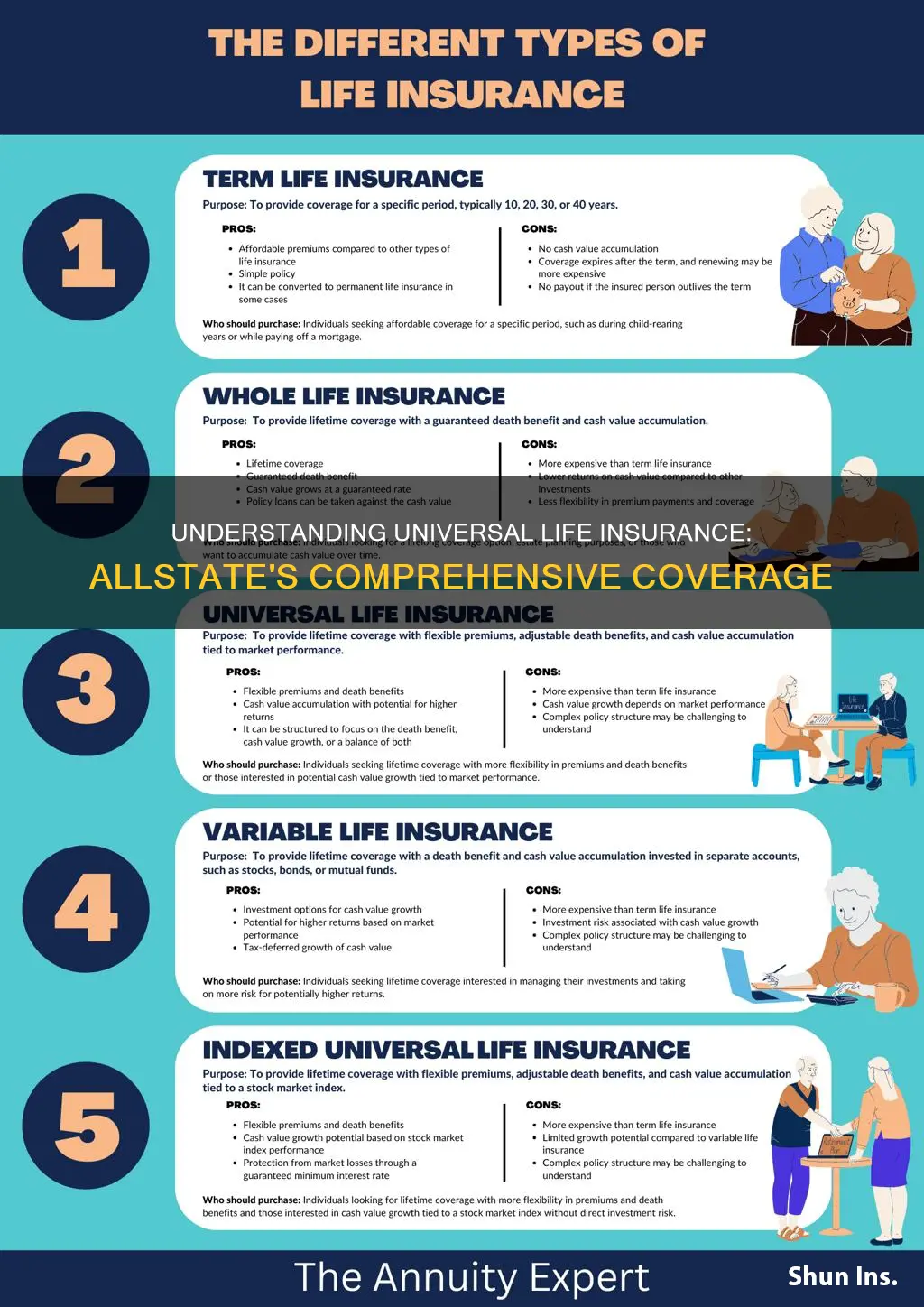

Universal life insurance is a type of permanent life insurance that offers flexibility and potential long-term savings. It provides coverage for the entire life of the insured individual and allows policyholders to adjust their premiums and death benefits over time. Allstate, a well-known insurance company, offers universal life insurance policies tailored to meet various financial needs. This type of insurance combines a death benefit with an investment component, allowing policyholders to build cash value that can be used for various purposes, such as loan payments or retirement planning. Understanding the features and benefits of universal life insurance from Allstate can help individuals make informed decisions about their financial protection and long-term financial goals.

