When it comes to life insurance, it's important to understand that not all policies are created equal. The right type of life insurance can provide financial security and peace of mind for you and your loved ones, but with so many options available, it can be overwhelming to choose the best fit. In this article, we'll explore the different types of life insurance, their benefits, and how to determine which one is worth the investment for your specific needs and circumstances.

What You'll Learn

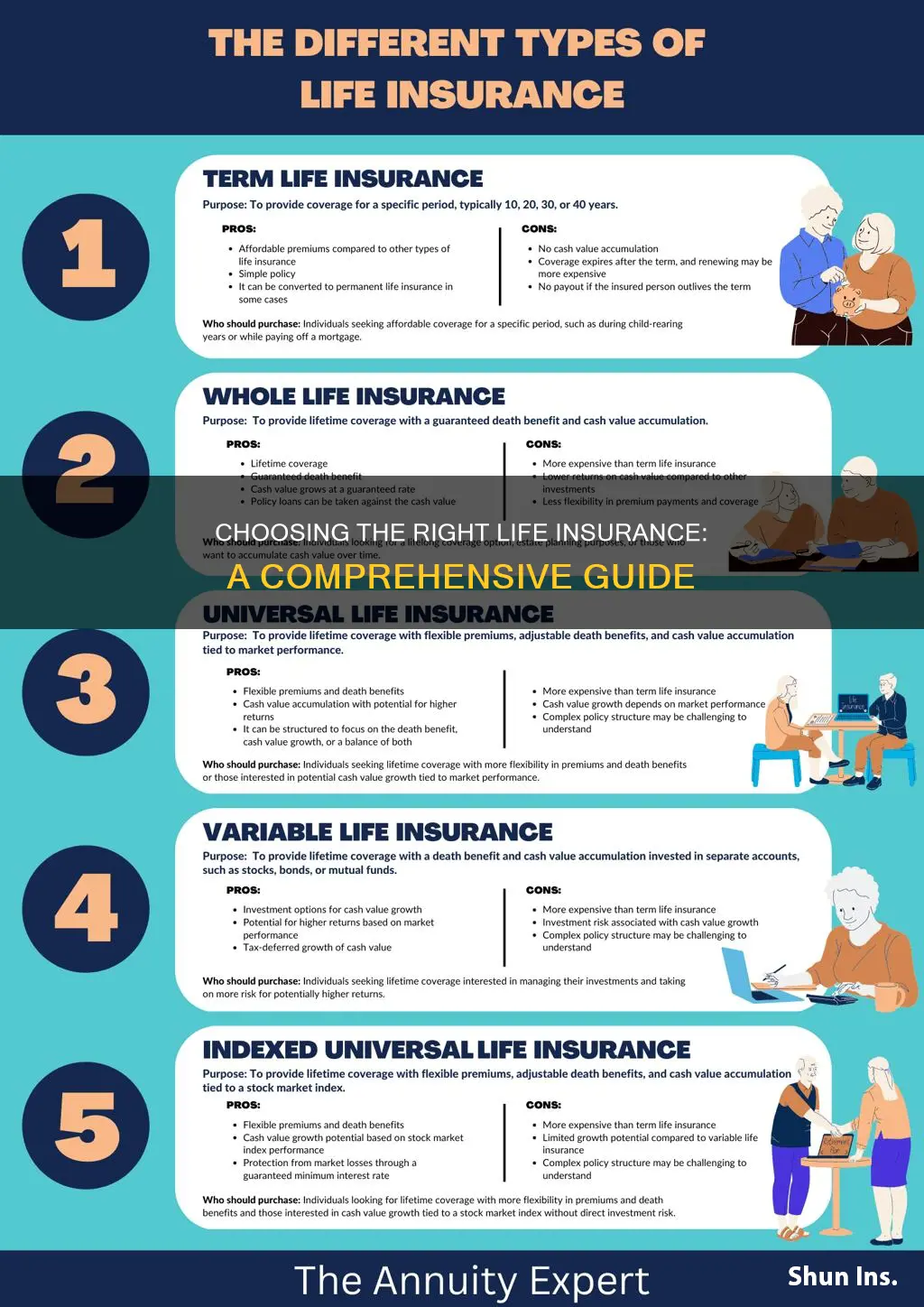

- Term Life: Affordable coverage for a set period, offering peace of mind

- Whole Life: Permanent coverage with a savings component, ensuring lifelong protection

