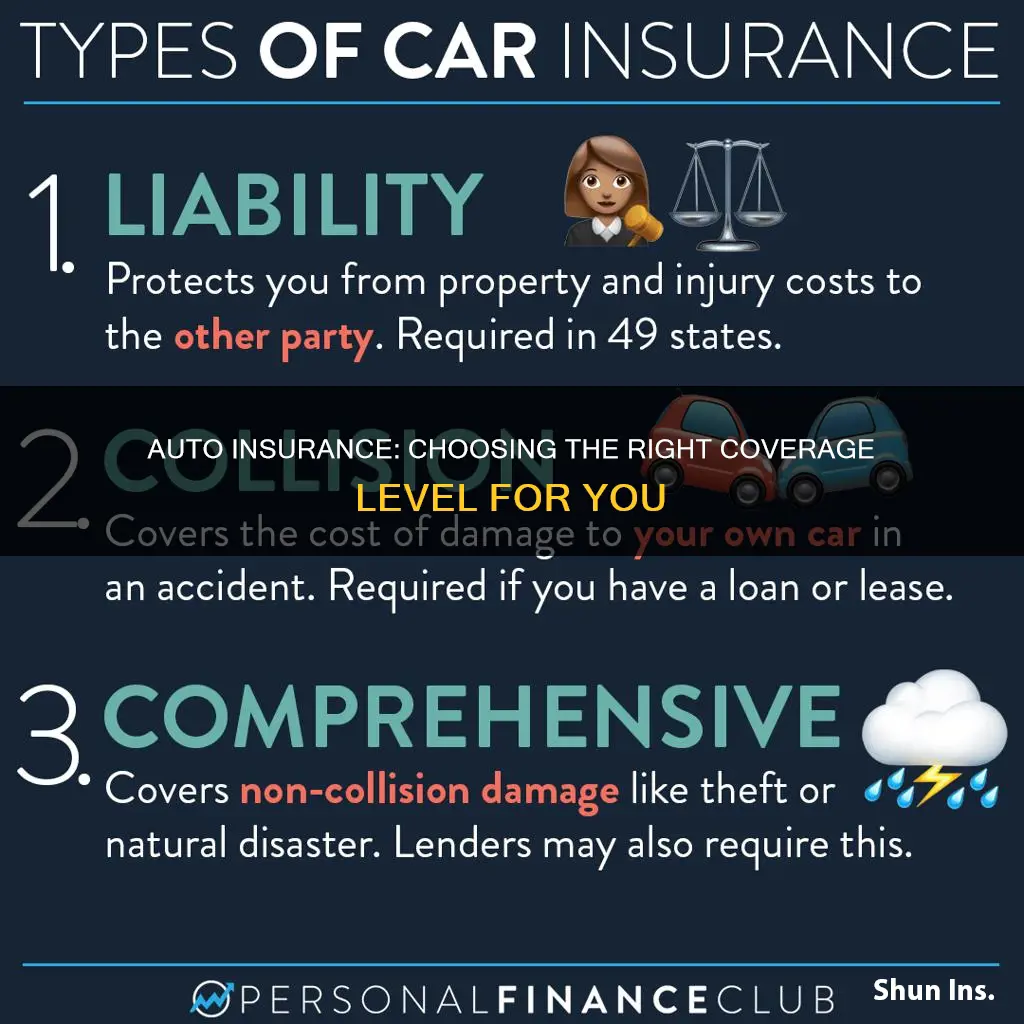

Auto insurance is a necessity, but how much insurance you need depends on your circumstances. Every state has a minimum amount of car insurance you must buy to satisfy financial responsibility laws. Liability insurance is the main mandated coverage. It covers damage and injuries you cause to others in an accident. The most common minimum limits for liability are $25,000 per person and $50,000 per accident for bodily injury and $25,000 for property damage. However, your state’s requirements may be higher or lower.

