Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. When it comes to life insurance, there are several types of accounts to consider, each with its own unique features and benefits. Understanding the different types of life insurance accounts is essential for making informed decisions about your financial protection. From term life insurance to permanent life insurance, whole life to universal life, and variable life to indexed universal life, each type offers distinct advantages and considerations. This introduction aims to explore these various life insurance account options, helping you navigate the complexities of choosing the right coverage to suit your specific needs and goals.

What You'll Learn

Term Life: Temporary coverage for a set period

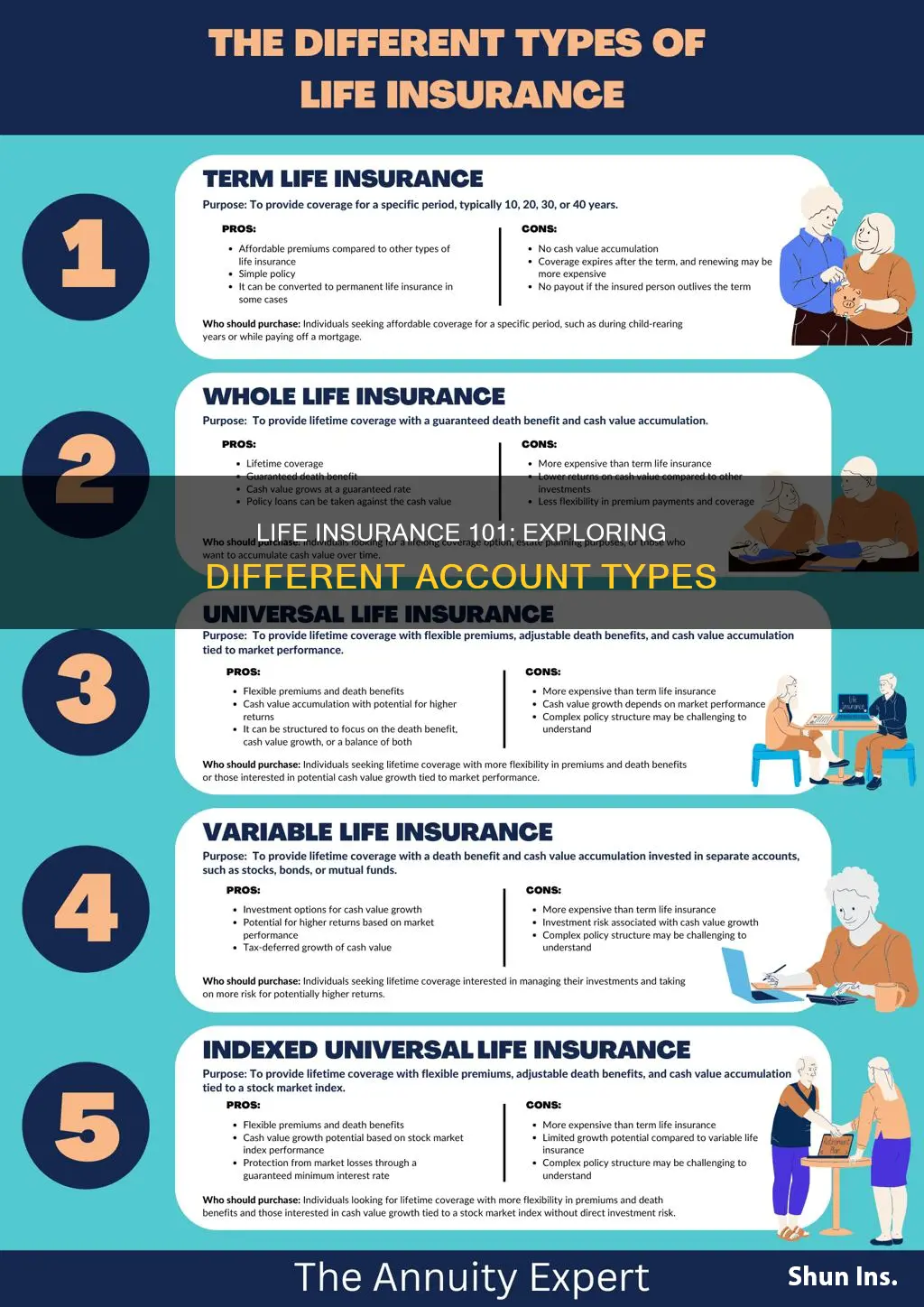

Term life insurance is a type of coverage that provides protection for a specific period, typically ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial stability for your loved ones during a defined period. This type of insurance is ideal for individuals who want to ensure their family's financial well-being without the long-term commitment of permanent life insurance.

The beauty of term life insurance lies in its simplicity. When you purchase a term policy, you agree to pay a fixed premium for a predetermined duration. During this term, the policy provides a death benefit, which is a lump sum amount paid to your beneficiaries if you pass away. This benefit can be used to cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring your family's financial obligations are met.

One of the advantages of term life insurance is its affordability. Since the coverage is temporary, the premiums are generally lower compared to permanent life insurance. This makes it an excellent option for those who want to maximize their coverage without straining their budget. Additionally, term life insurance offers flexibility, allowing you to choose the duration that best aligns with your financial goals and the needs of your beneficiaries.

