Whole life insurance is a type of long-term coverage designed to provide financial security for individuals and their families. It is particularly important for seniors as it offers a guaranteed death benefit, meaning the insurance company will pay out a predetermined amount to the policyholder's beneficiaries upon their passing. This type of policy is permanent, meaning it remains in force for the entire life of the insured individual, providing a sense of stability and peace of mind. Seniors can benefit from whole life insurance as it can help cover final expenses, such as funeral costs and outstanding debts, ensuring that their loved ones are not left with a financial burden during an already difficult time. Additionally, it can serve as a valuable asset, allowing policyholders to build cash value over time, which can be borrowed against or withdrawn to access the funds.

What You'll Learn

- Benefits: Whole life insurance for seniors offers lifelong coverage and a guaranteed death benefit

- Cost: Premiums remain consistent, providing financial security for the elderly

- Flexibility: Policies can be tailored to individual needs, including riders and optional benefits

- Longevity: It ensures financial protection for seniors, covering potential healthcare costs

- Legacy: Whole life insurance can help seniors leave a financial legacy for beneficiaries

Benefits: Whole life insurance for seniors offers lifelong coverage and a guaranteed death benefit

Whole life insurance is a type of long-term coverage designed to provide financial security and peace of mind for seniors. One of its key advantages is the lifelong coverage it offers, ensuring that individuals remain protected throughout their later years. This is particularly valuable for older adults who may have specific financial needs and goals, such as covering final expenses, providing for their loved ones, or funding a legacy.

The guaranteed death benefit is a cornerstone of whole life insurance. When an insured senior passes away, the insurance company pays out a predetermined amount to the designated beneficiaries. This financial safety net can help cover various expenses, including funeral costs, outstanding debts, or even provide a financial cushion for surviving family members. Knowing that there is a guaranteed payout can offer seniors and their families a sense of security and financial stability during an already challenging time.

Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the entire lifetime of the insured individual. This means that as long as the premiums are paid, the coverage will continue, providing a consistent level of protection. For seniors, this can be especially important as their health and financial needs may evolve over time, and whole life insurance offers a solution that adapts to these changes without requiring frequent policy adjustments.

Additionally, whole life insurance policies often accumulate cash value over time, which can be borrowed against or withdrawn, providing seniors with a source of funds for various purposes. This feature can be particularly beneficial for those who want to access their insurance's financial benefits without disrupting their coverage.

In summary, whole life insurance for seniors provides lifelong coverage, ensuring that individuals remain protected even in their later years. The guaranteed death benefit offers financial security and peace of mind, helping to cover essential expenses and provide for loved ones. With its adaptability and potential financial benefits, whole life insurance can be a valuable tool for seniors to secure their financial future and leave a lasting legacy.

Canceling Aditya Birla Life Insurance: A Step-by-Step Guide

You may want to see also

Cost: Premiums remain consistent, providing financial security for the elderly

Whole life insurance is a type of long-term coverage that offers a range of benefits, particularly for seniors. One of its key advantages is the cost structure, which is designed to provide financial security for the elderly. When you purchase this insurance, you pay a consistent premium throughout the entire duration of the policy. This means that unlike term life insurance, where premiums can increase over time, whole life insurance offers a fixed cost for the entire policy period.

For seniors, this consistency in pricing is a significant benefit. As individuals age, their health and financial situations may become more uncertain. With whole life insurance, the premium remains the same, ensuring that the elderly can afford the coverage they need without the worry of increasing costs. This predictability in expenses is especially valuable for those on a fixed income or with limited financial resources.

The consistent premium also provides a sense of financial security and peace of mind. Seniors can rest assured that their insurance coverage will not become unaffordable as they age, allowing them to maintain their financial plans and strategies without disruption. This stability is particularly important for those who have already invested in long-term care or retirement savings, as whole life insurance can complement these financial arrangements.

