Underivable life insurance, also known as non-derivative life insurance, is a type of insurance policy that provides financial protection for the insured individual's beneficiaries in the event of their death. Unlike other insurance products, underivable life insurance does not have a financial value that can be easily converted into cash or used as collateral. This unique characteristic makes it an attractive option for individuals who want to ensure their loved ones are financially secure without the risk of their policy being easily accessible or transferable.

What You'll Learn

- Definition: Underivable life insurance is a policy that pays out if the insured dies, but not if they survive

- Benefits: It offers guaranteed death benefits, providing financial security for beneficiaries

- Features: Underlying policies typically have no cash value and are often more affordable

- Risks: The main risk is the possibility of outliving the policy, resulting in no payout

- Alternatives: Traditional whole life insurance offers lifelong coverage and a cash value component

Definition: Underivable life insurance is a policy that pays out if the insured dies, but not if they survive

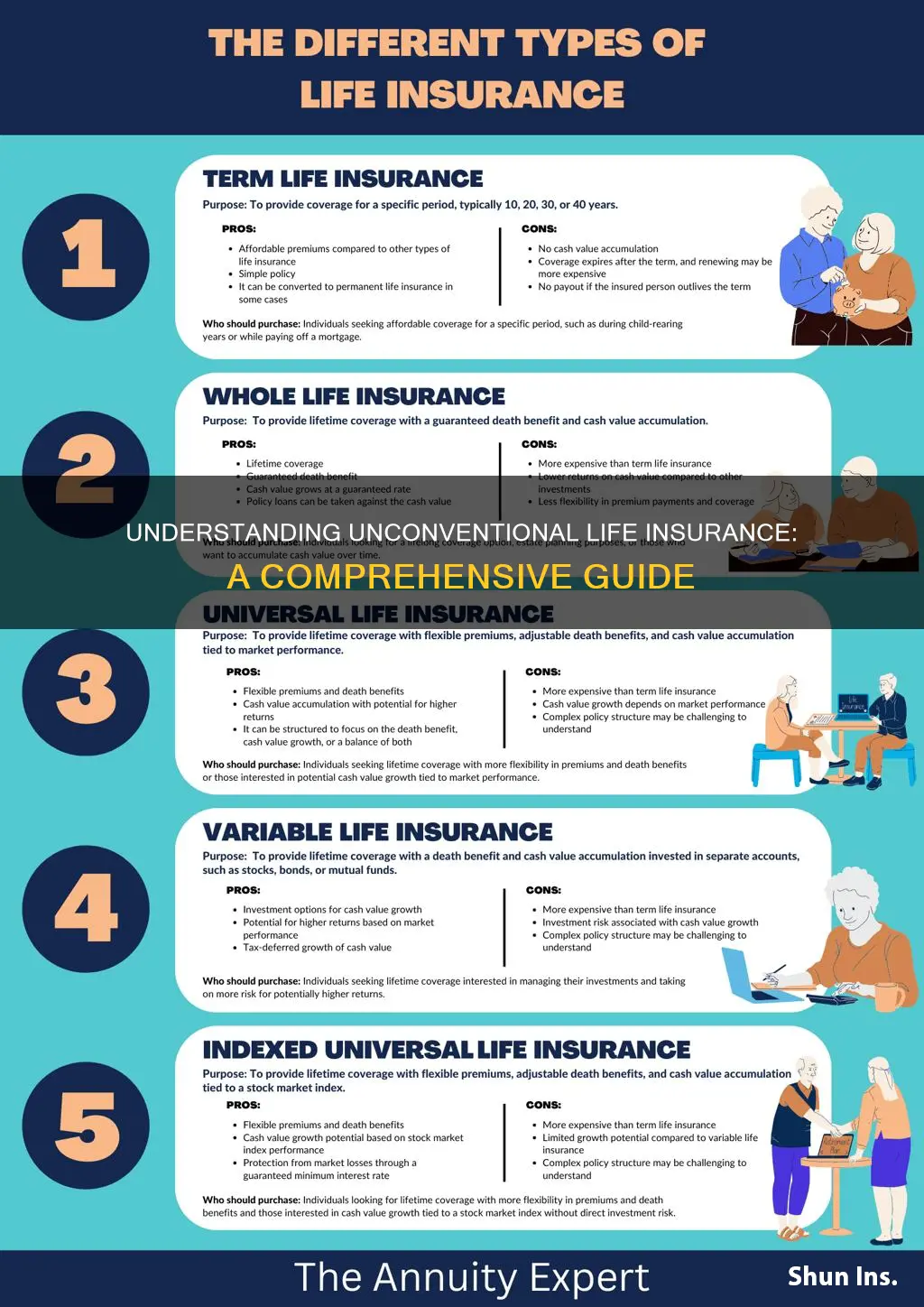

Underivable life insurance, often referred to as "term life insurance," is a type of life insurance policy that provides coverage for a specific period, or "term," of time. This policy is designed to offer financial protection to the policyholder's beneficiaries in the event of the insured individual's death during the specified term. The key characteristic that sets underivable life insurance apart is its straightforward payout structure: it guarantees a death benefit if the insured person passes away within the agreed-upon term, but it does not provide any benefits if the insured individual survives the term.

In simpler terms, underivable life insurance is a temporary safety net that ensures financial security for loved ones in the event of an untimely death. It is a pure risk transfer mechanism, where the insurance company takes on the risk of paying out a lump sum or regular income if the insured dies within the policy's term. This type of insurance is particularly useful for individuals who want to provide financial coverage for a specific period, such as covering mortgage payments, children's education, or other short-term financial obligations.

The beauty of underivable life insurance lies in its simplicity and cost-effectiveness. Since the policy is term-based, it typically has lower premiums compared to permanent life insurance policies. This makes it an attractive option for those seeking affordable coverage for a defined period without the need for long-term financial commitments. When the term ends, the policy expires, and the coverage ceases unless the policyholder decides to renew or convert it.

