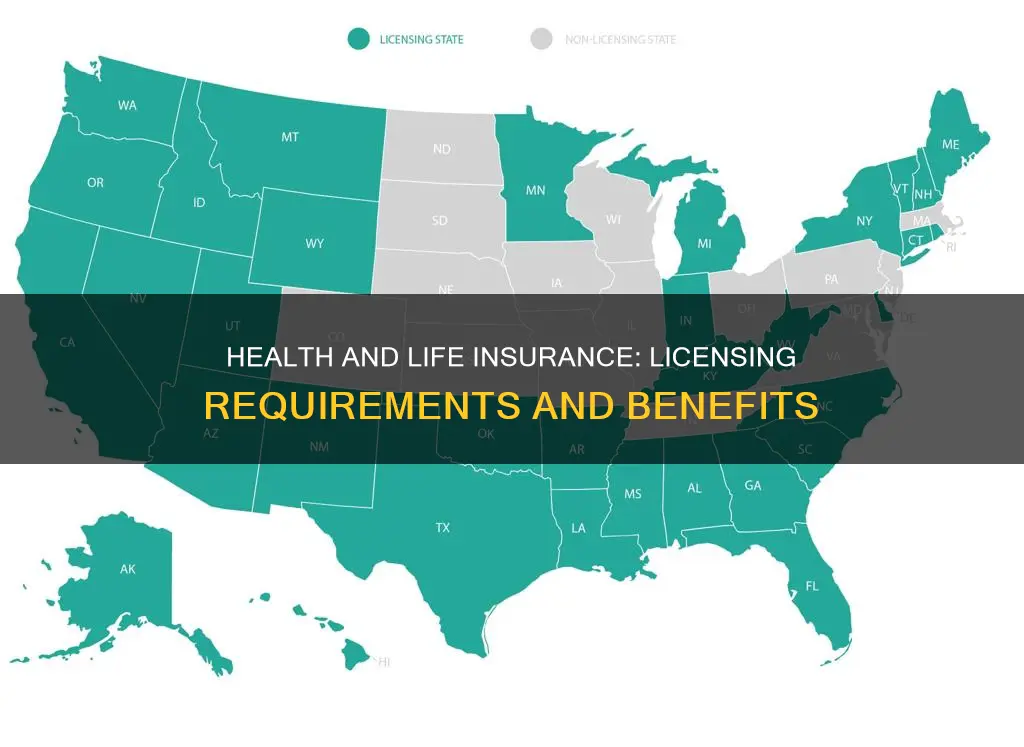

A health and life insurance license is a professional certification that allows agents to sell and advise on health and life insurance policies and products. This license is granted by state authorities and permits the selling of insurance policies within the issuing state. The requirements for obtaining a health and life insurance license vary across states, but generally, candidates must be at least 18 years old, complete pre-licensing education, pass a state licensing exam, and pass a background check. The license enables agents to work independently or for an insurance agency, selling and providing advice on health and life insurance to clients.

| Characteristics | Values |

|---|---|

| Purpose | To sell life and/or health insurance in a specific state |

| Prerequisites | Vary by state, but typically include completing a pre-licensing education course, passing a state licensing exam, and undergoing a background check |

| Scope of Coverage | Life insurance, accident insurance, and health insurance |

| Licensing Requirements | Completing pre-licensing education, passing a state licensing exam, and meeting state-specific requirements |

| Responsibilities | Selling insurance policies, advising clients, assisting with claims and inquiries, staying up-to-date with industry trends |

| Continuing Education | Ongoing requirements to stay informed about industry changes, new products, and regulations |

| Regulatory Oversight | Licensing and regulation overseen by state insurance departments or commissions to protect consumers and maintain industry integrity |

| Application Requirements | Online registration, completion of pre-licensing education, background check |

| Fees | Vary by state, typically include exam fees and license application fees |

| Renewal Period | Varies by state, typically 2 years with renewal fees |

What You'll Learn

Life and Health Insurance Licenses

A Life and Health Insurance License is a professional certification that allows agents to sell and advise on various life and health insurance policies and products. This license is granted by state authorities in the US and the requirements vary across states. The license generally allows agents to market and sell life and health insurance policies to their customers.

The license covers three main areas of insurance:

- Life Insurance: This provides financial stability to the dependents of the policyholder after their death.

- Accident Insurance: This provides income protection for incidents such as injuries, disability, and unintentional death.

