Life insurance is a financial asset that provides financial stability for your family or beneficiaries after your death. The death benefit of a life insurance policy is not considered an asset, but some policies have a cash value, which is considered an asset. This cash value component is a secondary benefit of life insurance and can be used to help with liquidity and estate planning. Permanent life insurance policies, such as whole life, universal life, and variable life insurance, can grow cash value over time. This cash value can be accessed by the policyholder during their lifetime and used for various purposes, such as paying premiums, taking out loans, or increasing the death benefit. However, withdrawals and loans against the cash value may reduce the death benefit. Understanding the value of your life insurance policy and its impact on your financial statement is important, and consulting a financial professional can provide clarity on your options.

| Characteristics | Values |

|---|---|

| Face value | The amount paid to your beneficiaries when you die |

| Cash value | Money you can take out of a life insurance policy while alive |

| Death benefit | A lump-sum payment to your family and/or beneficiaries after you are gone |

| Term life insurance | Temporary coverage for a set amount of time, usually 10 to 20 years |

| Permanent life insurance | Coverage for your entire life |

| Whole life insurance | A type of permanent insurance that lasts the entire life of the policyholder |

| Universal life insurance | More flexible with generally lower premiums; the policy and amount paid can be adjusted |

| Variable life insurance | Access to investment tools; higher risk as cash value depends on performance of investments |

What You'll Learn

The face value of a life insurance policy

It is important to periodically review your life insurance policy to ensure that the face value meets your needs and that you understand how any riders or additional benefits may impact the face value.

Group Life Insurance: Retirement and Coverage

You may want to see also

Cash value vs. surrender value

Life insurance policies can be a useful financial asset, but it's important to understand the nuances of the policy you're taking out.

Cash Value

The death benefit of a life insurance policy is not considered an asset, but some policies have a cash value, which is considered an asset. Only permanent life insurance policies, like whole life, can grow cash value. This cash value is a secondary benefit of life insurance and can be used in a variety of ways to help with liquidity and estate planning.

Cash value is the sum of money that grows in a cash-value-generating annuity or permanent life insurance policy. It is the money held in your account. Your insurance provider allocates some of your premium toward the cost of insurance and some toward your cash value account. The cash value money is then invested, and your policy is credited based on the performance of those investments, as well as any dividends the policy earns.

Cash value is a feature that only applies to permanent life insurance (whole life or universal life, for example) or annuities—not term life insurance. In the US, it is technically illegal for a life insurance policy to market itself as an investment vehicle. However, many policyholders use their whole life, universal life, or variable universal life insurance policies to grow tax-advantaged retirement assets.

Surrender Value

Surrender value, on the other hand, is the actual amount of money a policyholder will receive if they try to withdraw all of the policy's cash value. It is the amount of money that a life insurance company pays out to a policyholder if they decide to cancel the plan.

When you surrender a policy, you receive whatever you paid in premiums back tax-free. If you receive more than you paid in total premiums, you owe income tax on your earnings.

In the early years of a policy, life insurance companies can deduct fees upon cash surrender. What you receive for your cash surrender value could be less than your current cash value balance after subtracting these fees. The surrender charge can start as high as 10% to 35% of your policy cash value. If your policy has a surrender charge, it goes down over time. Most policies end the surrender charge after 10 to 15 years. At this point, your cash surrender value equals your cash value.