There are different types of term life insurance policies available, including level term and decreasing term. Level term insurance maintains a consistent death benefit throughout the policy term, providing a steady level of coverage. On the other hand, decreasing term insurance starts with a higher death benefit and gradually decreases over time, often aligning with the decreasing value of long-term financial commitments.

When considering term life insurance, it's essential to evaluate your specific circumstances. Assess your financial obligations, the duration of your commitments, and the potential risks you want to mitigate. Consulting with a financial advisor can help you determine the appropriate term length and ensure you choose the right policy to provide adequate protection for your loved ones.

Contacting First Command: Steps to Get Your Life Insurance Payout

You may want to see also

Permanent: Long-term, lifelong coverage with cash value

Permanent life insurance, also known as lifelong coverage, is a type of insurance policy that provides long-term financial protection and offers a range of unique features. This type of insurance is designed to remain in force for the entire lifetime of the insured individual, ensuring that beneficiaries receive a death benefit when the insured person passes away. One of the key advantages of permanent life insurance is its ability to accumulate cash value over time, which can be a valuable asset for various financial goals.

The cash value component of permanent life insurance is a significant feature that sets it apart from other types of insurance. As the policyholder, you pay regular premiums, and a portion of these premiums is invested by the insurance company. This investment grows over time, generating interest and building up cash value. The cash value can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. This flexibility is a major benefit, especially for those who want a financial safety net that can adapt to their changing needs.

Over time, the cash value in a permanent life insurance policy can become substantial. It can be used to pay for the policy's future premiums, ensuring that the coverage remains in force even if the policyholder faces financial challenges. This is particularly useful for those who want to maintain their insurance coverage without the need for frequent premium payments. Additionally, the cash value can be a valuable asset that can be borrowed against or withdrawn, providing financial flexibility and security.

There are several types of permanent life insurance policies available, each with its own set of features and benefits. These include whole life insurance, universal life insurance, and variable universal life insurance. Whole life insurance offers level premiums and guaranteed death benefits, while universal life insurance provides flexibility in premium payments and death benefit amounts. Variable universal life insurance allows policyholders to invest a portion of their premiums in various investment options, offering potential for higher returns but also carrying more risk.

In summary, permanent life insurance with its associated cash value is a powerful financial tool that provides long-term coverage and a range of benefits. It offers a sense of security and financial flexibility, allowing individuals to build a valuable asset while ensuring their loved ones are protected. Understanding the different types of permanent life insurance policies can help individuals make informed decisions about their insurance needs and financial planning.

Life Insurance Rating: Is Third-Best Good Enough?

You may want to see also

Universal Life: Flexible premiums and investment options

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits and customization options. One of its key advantages is the ability to adjust premiums and tailor the policy to individual needs. Unlike traditional term life insurance, where premiums are fixed for a specified period, universal life insurance allows for more adaptability. Policyholders can choose to pay a minimum premium, ensuring the policy remains in force, or they can opt for higher payments to build up a larger cash value over time. This flexibility is particularly appealing to those who want to manage their insurance costs effectively, especially during periods of financial change or uncertainty.

The premium payments in universal life insurance are directly linked to the policy's investment component. A portion of each premium is allocated to an investment account, which can be managed by the insurance company or, in some cases, by the policyholder. This investment aspect allows individuals to potentially grow their money through various investment options, such as stocks, bonds, and mutual funds. The performance of these investments directly impacts the cash value of the policy, providing an opportunity for policyholders to benefit from market growth. As the cash value accumulates, it can be used to pay future premiums, ensuring the policy remains active without the need for additional payments.

A significant advantage of universal life insurance is the potential for long-term savings. The investment component can offer higher returns compared to traditional savings accounts, allowing the policyholder's money to grow faster. Over time, the cash value can become a substantial asset, providing financial security and flexibility. Additionally, the policyholder can access this cash value through loans or withdrawals, providing funds for various purposes, such as education expenses or business ventures. This feature makes universal life insurance an attractive option for those seeking both insurance protection and a long-term savings strategy.

Another aspect of universal life insurance's flexibility is the ability to customize the policy's death benefit. Policyholders can adjust the amount of coverage they want to ensure it aligns with their changing needs and financial goals. For instance, during their earning years, individuals might opt for a higher death benefit to provide financial security for their family. As they approach retirement, they may choose to reduce the coverage, aligning with their lower earning potential and potential reliance on other sources of income. This customization ensures that the insurance policy remains relevant and valuable throughout one's life.

In summary, universal life insurance stands out for its flexibility in premium payments and investment opportunities. It empowers individuals to take control of their insurance costs and financial growth. With the ability to adjust premiums, invest in various markets, and customize the death benefit, universal life insurance offers a comprehensive and adaptable solution for those seeking both insurance protection and a robust savings strategy. This type of policy provides a unique blend of security and flexibility, making it an attractive choice for a wide range of individuals and their specific life circumstances.

Life Insurance for Your Dog: Is It Possible?

