Choosing the right life insurance for teens can be a crucial decision for parents and guardians. With the increasing responsibilities and financial commitments that come with adulthood, it's important to consider the unique needs and risks associated with teenage life. This guide will explore the various factors to consider when selecting life insurance for teens, including the types of policies available, the benefits of term life insurance, and how to ensure the best coverage for your teenager's future. By understanding the options and making an informed choice, you can provide valuable financial protection for your teen's life and well-being.

What You'll Learn

- Health Insurance: Coverage for medical expenses, doctor visits, and prescription drugs

- Auto Insurance: Protection against accidents, theft, and liability for driving

- Liability Insurance: Coverage for damages and injuries caused to others

- Life Insurance: Financial support for dependents in the event of death

- Discounts and Savings: Ways to reduce costs and save money on insurance

Health Insurance: Coverage for medical expenses, doctor visits, and prescription drugs

Health insurance is a crucial aspect of financial planning, especially for teenagers, as it provides coverage for various medical expenses and ensures access to quality healthcare. When considering the best health insurance for teens, it's essential to focus on comprehensive coverage that caters to their unique needs. Here's an overview of what you should look for:

Medical Expenses: Teenagers often require regular medical attention, including check-ups, vaccinations, and minor surgeries. A good health insurance plan should cover these routine medical costs without placing a significant financial burden on the teen or their family. It should include a reasonable allowance for out-of-pocket expenses, ensuring that teens can access necessary treatments without delay.

Doctor Visits: Regular visits to healthcare professionals are essential for monitoring a teenager's growth, development, and overall health. Insurance policies should cover consultations with pediatricians, general practitioners, and specialists. This coverage ensures that teens can address any health concerns promptly and receive appropriate referrals for specialized care.

Prescription Drugs: Many teens require medications for various conditions, such as asthma, allergies, or mental health issues. Health insurance plans should offer coverage for prescription drugs, ensuring that teens can access the necessary medications at affordable prices. It's important to check the formulary (list of covered drugs) to ensure that the required medications are included.

Additionally, consider the following factors when choosing health insurance for teens:

- Network of Healthcare Providers: Opt for plans that have a wide network of trusted healthcare providers, including hospitals, clinics, and pharmacies. This ensures that teens can access care from familiar and reputable medical facilities.

- Preventive Care: Emphasize the importance of preventive care, as insurance should cover routine check-ups, immunizations, and screenings. This proactive approach can help identify potential health issues early on.

- Mental Health Services: Teenagers may require support for mental health concerns. Ensure that the insurance plan provides coverage for counseling, therapy, and mental health-related services.

- Customizable Plans: Look for insurance providers that offer flexible plans, allowing you to customize coverage based on your teen's specific needs and budget.

By selecting a health insurance plan that prioritizes medical expenses, doctor visits, and prescription drug coverage, you can provide your teenager with the necessary tools to maintain their health and well-being. It's an investment in their future, ensuring they can access quality healthcare when needed.

Future Generali: A Good Life Insurance Option?

You may want to see also

Auto Insurance: Protection against accidents, theft, and liability for driving

Auto insurance is a crucial aspect of being a responsible driver, especially for teenagers who are new to the road. It provides financial protection and peace of mind in the event of accidents, theft, or liability issues while driving. Here's an overview of why auto insurance is essential for teens and how it works:

Understanding the Risks: Teenagers are statistically more prone to accidents due to their lack of experience and maturity. Their risk-taking behavior and limited driving skills can lead to costly mistakes. Auto insurance is designed to mitigate these risks and provide a safety net for teens and their families. It ensures that in the event of an accident, the financial burden of repairs or medical expenses is not solely on the teen or their parents.

Coverage Options: Auto insurance policies offer various coverage types tailored to different needs. For teens, the most relevant coverage includes:

- Liability Coverage: This is essential as it protects the teen and their parents from financial liability if they cause an accident. It covers the costs of medical treatment and property damage for the other party involved.

- Collision Coverage: This type of insurance pays for repairs to the teen's vehicle if it's damaged in an accident, regardless of who is at fault. It's particularly useful for newer drivers who might be more prone to accidents.

- Comprehensive Coverage: This coverage protects against non-collision-related incidents like theft, vandalism, fire, or natural disasters. It provides additional peace of mind, especially for teens living in areas with higher crime rates.

