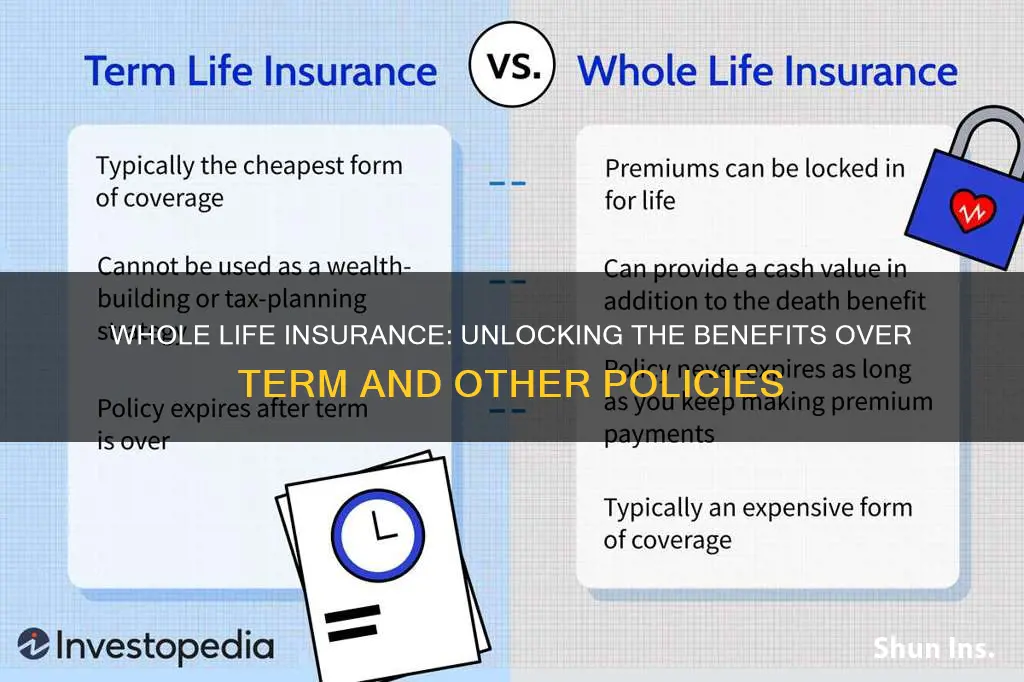

Whole life insurance is a type of permanent life insurance that offers lifelong coverage, providing a sense of security and financial protection for individuals and their families. Unlike term life insurance, which only covers a specific period, whole life insurance remains in force for the entire life of the policyholder, ensuring that beneficiaries receive a death benefit regardless of the insured's age or health status. This makes it a valuable long-term financial tool, as it not only provides a financial safety net but also accumulates cash value over time, which can be borrowed against or withdrawn. When comparing whole life insurance to other types of insurance, such as term life, health, or auto insurance, it's essential to understand the unique features and benefits of whole life, including its ability to build wealth, offer guaranteed death benefits, and provide a sense of financial security that can adapt to changing life circumstances.

What You'll Learn

- Coverage Duration: Whole life offers lifelong coverage, unlike term insurance, which is for a set period

- Cash Value Accumulation: It builds cash value, providing a savings component and investment options

- Flexibility: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

- Death Benefits: Provides a guaranteed death benefit, ensuring financial security for beneficiaries

- Long-Term Financial Planning: Whole life is a tool for long-term wealth accumulation and financial planning

Coverage Duration: Whole life offers lifelong coverage, unlike term insurance, which is for a set period

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. This means that as long as the policyholder remains in good health and pays the required premiums, the insurance coverage will continue without any gaps or interruptions. One of the key advantages of whole life insurance is its longevity, which sets it apart from other insurance products.

In contrast, term insurance is a more temporary solution, offering coverage for a specified period, typically 10, 20, or 30 years. Once the term ends, the policyholder must decide whether to renew or purchase a new policy. This type of insurance is ideal for individuals who want coverage for a specific period, such as when they are young and have a growing family or when they are starting a business. However, it does not provide lifelong protection.

The difference in coverage duration is a significant factor when choosing between whole life and term insurance. With whole life, policyholders can rest assured that their loved ones will be financially protected throughout their entire lives. This long-term coverage can provide peace of mind, knowing that the financial security of the family is guaranteed, even in the event of the insured's passing.

On the other hand, term insurance offers a more flexible and affordable option for those who need coverage for a defined period. It is particularly useful for individuals who want to ensure their families are protected during specific life stages, such as when they are raising children or paying off a mortgage. After the term ends, the policy can be adjusted or replaced to suit changing needs.

When considering insurance options, understanding the coverage duration is crucial. Whole life insurance provides a continuous safety net, ensuring that financial obligations and loved ones are protected indefinitely. In contrast, term insurance offers a targeted solution for a set period, allowing individuals to tailor their coverage to their specific needs during those years. Both types of insurance have their merits, and the choice depends on the individual's long-term financial goals and personal circumstances.