Beyond what is required by state car insurance laws and your lender, you need enough car insurance to pay for injuries, property damage and lawsuits that may arise from an accident if you don’t have enough savings to pay for them otherwise. It is recommended that you carry the highest amount of liability coverage you can afford, with $100,000 per person, $300,000 per accident in bodily injury liability and $100,000 per accident in property damage liability being ideal.

Full coverage insurance is also an option. It covers damage to your own car, up to your vehicle’s market value. It is especially useful if you have an expensive car that would be difficult to replace.

There are also several add-on coverage options, such as uninsured motorist coverage, medical payments coverage, and roadside assistance, which may be worth considering depending on your specific needs and concerns.

| Characteristics | Values |

|---|---|

| Liability insurance | $25,000 per person and $50,000 per accident for bodily injury and $25,000 for property damage. |

| Collision insurance | Covers the cost to repair or replace your car after a crash. |

| Comprehensive insurance | Covers damage to your car from situations outside your control, such as theft, vandalism or natural disasters. |

| Uninsured/Underinsured motorist coverage | Covers your medical expenses and other losses when another driver is at fault and has insufficient liability insurance or none at all. |

| Medical payments coverage | Pays for your or your passengers' injuries after an accident. |

| Personal injury protection | Covers medical bills for you and your passengers no matter who caused the car accident. |

What You'll Learn

Liability insurance

Understanding Liability Insurance

Types of Liability Coverage

Liability coverage typically includes two main components: property damage coverage and bodily injury coverage.

Property Damage Coverage

This type of coverage insures you against damage caused to another person's property by your vehicle. It includes repairs to the other driver's vehicle, providing a rental vehicle while their car is being repaired, repairs to buildings, fences, or other structures, and damage to personal property inside the vehicle, such as electronics or belongings. It also covers legal fees if you are sued for property damage.

Bodily Injury Coverage

Bodily injury coverage takes care of the payments for injuries sustained by others in an accident. This includes legal fees if you are sued for causing injuries, and it may also include rehabilitation expenses and other related costs. It is important to note that different states may have varying requirements regarding who can file a bodily injury claim against you.

Determining the Right Amount of Liability Coverage

When deciding on the appropriate level of liability coverage, it is essential to consider your state's minimum requirements and your specific situation. Most states have minimum liability coverage requirements, such as $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these amounts may not be sufficient, especially if you have assets to protect. It is recommended to choose liability coverage that matches or exceeds your net worth to ensure adequate protection.

Additionally, consider using a coverage calculator or consulting an insurance agent to determine the right amount of coverage for your needs. You can also opt for an umbrella policy, which provides additional coverage for more serious accidents and lawsuits.

Mandatory Nature of Liability Insurance

Kansas Auto Insurance: Minimum Liability Requirements Explained

You may want to see also

Collision insurance

The cost of collision insurance varies depending on the company and your personal details, such as the car you drive and your location. It tends to be expensive, but you can lower your premiums by choosing a higher deductible, i.e. the amount you pay out of pocket before the insurance coverage begins paying for a claim. For example, a $500 deductible can result in slightly cheaper premiums compared to a $250 deductible.

When deciding whether to purchase collision insurance, consider the value of your car. Collision insurance becomes less valuable over time because it will never pay out more than the car's current market value. If the cost of collision insurance and the deductible combined is higher than the value of your car, it might not be worth purchasing.

In summary, collision insurance can provide peace of mind and protect you from financial loss in the event of an accident. However, it is important to weigh the costs and benefits to determine if it is the right choice for your situation.

Betterment in Auto Insurance: Understanding the Fundamentals

You may want to see also

Comprehensive insurance

When considering comprehensive coverage, it is important to note that it does not cover collisions with objects or other vehicles. For that, you would need collision coverage. Additionally, comprehensive coverage does not apply if you are responsible for an accident; separate coverage is needed in such cases. Comprehensive coverage also does not include a deductible, so you will need to choose a deductible amount that you can afford if you need to file a claim.

