Volunter life insurance is a type of coverage that individuals can choose to purchase for themselves, offering financial protection to their loved ones in the event of their passing. Unlike term life insurance, which is typically tied to a specific period, voluntary life insurance is a permanent policy that provides coverage for the insured's entire life. This type of insurance is often sought by those who want to ensure their family's financial security, covering expenses such as mortgage payments, education costs, or other long-term financial commitments. It can be a valuable tool for individuals who want to leave a lasting legacy and provide peace of mind for their beneficiaries.

What You'll Learn

- Definition: Voluntary life insurance is a policy purchased by an individual, not required by an employer

- Benefits: It provides financial security for beneficiaries in the event of the insured's death

- Premiums: Policyholders pay regular premiums for coverage, with no mandatory contributions

- Flexibility: Policies can be tailored to individual needs and often offer higher coverage amounts

- Portability: Voluntary insurance is portable, allowing transfer between employers or personal use

Definition: Voluntary life insurance is a policy purchased by an individual, not required by an employer

Voluntary life insurance is a type of life insurance policy that an individual chooses to purchase independently, without any obligation or requirement from an employer. This type of insurance is often seen as a personal financial decision, allowing individuals to protect their loved ones and ensure financial security in the event of their passing. Unlike group life insurance, which is typically provided by an employer as part of an employee benefits package, voluntary life insurance is a personal choice.

When an individual decides to purchase voluntary life insurance, they are taking control of their financial future. This policy is tailored to the specific needs and preferences of the policyholder, allowing them to choose the coverage amount, duration, and other relevant terms. It provides a financial safety net for the individual's beneficiaries, who can receive a death benefit to cover various expenses, such as funeral costs, mortgage payments, or daily living expenses.

One of the key advantages of voluntary life insurance is the flexibility it offers. Policyholders can customize the policy to align with their unique circumstances and financial goals. They can select the coverage amount based on their assessment of the financial needs of their family or dependents. For example, a young professional might opt for a lower coverage amount to keep premiums affordable, while a family with dependent children may choose a higher amount to ensure their long-term financial stability.

Furthermore, voluntary life insurance provides individuals with the freedom to make changes to their policy as their life circumstances evolve. If an individual's financial situation improves, they can increase the coverage amount or adjust other policy terms. Conversely, if their needs change, they can also decrease the coverage or cancel the policy, ensuring that they only pay for the insurance they currently require.

In summary, voluntary life insurance is a personal insurance policy that empowers individuals to take charge of their financial well-being. It offers flexibility, customization, and the ability to adapt to changing life circumstances. By purchasing voluntary life insurance, individuals can provide peace of mind for themselves and their loved ones, knowing that their financial future is protected.

Record Labels, Artists, and Life Insurance: Who Benefits?

You may want to see also

Benefits: It provides financial security for beneficiaries in the event of the insured's death

Voluntary life insurance is a type of life insurance policy that individuals can choose to purchase on their own, without any employer or group affiliation. It offers a crucial benefit: providing financial security for beneficiaries in the event of the insured's death. This financial protection is an essential aspect of personal financial planning, ensuring that loved ones are taken care of during difficult times.

When an individual purchases voluntary life insurance, they select the amount of coverage they desire, often based on their specific needs and financial goals. The policy then provides a death benefit, which is a lump sum payment made to the designated beneficiaries upon the insured's passing. This benefit can be a significant source of financial support for the family, covering various expenses such as mortgage payments, education costs, funeral expenses, and daily living expenses. By having this financial safety net, beneficiaries can focus on healing and adjusting to life without the added stress of financial burdens.

The beauty of voluntary life insurance lies in its flexibility. Policyholders can customize their coverage to fit their unique circumstances. They can choose the duration of the policy, the premium payment options, and even the type of coverage, such as term life or permanent life insurance. This flexibility allows individuals to tailor the policy to their changing needs over time, ensuring that the financial security provided remains relevant and adequate.

