Life events such as marriages, births, deaths, and major home purchases can trigger insurance enrollment periods, allowing individuals to add or remove coverage as needed. These events often require a reevaluation of insurance needs, and insurance companies offer open enrollment periods to facilitate these changes. During these times, individuals can review their current policies, make adjustments, and potentially save money by selecting the most appropriate coverage for their new circumstances. Understanding these enrollment periods is crucial for ensuring that insurance coverage remains adequate and cost-effective throughout life's transitions.

What You'll Learn

- Life Changes: Marriages, births, deaths, and major moves trigger insurance enrollment periods

- Income Fluctuations: Job loss, salary increases, or bonuses warrant insurance adjustments

- Health Status: Major health changes, like diagnoses, require insurance updates

- Education: College enrollment or graduation impacts insurance needs

- Legal Status: Citizenship changes or marriages impact eligibility for specific insurance plans

Life Changes: Marriages, births, deaths, and major moves trigger insurance enrollment periods

Life changes are inevitable, and they often come with a host of new considerations, especially when it comes to insurance. Major life events, such as marriages, births, deaths, and significant moves, can trigger specific enrollment periods for insurance plans, allowing individuals to make necessary adjustments to their coverage. Understanding these enrollment windows is crucial to ensure that your insurance remains up-to-date and relevant to your current circumstances.

When you get married, it's a significant life event that often prompts a review of your insurance coverage. Spouses may have different insurance needs and preferences, and combining policies can offer benefits like shared deductibles and lower premiums. During this time, you can explore options to enroll in a joint health plan or update your existing policies to include your spouse. Additionally, consider the impact of marriage on your financial situation, as it may affect your eligibility for certain insurance programs or require adjustments to your coverage to accommodate any changes in income or assets.

The arrival of a new family member is another life-changing event that opens up insurance enrollment opportunities. When you have a child, it's essential to review your health and life insurance policies to ensure adequate coverage for the baby. This may involve enrolling the child in a separate health insurance plan or adding them as a dependent to your existing policy. Life insurance policies may also need to be adjusted to account for the new financial responsibilities and the well-being of the child. Don't forget to explore options for long-term savings or investment plans that can provide for your child's future needs.

Death, unfortunately, is another life event that triggers insurance enrollment. When a family member or close associate passes away, it is a critical time to review and update insurance policies. This includes life insurance, which may need to be adjusted to reflect the current financial situation and the remaining family members' needs. Additionally, consider the enrollment period for any dependent benefits that may be available through the deceased's insurance plan. During this period, you can also review and potentially update your own life insurance coverage to ensure your loved ones are protected.

Major life moves, such as relocating to a new city or country, also trigger insurance enrollment. When you move, your insurance needs may change due to variations in healthcare costs, availability of medical facilities, and lifestyle factors. This is an opportunity to assess your health insurance coverage and ensure it aligns with the new location's healthcare system. You might need to enroll in a new health plan or adjust your existing policy to include coverage for local medical services. Don't overlook the importance of updating your address and contact information with insurance providers to ensure smooth communication and timely enrollment.

Reinstating Your Life and Health Insurance License: A Guide

You may want to see also

Income Fluctuations: Job loss, salary increases, or bonuses warrant insurance adjustments

Income fluctuations can significantly impact your insurance coverage and are important life events that may trigger a review of your insurance policies. Whether you experience a job loss, a salary increase, or receive a bonus, these changes in income can affect your insurance needs and the types of coverage you require. Here's a detailed guide on how these income fluctuations should prompt you to adjust your insurance:

Job Loss: When you lose your job, it's a critical time to reassess your insurance coverage. Your income has decreased, and you may need to adjust your insurance policies to reflect your new financial situation. Consider the following: First, review your health insurance. If you were previously covered under your employer's plan, you might need to switch to a different plan or explore individual health insurance options. Evaluate your ability to afford the premiums and ensure the coverage still meets your needs. Additionally, if you had group life insurance through your employer, you may need to consider individual life insurance to ensure your family is protected.

Salary Increases: A salary increase is generally a positive life event, but it also warrants a review of your insurance. As your income rises, you may be able to afford better coverage or consider adding additional policies. Here's how to approach it: Update your health insurance to a higher-tier plan that offers more comprehensive coverage. This could include better benefits, higher annual limits, or lower copayments. Also, consider increasing your life insurance coverage to match your new income level, ensuring your family is adequately protected in the event of your passing. Review your disability insurance as well, as a higher salary might make you eligible for more comprehensive coverage or a higher benefit amount.

