you were to pass away within those 10 years. This ensures that your family can maintain their standard of living, cover essential expenses, and achieve their financial goals, even in your absence.

One of the advantages of term life insurance is its affordability. Since the coverage is limited to a specific term, the premiums are generally lower compared to permanent life insurance policies. This makes it an attractive option for individuals who want to provide financial security for their families without incurring significant long-term costs. By choosing a term that aligns with your specific needs, you can tailor the coverage to match the duration of your financial obligations or the time you wish to provide for your beneficiaries.

During the term, the policyholder has the flexibility to manage their insurance policy. They can choose to pay premiums annually, monthly, or even make a lump-sum payment if they prefer. This flexibility allows individuals to adapt their insurance coverage to their changing financial circumstances. Additionally, some term life insurance policies offer the option to convert the coverage to a permanent policy before the term ends, providing long-term financial security.

In summary, term life insurance offers a straightforward and cost-effective way to ensure financial security for your beneficiaries during a specific period. With its affordable premiums and customizable terms, it provides a valuable layer of protection for individuals who want to leave a lasting legacy for their loved ones. Understanding the term of your policy is crucial to making informed decisions about your insurance coverage.

Suffolk County Correction Officers: Life Insurance Coverage Explained

You may want to see also

Premiums: Regular payments are made to maintain coverage until the term ends

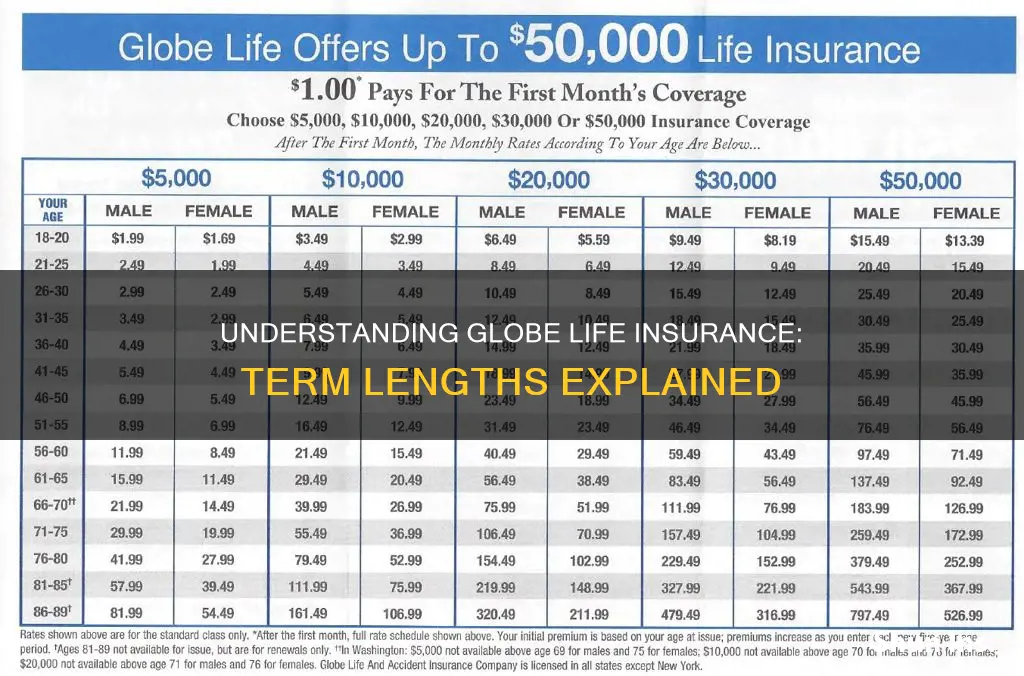

When it comes to term life insurance, particularly with a provider like Globe Life, understanding the concept of premiums is crucial. These premiums are the regular payments made by the policyholder to maintain their insurance coverage for a specified period, known as the term. This term can vary, typically ranging from 10 to 30 years, and it is a predetermined duration during which the insurance coverage is active.

