VGLI, or Veterans Group Life Insurance, is a type of life insurance specifically designed for veterans of the U.S. military. It offers a range of coverage options tailored to the unique needs of veterans, providing financial protection and peace of mind. VGLI is a valuable resource for veterans, ensuring they and their families are supported in the event of unforeseen circumstances. This insurance is an essential benefit for those who have served their country, offering a safety net that can be a significant asset in various life stages.

What You'll Learn

- VGLI: Veterans Group Life Insurance, a U.S. military benefit offering coverage and options

- VGLI Benefits: Provides financial security for military families with competitive rates and terms

- VGLI Comparison: Compare VGLI to other life insurance plans for veterans

- VGLI Eligibility: Understand who is eligible for VGLI enrollment and coverage

- VGLI Premiums: Learn about VGLI premium payments and their impact on coverage

VGLI: Veterans Group Life Insurance, a U.S. military benefit offering coverage and options

Veterans Group Life Insurance (VGLI) is a comprehensive life insurance program specifically designed for U.S. military veterans. It is a valuable benefit offered by the Department of Veterans Affairs (VA) to provide financial security and peace of mind to veterans and their families. VGLI offers a range of coverage options and is tailored to meet the unique needs of those who have served in the armed forces.

This insurance program is a group policy, meaning it is available to veterans as a package deal, providing an efficient and cost-effective way to secure life insurance. VGLI offers two primary types of coverage: Basic and Optional. The Basic VGLI plan provides a standard level of coverage, ensuring that veterans and their beneficiaries receive a solid foundation of financial protection. This basic coverage is available to all eligible veterans and is a valuable asset for those seeking a straightforward insurance solution.

For those seeking additional coverage, the Optional VGLI plan presents a range of customizable options. This plan allows veterans to tailor their insurance to their specific needs and preferences. The optional coverage includes various death benefits, such as an increased death benefit, which provides a higher payout in the event of the veteran's passing, ensuring that their loved ones are adequately provided for. Other optional features may include waiver of premium, which allows veterans to temporarily suspend payments if they become disabled, and a conversion privilege, enabling veterans to convert their VGLI policy to a permanent life insurance plan.

One of the key advantages of VGLI is its affordability. The premiums are typically lower compared to individual life insurance policies, making it an attractive and accessible option for veterans. The VA sets the rates, ensuring that the cost remains reasonable for those who have served their country. Additionally, VGLI offers a simplified underwriting process, which means that veterans may not need to undergo extensive medical exams, making it even more accessible to a wide range of applicants.

Enrolling in VGLI is a straightforward process. Veterans can apply directly through the VA or via their local VA medical center. The application typically requires providing personal and military service information, and veterans may be asked to complete a health questionnaire. Once approved, veterans can choose their preferred coverage options and make the necessary premium payments. This benefit is an excellent way for veterans to secure their financial future and provide long-term protection for their families.

Rescheduled Appointments: Life Insurance Agents' Frequency Woes

You may want to see also

VGLI Benefits: Provides financial security for military families with competitive rates and terms

VGLI Benefits: Financial Security for Military Families

VGLI, or Veterans Group Life Insurance, is a valuable benefit designed to provide financial security for military families. This insurance program offers a range of competitive rates and terms tailored to the unique needs of veterans and their loved ones. By understanding the VGLI benefits, military personnel and their families can make informed decisions about their financial well-being.

One of the key advantages of VGLI is its competitive rates. The insurance is offered at affordable prices, ensuring that military families can access comprehensive coverage without incurring excessive costs. These competitive rates make it an attractive option for those seeking reliable life insurance without breaking the bank.

In addition to competitive pricing, VGLI provides flexible terms that can be customized to suit individual needs. Military personnel can choose the level of coverage that aligns with their specific requirements, ensuring that their families are adequately protected. This flexibility allows for a personalized approach to life insurance, catering to the diverse circumstances of military families.

The VGLI program also offers a range of additional benefits. These may include options for accelerated death benefits, allowing policyholders to receive a portion of their death benefit if they are diagnosed with a terminal illness. Such features provide an extra layer of financial security, ensuring that military families are supported even in challenging times.

By enrolling in VGLI, military families can gain peace of mind, knowing that they have a reliable financial safety net. The combination of competitive rates, flexible terms, and additional benefits makes VGLI an excellent choice for those seeking to secure their loved ones' future. It is a valuable resource that empowers military personnel to make informed decisions about their family's financial well-being.

