Life insurance is an important consideration for schools, as it provides financial protection for teachers and staff in the event of their passing. Schools often offer various types of life insurance policies to their employees, including term life, whole life, and universal life insurance. These policies can help cover expenses such as mortgage payments, student loans, and living expenses for the beneficiary, ensuring financial security for the family of the deceased. Understanding the different types of life insurance available and their benefits is crucial for educators to make informed decisions about their coverage and ensure their loved ones are protected.

What You'll Learn

- Term Life Insurance: Schools often provide temporary coverage for faculty and staff

- Whole Life Insurance: Permanent coverage with fixed premiums and a cash value component

- Group Life Insurance: Collective coverage for employees, typically offered by the school

- Accidental Death Insurance: Additional coverage for accidental death, often included in group plans

- Critical Illness Insurance: Covers major illnesses, offering financial support during treatment

Term Life Insurance: Schools often provide temporary coverage for faculty and staff

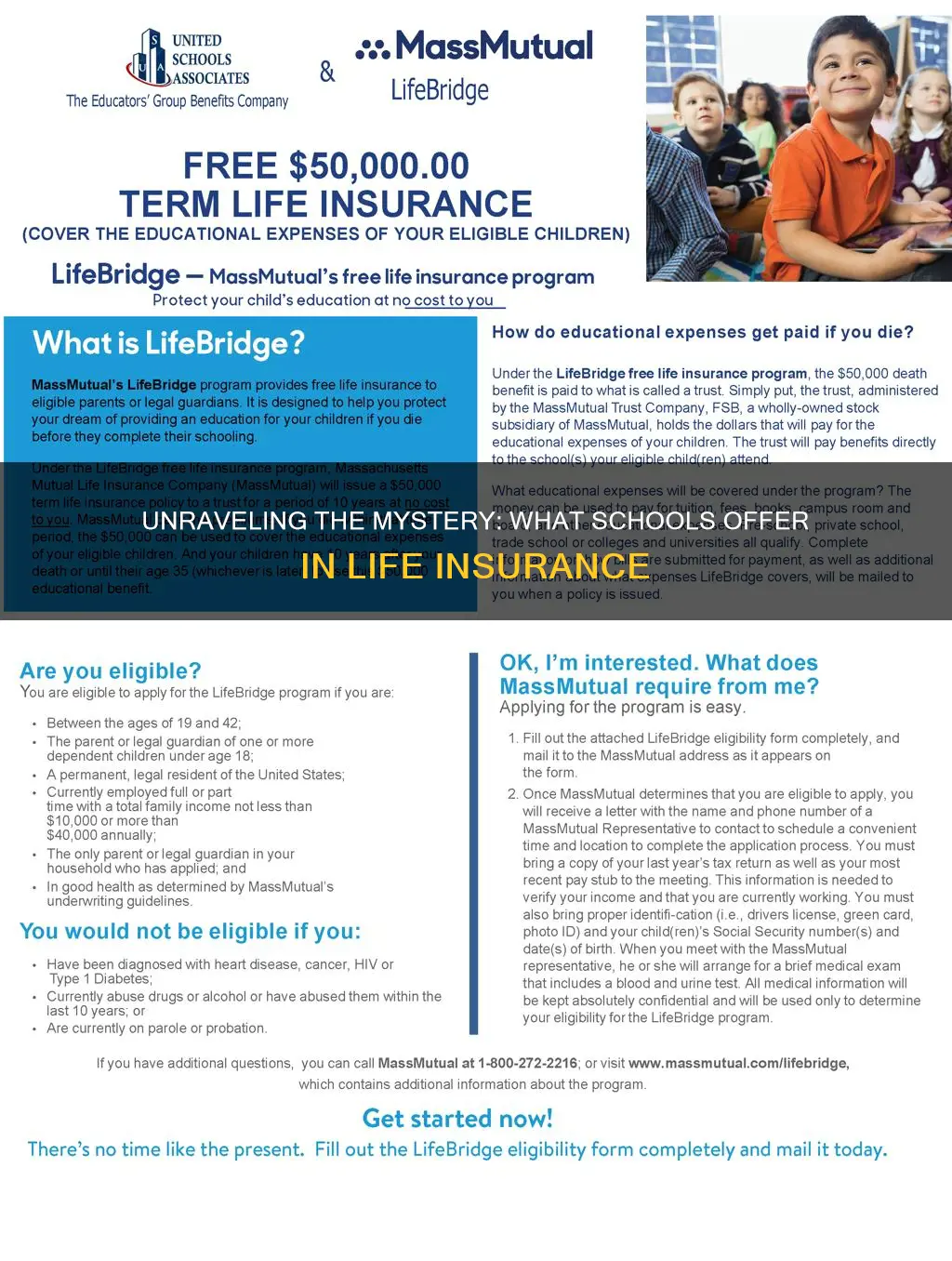

Term life insurance is a common type of coverage that schools often offer to their faculty and staff members. This insurance provides a temporary safety net for the policyholder's beneficiaries in the event of their death during the specified term period. It is a straightforward and cost-effective way for schools to ensure that their employees and their families are financially protected during their tenure.