It's important to note that underivable life insurance does not accumulate cash value over time, unlike permanent life insurance policies. This means that the primary purpose of this insurance is to provide a death benefit, and any premiums paid beyond the initial coverage period do not build up a cash reserve. As a result, underivable life insurance is often more affordable and suitable for individuals who prioritize short-term financial protection over long-term savings or investment components.

In summary, underivable life insurance is a term-based policy that offers a straightforward and cost-effective solution for individuals seeking financial protection for a specific period. It provides a guaranteed death benefit if the insured dies within the term, ensuring that beneficiaries receive the intended financial support. This type of insurance is a valuable tool for managing short-term risks and providing peace of mind to those who want to secure their loved ones' financial future.

Perium Reinsurance: Direct Term Life Insurance's Impact

You may want to see also

Benefits: It offers guaranteed death benefits, providing financial security for beneficiaries

Untermined life insurance, often referred to as level term life insurance, is a type of life insurance that provides a fixed amount of coverage for a specified period. One of its key benefits is the guaranteed death benefit, which is a crucial aspect of financial security for beneficiaries. When an individual purchases this type of insurance, they agree to pay a premium for a set duration, typically 10, 15, or 20 years. During this period, the policyholder is protected, and if they pass away, the insurance company pays out a predetermined sum to the designated beneficiaries. This guaranteed death benefit ensures that the financial obligations and future needs of the family or beneficiaries are met, even in the event of the policyholder's untimely demise.

The financial security provided by this insurance is particularly valuable as it offers a sense of stability and peace of mind. Beneficiaries can rely on the assured sum to cover various expenses, such as mortgage payments, children's education, or daily living costs. Knowing that a financial safety net is in place can significantly reduce the stress and anxiety associated with the loss of a primary income earner. This type of coverage is especially important for those with dependents, as it ensures that the family's standard of living is maintained and that the financial goals of the deceased are not compromised.