Furthermore, the fixed premium structure encourages individuals to maintain their coverage over the long term. Knowing that the cost will not increase makes it more appealing for seniors to continue their insurance policy, ensuring they are protected throughout their later years. This consistency in cost can be a powerful incentive for those who value financial stability and want to ensure their loved ones are taken care of.

In summary, whole life insurance for seniors offers a unique advantage with its consistent premium structure. This feature provides financial security, predictability, and peace of mind, allowing the elderly to maintain their coverage without the concern of increasing costs. By understanding the cost benefits, seniors can make informed decisions about their insurance needs and ensure a more secure future.

Adjustable Life Insurance: What's the Real Deal?

You may want to see also

Flexibility: Policies can be tailored to individual needs, including riders and optional benefits

Whole life insurance for seniors offers a unique and flexible approach to financial planning, providing a sense of security and peace of mind for individuals in their later years. This type of insurance is designed to cater to the specific needs and preferences of older adults, ensuring they receive the coverage they require. One of the key advantages is the adaptability of these policies, which can be customized to fit the individual's circumstances.

Seniors often have unique financial goals and requirements, and whole life insurance policies can be tailored accordingly. For instance, an older individual might want to ensure their loved ones are financially protected in the event of their passing. In this case, the policy can be structured to provide a substantial death benefit, offering financial security to the family. Additionally, the policyholder can choose to include riders, which are additional benefits that enhance the coverage. These riders could include accelerated death benefits, allowing the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, providing financial support for end-of-life care.

The flexibility of whole life insurance extends beyond the basic policy structure. It allows seniors to add optional benefits, ensuring the policy adapts to their changing needs over time. For example, an older adult might opt for an additional rider that provides long-term care benefits, which can be crucial if they require assistance with daily activities in the future. This flexibility ensures that the insurance policy remains relevant and valuable even as the individual's health and financial goals evolve.

Furthermore, the customization options available with whole life insurance for seniors can provide a sense of control and ownership over their financial future. Policyholders can decide on the premium payments, ensuring they are comfortable with the financial commitment. They can also choose the policy term, whether it's for a specific period or for the rest of their lives, depending on their preferences and financial strategies. This level of customization empowers seniors to make informed decisions about their insurance, ensuring it aligns with their personal circumstances.

In summary, whole life insurance for seniors is a flexible and adaptable financial tool. It allows older adults to customize their policies, including adding riders and optional benefits, to meet their specific needs. This flexibility ensures that the insurance remains a valuable asset, providing financial security and peace of mind as individuals age and their requirements change. With such tailored coverage, seniors can approach their later years with confidence, knowing their loved ones and financial goals are protected.

Understanding Expiry Dates: Life Insurance's Time Limits

You may want to see also

Longevity: It ensures financial protection for seniors, covering potential healthcare costs

Whole life insurance for seniors is a specialized financial product designed to provide long-term financial security and peace of mind for older individuals. It is a type of permanent life insurance that offers a range of benefits tailored to the unique needs of seniors, ensuring they are protected financially during their later years. This insurance is particularly crucial for seniors as it addresses the potential healthcare costs and expenses that can arise as they age.

As individuals progress into their senior years, the likelihood of requiring extensive medical care increases. Whole life insurance for seniors is structured to cover these potential healthcare costs, providing a safety net that can be invaluable. It ensures that seniors and their families are financially prepared for the unexpected medical expenses that may arise, such as long-term care, chronic illness management, or emergency treatments. With this insurance, seniors can have the confidence to age gracefully, knowing their financial well-being is protected.

The coverage provided by this insurance policy is comprehensive and long-lasting. It guarantees a death benefit, which means the insurance company will pay out a predetermined sum to the policyholder's beneficiaries upon their passing. This financial support can be used to cover various expenses, including funeral costs, estate distribution, and, most importantly, healthcare expenses. Additionally, some policies offer an accumulation of cash value over time, which can be borrowed against or withdrawn to cover immediate financial needs or healthcare costs.

