Choosing the right term life insurance can be a crucial decision, as it provides financial protection for your loved ones during a specific period. The type of term life insurance you select depends on your unique needs and circumstances. It's essential to consider factors such as the duration of coverage, the amount of insurance needed, and the cost of premiums. Understanding the different types of term life insurance, such as level term, decreasing term, and increasing term, can help you make an informed decision. This guide will explore these options and provide insights to help you determine the best term life insurance for your situation.

What You'll Learn

- Term Length: Choose a term length that aligns with your financial goals and needs

- Death Benefit: Understand the death benefit and how it will be paid out

- Premiums: Compare premium costs and payment options to find the best fit

- Conversion Options: Look for policies with conversion rights to permanent coverage

- Additional Benefits: Consider riders or add-ons for extra coverage or flexibility

Term Length: Choose a term length that aligns with your financial goals and needs

When it comes to selecting the right term life insurance, one of the most critical decisions you'll make is choosing the appropriate term length. This decision is pivotal as it determines how long your insurance coverage will be in effect and how well it aligns with your financial objectives. The term length you choose should be a strategic match between your current needs and future financial goals.

The term life insurance policy typically offers coverage for a specified period, often ranging from 10 to 30 years. During this term, the policy provides a death benefit if the insured individual passes away. The key is to select a term that covers you adequately during the period when your loved ones or beneficiaries would most need the financial support. For instance, if you have young children or a mortgage, a longer term might be more appropriate to ensure their financial security.

A common strategy is to start with a longer term, such as 20 or 30 years, which can provide comprehensive coverage during the years when your family's financial needs are likely to be at their highest. This approach ensures that your loved ones are protected in the event of your untimely death, covering essential expenses like mortgage payments, education costs, and daily living expenses. As you age and your financial situation changes, you can consider adjusting your policy or switching to a different type of life insurance.

On the other hand, if you have already paid off your mortgage or your children are grown, a shorter term might be sufficient. For example, a 10-year term can be an excellent choice if you want to cover a specific period, such as the duration of a business loan or a personal financial goal. This approach allows you to manage your insurance costs more effectively, as shorter terms generally result in lower premiums.

In summary, the term length you choose should be a well-thought-out decision, considering your current and future financial obligations. It's essential to regularly review and adjust your policy as your life circumstances change. By aligning the term length with your financial goals, you can ensure that your term life insurance provides the necessary protection when it's needed most, offering peace of mind and financial security for your loved ones.

Executive Bonus: A Life Insurance Incentive

You may want to see also

Death Benefit: Understand the death benefit and how it will be paid out

When considering term life insurance, understanding the death benefit is crucial as it forms the core of the policy's value and purpose. The death benefit is the amount of money that will be paid out to your beneficiaries upon your passing. This payout is a critical financial safety net for your loved ones, ensuring they have the necessary resources to cover expenses, maintain their standard of living, and achieve their financial goals.

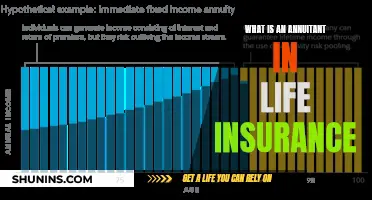

There are typically two methods for paying out the death benefit: a lump sum and periodic payments. A lump sum payment provides a one-time, tax-free sum to the beneficiaries, which can be used for various purposes, such as paying off debts, covering funeral expenses, or providing a financial cushion for the family. This option offers flexibility and allows the beneficiaries to decide how to utilize the funds according to their needs. On the other hand, periodic payments, also known as term insurance, provide a regular income stream over a specified period, often aligning with the duration of your mortgage, children's education, or other long-term financial commitments. This ensures a consistent financial support structure for your family during the most critical times.