Moreover, the guaranteed nature of the death benefit is a significant advantage. Unlike some other insurance products, where the payout may decrease over time, this insurance provides a consistent and predictable amount. This predictability allows beneficiaries to plan and budget effectively, knowing exactly what financial support they can expect. It also enables them to make informed decisions about their future, such as investing in education, starting a business, or planning for retirement.

In summary, the guaranteed death benefit of untermined life insurance is a powerful tool for providing financial security and peace of mind. It ensures that beneficiaries are protected financially, even in the face of tragedy, allowing them to focus on healing and moving forward with their lives. This type of insurance is a valuable consideration for anyone seeking to safeguard their loved ones' financial well-being.

Canceling AXA Life Insurance: A Step-by-Step Guide

You may want to see also

Features: Underlying policies typically have no cash value and are often more affordable

When considering life insurance, it's important to understand the different types available, especially when it comes to "underlying policies." These policies are a specific type of life insurance that offers unique features and benefits. One of the key characteristics of underlying policies is that they typically do not accumulate cash value. This means that the policyholder does not build up a savings component within the policy, which is a common feature in some other types of life insurance, such as whole life or universal life.

The lack of cash value in underlying policies is a deliberate design choice. These policies are primarily focused on providing pure protection against the risk of death. They are designed to pay out a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term of the policy. This simplicity in structure often results in lower costs compared to policies with cash value accumulation.

Affordability is another significant feature of underlying policies. Since these policies do not have a savings component, they can be more cost-effective. The premiums for underlying life insurance are generally lower because there is no need to fund the growth of an investment account or a cash value reserve. This affordability factor makes underlying policies an attractive option for individuals who want life insurance coverage without the additional costs associated with building up a cash value.

For those seeking life insurance, understanding the difference between underlying policies and other types can be crucial. While underlying policies may not offer the same long-term financial benefits as policies with cash value, they provide a straightforward and often more affordable way to secure financial protection for one's loved ones. This simplicity can be particularly appealing to those who prioritize the immediate coverage aspect of life insurance over the potential investment returns.

In summary, underlying policies in life insurance are characterized by their lack of cash value and the resulting affordability. This design choice allows for a more straightforward and cost-effective approach to life insurance, making it an excellent option for those who want pure protection without the additional financial complexities.

Life Insurance Agent: A Fulfilling Career Choice?

You may want to see also

Risks: The main risk is the possibility of outliving the policy, resulting in no payout

The concept of universal life insurance is a type of permanent life insurance that offers a flexible and customizable way to secure financial protection for your loved ones. It provides a death benefit to your beneficiaries when you pass away, ensuring financial security for your family. However, like any financial product, it comes with certain risks that policyholders should be aware of.

One of the primary risks associated with universal life insurance is the possibility of outliving the policy. This risk is inherent in any long-term insurance product, but it is particularly relevant with universal life due to its permanent nature. As you age, the likelihood of making premium payments increases, and if you reach a point where you can no longer afford the premiums, the policy may lapse. In such a scenario, the insurance company may offer a grace period, but if you fail to pay the premiums during this period, the policy could be terminated, resulting in no payout to your beneficiaries.

Outliving the policy can have significant financial implications. Universal life insurance policies typically have a minimum number of years during which they must remain in force to ensure the death benefit is paid out. If you outlive this period, the policy may become less valuable, and the insurance company may adjust the death benefit accordingly. Additionally, the longer you live, the more premiums you will have paid over the years, which can impact your overall financial planning and savings.

To mitigate this risk, it is essential to carefully consider your life expectancy and financial situation when purchasing universal life insurance. Assess your ability to make premium payments over the long term and ensure that the policy's terms align with your financial goals. Regularly reviewing and adjusting your policy as your life circumstances change can also help manage this risk effectively.