Life Insurance and Medi-Cal: Is It Possible?

You may want to see also

Cash Value Accumulation: It builds cash value, providing a savings component and investment options

Whole life insurance is a type of permanent life insurance that offers a unique feature: the accumulation of cash value over time. This cash value is a significant advantage, providing policyholders with a savings component and various investment options. Unlike term life insurance, which focuses solely on providing coverage for a specific period, whole life insurance ensures that the policy remains in force for the entire life of the insured individual. This longevity allows for the gradual accumulation of cash value, which can be utilized in several ways.

The cash value in whole life insurance is built through regular premium payments. A portion of each premium goes towards covering the policyholder's death benefit and the associated costs, while the remaining amount is invested in a separate account. This investment component can grow tax-deferred, allowing the cash value to accumulate steadily over time. As the policyholder makes consistent payments, the cash value grows, providing a financial asset that can be borrowed against or withdrawn, offering financial flexibility.

One of the key benefits of cash value accumulation is the ability to access funds without surrendering the policy. Policyholders can take out loans against the cash value, providing immediate access to funds for various purposes, such as education expenses or business ventures. Additionally, the cash value can be used to pay for future premiums, ensuring that the policy remains in force even if the insured individual faces financial challenges. This feature provides a safety net and financial security, especially during times of economic uncertainty.

Furthermore, the investment options associated with cash value accumulation can be tailored to the policyholder's financial goals and risk tolerance. Insurance companies often offer various investment accounts, allowing policyholders to choose how they want to allocate their cash value. This customization enables individuals to align their investments with their long-term financial objectives, such as retirement planning or wealth accumulation. The ability to invest within the policy provides a convenient way to build a diversified portfolio and potentially earn higher returns compared to traditional savings accounts.

In summary, whole life insurance with cash value accumulation offers a valuable savings and investment component. It provides policyholders with the opportunity to build a financial asset, access funds when needed, and tailor their investment strategy. This feature sets whole life insurance apart from other insurance types, making it an attractive option for those seeking long-term financial security and the potential for wealth creation. Understanding the mechanics of cash value accumulation is essential for individuals to make informed decisions about their insurance and investment needs.

Group Term Life Insurance: Taxable or Not?

You may want to see also

Flexibility: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

Whole life insurance offers a unique advantage in terms of flexibility, providing policyholders with a level of financial control that is not typically found in other insurance types. One of the key features of whole life insurance is the accumulation of cash value over time. This cash value is a result of the premiums paid and the investment of those premiums by the insurance company. Policyholders can access this cash value in several ways, offering a degree of flexibility that is highly beneficial.

One of the primary methods of accessing cash value is through policy loans. Policyholders can borrow money against the cash value of their policy, typically at a relatively low-interest rate. This loan can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. The advantage of using policy loans is that the interest rate is often fixed and competitive, and the loan is secured by the policy itself, making it a relatively secure form of borrowing. Repayments can be made over time, often with interest, ensuring that the policy remains in force and the cash value continues to grow.

Another way to access cash value is through policy withdrawals. Policyholders can take out a lump sum from the cash value, which can be used for immediate financial needs. This provides a level of financial freedom, allowing individuals to make significant purchases or investments without having to liquidate other assets. Withdrawals are typically subject to certain rules and restrictions, such as minimum withdrawal amounts and potential fees, but they offer a degree of control and accessibility that is appealing to many policyholders.

The flexibility provided by whole life insurance's cash value access is particularly valuable for those who want to ensure financial security and have a plan for their money. It allows individuals to make use of their insurance policy as a financial tool, providing a safety net while also offering the potential for growth and investment. This flexibility is a significant differentiator from other insurance types, where access to funds is often more restricted and may not provide the same level of control and customization.

In summary, whole life insurance's ability to offer financial flexibility through policy loans and withdrawals is a powerful feature. It allows policyholders to access their cash value in a way that suits their needs, providing a sense of security and control over their financial future. This flexibility is a key advantage of whole life insurance, setting it apart from other insurance products and making it an attractive option for those seeking comprehensive financial protection and investment opportunities.

Whole Life Insurance: Waiting Periods and Their Impacts

You may want to see also

Death Benefits: Provides a guaranteed death benefit, ensuring financial security for beneficiaries

Whole life insurance is a type of permanent life insurance that offers a unique and valuable feature: a guaranteed death benefit. This is a key differentiator from other insurance policies, such as term life insurance, and it provides a sense of financial security for the policyholder's beneficiaries. When you purchase whole life insurance, you are essentially making a commitment to provide a specific amount of financial support to your loved ones in the event of your passing. This guaranteed death benefit is a fixed amount that the insurance company promises to pay out upon your death, ensuring that your family or designated beneficiaries receive the intended financial assistance.