The term period can vary, typically ranging from one to ten years, and sometimes even longer. During this period, the insurance company promises to pay out a predetermined amount if the insured individual passes away. This coverage is particularly useful for educators and staff who want to provide financial security for their loved ones without the long-term commitment of permanent life insurance.

Schools often make this insurance accessible to their employees through group policies, which can offer lower premiums compared to individual plans. By pooling the risks of multiple policyholders, schools can provide affordable coverage to their staff. This approach also simplifies the process for employees, as they can typically enroll in the plan without extensive medical examinations or health questions, making it a convenient option.

When considering term life insurance, it's essential to evaluate the specific needs of the individual and their family. Factors such as age, health, and the number of dependents will influence the premium rates and the overall cost of the policy. Schools should provide clear information about the available coverage options and encourage employees to choose a term length that aligns with their personal circumstances.

Additionally, schools can offer flexibility by allowing employees to adjust their coverage as their lives change. For instance, a faculty member might opt for a longer term policy if they plan to have children or take on additional financial responsibilities. This adaptability ensures that the insurance remains relevant and valuable throughout the employee's time with the school.

Life Insurance Agents: Canada's Competitive Market Overview

You may want to see also

Whole Life Insurance: Permanent coverage with fixed premiums and a cash value component

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the term "permanent." One of its key advantages is the stability it offers in terms of premiums and coverage. Unlike term life insurance, which has a specific period of coverage, whole life insurance remains in force as long as the premiums are paid. This predictability is particularly valuable for individuals who want long-term financial protection for their families or beneficiaries.

In a whole life insurance policy, the premium amount remains fixed throughout the life of the policyholder. This means that the insured individual pays the same amount each year, providing a sense of financial planning and security. The fixed nature of the premiums is a significant differentiator from other life insurance products, ensuring that the policyholder's budget remains consistent over time.

Another essential feature of whole life insurance is the inclusion of a cash value component. This aspect of the policy allows the policyholder to build up a cash reserve over time. A portion of the premium payments goes into an investment account, which grows tax-deferred. The cash value can be borrowed against or withdrawn, providing a source of funds that can be used for various purposes, such as paying for college tuition, starting a business, or covering unexpected expenses. This feature also ensures that the policyholder has a financial asset that can be utilized or passed on to beneficiaries.

The cash value accumulation in whole life insurance is particularly beneficial for long-term financial goals. It allows individuals to build a substantial sum over the years, providing a financial safety net and potential wealth-building opportunity. Additionally, the cash value can be used to pay for the premiums in the future, ensuring that the policy remains in force even if the primary source of income is no longer available.

When considering whole life insurance, it is essential to evaluate your specific needs and financial goals. The policy's flexibility in terms of premium payments and cash value accumulation makes it a versatile option for various life stages. Whether you are a parent wanting to secure your child's future, a homeowner seeking additional financial security, or an individual looking to build a legacy, whole life insurance can provide the permanent coverage and financial benefits you require.

Health and Life Insurance: Licensing Requirements and Benefits

You may want to see also

Group Life Insurance: Collective coverage for employees, typically offered by the school

Group life insurance is a type of coverage that provides financial protection for a group of individuals, in this case, the employees of a school. It is a common benefit offered by educational institutions to their staff, ensuring that their loved ones are financially secure in the event of the employee's untimely passing. This type of insurance is a valuable addition to any employee's benefits package, offering peace of mind and a safety net for their families.

When a school offers group life insurance, it means that the entire workforce is covered under a single policy. This collective approach simplifies the process for both the employer and the employees. The school acts as the policyholder, managing the administration and ensuring the coverage is in place. Group life insurance typically provides a death benefit, which is a lump sum payment made to the designated beneficiaries upon the insured individual's death. This benefit can be a significant financial cushion for the family, helping to cover various expenses and provide financial stability during a difficult time.

The coverage amount for group life insurance can vary depending on the school's policy and the employee's role and salary. Schools often offer different tiers of coverage to cater to various needs. For instance, a basic level of coverage might provide a set amount per employee, while higher tiers could offer more substantial benefits. It is essential for employees to understand the terms and conditions of their group life insurance policy, including any exclusions or limitations, to ensure they are adequately protected.

One of the advantages of group life insurance is that it is often more affordable than individual policies. The collective nature of the coverage allows for lower premiums, making it an attractive benefit for both the employer and the employees. Additionally, schools can customize the policy to fit their budget and the specific needs of their workforce, ensuring that the coverage is tailored to the unique circumstances of the educational institution and its staff.