Benefits of Auto Insurance for Teens:

- Financial Protection: Auto insurance ensures that teens and their families are not left with overwhelming medical or repair bills after an accident. It provides a safety net, allowing young drivers to focus on recovery and healing without financial worry.

- Legal Requirement: In many places, having auto insurance is mandatory for drivers, including teenagers. Obtaining insurance ensures compliance with local laws and regulations, preventing potential legal issues and fines.

- Building a Driving Record: Responsible insurance can contribute to a positive driving record. By understanding the importance of insurance, teens are more likely to drive safely and responsibly, which can lead to lower insurance premiums in the future.

When choosing an auto insurance policy for a teen, it's advisable to compare different providers and policies to find the best coverage at a reasonable cost. Parents can also consider adding their teen as a named driver on their existing policy, which might be more affordable initially. As teens gain driving experience and a clean record, they can gradually transition to their own policies, ensuring they have the necessary protection throughout their driving journey.

Oral Swab Test: Vaping and Life Insurance

You may want to see also

Liability Insurance: Coverage for damages and injuries caused to others

Liability insurance is a crucial component of any teen's insurance portfolio, as it provides financial protection against potential lawsuits and claims arising from accidents or incidents where the teen is at fault. This type of insurance is designed to cover the costs associated with damages and injuries caused to others, offering a safety net for teens and their families. When a teen is involved in an accident, whether it's a car crash, a slip and fall, or any other incident, liability insurance can help mitigate the financial burden that comes with legal proceedings and compensation.

The primary purpose of liability coverage is to protect the insured teen and their family from the financial consequences of being held responsible for an accident. For instance, if a teen driver causes a car accident that results in injuries to another driver or their passengers, liability insurance will cover the medical expenses, rehabilitation costs, and any other related damages. This coverage ensures that the teen and their family are not left with overwhelming medical bills and legal fees, especially if the accident is deemed their fault.

In the context of teens, liability insurance is particularly important due to their limited financial resources and potential legal exposure. Teenagers are often less experienced and may have fewer assets, making them more vulnerable in legal disputes. Liability insurance provides a layer of financial protection, ensuring that they can handle potential claims without facing significant financial strain. It is a wise investment for parents and guardians to consider, as it not only safeguards their child's assets but also provides peace of mind.

When purchasing liability insurance for teens, it is essential to understand the coverage limits and options available. Policies typically offer different levels of coverage, and the teen's family should choose a limit that provides adequate protection. Higher coverage limits mean the insurance company will pay more if a claim is made, but it also comes with higher premiums. It is a balance between ensuring sufficient protection and managing the cost of insurance.

Moreover, liability insurance can also cover other situations, such as property damage. For example, if a teen accidentally damages someone else's property, such as a fence or a neighbor's car, the insurance can cover the repair or replacement costs. This aspect of liability insurance is vital for teens, as it covers a wide range of potential liabilities they may face during their formative years. By having comprehensive liability coverage, teens and their families can navigate potential legal challenges with greater confidence and financial security.

Mortgage Life Insurance: Worth the Cost?