The death benefit can be paid out in various ways, including a single, level, or decreasing benefit. A single benefit is a fixed amount that remains the same throughout the policy term, providing a consistent payout. Level benefits, also known as level term insurance, offer a death benefit that increases by a predetermined amount each year, ensuring that the payout keeps pace with inflation and potential increases in the cost of living. Conversely, a decreasing benefit starts with a higher amount and then reduces over time, which can be useful if you want the death benefit to align with decreasing financial obligations as your children grow up and your mortgage is paid off.

It's essential to consider your financial goals and the needs of your beneficiaries when deciding on the death benefit amount. You should aim to provide a sufficient payout to cover essential expenses and any outstanding debts, ensuring your family's financial stability. Additionally, you might want to consider the potential future needs of your beneficiaries, such as education costs for children or long-term care expenses for parents. Consulting with a financial advisor can help you determine the appropriate death benefit amount based on your unique circumstances.

In summary, the death benefit is a critical aspect of term life insurance, offering financial security and peace of mind to your loved ones. By understanding the different payment methods and benefit structures, you can make an informed decision that best suits your family's needs and ensures a stable financial future for those who depend on you.

Life Insurance for US Non-Residents: What's Possible?

You may want to see also

Premiums: Compare premium costs and payment options to find the best fit

When considering term life insurance, one of the most critical aspects to evaluate is the cost, or premium, associated with the policy. The premium is the amount you pay regularly (monthly, quarterly, or annually) to maintain your insurance coverage. Understanding the factors that influence premium costs and the various payment options available can help you make an informed decision about the best term life insurance plan for your needs.

The cost of a term life insurance premium is primarily determined by several key factors. Firstly, the amount of coverage you choose directly impacts the premium. Higher coverage amounts typically result in higher premiums because the insurance company needs to pay out a larger sum in the event of a claim. Age is another significant factor; younger individuals generally pay lower premiums as they are considered less risky to insure. Additionally, the duration of the term plays a role; longer-term policies may have higher premiums but provide more extended coverage, which can be beneficial for long-term financial planning.

Another essential consideration is your personal health and lifestyle. Insurance companies often assess your health through medical exams or health questionnaires. Factors such as smoking, obesity, pre-existing medical conditions, and lifestyle choices (e.g., excessive alcohol consumption or dangerous hobbies) can significantly affect your premium rates. A healthier lifestyle and medical history may lead to lower premiums, as you are considered a lower-risk individual.

Payment options for term life insurance premiums can vary, providing flexibility to suit different financial situations. Many policies offer the option to pay annually, which can be cost-effective for those who prefer a one-time payment. Semi-annual or quarterly payments are also common, allowing for more frequent but smaller payments. For those who prefer a more flexible approach, monthly payments are available, making it easier to budget and manage expenses. Some insurance providers even offer the convenience of automatic payments, deducting the premium directly from your bank account or credit card.

Comparing premium costs and payment options is crucial to finding the best value for your money. It's essential to obtain quotes from multiple insurance companies to understand the range of prices available. Additionally, consider the payment flexibility that each company offers. For instance, some insurers may provide the option to increase or decrease your coverage amount without changing your premium rate, allowing you to adjust your policy as your needs evolve. By carefully evaluating these factors, you can select a term life insurance policy that provides adequate coverage at a cost that aligns with your financial goals and circumstances.

Unraveling the Mystery: Genomic Life Insurance Explained

You may want to see also

Conversion Options: Look for policies with conversion rights to permanent coverage

