Ticketmaster Insurance is a specialized coverage designed to protect individuals and businesses from financial losses incurred due to unforeseen events related to ticket sales. It provides a safety net for event organizers, ticket vendors, and consumers, ensuring that they are not left financially vulnerable in the event of cancellations, rescheduling, or other disruptions. This insurance can cover a range of potential issues, including venue closures, weather-related problems, and technical difficulties, offering peace of mind and financial security in the dynamic world of event management and entertainment.

What You'll Learn

- Eligibility: Ticketmaster insurance covers eligible ticket purchases, ensuring protection against loss or damage

- Coverage Types: It offers various coverage options, including replacement, refund, and event cancellation

- Purchase Protection: Insured tickets are protected from unauthorized resales and fraudulent transactions

- Claim Process: A straightforward process allows insured individuals to file claims for eligible losses

- Terms and Conditions: Specific terms define coverage, exclusions, and claim requirements

Eligibility: Ticketmaster insurance covers eligible ticket purchases, ensuring protection against loss or damage

Ticketmaster Insurance is a specialized coverage designed to protect ticket buyers from potential losses or damages related to their ticket purchases. This insurance is an additional layer of security, ensuring that customers are financially protected in the event of unforeseen circumstances. The primary purpose is to provide peace of mind and guarantee that ticket buyers can attend the event even if their tickets are lost, stolen, or damaged.

Eligibility for Ticketmaster Insurance typically applies to ticket purchases made through the Ticketmaster platform. This includes tickets for various events, such as concerts, sports matches, theater performances, and festivals. When buying tickets, customers are often presented with the option to purchase insurance alongside their tickets. It is essential to review the terms and conditions of the insurance policy to understand the specific coverage and any exclusions.

The insurance coverage generally covers eligible ticket purchases, offering protection against loss or damage. This means that if a ticket is lost, stolen, or damaged beyond repair, the insurance will provide a replacement or refund. For instance, if a concertgoer's ticket is misplaced before the event, the insurance can facilitate a new ticket issuance, ensuring the customer's attendance. Similarly, in cases of ticket damage, the insurance might cover the cost of a replacement, allowing the buyer to enjoy the event without further hassle.

To be eligible for this insurance, customers must meet certain criteria, which may include purchasing tickets directly from Ticketmaster, adhering to the event's ticket sales guidelines, and providing accurate and complete information during the purchase process. It is crucial to note that not all ticket purchases qualify for insurance coverage, and certain restrictions or exclusions might apply. These could include tickets bought from unauthorized sellers, secondary markets, or through third-party platforms.

In summary, Ticketmaster Insurance is a valuable service that safeguards ticket buyers' investments. By understanding the eligibility criteria and terms of the insurance policy, customers can make informed decisions and ensure they are protected in the event of ticket-related issues. This additional layer of security is particularly beneficial for high-demand events, where ticket loss or damage could result in significant financial and logistical challenges for buyers.

Understanding New Mexico's Auto Insurance Requirements and Minimums

You may want to see also

Coverage Types: It offers various coverage options, including replacement, refund, and event cancellation

Ticket Master Insurance is a specialized type of coverage designed to protect ticket buyers and sellers in the event of unforeseen circumstances. It is an essential aspect of the ticketing industry, ensuring that financial losses are minimized and customers are protected when attending live events. This insurance offers a range of coverage options tailored to different scenarios, providing peace of mind to those involved in the ticket sales process.

One of the primary coverage types is replacement insurance. This option is crucial for ticket buyers who may encounter issues with their tickets, such as loss, theft, or damage. With replacement insurance, customers can easily obtain a new ticket without incurring additional costs, ensuring they don't miss out on the event. For instance, if a ticket is lost in the mail, the insurance provider will facilitate the issuance of a replacement, allowing the buyer to attend the event as planned.

Refund insurance is another critical component of Ticket Master Insurance. This coverage protects buyers in cases where they are unable to attend the event due to unforeseen circumstances. Whether it's an illness, a last-minute schedule conflict, or any other valid reason, the insurance provider will process a refund, ensuring that the customer's financial investment is protected. This aspect is particularly beneficial for those who purchase tickets well in advance and may face challenges that prevent their attendance.