Life Insurance: Credit Checks and Their Role

You may want to see also

VGLI Comparison: Compare VGLI to other life insurance plans for veterans

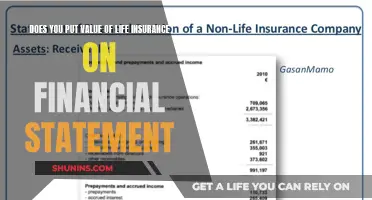

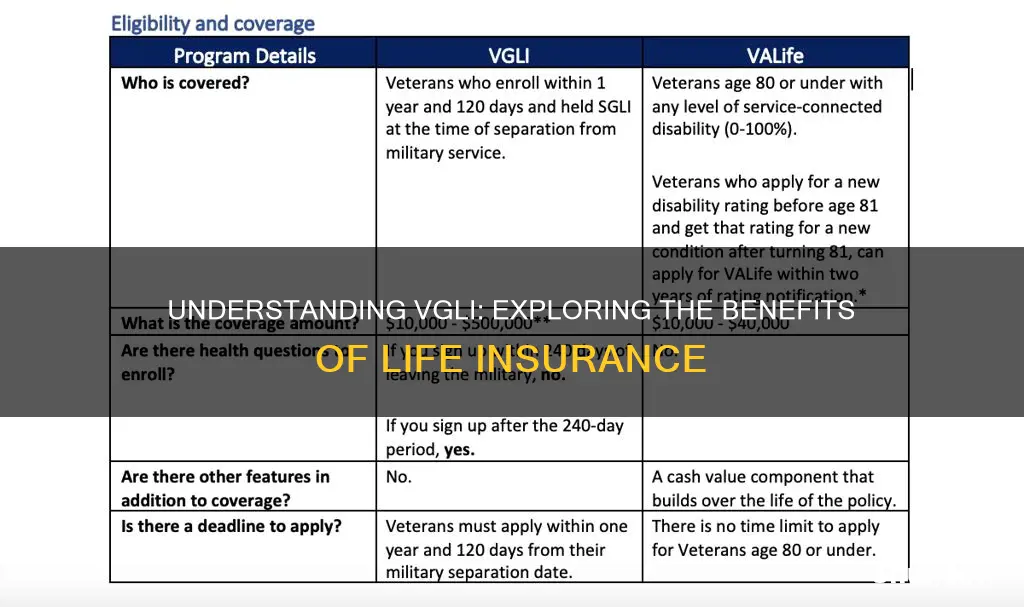

Veterans' Group Life Insurance (VGLI) is a unique life insurance program specifically designed for U.S. military veterans. It offers a comprehensive and affordable way to secure financial protection for veterans and their families. When comparing VGLI to other life insurance plans, it's essential to understand its distinct features and how it benefits veterans.

One of the key advantages of VGLI is its guaranteed acceptance for veterans. Unlike many other life insurance policies, VGLI does not require a medical examination or health assessments, making it accessible to veterans with pre-existing conditions or disabilities. This feature sets it apart from traditional term life insurance, which often requires a medical evaluation and may be more challenging to obtain for veterans with health issues. VGLI provides a straightforward and efficient way to secure coverage without the typical medical underwriting process.

In terms of coverage, VGLI offers a fixed amount of insurance, typically ranging from $10,000 to $100,000, depending on the veteran's service-connected disability rating. This fixed benefit is a significant advantage as it provides a clear and predictable level of financial protection. Other life insurance plans, such as term life insurance, often offer variable benefits that can change over time, making it harder to plan and budget for the future. With VGLI, veterans can have peace of mind knowing their coverage will remain consistent and reliable.

Another aspect to consider is the cost. VGLI is known for its competitive pricing, especially for veterans with disabilities. The premiums are generally lower compared to standard life insurance policies, making it an attractive option for those seeking affordable coverage. This affordability factor is particularly beneficial for veterans who may have limited financial resources or those who have already invested in other insurance plans.

When comparing VGLI to other life insurance plans, it's important to note that VGLI is designed specifically for veterans and their unique needs. It provides a safety net for veterans and their families, ensuring financial security in the event of the veteran's passing. While other life insurance options may offer more extensive coverage, they might not cater to the specific requirements and benefits available to veterans. VGLI's focus on veterans' welfare makes it an ideal choice for those seeking tailored life insurance coverage.

In summary, VGLI stands out as a specialized and advantageous life insurance option for veterans. Its guaranteed acceptance, fixed coverage, and competitive pricing make it a valuable tool for securing financial protection. When considering life insurance, veterans should explore VGLI as a potential solution, especially if they have health considerations or are looking for a straightforward and affordable plan. Understanding the unique features of VGLI compared to other insurance plans can help veterans make informed decisions about their life insurance needs.