- Universal Life: Flexible premiums and investment options, tailored to individual financial goals

- Final Expense: Covers funeral and burial costs, providing financial relief to beneficiaries

- Critical Illness: Provides financial support if a serious illness or injury occurs

Term Life: Affordable coverage for a set period, offering peace of mind

Term life insurance is a popular and often recommended choice for individuals seeking affordable and straightforward coverage for a specific period. It provides a safety net for your loved ones in the event of your untimely passing, ensuring financial security during the term. This type of policy is particularly appealing due to its simplicity and cost-effectiveness compared to other life insurance options.

The beauty of term life insurance lies in its term, which is a predetermined period, typically ranging from 10 to 30 years. During this term, the policy provides a fixed death benefit if the insured individual passes away. The simplicity of this structure means that the policy is easy to understand and manage, with no complicated features or riders to navigate. This type of insurance is ideal for those who want coverage for a specific goal, such as paying off a mortgage or covering children's education, without the long-term commitment of permanent life insurance.

One of the key advantages is its affordability. Since the coverage is limited to a set period, the premiums are generally lower compared to whole life or universal life insurance. This affordability makes it accessible to a wide range of individuals, allowing them to secure their family's financial future without straining their budget. For those who prioritize financial stability and have a defined period of need, term life insurance offers an excellent solution.

Furthermore, term life insurance provides peace of mind. Knowing that your loved ones will be financially protected in the event of your death can significantly reduce stress and anxiety. This type of policy ensures that your family can maintain their standard of living, cover daily expenses, and achieve their financial goals, even if you are no longer around. It allows you to focus on the present and future, knowing that you've made a responsible decision to protect your loved ones.

In summary, term life insurance is a valuable and practical choice for individuals seeking affordable coverage for a specific duration. Its straightforward nature, lower premiums, and ability to provide financial security during a defined period make it an attractive option. By choosing term life, you can ensure that your family's well-being is protected without the complexity and higher costs associated with other life insurance types. It is a wise decision for those who want to secure their loved ones' future with a simple and effective insurance solution.

Life Insurance Lies: What's the Real Cost?

You may want to see also

Whole Life: Permanent coverage with a savings component, ensuring lifelong protection

When considering what kind of life insurance is worth the investment, Whole Life insurance stands out as a reliable and comprehensive choice. This type of policy offers permanent coverage, providing financial protection for your loved ones throughout their entire lives, regardless of any changes in your health or circumstances. One of the key advantages of Whole Life is its dual function: it serves as both a death benefit and a long-term savings plan.

As a permanent insurance policy, Whole Life remains in force for the entire lifetime of the insured individual, ensuring that your beneficiaries receive the promised death benefit when the time comes. This is in contrast to term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. With Whole Life, you can rest assured that your family's financial needs will be met, even if your health status changes or you experience unexpected life events.

The savings component of Whole Life is a significant benefit that sets it apart from other insurance products. A portion of your premium payments goes into an investment account, which grows tax-deferred. Over time, this investment component can accumulate a substantial cash value, providing you with a financial asset that can be borrowed against or withdrawn if needed. This feature is particularly valuable for those who want to build a personal savings portfolio while also securing their family's future.

Whole Life insurance is an excellent choice for those seeking long-term financial security and peace of mind. It offers a consistent and reliable death benefit, ensuring that your family's financial obligations are covered. Additionally, the savings aspect allows you to grow your wealth over time, providing financial flexibility and the potential for tax-advantaged growth. This type of insurance is especially beneficial for individuals and families who want a permanent solution, as it adapts to your changing needs and provides lifelong protection.