What You'll Learn

- Definition: Universal life insurance is a permanent policy with a flexible premium and investment component

- Benefits: Offers lifelong coverage, cash value accumulation, and potential investment returns

- Customization: Policyholders can adjust premiums and death benefits to fit their needs

- Tax Advantages: Tax-deferred growth and potential tax-free withdrawals of cash value

- Flexibility: Allows for loan options and the ability to increase coverage over time

Definition: Universal life insurance is a permanent policy with a flexible premium and investment component

Universal life insurance is a type of permanent life insurance policy that offers a unique blend of coverage and investment opportunities. Unlike term life insurance, which provides coverage for a specific period, universal life insurance is designed to be a long-term financial tool, offering both death benefit protection and an investment component. This policy is particularly attractive to those seeking a more flexible and customizable insurance solution.

The key feature of universal life insurance is its flexibility. Policyholders can adjust their premiums and death benefits over time, allowing for a tailored approach to insurance. This flexibility is especially beneficial for individuals who want to adapt their coverage as their financial situation changes. For instance, if a policyholder's financial circumstances improve, they can increase their premium payments to enhance the cash value of the policy, which can then be used to borrow against or withdraw funds. Conversely, if their financial situation becomes more challenging, they can reduce the premium payments, ensuring the policy remains in force.

The investment component of universal life insurance is another significant advantage. The policy's cash value, which grows tax-deferred, can be used to build wealth over time. Policyholders can allocate a portion of their premium payments to the investment portion of the policy, allowing the cash value to accumulate. This investment aspect provides an opportunity for policyholders to potentially earn higher returns compared to traditional savings accounts or fixed-rate investments. The investment options within the policy can be customized to fit the policyholder's risk tolerance and financial goals.

In addition to the investment growth, universal life insurance also provides a guaranteed death benefit. This means that if the insured individual passes away, the beneficiary will receive the full death benefit amount, which is typically the policy's cash value plus any additional premiums paid. This guaranteed benefit ensures that the policyholder's family or designated beneficiaries are financially protected in the event of their passing.

Overall, universal life insurance offers a comprehensive and adaptable solution for individuals seeking both insurance coverage and investment opportunities. Its flexibility in premium payments and death benefits, coupled with the potential for investment growth, makes it a valuable tool for long-term financial planning and risk management.

Life Insurance Options for Pancreatic Cancer Patients

You may want to see also

Benefits: Offers lifelong coverage, cash value accumulation, and potential investment returns

Universal life insurance is a type of permanent life insurance offered by Allstate, providing a range of benefits that make it a valuable financial tool. One of its key advantages is lifelong coverage, ensuring that your loved ones are protected for the long term. This means that as long as the policy remains in force, your beneficiaries will receive a death benefit if you pass away. Unlike term life insurance, which provides coverage for a specified period, universal life insurance offers a more flexible and permanent solution.

The policy also includes a cash value component, which is a significant benefit. As you make regular premium payments, a portion of each payment goes towards building cash value. This cash value grows over time, earning interest, and can be used for various purposes. Policyholders can access this cash value through policy loans or withdrawals, providing financial flexibility. For instance, if you need funds for a major purchase or to cover unexpected expenses, you can borrow against the cash value without affecting your coverage.

Another attractive feature is the potential for investment returns. Allstate invests a portion of the cash value in various investment options, such as stocks, bonds, and mutual funds. These investments can grow over time, and the returns are credited back to the policy's cash value. This feature allows your money to work harder and potentially accumulate more wealth. As the investment markets perform well, your policy's cash value can grow, providing a safety net and a means to build wealth over the long term.

With universal life insurance, you have the freedom to adjust your coverage as your life circumstances change. You can increase or decrease the death benefit and premium payments to align with your evolving needs. This flexibility ensures that your insurance policy remains relevant and effective throughout your life. Additionally, the cash value accumulation means that your money is working for you, providing financial security and the potential for long-term growth.