Event cancellation insurance is a comprehensive coverage option that safeguards both ticket buyers and sellers. This type of insurance is designed to provide financial protection in the event of event cancellations or postponements. When an event is canceled or rescheduled, ticket buyers may face significant losses, and sellers might also incur expenses related to ticket distribution and management. With event cancellation insurance, both parties can be reimbursed, ensuring that the financial impact of such disruptions is minimized. This coverage is especially relevant for high-profile events or those with limited attendance, where the consequences of cancellation can be severe.

In summary, Ticket Master Insurance provides a safety net for ticket buyers and sellers, offering various coverage types to address different potential issues. From replacement and refund insurance to event cancellation coverage, this specialized insurance ensures that financial losses are mitigated, and customers can attend their desired events without unnecessary worries. Understanding these coverage options is essential for anyone involved in the ticketing process to make informed decisions and enjoy a seamless experience.

Understanding Liability Auto Insurance: Getting Covered

You may want to see also

Purchase Protection: Insured tickets are protected from unauthorized resales and fraudulent transactions

When you purchase tickets through Ticketmaster, you can opt for an additional layer of security and peace of mind by purchasing Ticketmaster Insurance. This insurance offers Purchase Protection, which safeguards your tickets from unauthorized resales and fraudulent transactions. Here's how it works:

Once you've bought your tickets, Ticketmaster Insurance provides a guarantee that the tickets you received are authentic and have not been sold to someone else. This protection is especially relevant in the secondary market, where tickets can sometimes be resold by unauthorized sellers or scalpers. By insuring your purchase, you're protected from buying tickets that might be duplicates, invalid, or from an unauthorized source.

In the event of a fraudulent transaction, where you receive tickets that are not what you ordered, the insurance policy will cover the cost of the tickets and any additional expenses incurred, such as travel and accommodation, if you need to attend the event. This protection ensures that you don't lose out financially due to fraudulent activities.

The Purchase Protection feature is a valuable addition to your ticket purchase, especially for high-demand events where tickets can be difficult to obtain. It provides an extra level of security, knowing that your investment is protected from unauthorized resales and fraudulent activities. This insurance can be a wise choice for concert-goers, sports fans, and theater enthusiasts who want to ensure a smooth and secure ticket-buying experience.

Remember, when purchasing tickets, always look for the option to add Ticketmaster Insurance to your order. This simple step can provide significant benefits and give you the confidence to enjoy the event without worrying about potential issues.

Auto Insurance: Getting the Right Coverage for Peace of Mind

You may want to see also

Claim Process: A straightforward process allows insured individuals to file claims for eligible losses

The claim process for Ticketmaster Insurance is designed to be efficient and straightforward, ensuring that insured individuals can quickly and easily file claims for any eligible losses they may have incurred. This process is a crucial aspect of the insurance policy, allowing policyholders to seek compensation and support when facing unforeseen circumstances related to their ticket purchases.

When an insured individual needs to file a claim, they typically start by contacting the insurance provider's customer support team. This can be done via phone, email, or through an online portal, depending on the insurance company's preferred methods of communication. The support team is trained to assist with claims and will guide the individual through the necessary steps. They will ask for relevant details, such as personal information, policy number, and a description of the loss or incident.

The next step involves providing evidence and documentation to support the claim. This may include ticket stubs or e-tickets, payment receipts, and any other relevant proof of the purchase and the circumstances surrounding the loss. For example, if a ticket is lost or stolen, the individual will need to provide details of the incident and, if possible, the steps taken to report the loss to Ticketmaster. The insurance company will then review the information and assess whether the claim is eligible for coverage.

Eligible losses can vary depending on the specific insurance policy. Common scenarios include lost or stolen tickets, ticket damage, and even the need to cancel a ticket purchase due to unforeseen events like illness or travel emergencies. In each case, the insurance provider will have clear guidelines on what constitutes an eligible claim. Once the claim is approved, the insurance company will proceed with the compensation process, which may involve issuing a refund, providing a replacement ticket, or offering other forms of financial assistance as per the policy terms.