In summary, Whole Life insurance is a valuable investment for anyone looking to secure their family's future and build long-term wealth. Its permanent coverage and savings component make it a robust financial tool, offering both protection and the potential for financial growth. By choosing Whole Life, you can have the confidence that your loved ones will be taken care of, and you will have a valuable asset that can serve multiple financial purposes over time.

Life Insurance: A Charitable Legacy Tool

You may want to see also

Universal Life: Flexible premiums and investment options, tailored to individual financial goals

Universal life insurance offers a flexible and customizable approach to life coverage, making it an attractive option for those seeking tailored financial protection. One of its key advantages is the ability to adjust premiums and investment strategies according to an individual's evolving financial circumstances and goals. Unlike traditional term life insurance, where premiums are fixed for a specified period, universal life insurance provides policyholders with the freedom to manage their insurance program.

With universal life, policyholders can choose to pay a minimum premium, ensuring that the insurance remains in force even during economic downturns or periods of financial strain. This flexibility is particularly beneficial for those who may experience fluctuations in income or who want to prioritize other financial objectives while still maintaining adequate life coverage. Additionally, the investment component of universal life insurance allows policyholders to allocate a portion of their premiums into various investment options, such as stocks, bonds, or mutual funds. This investment aspect provides an opportunity to grow the policy's cash value over time, potentially outpacing the rate of return on traditional savings accounts.

The investment options available within universal life insurance policies can be tailored to individual risk tolerances and financial objectives. For instance, conservative investors might opt for bond funds, which offer a steady income stream and a lower level of risk. On the other hand, those seeking higher returns could choose stock-based investments, which may come with increased volatility but also the potential for greater growth. This customization ensures that the policyholder's financial strategy aligns with their unique needs and preferences.

Furthermore, the flexibility of universal life insurance extends to the ability to increase or decrease coverage as life circumstances change. For example, a policyholder may opt to increase their coverage during significant life events like getting married, having children, or purchasing a home. Conversely, they can reduce coverage if their financial situation improves or if other forms of protection, such as employer-provided benefits, become available. This adaptability ensures that the insurance remains relevant and effective throughout one's life.

In summary, universal life insurance stands out for its flexibility in premium payments and investment strategies, making it a versatile tool for managing financial risks and goals. By allowing policyholders to customize their insurance program, it empowers individuals to take control of their financial future, ensuring adequate protection while also accommodating changing financial priorities. This level of customization and adaptability is a compelling reason for individuals to consider universal life insurance as a valuable component of their overall financial plan.

Independent Agents: NY Life Insurance's Secret Weapon?

You may want to see also

Final Expense: Covers funeral and burial costs, providing financial relief to beneficiaries

When considering life insurance, it's important to understand the various types available and their unique benefits. One type of coverage that often gets overlooked but can be incredibly valuable is Final Expense insurance. This type of policy is specifically designed to cover the costs associated with end-of-life expenses, providing financial relief to both the policyholder and their beneficiaries during a difficult time.

Final Expense insurance, also known as burial insurance, is a straightforward and compassionate solution to a challenging financial burden. It ensures that the policyholder's loved ones are not burdened with the financial responsibility of arranging a funeral and burial, which can be costly and emotionally taxing. This type of insurance typically covers expenses such as funeral services, casket or urn, transportation, and even legal and administrative fees. By having this coverage in place, individuals can rest assured that their final wishes will be honored without causing financial strain on their families.

The beauty of Final Expense insurance lies in its simplicity and the peace of mind it offers. It is a pre-paid arrangement, meaning the policyholder pays a fixed amount regularly, and in return, the insurance company promises to cover the specified expenses upon their passing. This eliminates the worry of unexpected costs and allows individuals to focus on their loved ones during their final days. Moreover, it provides a sense of security, knowing that the financial aspect of death has been addressed, and the burden of arranging a funeral is lifted from the shoulders of the deceased's family.