- Health Insurance: This covers expenses associated with medical treatments, hospitalization, and other health-related costs.

How to Get a Life and Health Insurance License

The requirements to obtain a Life and Health Insurance License vary across US states, but typically include:

- Completing a pre-licensing education course: This involves a specified number of hours of coursework covering insurance principles, ethics, policy types, and regulations.

- Passing a state licensing exam: Candidates must pass a life and health insurance exam administered by their state's insurance regulatory authority. The exam assesses knowledge of insurance concepts, laws, and regulations.

- Background check: Some states require candidates to undergo a criminal background check.

- Application and fee: After passing the exam, candidates must submit an application and pay a fee to obtain their license.

Benefits of a Life and Health Insurance License

Obtaining a life and health insurance license offers several benefits, including:

- Greater job opportunities: Insurance agents are in high demand, and a license provides access to a wider range of job options.

- Higher earning potential: Many licensed insurance agents become high-income earners within the field.

- Serving the community: A license allows agents to provide vital financial protection and advice to their clients and communities.

Life Insurance: Geico's Offer and Your Options

You may want to see also

The Licensing Exam

The Life and Health Insurance License exam is a requirement for anyone wishing to sell life and health insurance in their state. The exam is administered by each state's insurance regulatory authority and must be passed before an individual can receive their license. While the specific requirements vary by state, there are some general guidelines that apply across the board.

The exam will cover a range of topics, including insurance concepts, laws, and regulations. It is designed to test your knowledge of the insurance industry and your ability to sell and provide advice on insurance products. To prepare for the exam, candidates must complete a pre-licensing education course that covers insurance principles, ethics, policy types, and regulations. The number of hours required for the course will depend on the state but expect a minimum of 40 hours.

The exam itself is a proctored, multiple-choice exam, which means an individual will be present while you take the assessment, either in person or via a computer. The exam will typically consist of around 100-150 questions, and you will need to complete it in around 2.5 to 3 hours. The cost to take the exam ranges from $40 to $150, depending on your state, and you will need to score a minimum of 70% to pass.

It is important to prepare thoroughly for the exam, as the pass rate for first-time test-takers is around 50%. In addition to completing the pre-licensing education course, you may also want to consider taking practice exams and reviewing your state's exam outline to familiarize yourself with the specific topics that will be covered.

Once you have passed the exam, you will be well on your way to becoming a licensed life and health insurance agent. However, there are still a few more steps to complete, including applying for your license and fulfilling any ongoing continuing education requirements.

Life Insurance for Seniors: Permanent Options Available?

You may want to see also

The Application Process

The process of obtaining a health and life insurance license typically involves the following steps:

Education and Pre-Licensing Requirements

Most states require individuals to complete a pre-licensing education course before they can sit for the insurance license exam. The number of hours required varies by state and the type of license being sought. These courses can often be taken online or in a classroom setting, covering topics such as insurance laws, regulations, ethics, and the basics of insurance products.

Exam Registration and Scheduling

After completing the pre-licensing education, individuals must register to take the state insurance licensing exam. This typically involves submitting an application and paying a fee to the state insurance department or its designated testing provider. The exam can usually be scheduled at a convenient time and location, such as a local testing center.

Taking the Insurance License Exam

The state insurance license exam tests an individual's knowledge of the topics covered in the pre-licensing education course. It typically consists of a combination of multiple-choice questions and may be taken on a computer or with a paper and pencil format. Passing the exam usually requires attaining a minimum score, which varies across states.

Submitting the License Application

Once the individual has successfully passed the exam, they can proceed to apply for their insurance license. This involves completing and submitting an application form, usually directed to the state insurance department, along with any necessary fees. A background check, which may include fingerprinting, might also be required during the licensing process to ensure the applicant meets the required standards of honesty and integrity.

Maintaining the License

After obtaining a health and life insurance license, individuals must stay up-to-date by completing continuing education (CE) credits to maintain their license. The specific requirements vary by state but typically involve completing a certain number of hours of approved CE courses annually or over a specified renewal period. These courses help insurance professionals remain current with industry changes, regulations, and product knowledge.

Factors Affecting Life Insurance Rates: Understanding the Basics

You may want to see also

License Renewal

The renewal process for a health and life insurance license will vary depending on the state in which you are licensed. Most states have a renewal period of two years and fees ranging from $15 to $200 per line. In Texas, for example, the renewal fee is $50, and there is a $25 late fee if payment is not made before the expiration date. In New York, a completed renewal application and prescribed fees must be filed every two years.