Furthermore, voluntary life insurance can be an attractive option for those who may not have access to group life insurance through their employer. It provides an opportunity for individuals to take control of their financial future and protect their loved ones, regardless of their employment status. With this type of insurance, individuals can make a meaningful difference in the lives of their beneficiaries and leave a lasting legacy.

In summary, voluntary life insurance offers a valuable benefit by providing financial security for beneficiaries when the insured passes away. It empowers individuals to take charge of their financial well-being and ensure that their loved ones are protected. With its customizable features, voluntary life insurance is a versatile tool for personal financial planning, offering peace of mind and a sense of security for the future.

BDO Life Insurance: Application Process Simplified

You may want to see also

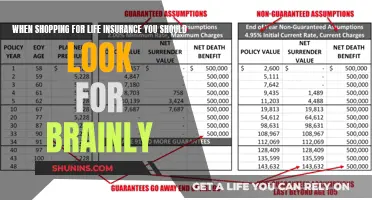

Premiums: Policyholders pay regular premiums for coverage, with no mandatory contributions

Voluntary life insurance is a type of life insurance policy where the decision to purchase coverage is entirely up to the individual. Unlike term life insurance, which is often provided as a standard benefit in group policies, voluntary life insurance is not mandatory and is chosen by the policyholder. This type of insurance offers a way for individuals to protect their loved ones financially in the event of their untimely death.

One of the key aspects of voluntary life insurance is the payment of premiums. Policyholders are responsible for paying regular premiums to maintain their coverage. These premiums are typically paid monthly, quarterly, or annually, depending on the insurance company's terms. The amount of the premium can vary based on several factors, including the policyholder's age, health, lifestyle, and the desired coverage amount. It is important to note that there are no mandatory contributions or assessments, giving policyholders complete control over their insurance expenses.

The flexibility in premium payments is a significant advantage of voluntary life insurance. Policyholders can choose how often they want to pay their premiums, providing financial flexibility. For instance, some individuals may prefer the convenience of monthly payments, while others might opt for annual payments to save on administrative fees. This customization allows policyholders to manage their insurance costs according to their financial situation and preferences.

Furthermore, voluntary life insurance policies often offer various payment options. Policyholders can select from different premium payment plans, such as level premiums, increasing premiums, or even a combination of both. Level premiums remain constant throughout the policy term, making budgeting easier. Increasing premiums, on the other hand, start lower and gradually rise, which can be beneficial for those who anticipate higher earnings in the future.

In summary, voluntary life insurance provides individuals with the freedom to choose and manage their insurance coverage. Policyholders pay regular premiums to maintain their protection, with the flexibility to choose payment frequencies and options that suit their needs. This type of insurance empowers individuals to take control of their financial security and ensure that their loved ones are protected according to their preferences.

Adjustable Whole Life Insurance: Customizable Coverage for Your Needs

You may want to see also

Flexibility: Policies can be tailored to individual needs and often offer higher coverage amounts

Voluntary life insurance offers a unique and flexible approach to life coverage, providing individuals with the ability to customize their insurance policies to fit their specific needs and preferences. This type of insurance is designed to be adaptable, ensuring that policyholders can make informed decisions about their coverage. One of the key advantages of voluntary life insurance is the flexibility it provides in tailoring policies. Unlike traditional life insurance, where coverage is often standardized, voluntary plans allow individuals to choose the level of protection that aligns with their personal circumstances. This customization is particularly beneficial for those with varying financial goals and risk profiles.

When it comes to coverage amounts, voluntary life insurance shines in its ability to offer higher protection levels. Policyholders can select the amount of coverage that suits their requirements, whether it's for financial security, debt repayment, or specific long-term goals. This flexibility ensures that individuals can adequately protect their loved ones and assets without being constrained by predetermined coverage limits. For instance, someone planning for a large family or a substantial estate may opt for a higher coverage amount to ensure comprehensive financial security.