Throughout the claim process, it is essential for insured individuals to maintain clear and accurate records of all communications and documentation. This ensures that the insurance company has all the necessary information to process the claim efficiently. Additionally, policyholders should be prepared to provide any additional details or evidence that may be required to support their claim, ensuring a smooth and successful resolution.

Speeding Ticket Disclosure: What Your Insurance Company Needs to Know

You may want to see also

Terms and Conditions: Specific terms define coverage, exclusions, and claim requirements

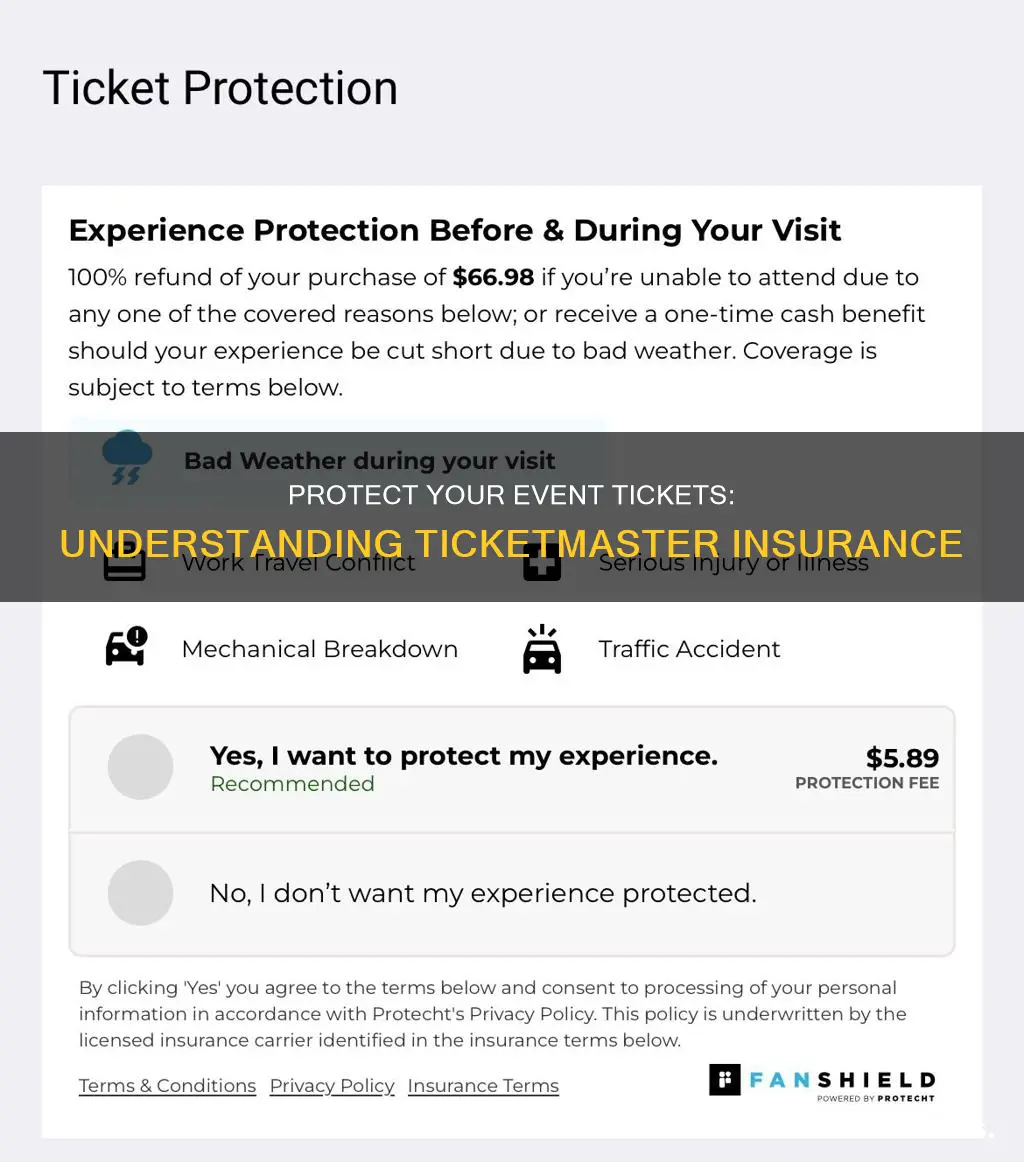

When purchasing tickets through Ticketmaster, you may have the option to purchase insurance, which is a valuable service that provides additional protection for your ticket purchase. Understanding the terms and conditions of this insurance is crucial to ensure you are aware of your rights and the coverage you receive. Here are some key points to consider regarding the terms and conditions of Ticketmaster insurance:

Coverage and Benefits: Ticketmaster insurance typically offers protection against various risks associated with ticket purchases. This may include coverage for ticket loss, theft, damage, or even the inability to attend the event due to unforeseen circumstances. The specific terms of coverage can vary, so it's essential to carefully review the policy details. For instance, some insurance plans might provide a full refund if the event is canceled, while others may offer a replacement ticket or a credit for future purchases. Understanding these nuances ensures you know what you're entitled to in different scenarios.

Exclusions and Limitations: Like any insurance policy, Ticketmaster's terms and conditions will outline certain exclusions and limitations. These are specific situations or events that the insurance does not cover. For example, insurance may not apply if you lose your ticket due to negligence, or if the event is postponed but still occurs on a different date. It's important to be aware of these exclusions to manage your expectations and understand the scope of the insurance coverage.

Claim Process and Requirements: The terms and conditions will also detail the process for making a claim. This includes providing evidence of the issue, such as a lost ticket, and meeting specific criteria to be eligible for a refund or replacement. For instance, you might need to provide a police report for a stolen ticket or a medical certificate for an event cancellation. Knowing these requirements beforehand ensures a smoother claims process if you ever need to file one.