Employees should review the group life insurance policy provided by their school to ensure it meets their expectations and provides adequate coverage. They can also consider the option to purchase additional individual life insurance to supplement the group policy, especially if they have specific financial goals or obligations. By understanding the benefits and taking proactive steps, employees can ensure that they and their families are protected, even in the face of unforeseen circumstances.

Mountain Climbing: Is Your Life Insurance at Risk?

You may want to see also

Accidental Death Insurance: Additional coverage for accidental death, often included in group plans

Accidental Death Insurance is an essential component of life insurance coverage that schools often provide as part of their employee benefits package. This type of insurance offers an additional layer of financial protection for educators and staff in the event of an accidental death. While it might seem counterintuitive to focus on accidents, which are typically rare, this coverage ensures that the financial well-being of the policyholder's family is protected in unforeseen circumstances.

In group life insurance plans, accidental death insurance is often included as a standard feature, providing coverage in addition to the basic life insurance policy. This means that if an employee were to pass away due to an accident, the beneficiary would receive a death benefit, which can be a substantial financial cushion. The amount of coverage can vary depending on the school's policy and the employee's role, age, and other factors.

Accidents can happen anywhere and at any time, and they often result in sudden and unexpected fatalities. For instance, a teacher might be involved in a car accident on their way to work, or a staff member could suffer a traumatic injury during a recreational activity. In such cases, the accidental death insurance would kick in, providing financial support to the family, covering expenses like funeral costs, outstanding debts, and even daily living expenses for a period of time.

This type of insurance is particularly valuable for school employees who engage in potentially risky activities as part of their job, such as coaches, teachers who organize outdoor activities, or staff involved in maintenance or construction work. It provides peace of mind, knowing that their loved ones will be financially secure if an accident occurs.

When reviewing the life insurance options provided by your school, it is crucial to understand the terms and conditions of the accidental death insurance coverage. This includes knowing the waiting periods, coverage limits, and any exclusions that might apply. By being well-informed, employees can ensure they have adequate protection for themselves and their families.

Oral Swab Test: Vaping and Life Insurance

You may want to see also

Critical Illness Insurance: Covers major illnesses, offering financial support during treatment

Critical Illness Insurance is a type of coverage that provides financial support to individuals facing major health issues. This insurance is designed to offer a lump sum payment or regular income if the policyholder is diagnosed with a critical illness, such as cancer, heart attack, stroke, or other specified conditions. The primary purpose is to ensure that the individual and their family have the necessary financial resources to manage the challenges that arise during the treatment and recovery process.

When it comes to critical illness insurance, the policy typically covers a range of serious medical conditions that can significantly impact an individual's health and well-being. These illnesses often require extensive medical treatment, hospitalization, and, in some cases, long-term care. The insurance company will pay out the agreed-upon benefit amount once the diagnosis is confirmed, providing immediate financial relief. This coverage can be particularly valuable as it allows individuals to focus on their health and recovery without the added stress of financial concerns.

The benefits of critical illness insurance are numerous. Firstly, it provides peace of mind, knowing that you and your loved ones will be financially protected in the event of a major health crisis. This type of insurance can cover a significant portion of medical expenses, including hospital stays, surgeries, medications, and even follow-up care. Moreover, it can help individuals maintain their standard of living during and after treatment, ensuring that they can continue to meet their financial obligations and support their families.

Another advantage is that critical illness insurance can be tailored to individual needs. Policyholders can choose the coverage amount, duration, and specific illnesses covered based on their preferences and risk assessment. This customization ensures that the insurance plan aligns with personal circumstances, providing comprehensive protection when it matters the most. Additionally, some policies offer additional benefits, such as income replacement or guaranteed renewal, further enhancing the value of the coverage.

In summary, critical illness insurance is a vital component of a comprehensive life insurance strategy, especially for those who want to ensure financial security during challenging health situations. It provides a safety net, allowing individuals to navigate major illnesses with the assurance that their financial well-being is protected. By understanding the coverage and benefits, individuals can make informed decisions about their insurance needs and choose the right policy to safeguard their future.

Make Money with NY Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

Life insurance provided by schools is typically a group policy designed to offer financial protection to the beneficiaries (often the family) of a student or staff member in the event of their death. It provides a financial safety net to help cover expenses and support loved ones during a difficult time.

Schools often provide life insurance as part of their employee benefits package or as a benefit for students and their families. Check with your school's human resources department or student services to confirm if this coverage is available. They can provide details on the policy, coverage amounts, and any associated costs or enrollment processes.

Schools may offer various types of life insurance policies, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers long-term coverage that can accumulate cash value over time. The specific options available may vary depending on the school's policies and partnerships with insurance providers.

The process for enrolling or adjusting life insurance coverage can vary. Typically, schools provide clear instructions and forms for employees or students to complete. This may involve providing personal and financial information, choosing coverage amounts, and selecting beneficiaries. Schools might also offer the option to increase or decrease coverage annually or upon significant life events. It's essential to review the school's guidelines and seek assistance from the designated support staff for accurate enrollment or changes.