In summary, while universal life insurance provides valuable financial protection, the risk of outliving the policy is a critical consideration. Understanding this risk and taking proactive steps to manage it can help ensure that your loved ones receive the intended death benefit, providing peace of mind and financial security for your family.

Life Insurance Surrender Charges: Do They Expire?

You may want to see also

Alternatives: Traditional whole life insurance offers lifelong coverage and a cash value component

Traditional whole life insurance is a comprehensive and long-term financial solution that provides several advantages over other forms of coverage. One of its key features is lifelong coverage, ensuring that the insured individual is protected throughout their entire life. This means that as long as the policyholder pays the premiums, the insurance company will provide a death benefit to the designated beneficiaries when the insured person passes away. Unlike term life insurance, which offers coverage for a specific period, whole life insurance provides a constant and reliable safety net.

In addition to the death benefit, traditional whole life insurance also includes a cash value component. This aspect of the policy allows the policyholder to build up a savings account over time. A portion of the premium payments goes into this cash value, which can be borrowed against or withdrawn as needed. The cash value grows tax-deferred, providing a valuable financial asset that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income. This feature is particularly attractive to those seeking a more permanent and flexible financial strategy.

The cash value accumulation in whole life insurance can be a powerful tool for wealth building. As the policyholder pays premiums, the cash value grows, and it can be utilized to pay for future expenses without disrupting the ongoing coverage. This is especially beneficial for individuals who want to ensure their family's financial security and have a long-term financial plan. With whole life insurance, the policyholder can enjoy the peace of mind that comes with knowing their loved ones will be financially protected, and they will also have a growing asset that can be utilized strategically.

Furthermore, traditional whole life insurance offers a level of predictability and stability. The premiums and death benefit are guaranteed, providing a consistent and reliable financial commitment. This predictability is in contrast to other insurance products, which may offer varying premiums and benefits over time. With whole life insurance, individuals can plan their finances with greater confidence, knowing that their coverage and savings will remain consistent, even as their financial needs evolve.

In summary, traditional whole life insurance stands out for its lifelong coverage and the valuable cash value component. These features make it an attractive option for individuals seeking long-term financial security and a strategic approach to wealth management. By combining protection with a growing asset, whole life insurance offers a comprehensive solution that can adapt to various life stages and financial goals.

Prudential Life Insurance: Logging In, Simplified

You may want to see also

Frequently asked questions

Unilateral life insurance, also known as non-forfeitable or guaranteed life insurance, is a type of policy that offers certain benefits and protections to the policyholder. Unlike traditional life insurance, where the policy can be surrendered or canceled, unilateral policies provide a guaranteed death benefit and certain rights to the policyholder. This type of insurance is often more expensive but offers greater security and flexibility.

Unilateral life insurance policies are designed to provide a guaranteed death benefit to the policyholder. When you purchase this type of insurance, you typically pay a set premium over a specific period. The policy guarantees that the death benefit will be paid out to the beneficiary(ies) upon your passing, regardless of the policy's cash value or other factors. This feature makes it a reliable and secure choice for those seeking long-term financial protection.

There are several advantages to choosing unilateral life insurance:

- Guaranteed Death Benefit: As mentioned, the policy ensures a fixed payout to the beneficiary, providing financial security for loved ones.

- Non-Forfeitable Rights: Policyholders have the right to keep the policy even if they miss premium payments, and they can also choose to surrender the policy for its cash value.

- Flexibility: Unilateral policies offer various options for policy customization, allowing individuals to tailor the coverage to their specific needs.

- Long-Term Financial Planning: This type of insurance can be a valuable tool for long-term financial planning, offering protection and potential investment opportunities.

Unilateral life insurance is suitable for individuals who want a reliable and secure insurance solution. It is often preferred by those who prioritize financial stability and want to ensure their loved ones are protected. This type of policy can be beneficial for families, business owners, or anyone seeking long-term financial planning. Additionally, individuals with a preference for guaranteed benefits and non-forfeitable rights may find unilateral life insurance more appealing.