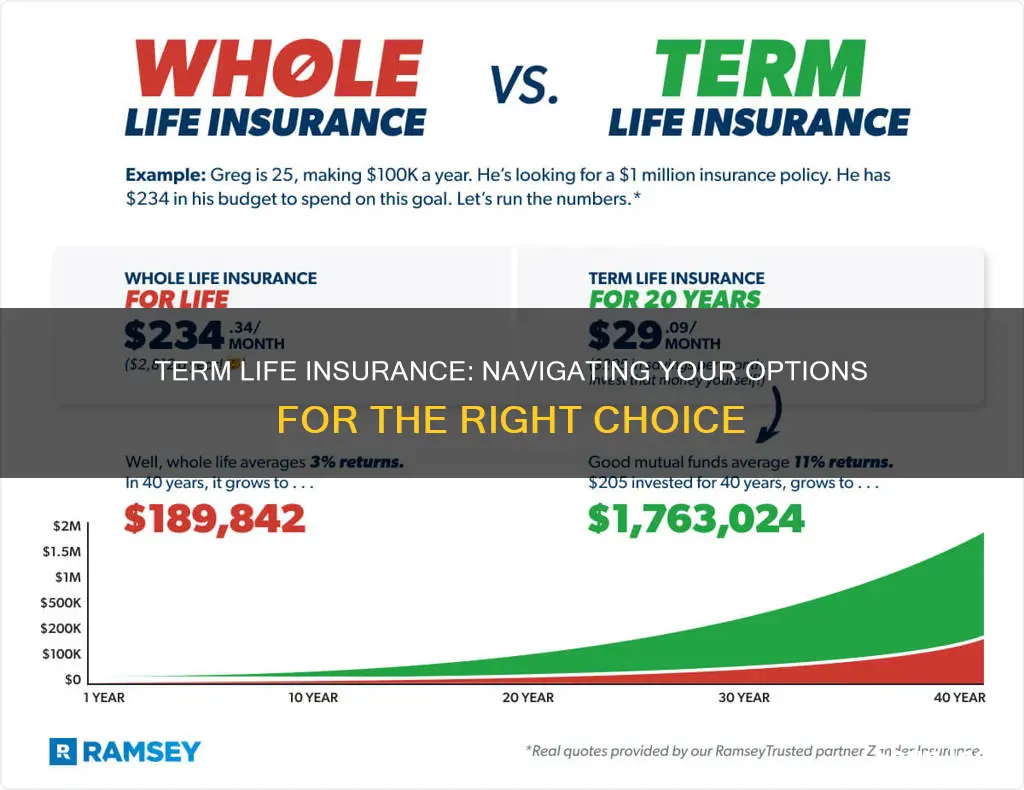

When considering term life insurance, it's important to explore the various options available to ensure you make the right choice for your long-term financial security. One crucial aspect to look out for is the conversion option, which can significantly enhance the value of your policy. This feature allows you to convert your term life insurance into a permanent life insurance policy, providing a sense of security and flexibility that is hard to find elsewhere.

Term life insurance is typically designed for a specific period, such as 10, 20, or 30 years. While it offers affordable coverage during this time, it may not provide the same level of protection for the rest of your life. This is where the conversion option comes into play. By opting for a policy with conversion rights, you gain the ability to switch to a permanent life insurance plan, such as whole life or universal life, without the need for a medical examination or additional underwriting. This is particularly beneficial if you anticipate needing long-term coverage or if you want to ensure your loved ones are protected even after your term policy expires.

The conversion process is straightforward. If you decide to convert, you typically notify your insurance provider, and they will offer you a new permanent policy based on your current term policy's terms and rates. This means you can lock in the current coverage amount and premium, which can be advantageous if you've built up a substantial death benefit during your term period. The conversion option provides a seamless transition, ensuring that your insurance needs are met without any gaps in coverage.

When evaluating term life insurance policies, pay close attention to the fine print regarding conversion rights. Some insurers may offer limited conversion periods, so it's essential to understand when you can exercise this option. Additionally, consider the conversion rates and any associated fees. Some companies may provide a guaranteed conversion rate, allowing you to convert to a permanent policy at a predetermined price, while others might offer a lower rate or require a medical assessment.

In summary, term life insurance with conversion rights is a powerful tool for those seeking long-term financial protection. It provides the flexibility to adapt your insurance needs as your life circumstances change. By choosing a policy with conversion options, you gain the assurance of permanent coverage without the complexities of a new application process. This feature is especially valuable for individuals who want to ensure their loved ones' financial security throughout their lives.