One of the key advantages of whole life insurance for seniors is its predictability and stability. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong coverage. This ensures that seniors have financial protection throughout their lives, regardless of age-related changes in health or medical needs. The policy's long-term nature allows seniors to build trust and rely on the financial security it provides, fostering a sense of stability and peace of mind.

In summary, whole life insurance for seniors is a specialized financial tool that ensures financial protection and covers potential healthcare costs for older individuals. It provides a safety net during their later years, addressing the unique challenges of aging, such as increased medical expenses. With its lifelong coverage, cash value accumulation, and predictable benefits, this insurance empowers seniors to age with confidence, knowing their financial future is secure.

Berriol Insurance: Whole Life Policy Benefits and Drawbacks

You may want to see also

Legacy: Whole life insurance can help seniors leave a financial legacy for beneficiaries

Whole life insurance is a powerful tool for seniors to ensure their loved ones are taken care of and to leave a lasting financial legacy. This type of insurance provides a sense of security and peace of mind, especially for those who want to guarantee a financial safety net for their beneficiaries. When considering whole life insurance for seniors, it is essential to understand the long-term benefits it offers.

Seniors can utilize whole life insurance to create a substantial financial legacy. As individuals age, their life expectancy may become a concern, and whole life insurance provides a solution. The policy guarantees a death benefit, which is paid out as a tax-free lump sum to the designated beneficiaries upon the insured senior's passing. This financial inheritance can be a significant asset, allowing beneficiaries to cover various expenses, such as funeral costs, estate taxes, or even provide ongoing financial support. By choosing the right policy and ensuring adequate coverage, seniors can leave a substantial financial legacy, ensuring their loved ones are financially secure.

The beauty of whole life insurance lies in its permanence. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong coverage. This means that as long as the premiums are paid, the policy remains in force, providing a consistent financial safety net. For seniors, this is particularly valuable as it ensures that their beneficiaries are protected even in their later years. The policy's cash value also accumulates over time, providing a potential source of funds for the insured senior or their beneficiaries, which can be borrowed against or withdrawn to meet financial needs.