In summary, universal life insurance from Allstate offers a comprehensive set of benefits. It provides lifelong coverage, ensuring your family's financial security. The cash value accumulation feature allows for policy loans and withdrawals, offering financial flexibility. Moreover, the potential for investment returns means your money can grow, providing a safety net and wealth-building opportunity. This type of insurance is a powerful tool for individuals seeking long-term financial protection and the potential for increased wealth.

Life Insurance Tax in Ohio: What's Taxable?

You may want to see also

Customization: Policyholders can adjust premiums and death benefits to fit their needs

Universal life insurance offers a unique level of flexibility and customization, allowing policyholders to tailor their coverage to their specific needs and financial goals. One of the key advantages of this type of insurance is the ability to adjust both the premiums and the death benefits, providing a personalized insurance experience.

Policyholders can start by determining their desired death benefit, which is the amount of money paid out to the beneficiary upon their passing. This amount can be customized to suit various financial objectives. For instance, individuals may opt for a higher death benefit to ensure their family's financial security or to cover significant expenses like education or mortgage payments. Conversely, those with smaller families or lower financial obligations might choose a lower death benefit, keeping costs more manageable.

Premiums, the regular payments made by the policyholder, are another aspect that can be tailored. Universal life insurance policies typically offer flexibility in premium payments, allowing policyholders to choose how and when they make these payments. Some may prefer higher initial premiums to build cash value more quickly, while others might opt for lower premiums and make additional payments when their financial situation allows. This customization ensures that the policy can be adapted to individual financial circumstances and goals.

The ability to adjust these parameters provides a sense of control and adaptability, which is particularly valuable in an ever-changing financial landscape. Policyholders can make changes to their policy as their life circumstances evolve, ensuring that their insurance remains relevant and effective. For example, a policyholder might increase the death benefit if they have a growing family or business, or they might reduce premiums if they experience a financial windfall.

In summary, universal life insurance from Allstate provides policyholders with the power to customize their insurance plan. This customization enables individuals to align their coverage with their unique financial needs and goals, offering a level of flexibility that is often lacking in other insurance products. By adjusting premiums and death benefits, policyholders can create a tailored insurance solution that provides both financial protection and peace of mind.

Spouse Life Insurance: Taxable or Not?

You may want to see also

Tax Advantages: Tax-deferred growth and potential tax-free withdrawals of cash value

Universal life insurance offers a unique tax advantage that can be particularly beneficial for long-term financial planning. One of the key features is the ability to build cash value, which grows tax-deferred. This means that the cash value in your policy accumulates over time without being subject to income tax. As you make premium payments, a portion of each payment goes towards building this cash value, and the earnings on this investment are also tax-deferred. This tax-deferred growth can be a powerful tool for wealth accumulation, allowing your money to grow faster than it would in a traditional savings account or investment account.

The tax advantages of universal life insurance become even more significant when you consider the potential for tax-free withdrawals. As the cash value in your policy grows, you can take out loans or make withdrawals against this value without incurring immediate taxes. When you withdraw cash value, you are essentially borrowing from your own policy, and the loan is secured by the cash value. The interest charged on these loans is typically lower than the earnings on the investment portion of the policy, and the loan is repaid with interest over time. This process does not trigger a taxable event, as you are not withdrawing earnings but rather using the policy's own earnings to fund the loan.

Over time, as the cash value grows, you can build a substantial reserve within your universal life insurance policy. This reserve can be used to provide a tax-free source of funds for various financial needs. For example, if you need to access funds for a major purchase, such as a home renovation or education expenses, you can take out a loan against the cash value without triggering a tax liability. This flexibility can be especially valuable for individuals who want to avoid the tax implications of selling assets or tapping into other investment accounts.

Additionally, the tax-deferred nature of universal life insurance can provide a long-term advantage. As your policy grows, the tax-deferred earnings can compound, leading to significant growth over time. This growth can result in a substantial cash value that can be used for various financial goals, such as retirement planning, funding a child's education, or leaving a legacy for future generations. The potential for tax-free withdrawals further enhances the value of this insurance type, making it an attractive option for those seeking tax-efficient wealth accumulation and management.