The beauty of this feature lies in its predictability and reliability. Unlike some other insurance products, whole life insurance does not rely on random factors or assumptions. The death benefit is locked in and will be paid out regardless of when the policyholder passes away, as long as the premiums are up to date. This predictability allows individuals to plan and budget with confidence, knowing that their family's financial needs will be met. For example, if a whole life insurance policy has a death benefit of $500,000, the beneficiaries will receive this exact amount when the insured person dies, providing a substantial financial safety net.

This guaranteed aspect of whole life insurance is particularly appealing to those who want to ensure their family's long-term financial stability. It offers peace of mind, knowing that the financial obligations associated with raising children, paying for education, covering living expenses, or funding other long-term goals will be met. By providing a fixed death benefit, whole life insurance becomes a reliable pillar of financial security, allowing individuals to focus on living their lives without constant worry about the future.

Furthermore, the guaranteed death benefit of whole life insurance can be a valuable asset for estate planning. It can help ensure that beneficiaries receive their intended share of the estate, even if other assets are depleted. This is especially important for those with substantial estates or complex family structures, as it provides a clear and certain way to distribute wealth according to the policyholder's wishes.

In summary, the guaranteed death benefit of whole life insurance is a powerful feature that sets it apart from other insurance types. It provides financial security and peace of mind, knowing that your loved ones will receive a specified amount of money when you pass away. This feature is particularly attractive to those seeking long-term financial planning and a reliable way to support their family's future. Understanding the death benefit's guarantee is essential when comparing different insurance options and making informed decisions about one's financial protection.

Ispa Insurance: Do They Offer Life Insurance Policies?

You may want to see also

Long-Term Financial Planning: Whole life is a tool for long-term wealth accumulation and financial planning

Whole life insurance is a powerful tool for long-term financial planning and wealth accumulation, offering a unique set of benefits that set it apart from other insurance products. This type of insurance provides a permanent coverage solution, ensuring that your loved ones are protected for their entire lives. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a guaranteed death benefit and a cash value component, making it an excellent choice for those seeking both protection and financial growth.

One of the key advantages of whole life insurance is its ability to act as a long-term investment. The cash value component of the policy grows over time, allowing policyholders to build a substantial savings account. This feature is particularly beneficial for long-term financial planning, as it provides a source of funds that can be used for various financial goals. For example, policyholders can borrow against the cash value or withdraw funds, providing flexibility and control over their financial resources.

In the context of long-term financial planning, whole life insurance can be a valuable asset for several reasons. Firstly, it provides a consistent and reliable source of income. The guaranteed death benefit ensures that your beneficiaries receive a predetermined amount, offering financial security during the most vulnerable times. Additionally, the cash value accumulation can be utilized to create a steady stream of income, either through policy loans or withdrawals, which can be particularly useful for retirement planning or funding other long-term financial objectives.

Another aspect of whole life insurance that contributes to long-term financial planning is its potential to provide tax advantages. The cash value growth within the policy may be tax-deferred, allowing your investments to grow without the immediate impact of taxes. This can result in significant tax savings over time, especially when compared to traditional investment vehicles. Furthermore, the death benefit received by beneficiaries is often tax-free, providing a substantial financial benefit to your loved ones.

For those with long-term financial goals, whole life insurance can be a strategic tool. It allows individuals to build a substantial financial cushion over time, which can be used to achieve various objectives. For instance, the accumulated cash value can be utilized to fund education expenses, provide a comfortable retirement income, or even be passed on to beneficiaries as part of an estate plan. By integrating whole life insurance into a comprehensive financial strategy, individuals can ensure that their long-term financial goals are not only protected but also actively worked towards.

Understanding Life Insurance Contracts: Insuring Agreement Explained

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a cash value component that grows over time. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers permanent coverage and a savings element, making it a comprehensive financial tool.

The cost of whole life insurance can vary depending on factors such as age, health, and the amount of coverage. Generally, it is more expensive than term life insurance because it provides coverage for a longer duration and includes a savings component. However, the premiums are typically lower compared to other permanent insurance options like universal life insurance, as whole life insurance has a fixed premium structure and a guaranteed death benefit.

One significant advantage is the lifelong coverage it provides, ensuring financial protection for your loved ones even if you pass away. Additionally, the cash value accumulation in whole life insurance can be borrowed against or withdrawn, offering financial flexibility. It also provides a guaranteed death benefit, meaning the insurance company will pay out a specific amount upon your passing, providing certainty and peace of mind.

Yes, one of the unique features of whole life insurance is its convertibility. If you decide to change your insurance needs or prefer a different type of coverage, you can typically convert your whole life policy to a term life policy or another permanent insurance option. This flexibility allows you to adapt your insurance plan as your life circumstances and financial goals evolve.