Bonuses and Additional Income: Bonuses, commissions, or any other forms of additional income can also impact your insurance needs. These extra earnings might make you eligible for certain insurance benefits or allow you to enhance your coverage. Here's the process: If you receive a significant bonus, consider using a portion of it to increase your insurance premiums. This could mean raising your deductibles or opting for a higher-coverage plan. For instance, if you receive a large year-end bonus, you might choose to increase your life insurance coverage for that period. Additionally, if you work as a freelancer or consultant and receive irregular income, ensure your health insurance plan can accommodate these fluctuations and provide stable coverage.

In all these scenarios, it's essential to review your insurance policies regularly and make adjustments as your income changes. Insurance companies often have guidelines or triggers for policy adjustments based on income fluctuations, so staying proactive and reviewing your coverage periodically is crucial. This ensures that your insurance remains relevant and effective in providing financial protection for you and your loved ones.

Life Insurance for the Differently Abled: Possibilities and Challenges

You may want to see also

Health Status: Major health changes, like diagnoses, require insurance updates

When it comes to insurance, certain life events trigger a review and potential update of your coverage. One of the most significant life events that often necessitates an insurance update is a major health change, particularly a new diagnosis. This is because health status plays a crucial role in determining the appropriate insurance coverage.

If you receive a major health diagnosis, such as a chronic illness, a serious injury, or a life-altering condition, it is essential to inform your insurance provider immediately. This is a critical step to ensure that your insurance policy accurately reflects your current health status and needs. Insurance companies often have specific provisions for such life events, allowing them to adjust your coverage accordingly.

The process typically involves providing detailed medical information, including the nature of the diagnosis, any recommended treatments, and the expected impact on your overall health and daily life. This information helps the insurance company assess the potential risks and determine the necessary adjustments to your policy. For instance, a new diagnosis might require an update to your health insurance plan to include specific treatments, medications, or specialist consultations.

It is important to act promptly when dealing with major health changes. Delays in updating your insurance information could result in gaps in coverage, leading to potential financial burdens if unexpected medical expenses arise. By staying proactive and informing your insurance provider, you can ensure that your policy remains comprehensive and tailored to your evolving health needs.

Additionally, major health changes may also prompt a review of other aspects of your insurance coverage, such as life insurance or disability insurance. These types of policies often have health-related provisions, and an updated health status could impact the terms and benefits offered. Therefore, a comprehensive approach to updating your insurance information is essential to maintain adequate coverage throughout life's significant health-related milestones.

Health Classes: Understanding Life Insurance Rates Better

You may want to see also

Education: College enrollment or graduation impacts insurance needs

Enrolling in college or graduating from an educational institution marks a significant life event that can influence an individual's insurance needs. During this period, students often require specialized coverage to address unique risks and responsibilities. Here's an overview of how college enrollment and graduation impact insurance considerations:

College Enrollment and Insurance:

When a student enrolls in college, their insurance requirements may evolve. Firstly, health insurance becomes crucial as students leave their family's coverage and enter a new environment with potential health risks. Many colleges offer student health plans, which typically include medical, dental, and vision coverage. These plans are often comprehensive and tailored to the needs of young adults, providing essential protection during a critical period of development. Additionally, students may consider purchasing personal injury protection (PIP) or no-fault insurance, which covers medical expenses and lost wages resulting from injuries, regardless of fault. This coverage is especially relevant for students who participate in sports or engage in activities with potential risks.

Graduation and Insurance Transition:

Graduation signifies a transition from student life to adulthood, bringing about changes in insurance coverage. As graduates leave their college health plans, they must decide whether to continue their student insurance or explore alternative options. Many graduates opt for individual health insurance plans, which offer more flexibility and customization. This transition also prompts considerations for life insurance. Young adults may want to review their life insurance needs, especially if they have financial responsibilities or dependents. Term life insurance, a popular choice for young graduates, provides coverage for a specific period, ensuring financial security for loved ones.

Other Insurance Considerations:

Beyond health insurance, college enrollment or graduation can prompt other insurance reviews. For instance, auto insurance may become necessary if students obtain their driver's license and own or lease a vehicle. Renters or homeowners insurance could also be required as students transition to independent living. Additionally, liability insurance might be beneficial, especially for students engaging in extracurricular activities or managing financial assets.

In summary, college enrollment and graduation are pivotal life events that necessitate a reevaluation of insurance coverage. Students and graduates should assess their unique needs, considering health, life, auto, and property insurance options. Consulting with insurance professionals can provide personalized guidance, ensuring that individuals make informed decisions to protect themselves and their loved ones during this transformative phase of life.

Life Insurance and Death: A Guide to Checking Policies in Singapore

You may want to see also

Legal Status: Citizenship changes or marriages impact eligibility for specific insurance plans

Life events, such as changes in legal status, can significantly impact an individual's insurance coverage and eligibility for specific plans. When it comes to legal status, two key life events to consider are citizenship changes and marriages. These events can affect an individual's ability to enroll in certain insurance plans and may require careful consideration and planning.