Time Limits and Policies: Ticketmaster insurance policies often have time limits for filing claims. These deadlines are crucial to ensure you can take advantage of the coverage. Additionally, some policies may have specific procedures for handling claims, such as submitting documentation within a certain timeframe or following a particular format. Adhering to these guidelines is essential to avoid any delays or potential rejections.

By thoroughly reviewing the terms and conditions of Ticketmaster insurance, you can make an informed decision about purchasing this additional protection. It empowers you to understand your rights, the extent of coverage, and the steps to take if any issues arise, ensuring a more secure and enjoyable ticket-buying experience.

The Hartford Auto Insurance: When and How to Contact Them

You may want to see also

Frequently asked questions

Ticketmaster Insurance is a service provided by Ticketmaster, a leading ticket sales and distribution company, to protect customers from financial loss in the event of ticket cancellation or non-delivery. It is designed to offer peace of mind and ensure that fans can recover their ticket purchase amount in specific circumstances.

When purchasing tickets through Ticketmaster, customers can opt for the insurance coverage at the time of booking. The insurance fee is typically a small percentage of the ticket price and varies depending on the event and location. In the event of ticket cancellation or non-delivery, Ticketmaster Insurance will reimburse the ticket cost, including the insurance fee, up to a specified limit.

The primary benefit is financial protection. It safeguards fans from potential losses if an event is canceled or if they are unable to attend due to ticket non-delivery. This is especially useful for high-demand events where ticket availability is limited, ensuring that customers can recover their investment in case of unforeseen circumstances.

Yes, like any insurance policy, there are certain conditions and exclusions. Common exclusions may include ticket fraud, ticket resale, or events that are postponed rather than canceled. It's essential to review the terms and conditions of the insurance policy to understand the coverage and any specific requirements for making a claim.

If an event is canceled or tickets are not delivered as per the insurance policy, customers can initiate a claim process. This usually involves providing proof of the cancellation or non-delivery, such as official event cancellations or shipping records. Ticketmaster will then assess the claim and, if approved, process the reimbursement according to the insurance terms.