Life Insurance Rates: Fluctuating Costs and Uncertain Future

You may want to see also

Additional Benefits: Consider riders or add-ons for extra coverage or flexibility

When considering term life insurance, it's important to explore the additional benefits and options available to ensure you get the most value and coverage for your needs. One way to enhance your policy is by adding riders or add-ons, which can provide extra protection and flexibility. These riders are additional benefits that can be attached to your base term life insurance policy, offering customized solutions to address specific concerns.

Riders can provide various benefits, such as increasing the death benefit amount, adding coverage for specific causes of death, or offering an option to convert the term policy into a permanent one. For instance, a "Term Plus" rider allows you to increase the death benefit during the initial term, providing additional coverage if your financial needs grow. Similarly, a "Guaranteed Acceptance" rider ensures that you are accepted for coverage, even if you have pre-existing health conditions, making it ideal for those who may be considered high-risk by standard insurers.

Another common rider is the "Accidental Death Benefit," which provides a higher payout if the insured person's death is a result of an accident. This rider can offer peace of mind, especially for those with active lifestyles or those who engage in potentially dangerous activities. Additionally, riders like "Child Coverage" or "Spouse Coverage" can be added to extend the policy's benefits to your family, ensuring their financial security in the event of your passing.

The flexibility of riders allows you to tailor your life insurance policy to your unique circumstances. You can choose to add or remove riders as your life changes, ensuring that your coverage remains relevant and adequate. For example, if you start a new business or purchase a valuable asset, you might consider adding a rider to increase the death benefit to cover potential business liabilities or asset values.

In summary, exploring the additional benefits and riders offered by insurance providers can significantly enhance your term life insurance policy. These add-ons provide extra coverage, address specific concerns, and offer flexibility to ensure your policy remains a valuable asset throughout your life's journey. It is a strategic approach to life insurance, allowing you to make informed decisions and protect your loved ones effectively.

Adjustable Life Insurance: Flexibility for Your Future

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is a pure insurance product, meaning it only covers the risk of death during the term. If you die within the term, the beneficiaries receive the death benefit. If you outlive the term, the policy expires, and no benefits are paid. Permanent life insurance, on the other hand, provides lifelong coverage. It combines insurance with an investment component, where a portion of your premiums is invested in an underlying fund. This type of insurance offers a cash value that grows over time and can be borrowed against or withdrawn.

The term length you choose should align with your financial goals and the time frame you want coverage for. If you need coverage for a specific period, such as to pay off a mortgage or fund your child's education, a shorter-term policy might be suitable. For example, a 10-year term can be ideal if you have a short-term financial obligation. If you want long-term coverage to provide for your family's future, a longer term, like 20 or 30 years, may be more appropriate. It's essential to consider your financial situation, the potential for future changes, and the time until you expect to no longer need the insurance.

Level term life insurance has a constant death benefit throughout the term, meaning the payout remains the same each year. This type of policy is straightforward and provides predictable coverage. Increasing term life insurance, as the name suggests, has a death benefit that increases annually by a specified percentage. This option is beneficial if you anticipate your financial needs or the cost of living increasing over time. For instance, if you start with a $100,000 policy and it increases by 5% each year, the death benefit will grow, providing more coverage as your needs evolve.

Several factors determine the premium cost of term life insurance. Firstly, your age plays a significant role, as younger individuals typically pay lower premiums due to a longer life expectancy. The term length also impacts the cost, with longer terms generally being more expensive. Your health and lifestyle are crucial considerations; if you have a healthy lifestyle, non-smoker status, and no significant medical conditions, you may qualify for lower rates. Additionally, the death benefit amount directly affects the premium, with higher benefits costing more.

Yes, many term life insurance policies offer the option to convert to permanent life insurance at the end of the term. This conversion allows you to continue your coverage without a medical examination or additional underwriting, as you have already been approved for the initial term. When converting, you may have the choice between different types of permanent policies, such as whole life or universal life. It's essential to review the terms and conditions of your policy to understand the conversion process and any associated costs or benefits.