For those who may be hesitant to consider life insurance, Final Expense coverage can be an attractive option due to its affordability and ease of qualification. Many providers offer this type of policy without the need for extensive medical exams, making it accessible to a wide range of individuals. It is particularly beneficial for older adults or those with pre-existing health conditions who might find it challenging to secure other forms of life insurance. By taking out a Final Expense policy, individuals can ensure that their final expenses are taken care of, providing a sense of financial security and peace of mind.

In summary, Final Expense insurance is a thoughtful and practical choice for anyone looking to provide financial protection for their loved ones. It addresses the often-overlooked aspect of funeral and burial costs, ensuring that the deceased's family can focus on grieving and honoring their loved one without the added stress of financial worries. With this type of coverage, individuals can leave a lasting legacy of love and support, even in their absence.

Finding Life Insurance Leads: Strategies for Success

You may want to see also

Critical Illness: Provides financial support if a serious illness or injury occurs

When considering life insurance, it's essential to explore the various types available to ensure you make an informed decision. One type of coverage that often stands out as valuable is Critical Illness insurance. This insurance is designed to provide financial support when you are diagnosed with a critical illness, offering a safety net during challenging times.

Critical Illness insurance is a comprehensive policy that covers a wide range of serious medical conditions. These illnesses typically include heart attacks, strokes, cancer, kidney failure, and other critical ailments. The policy is structured to provide a lump-sum payment or regular income if you are diagnosed with one of these covered illnesses. This financial support can be a lifeline, helping you manage medical expenses, cover daily living costs, and even provide additional funds for rehabilitation and recovery.

The beauty of Critical Illness insurance lies in its ability to offer peace of mind. Knowing that you have this financial safety net can reduce stress and anxiety associated with serious illnesses. It allows you to focus on your health and recovery without the constant worry of financial burdens. This type of insurance is particularly valuable as it can cover expenses that might not be fully covered by your health insurance, ensuring you receive the best possible care without financial strain.

Furthermore, Critical Illness insurance can be tailored to your specific needs. You can choose the coverage amount based on your financial goals and the level of support you believe is necessary. This customization ensures that the policy provides the right amount of financial assistance when it's needed most. Whether it's covering mortgage payments, educational expenses, or simply ensuring your family's financial stability, this insurance can be a powerful tool in your financial planning.

In summary, Critical Illness insurance is a valuable addition to your life insurance portfolio. It provides a critical layer of financial protection when you need it most, offering support during the diagnosis and treatment of serious illnesses. By understanding the benefits and flexibility of this insurance, you can make an informed decision about your life insurance needs, ensuring a more secure and worry-free future.

Life Insurance Beneficiary: Who Qualifies and How to Claim

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and it's a more affordable option for temporary needs. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, making it suitable for long-term financial goals.

The ideal coverage amount should be enough to cover your family's essential expenses, such as mortgage, education costs, and daily living expenses, for a specified period. It's a good practice to review and adjust your policy regularly to ensure it aligns with your changing financial circumstances.

While having substantial life insurance coverage can provide financial security to your loved ones, it may also result in higher premiums. Additionally, if you outlive the expected lifespan covered by the policy, the death benefit might not be as valuable. It's essential to strike a balance between coverage and affordability.

Yes, it is possible to obtain life insurance with pre-existing health issues, but the process might be more complex. Insurers often consider factors like the severity of the condition, recent medical history, and lifestyle choices. Some companies offer specialized policies for individuals with health concerns, ensuring coverage despite their medical background.

In many countries, life insurance death benefits are generally tax-free and paid out as a lump sum or in installments. However, there might be tax consequences for the policyholder during the policy's term, especially with permanent life insurance, where cash value accumulation can be subject to taxation. It's advisable to consult a financial advisor for personalized tax advice.