Understanding 1035 Exchanges: How Life Insurance Agents Earn Commissions

You may want to see also

VGLI Eligibility: Understand who is eligible for VGLI enrollment and coverage

The Veterans Group Life Insurance (VGLI) is a valuable benefit offered to veterans, providing them with a sense of financial security and peace of mind. Understanding the eligibility criteria for VGLI is crucial for veterans who want to ensure they and their families are protected. Here's a detailed breakdown of who is eligible for VGLI enrollment and coverage:

Eligibility for VGLI:

- Active Duty Service: VGLI is primarily designed for veterans who have completed at least 90 consecutive days of active duty service in the U.S. Armed Forces. This includes those who have served in the Army, Navy, Air Force, Marines, or Coast Guard.

- Service Period: The veteran must have been honorably discharged or released from active duty. The discharge should be due to a variety of reasons, including retirement, disability, or other honorable circumstances.

- Age and Residency: There are specific age requirements for VGLI enrollment. Generally, veterans must be between 18 and 65 years old at the time of enrollment. Additionally, U.S. citizenship or legal resident status is mandatory.

- Spouse and Dependents: VGLI coverage extends to the veteran's spouse and eligible dependents. Dependents include children, regardless of age, and certain family members who are financially dependent on the veteran.

To be eligible for VGLI, veterans must meet the active duty service criteria and ensure they are within the specified age range. It is important to note that veterans who have already served and are now retired or disabled may still be eligible, but they should review the specific guidelines provided by the U.S. Department of Veterans Affairs (VA).

Enrollment Process:

Once eligible, veterans can enroll in VGLI during their initial enrollment period, which is typically one year from their discharge date. After this period, enrollment may be available during the annual open enrollment period. The VA provides a comprehensive guide and application process to ensure a smooth enrollment experience.

Understanding the eligibility criteria is the first step towards securing VGLI coverage. Veterans should carefully review the VA's guidelines and seek assistance if needed to ensure they take advantage of this valuable benefit.

Life Insurance Disqualifiers: Health, Age, and Lifestyle Factors

You may want to see also

VGLI Premiums: Learn about VGLI premium payments and their impact on coverage

When considering VGLI (Veterans Group Life Insurance), understanding the premium structure is crucial for making informed decisions about your life insurance coverage. VGLI is a group life insurance program designed specifically for veterans, offering a range of benefits tailored to their unique needs. The premiums for VGLI are typically calculated based on several factors, ensuring that the coverage is both affordable and comprehensive.

The premium payments for VGLI are directly linked to the level of coverage you choose. As a veteran, you have the option to select from various coverage amounts, each with its own associated premium rate. Higher coverage amounts generally result in higher premium payments, as the insurance company assumes a greater risk by providing more extensive financial protection. It's essential to assess your financial situation and risk tolerance to determine the most suitable coverage level for your needs.

VGLI premiums are often structured as annual payments, providing veterans with the flexibility to manage their insurance expenses. The payment schedule may vary, allowing you to choose when and how you make these contributions. This flexibility can be particularly beneficial for veterans with varying financial circumstances or those who prefer to adjust their coverage periodically.

One of the advantages of VGLI is that the premiums remain level over the life of the policy, providing stability and predictability. Unlike some other life insurance products, where premiums may increase with age, VGLI premiums are fixed, ensuring that your coverage costs remain consistent. This feature can be advantageous for long-term financial planning, allowing veterans to budget effectively for their insurance needs.

Understanding the impact of premium payments on coverage is essential for maximizing the benefits of VGLI. By carefully selecting the appropriate coverage amount and managing your premium payments, you can ensure that you have adequate financial protection for yourself and your loved ones. It is recommended to review your VGLI policy regularly and consult with a financial advisor to make any necessary adjustments to your coverage as your circumstances change.

Whole Life Insurance: Is SGLI a Good Option?

You may want to see also

Frequently asked questions

VGLI is a group life insurance program designed specifically for veterans and their families. It provides coverage for death due to any cause and offers additional benefits like accidental death insurance.

Eligibility for VGLI is open to veterans who have been honorably discharged from the U.S. military and their spouses or domestic partners. It also covers dependent children of the veteran.

The coverage amount for VGLI varies based on the veteran's rank, years of service, and other factors. It typically ranges from $10,000 to $100,000, with the option to increase the coverage amount.

Yes, there is a two-year waiting period for certain benefits, including coverage for death due to any cause. During this period, benefits are limited to accidental death insurance.

Yes, VGLI offers the option to convert the coverage to a permanent life insurance policy after the initial two-year period. This allows veterans to have long-term coverage and potentially build cash value over time.