The payment of premiums is a fundamental aspect of the insurance policy. Policyholders agree to make these payments at regular intervals, often monthly, quarterly, or annually, to ensure that the insurance coverage remains in effect. During this term, the insurance company promises to provide financial protection to the policyholder or their beneficiaries if a specified event occurs, such as the insured's death.

It's important to note that the amount of the premium is calculated based on various factors, including the policyholder's age, health, lifestyle, and the desired coverage amount. Younger individuals often pay lower premiums compared to older individuals, as the risk of mortality is generally lower for the former. Additionally, a higher coverage amount will typically result in higher premiums, as the insurance company needs to compensate for a larger potential payout.

The term of the policy is a critical aspect of term life insurance. It defines the length of time for which the coverage is provided. Once the term ends, the policy may continue, but it will require additional premium payments to maintain the coverage. Some policies offer the option to convert the term policy into a permanent life insurance policy, ensuring long-term protection.

In summary, understanding the term of Globe Life Insurance and the associated premiums is essential for anyone considering this type of coverage. Regular premium payments are the key to maintaining the insurance benefit for the specified term, providing financial security for the policyholder's loved ones during that period. It is a straightforward and effective way to manage and protect one's financial affairs.

Life Insurance for Veterans: Affordable Options Available

You may want to see also

Renewal: Some policies allow renewal, extending coverage beyond the initial term

When it comes to life insurance, understanding the term of your policy is crucial. The term refers to the length of time for which the insurance coverage is in effect. In the case of Globe Life Insurance, the term can vary depending on the specific policy you choose.

One important aspect to consider is the concept of renewal. Some life insurance policies, including those offered by Globe Life, offer the option of renewal, which allows you to extend your coverage beyond the initial term. This is particularly useful if you want to ensure long-term protection for your loved ones. When you renew your policy, you essentially agree to continue paying premiums for an additional period, typically one year at a time. This provides continuity in your coverage and ensures that you remain protected even after the initial term ends.

Renewal policies often come with certain conditions and benefits. For instance, during the renewal period, the insurance company may offer the same or similar coverage options as the initial term. This includes the potential for increased coverage amounts or the addition of new features to suit your evolving needs. It's essential to review the terms and conditions of the renewal policy to understand any changes or limitations that may apply.

The process of renewing a policy is typically straightforward. You will receive a notice from the insurance company before the initial term ends, informing you of the renewal options available. This notice will outline the new premium rates, any changes to the policy terms, and the steps required to continue your coverage. By taking prompt action, you can ensure that your life insurance remains active and continues to provide financial security for your family.

In summary, when considering Globe Life Insurance or any other life insurance provider, be mindful of the renewal option. It allows you to extend your coverage and maintain protection for your loved ones over the long term. Understanding the renewal process and its implications will enable you to make informed decisions regarding your insurance needs and ensure that you have the right level of coverage at all times.

Sleep Apnea: Does it Affect Your Life Insurance Eligibility?

You may want to see also

Frequently asked questions

The term of a globe life insurance policy refers to the duration for which the insurance coverage is valid. It is typically a specific period, such as 10, 20, or 30 years, during which the insurance company promises to pay out the death benefit if the insured individual passes away. At the end of the term, the policy may continue, or it can be renewed, depending on the terms and conditions agreed upon during the initial policy purchase.

The term of the policy directly influences the cost and benefits of the insurance. Longer terms often provide more comprehensive coverage and may offer lower premiums, as the risk to the insurance company is spread over a more extended period. Conversely, shorter-term policies can be more affordable upfront but may require renewal or a new application if the insured wants to continue the coverage after the term ends.

Yes, many insurance providers offer the option to convert a term life insurance policy to a permanent or whole life insurance policy before the term ends. This conversion allows the insured individual to continue the coverage for the rest of their lives, providing lifelong protection. The process and terms of conversion may vary, and it is essential to review the policy details and consult with the insurance company to understand the specific requirements and benefits associated with converting the policy.