Citizenship Changes:

If an individual's citizenship status changes, whether through naturalization, deportation, or other legal processes, it can have immediate implications for their insurance coverage. In many countries, insurance plans are tied to an individual's legal status, and a change in citizenship may result in a loss of eligibility for certain plans. For example, a non-citizen resident may have access to specific health insurance options, but once they become a citizen, they might need to re-evaluate their coverage to ensure it meets their needs. During this transition, individuals should carefully review their insurance policies and understand the requirements for maintaining coverage. They may need to contact their insurance providers to discuss the impact of citizenship changes and explore options for transitioning to a suitable plan.

Marriages and Domestic Partnerships:

Marriage or entering into a domestic partnership can also influence insurance eligibility. Many insurance companies offer different coverage options for married couples or domestic partners. For instance, a married individual may be eligible for spousal coverage under their partner's insurance plan, which could provide more comprehensive benefits. In some cases, marriages between individuals of different legal statuses (e.g., citizen and non-citizen) might require additional considerations. It is essential to understand the insurance policies' terms and conditions regarding marriages and domestic partnerships to ensure that the coverage is appropriate and meets the needs of both individuals.

When experiencing these life events, individuals should promptly notify their insurance providers to update their records and ensure accurate eligibility determinations. Insurance companies often have specific procedures for handling such changes, and timely communication can help prevent gaps in coverage. Additionally, seeking guidance from insurance brokers or financial advisors who specialize in insurance matters can provide valuable insights into navigating these legal status changes and their impact on insurance enrollment.

Understanding the legal implications of citizenship changes and marriages is crucial for making informed decisions about insurance coverage. These life events can trigger the need to re-evaluate and potentially switch insurance plans to ensure continued protection and access to essential benefits. By staying informed and proactive, individuals can effectively manage their insurance needs throughout various life transitions.

Understanding the Legal Process: Life Insurance Ownership Transfer

You may want to see also

Frequently asked questions

When an individual starts a new job, they typically have a specific enrollment period to choose their health insurance plan. This window is usually a few days to a few weeks after joining the company, depending on the employer's policies. It's important to review the benefits package and understand the options available during this time.

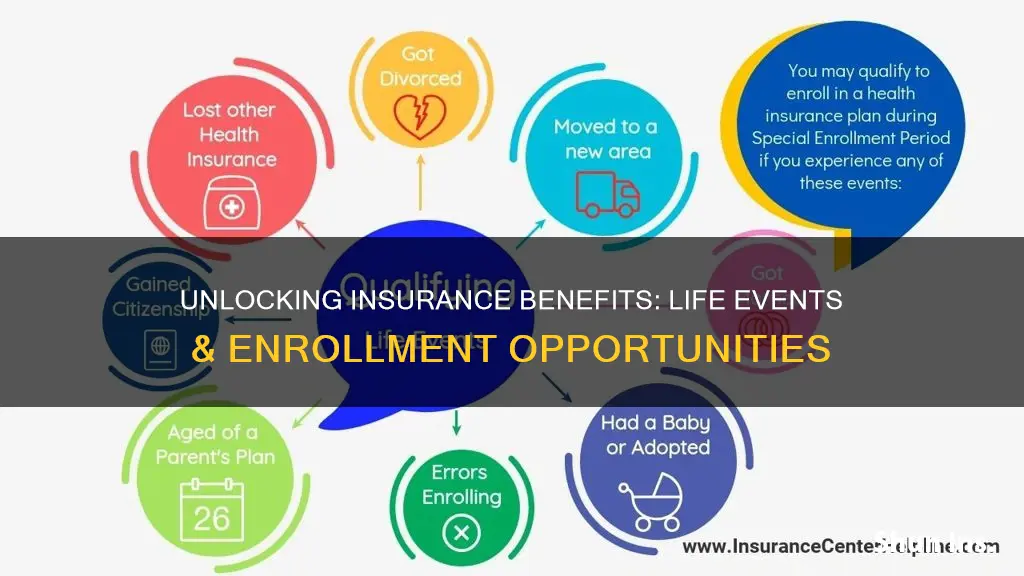

Life events such as marriage, divorce, birth of a child, or the loss of a dependent can trigger special enrollment periods. These events may allow individuals to make changes to their insurance plans, add or remove family members, or switch to different coverage options. It's a good idea to review your insurance policy and contact the provider to understand the specific rules and deadlines for such life events.

Yes, relocating to a different state or country can impact insurance coverage. When moving, individuals should review their insurance policies to ensure they meet the new location's requirements. Some insurance plans may have specific enrollment periods or exclusions for out-of-state or out-of-network services. It's essential to understand the coverage options available in your new area and potentially explore new insurance providers if needed.