You may want to see also

Whole Life: Permanent coverage with fixed premiums

Whole life insurance is a type of permanent life insurance that offers long-term coverage and a range of benefits. It is designed to provide financial security for the policyholder and their beneficiaries throughout their entire life, hence the term "permanent." One of the key advantages of whole life insurance is the stability it offers in terms of premiums. Unlike term life insurance, where premiums can vary over time, whole life insurance has fixed premiums that remain the same for the life of the policy. This predictability allows policyholders to plan and budget more effectively, knowing exactly how much they will pay each year.

With whole life insurance, the policyholder pays a set amount of premium regularly, typically on a monthly, quarterly, or annual basis. These premiums are invested by the insurance company, and the earnings are used to build a cash value component within the policy. Over time, the cash value grows, providing a substantial sum that can be borrowed against or withdrawn if needed. This feature makes whole life insurance a valuable financial tool, as it not only provides death benefit protection but also offers a means to accumulate wealth.

The fixed nature of whole life insurance premiums ensures that the policyholder's financial obligations remain consistent, providing peace of mind. This is particularly beneficial for those who want long-term financial planning and want to ensure that their loved ones are protected, regardless of economic fluctuations. Additionally, whole life insurance offers a guaranteed death benefit, meaning the insurance company will pay out a specified amount to the beneficiaries upon the policyholder's passing. This guaranteed payout can be a significant financial safety net for families and dependents.

Another advantage is the ability to build equity over time. As the cash value grows, it can be used to pay for various expenses, such as college tuition, home renovations, or business ventures. Policyholders can also choose to take out loans against the cash value, providing access to funds without disrupting the policy's coverage. This flexibility allows whole life insurance to serve multiple purposes, making it a versatile financial product.

In summary, whole life insurance provides permanent coverage with the benefit of fixed premiums, ensuring stability and predictability for policyholders. The accumulation of cash value and the ability to build equity make it a powerful tool for long-term financial planning. With its guaranteed death benefit and various policy options, whole life insurance offers comprehensive protection and wealth-building opportunities, making it an attractive choice for individuals seeking permanent and reliable coverage.

Understanding TPA: The Key to Efficient Life Insurance Processing

You may want to see also

Variable: Investment-based, offering potential for higher returns

Variable life insurance is a unique type of life insurance policy that combines the security of a death benefit with the potential for investment growth. Unlike traditional whole life insurance, which has a fixed premium and death benefit, variable life insurance offers policyholders more flexibility and control over their insurance portfolio. This type of policy is designed to provide a safety net for your loved ones while also allowing you to potentially grow your money through various investment options.

The 'variable' aspect refers to the policy's investment component. When you purchase a variable life insurance policy, a portion of your premium is allocated to an investment account. This investment account can be customized to suit your financial goals and risk tolerance. The policyholder can choose from a range of investment options, such as stocks, bonds, and mutual funds, which are managed by the insurance company or an external investment manager. This investment strategy offers the potential for higher returns compared to traditional fixed-income investments.

One of the key advantages of variable life insurance is the ability to adjust your investment strategy over time. Policyholders can make changes to their investment allocation, allowing them to take advantage of market opportunities or adjust for changing financial goals. For example, during periods of market growth, you might allocate more funds to stocks to potentially increase your returns. Conversely, in a more conservative market environment, you can shift your investments towards bonds or other fixed-income securities to preserve capital.

Additionally, variable life insurance policies often provide a death benefit that is linked to the performance of the underlying investments. This means that the death benefit amount can vary depending on the investment performance. If the investments grow significantly, the death benefit could be substantial, providing a larger financial safety net for your beneficiaries. However, it's important to note that the investment component also carries the risk of potential losses, and the value of the policy can fluctuate over time.

In summary, variable life insurance offers a flexible and potentially rewarding approach to life insurance. By combining insurance coverage with investment opportunities, policyholders can create a comprehensive financial plan. This type of policy is well-suited for individuals who want to actively manage their investments and potentially benefit from market growth while still ensuring financial security for their loved ones. As with any investment strategy, careful consideration and ongoing review are essential to make informed decisions.

Becoming a Phoenix Life Insurance Agent: A Guide

You may want to see also

Frequently asked questions

There are primarily three types of life insurance accounts: Term Life, Permanent Life, and Universal Life. Each type offers unique features and benefits, catering to different financial goals and needs.

Term Life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It is a cost-effective option for temporary protection. On the other hand, Permanent Life insurance, also known as whole life, offers lifelong coverage and includes a savings component, allowing for potential cash value accumulation over time.

Universal Life insurance is a flexible type of permanent life insurance. It provides coverage for the entire life of the insured and offers a variable death benefit. Policyholders can adjust their premiums and death benefits, and the cash value can grow tax-deferred, providing a source of funds for various financial needs.

Yes, there are different types of Permanent Life insurance, including Whole Life and Variable Universal Life. Whole Life offers consistent premiums and a guaranteed death benefit, while Variable Universal Life allows for potential higher returns on the cash value through investment options.

Selecting the appropriate life insurance account depends on your financial objectives, risk tolerance, and long-term goals. It's essential to evaluate your current and future financial needs, consider the level of coverage required, and seek professional advice to determine the best fit between the available options.