To renew your license, you will typically need to provide your license number, the last four digits of your Social Security Number, date of birth, and applicant, licensee, license, and residency type. You may also need to provide your National Producer Number (NPN), which is a unique identifier assigned during the licensing application process.

In addition to paying any required fees, you must also complete continuing education (CE) requirements to keep your license in good standing. The number of hours required varies by state, but it is typically between 16 and 30 hours per line. These hours must be completed before your license expiration date to avoid fines and delays in your license renewal. In Texas, for example, you must complete 24 hours of CE every two years, including a minimum of 12 hours of "classroom" or "classroom-equivalent" courses and three hours of ethics.

It is important to stay up-to-date with the specific requirements and guidelines of your state, as there may be additional steps or considerations for renewing your health and life insurance license.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

Career Prospects

The career prospects for individuals with a health and life insurance license are varied and promising. Here are some of the popular career options to consider:

Life Insurance Agent:

Life insurance agents sell life insurance policies, annuities, and work with clients and beneficiaries to process insurance claims. They need to have strong marketing skills and excellent interpersonal and communication skills. Life insurance agents can be "captive," working exclusively for one insurance company, or "independent," selling products from multiple companies. The average salary for a life insurance agent as of November 2019 was $79,606, and they are typically paid on commission.

Health Insurance Agent:

Health insurance agents sell health-related products and insurance to their clients. They help clients understand their options, and assist them with claims settlement. Health insurance agents also guide people in navigating healthcare exchanges and choosing the coverage that suits their needs and budget. Strong customer service, analytical skills, and verbal and written communication skills are essential for this role. Health insurance agents can also be captive or independent. In most U.S. states, the health insurance agent license is packaged with life insurance qualifications. The average salary for a health insurance agent was $55,839 as of November 2019, and they are paid by commission.

Property and Casualty Insurance Agent:

This is a great entry-level option for those with a fresh insurance license. Property and casualty insurance agents help clients insure their property, such as autos, homes, and valuables, against damage or legal liability, and assist them with claims settlement. All states in the U.S. require licensed drivers to have auto insurance, and mortgage loan companies mandate homeowners insurance, ensuring a consistent demand for these agents. Like life and health insurance agents, property and casualty insurance agents can work independently or for a single company. The average salary for this position was $48,723 as of November 2019.

Claims Adjuster:

Claims adjusters investigate incidents or catastrophes to determine a fair settlement price. They gather information such as police reports, witness statements, and photos of property damage. They may work as full-time employees or contractors, and sometimes specifically for a single insurance company. Some claims adjusters also work on behalf of policyholders, helping them file claims if they believe the proposed settlement is unfair. Most states require claims adjusters to be licensed, which can be obtained through licensing education and passing an exam. The average salary for a claims adjuster was $54,479 as of November 2019.

Insurance Underwriter:

Insurance underwriters evaluate insurance applications to decide whether to provide insurance coverage, and if so, the amount and premium. They act as intermediaries between insurance agents and the insurance company, managing the balance between the desire to sell policies and the company's risk mitigation goals. While licensing is not required for this position, some underwriters choose to obtain a license in the same specialty as their underwriting, such as life or property and casualty insurance. The average salary for an insurance underwriter was $71,116 as of November 2019.

The insurance industry offers a range of career paths, and the demand for insurance agents is expected to grow. With the right combination of skills, knowledge, and perseverance, individuals with a health and life insurance license can look forward to promising career prospects and advancement opportunities.

Life Insurance and Schizophrenia: What's the Verdict?

You may want to see also

Frequently asked questions

A Health and Life Insurance License is a professional certification that allows agents to sell and advise on health and life insurance policies and products. This license is granted by state authorities and permits the recipient to solicit and sell health and life insurance within that state.

Obtaining a Health and Life Insurance License opens up more job opportunities, increases earning potential, and enables agents to provide essential services to their communities.

The requirements vary by state, but generally include completing a pre-licensing education course, passing a state licensing exam, undergoing a background check, and meeting state-specific requirements.

Candidates must complete a pre-licensing course offered by approved insurance pre-licensing education providers. These courses cover topics such as insurance principles, ethics, policy types, regulations, contract provisions, and risk management.

No, it is not mandatory to obtain both licenses. Insurance agents can choose to specialize in either health or life insurance policies. However, most agents obtain both licenses to offer a wider range of services to their clients.