The customization of voluntary life insurance policies extends beyond the coverage amount. It also includes various policy options and riders that can be added to enhance the protection. These options might include term life insurance, which provides coverage for a specified period, or permanent life insurance, which offers lifelong coverage with an investment component. Additionally, riders can be added to address specific concerns, such as accidental death benefits, waiver of premium, or critical illness coverage. By carefully selecting these options, individuals can create a comprehensive and personalized insurance plan.

Furthermore, the flexibility of voluntary life insurance allows policyholders to adjust their coverage as their life circumstances change. For example, a young professional might start with a lower coverage amount and gradually increase it as their income and financial responsibilities grow. This adaptability ensures that the insurance remains relevant and effective throughout one's life. It also provides peace of mind, knowing that the policy can be modified to reflect evolving needs without the hassle of switching providers or policies.

In summary, voluntary life insurance stands out for its flexibility and adaptability. It empowers individuals to take control of their financial security by tailoring policies to their unique requirements. With the ability to choose higher coverage amounts and customize policy options, voluntary life insurance offers a personalized approach to protection. This flexibility ensures that individuals can make informed decisions, ensuring their loved ones and financial goals are adequately safeguarded.

Determining Fair Market Value for Life Insurance Policies

You may want to see also

Portability: Voluntary insurance is portable, allowing transfer between employers or personal use

Voluntary insurance is a type of coverage that individuals can purchase independently, without being mandated by their employer or any other entity. One of its key advantages is its portability, which means it can be easily transferred between different employers or even used on a personal basis. This feature is particularly valuable in today's dynamic job market, where employees often change jobs frequently or work for multiple employers over their careers.

When it comes to portability, voluntary insurance offers individuals the flexibility to choose the coverage that best suits their needs. For instance, if an employee leaves their current job and starts working for a new employer, they can transfer their voluntary insurance policy to the new company. This ensures that the individual doesn't have to start the insurance process from scratch and can continue to have coverage without any gaps. Portability also allows individuals to maintain their insurance coverage if they decide to work freelance or become self-employed, providing a safety net during periods of self-employment.

The process of transferring voluntary insurance is typically straightforward. Individuals can notify their current insurance provider of their intention to switch jobs or change their employment status. The insurance company will then guide the individual through the necessary steps to transfer the policy, which may include updating personal information, reviewing coverage options, and paying any required fees. This portability aspect ensures that individuals can make informed decisions about their insurance coverage and adapt it to their changing circumstances.

Moreover, voluntary insurance's portability is not limited to employment changes. It can also be transferred for personal use, providing individuals with the freedom to customize their coverage. For example, someone may purchase voluntary life insurance as a personal policy to protect their loved ones, even if they are not employed by an organization that offers such benefits. This allows individuals to take control of their financial security and ensure that their dependents are protected, regardless of their employment status.

In summary, the portability of voluntary insurance is a significant advantage that empowers individuals to manage their insurance coverage effectively. It enables seamless transitions between employers and provides a safety net for personal use, ensuring that individuals can adapt their insurance needs to various life changes. Understanding and utilizing this portability feature can help individuals make the most of their insurance benefits and maintain financial protection throughout their lives.

Life Insurance and Doctor Visits: What's the Connection?