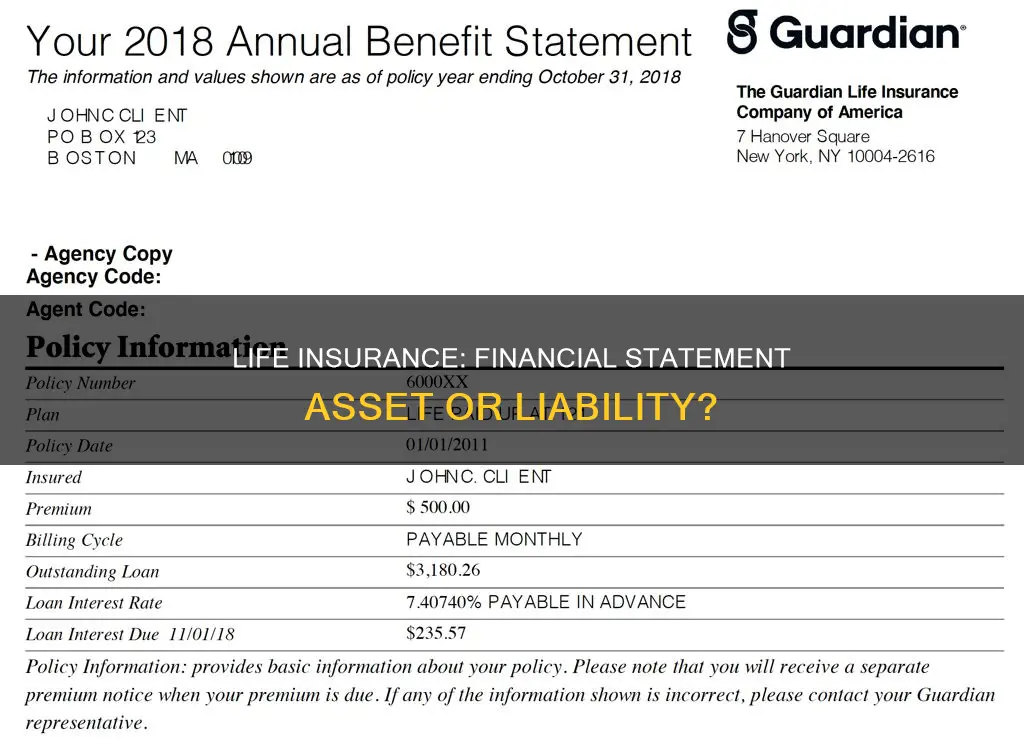

The cash surrender value of a life insurance policy is equal to the total accumulated cash value, minus prior withdrawals, outstanding loans, and surrender charges.

Cash value and surrender value are not the same as the policy's face value, which is the death benefit. However, outstanding loans against the policy's cash value can reduce the total death benefit.

In most whole life insurance plans, the cash value is guaranteed, but it can only be surrendered when the policy is canceled. Policyholders may borrow or withdraw a portion of their cash value for current use. In universal life insurance plans, the cash value isn't guaranteed. However, after the first year or two, it may have enough cash value built up to be partially surrendered (withdrawn).

Often, your insurance company will charge a penalty for withdrawing all of the cash value from a policy before a specified amount of time has passed. Surrender fees will reduce your surrender value. These costs and the policy's surrender value can fluctuate over the life of a policy. After a certain time period, the surrender costs will no longer be in effect, and your cash value and surrender value will be the same.

The death benefit of a life insurance policy is not considered an asset, but some policies have a cash value, which is considered an asset. Therefore, the cash value of a life insurance policy can be put on a financial statement.

Universal Life Insurance: Does It Expire or Endure?

You may want to see also

Whole life insurance

- An income tax-free death benefit paid to your beneficiaries upon your passing.

- A cash value component that grows over time, which can be used for various financial needs.

- Fixed premiums that remain consistent throughout the life of the policy.

- The ability to borrow against the accumulated cash value or withdraw funds during your lifetime.

- Peace of mind knowing that your coverage will not expire and your loved ones will receive a payout.

The cost of whole life insurance depends on several factors, such as the age and health of the insured, the desired coverage amount, and the rate of cash value growth. Generally, younger and healthier individuals pay lower premiums.

The cash value component of whole life insurance functions similarly to a savings account. A portion of your premium payments goes into this account, earning interest over time. This cash value can be accessed through loans or withdrawals, but doing so will reduce the death benefit paid out to your beneficiaries.

In summary, whole life insurance offers permanent coverage, fixed premiums, and the ability to build cash value, making it a comprehensive solution for individuals seeking lifelong financial protection and the potential to access funds during their lifetime.

Whole Foods: Free Life Insurance for Employees?

You may want to see also

Term life insurance

When taking out a term life insurance policy, the policyholder chooses the length of the term and the coverage amount. The insurance company then determines the premium based on the policy's value and factors such as the policyholder's age, gender, and health. The policy guarantees payment of the death benefit to the insured person's beneficiaries if the insured person dies during the specified term.

While term life insurance does not create cash value, some policies offer a return of premium feature, which refunds the premiums paid if the policyholder outlives the policy. This option makes the policy more expensive.

Life Insurance for Army Personnel: What You Need to Know

You may want to see also

Permanent life insurance

The cash value of a permanent life insurance policy accumulates over time as a portion of the premium payments goes towards it. The rate of accumulation can vary depending on the type of policy, with some policies offering fixed rates and others depending on market performance. The cash value can be withdrawn or borrowed against, but doing so will reduce the death benefit.

There are several types of permanent life insurance policies, including whole life, universal life, and variable universal life. Whole life insurance policies have fixed premiums and offer guaranteed cash value accumulation. Universal life insurance allows for more flexibility, as the premium payments and death benefit can be adjusted over time. Variable universal life insurance provides the most flexibility, as policyholders can choose how to invest their cash value, but it also carries more risk.

The cost of permanent life insurance can be significantly higher than term life insurance due to the lifelong coverage and investment opportunities. However, it may be worth considering for individuals who want coverage for their entire lives or want to use life insurance to leave an inheritance.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

Frequently asked questions

The face value of a life insurance policy is the amount that your beneficiaries would receive if you die while insured. You pick a death benefit to set the policy's original face value when you sign up for coverage.

Cash value accumulates in a life insurance policy because your premiums are split into three categories. One portion of your premium goes toward the death benefit, another goes toward the insurer's costs and profits, and the third contributes to the policy's cash value.

You can use the cash value in your life insurance policy in various ways. You can pay premiums, take a loan from your insurer, increase the death benefit on your policy, or withdraw money from your cash value.