In summary, comprehensive insurance is a valuable addition to your auto insurance policy if you want protection against unforeseen events that are outside your control. It ensures that you are covered for damages to your vehicle beyond collisions, giving you peace of mind and financial protection.

Gap Insurance: Nissan Lease Protection

You may want to see also

Personal injury protection (PIP)

PIP is required in some states as part of "no-fault auto insurance" laws that restrict your ability to sue for car crash injuries. In other states, PIP is optional or unavailable. If PIP is optional in your state, it can still be a valuable addition to your auto insurance policy, as it can help cover expenses such as your health insurance deductible, lost wages, and replacement services for tasks you cannot perform due to your injuries.

PIP policies have a minimum coverage amount and a per-person maximum coverage limit. The minimum coverage requirements are set by state governments and can vary, while the maximums are set by insurance companies. PIP coverage limits vary between states, with some maximums as low as $10,000 per person and others as high as $25,000 per person.

In addition to covering medical expenses, PIP can also provide payments for lost income, childcare, and funeral expenses related to the accident. It is important to note that PIP does not cover everything, and there may be situations where additional insurance coverage is needed. For example, PIP does not cover bodily injuries to the other driver and their passengers, injuries sustained while driving for work purposes, or damage to someone else's property.

When deciding whether to include PIP in your auto insurance policy, consider the requirements and options in your state, as well as your own financial situation and needs.

RV Insurance: Understanding Fixed RV Coverage

You may want to see also

Medical payments coverage (MedPay)

Medical payments coverage, or MedPay, is an optional add-on to your car insurance policy in most states, but it is required in Maine and New Hampshire. In some states, MedPay is not available because personal injury protection (PIP) is required. MedPay is supplemental to your regular health insurance and covers expenses related to vehicular accidents. It covers you, any passengers in your vehicle, any pedestrians you may injure, and you if you are riding as a passenger in another vehicle or are injured by a vehicle as a pedestrian, bike rider, or public transportation rider.

MedPay covers a variety of expenses relating to injuries stemming from an automobile accident, including:

- Health insurance deductibles and co-pays

- Visits to a doctor or hospital

- X-rays and surgery

- Ambulance and emergency medical technician fees

- Rehabilitation and nursing care

- Some medical equipment, such as prostheses

- Funeral costs following a fatal crash

MedPay is useful if you live in an urban area, where there is a greater incidence of foot traffic and, therefore, a higher chance of injuring a pedestrian. It is also useful if you are at fault for an accident, as MedPay will cover your own medical expenses even if your auto insurance policy is a no-fault one.

The amount of MedPay coverage you buy represents the maximum amount available to each person who is covered under your policy. MedPay is usually sold in small amounts, with coverage limits ranging from $1,000 to $10,000 per person. When deciding how much coverage you need, consider the healthcare coverage you already have, including your health insurance deductible.

Insurance: Listing Vehicle Drivers Matters

You may want to see also

Frequently asked questions

The minimum level of auto insurance you need is the state-required liability coverage. The most common minimum liability limits are $25,000 per person for bodily injury, $50,000 total bodily injury per accident, and $25,000 for property damage per accident. However, individual state requirements vary, and your state may mandate higher or lower limits.

Full coverage auto insurance includes liability, collision, and comprehensive insurance. Collision insurance covers the cost of repairing or replacing your car after an accident with another vehicle or object, while comprehensive insurance covers damage to your car from non-collision incidents such as theft, vandalism, or weather damage. While full coverage is not required in most states, it is recommended if you want to protect yourself from the financial burden of car repairs or replacement.

Some optional types of auto insurance coverage include uninsured/underinsured motorist coverage, personal injury protection, medical payments coverage, rental reimbursement insurance, gap insurance, and roadside assistance. These coverages can provide additional protection in specific scenarios, such as accidents with uninsured drivers or rental car usage.