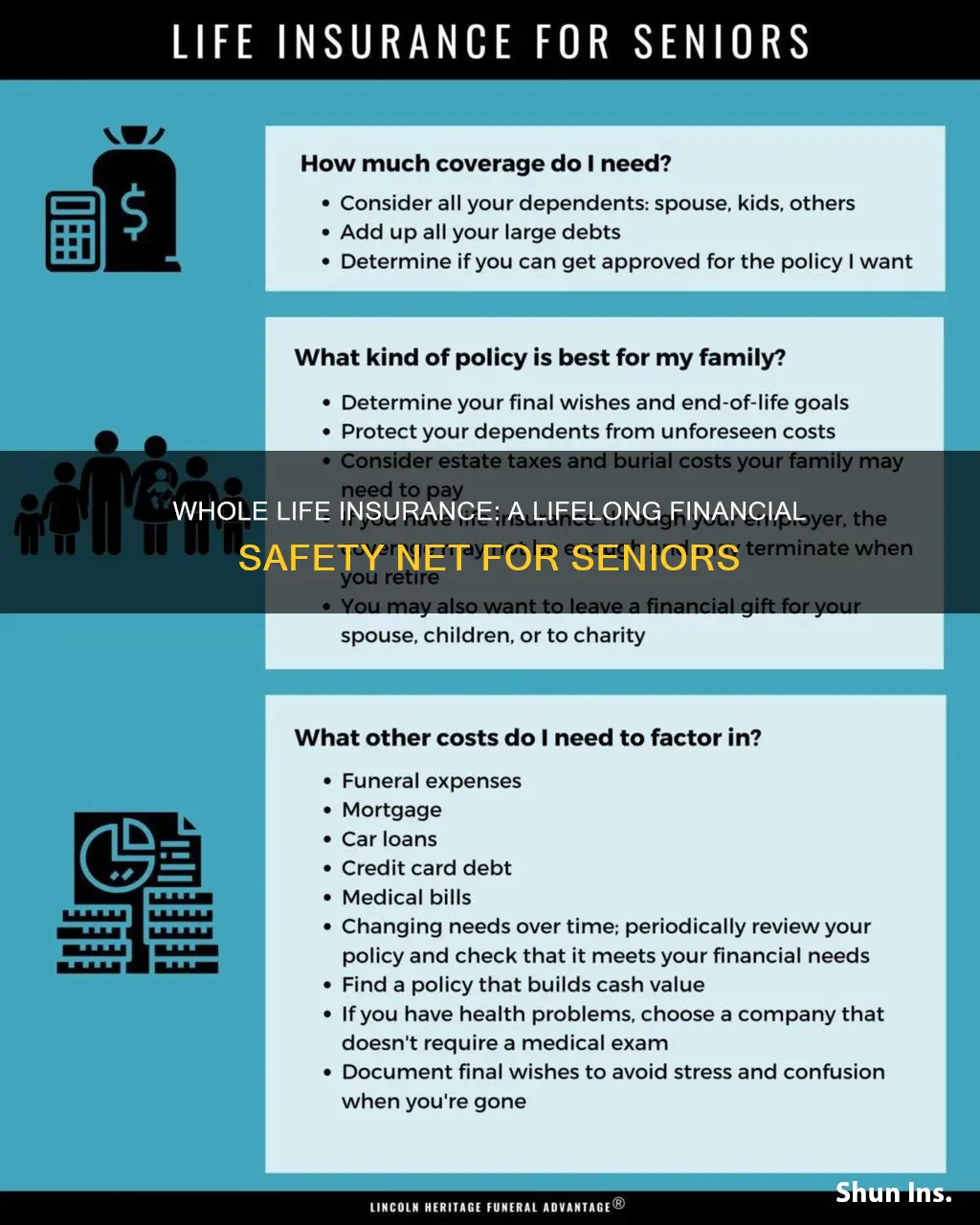

When selecting a whole life insurance policy, seniors should consider their specific needs and preferences. Factors such as the desired death benefit, premium affordability, and the policy's features (e.g., guaranteed death benefit, cash value accumulation) should be evaluated. Consulting with a financial advisor or insurance professional can help seniors make an informed decision, ensuring the policy aligns with their goals and provides the necessary financial legacy.

In summary, whole life insurance is an excellent strategy for seniors to leave a meaningful financial legacy. It offers guaranteed death benefits, lifelong coverage, and the potential for cash value accumulation. By carefully considering their options and seeking professional guidance, seniors can choose a policy that provides financial security and peace of mind, ensuring their loved ones are taken care of and their wishes are honored. This type of insurance is a valuable tool for those who want to make a lasting impact and provide for their beneficiaries' future.

American Income Life Insurance: Is It Worth the Hype?

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term financial product designed to provide coverage for seniors. It offers a guaranteed death benefit and a fixed premium that remains the same throughout the policyholder's lifetime. This type of insurance is particularly valuable for older individuals as it provides financial security and peace of mind, ensuring that their loved ones are protected even after they are gone.

Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers coverage for the entire life of the insured individual. The premiums are typically higher for seniors due to their age, but the policy builds cash value over time, which can be borrowed against or withdrawn. This feature makes it a more comprehensive and permanent solution for long-term financial planning.

Seniors can benefit from whole life insurance in several ways. Firstly, it provides a guaranteed payout to beneficiaries, ensuring financial support for loved ones. Secondly, the cash value accumulation can be used to pay for future expenses, such as long-term care or medical costs. Additionally, whole life insurance can be a valuable asset for estate planning, allowing seniors to leave a financial legacy to their heirs.

Yes, while the underwriting process may be more rigorous for seniors with health issues, it is still possible to obtain whole life insurance. Insurers consider various factors, including age, medical history, and lifestyle, to determine eligibility and premium rates. Some companies offer guaranteed acceptance plans for seniors, making it more accessible to those with pre-existing conditions.