In summary, universal life insurance from Allstate offers a compelling tax advantage through tax-deferred growth of cash value. This feature allows policyholders to build a substantial reserve over time, providing financial flexibility and the potential for tax-free withdrawals. By understanding and utilizing these tax benefits, individuals can make informed decisions about their long-term financial planning and take advantage of a powerful tool for wealth creation and preservation.

Life Insurance After Retirement: Keeping Your Policy Post-Job

You may want to see also

Flexibility: Allows for loan options and the ability to increase coverage over time

Universal life insurance offers a unique level of flexibility that sets it apart from other life insurance policies. One of its key advantages is the ability to access loan options, providing policyholders with a financial safety net when needed. This feature allows insured individuals to borrow against the cash value of their policy, which can be a valuable resource for various financial needs. Whether it's funding a business venture, consolidating debt, or covering unexpected expenses, the loan feature of universal life insurance provides a convenient and accessible way to access funds without selling the policy or disrupting the coverage.

In addition to loan options, universal life insurance also offers the flexibility to increase coverage over time. Policyholders have the autonomy to adjust their coverage as their financial situation and needs evolve. This adaptability is particularly beneficial for those who experience significant life changes, such as starting a family, purchasing a home, or achieving career milestones. By increasing the coverage amount, individuals can ensure that their loved ones are adequately protected in the event of their passing. This flexibility empowers policyholders to make informed decisions about their insurance coverage, aligning it with their current and future financial goals.

The ability to increase coverage is a significant advantage, especially for those who want to provide comprehensive protection for their families. As individuals progress through different life stages, their insurance needs may change. For instance, a young professional might start with a basic coverage amount but later decide to increase it when they become a parent or purchase a substantial asset. Universal life insurance allows for these adjustments, ensuring that the policy remains relevant and effective throughout the policyholder's life. This flexibility is particularly appealing to those who value a personalized and tailored insurance experience.

Furthermore, the loan options associated with universal life insurance can be a strategic financial tool. Policyholders can utilize the cash value of their policy as collateral for a loan, providing a source of funds that is typically more accessible and cost-effective than traditional loans. This feature can be especially useful for individuals who want to leverage their insurance policy for financial growth or to cover significant expenses without disrupting their regular budget. By accessing the loan options, policyholders can make informed financial decisions, ensuring that their insurance policy remains a valuable asset.

In summary, universal life insurance from Allstate offers a high level of flexibility, including loan options and the ability to increase coverage. These features empower policyholders to take control of their financial well-being and adapt their insurance coverage to changing circumstances. With the loan options, individuals can access funds when needed, and by increasing coverage, they can ensure that their loved ones are protected. This flexibility is a significant advantage, providing policyholders with a sense of security and the freedom to make informed decisions about their insurance needs.

Insurable Interest: When Life Insurance Becomes Legally Binding

You may want to see also

Frequently asked questions

Universal Life Insurance is a type of permanent life insurance policy offered by Allstate. It provides long-term coverage and offers flexibility in premium payments and death benefit amounts. This policy allows policyholders to build cash value over time, which can be used for various purposes, such as loaning against the policy or making additional payments to increase the cash value.

With Universal Life, you pay a fixed premium for a certain period, typically the first few years of the policy. After that, you can choose to pay higher or lower premiums based on your financial situation. The death benefit remains guaranteed for your entire life, providing financial protection for your loved ones. The policy also accumulates cash value, which can grow tax-deferred and can be borrowed against or withdrawn.

Allstate's Universal Life Insurance offers several advantages. Firstly, it provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit when you pass away. Secondly, the policy's cash value can be used for various financial needs, such as supplementing retirement income or funding education expenses. Additionally, you have the flexibility to adjust your premiums and death benefit to align with your changing financial goals.

Yes, customization is a key feature of Allstate's Universal Life Insurance. You can choose the initial death benefit amount and adjust it over time based on your financial needs. The policy also allows you to select the premium payment period, typically ranging from 10 to 30 years. You can also decide on the investment options for the cash value, which can help grow your policy's value over time.