You may want to see also

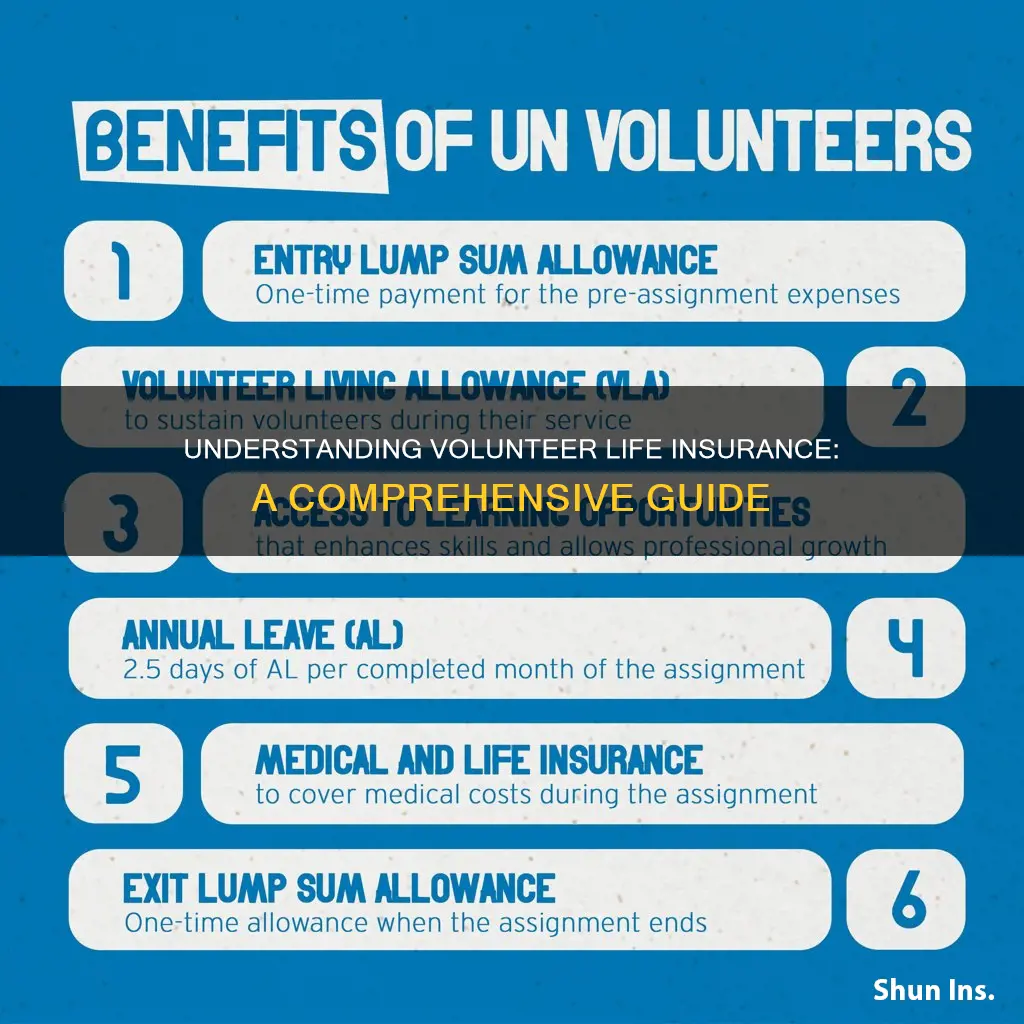

Frequently asked questions

Volunteer life insurance is a type of coverage that provides financial protection for individuals who volunteer their time and skills to a non-profit organization or a charitable cause. It is designed to offer peace of mind and financial support to volunteers in the event of their passing.

This insurance can provide a financial safety net for volunteers and their families. In the unfortunate event of a volunteer's death, the policy can offer a lump-sum payment or regular benefits to cover expenses, such as funeral costs, outstanding debts, or to support their loved ones.

Volunteer life insurance is typically available to individuals who are actively volunteering for a recognized non-profit organization or charity. The eligibility criteria may vary depending on the insurance provider and the specific volunteer program.

Having this insurance can provide volunteers with added security and peace of mind. It ensures that their dedication and efforts are protected, and it can also help alleviate financial burdens on their families during difficult times. Additionally, it may be a requirement for certain volunteer programs or organizations.

You can inquire about volunteer life insurance options through your non-profit organization or charity. Many insurance companies offer specialized policies for volunteers, and they can guide you through the application process. It is essential to review the terms and conditions to ensure the policy meets your specific needs.