You may want to see also

Life Insurance: Financial support for dependents in the event of death

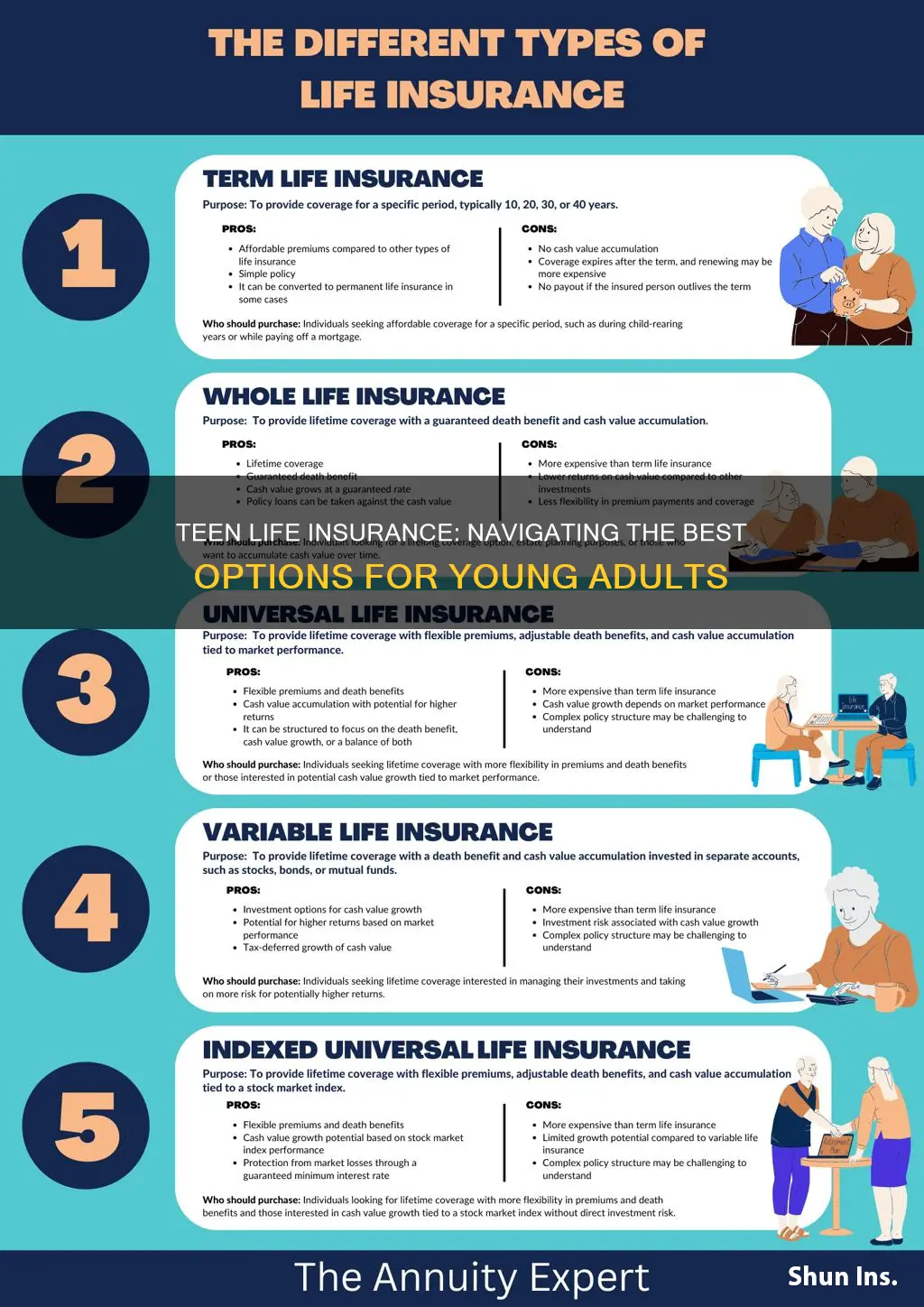

Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your untimely death. It ensures that your dependents, such as your spouse, children, or other family members who rely on your income, are financially protected and can maintain their standard of living. When considering life insurance, especially for teenagers, it's essential to understand the various options available and how they can benefit your loved ones.

For teens, life insurance can be a valuable way to secure their future and provide financial support to their family. While it might seem counterintuitive to think about life insurance at a young age, it can offer long-term benefits. Term life insurance, for instance, is a popular choice for young individuals as it provides coverage for a specific period, often 10, 20, or 30 years. This type of policy is typically more affordable and can be a cost-effective way to build a financial safety net. During this period, the premiums are usually lower, and the coverage amount can be adjusted as the individual's needs and circumstances change.

The primary purpose of life insurance is to provide financial security. If you were to pass away, the insurance company would pay out a death benefit to your designated beneficiaries. This financial support can help cover various expenses, such as mortgage payments, education costs, medical bills, or even daily living expenses for your dependents. It ensures that your family can maintain their lifestyle and have the resources to manage their financial obligations without the added stress of sudden financial strain.

When choosing life insurance for teens, it's important to consider the individual's circumstances. For instance, if a teenager has a part-time job or a small income, they might opt for a smaller policy with a lower premium. Alternatively, if they are part of a larger family with multiple dependents, a more substantial policy could be necessary to ensure adequate financial support. Additionally, term life insurance can be a flexible option, allowing the policyholder to increase the coverage amount as their income grows or their family's needs change.

In summary, life insurance is a vital consideration for teenagers and their families. It provides a financial safety net, ensuring that dependents are cared for and their financial obligations are met in the event of the policyholder's death. By understanding the different types of life insurance and their benefits, you can make an informed decision to protect your loved ones' future. Remember, starting early and reviewing policies periodically can help ensure that your life insurance plan remains relevant and effective throughout your life's journey.

Brain Hemorrhage: Is Life Insurance Coverage Guaranteed?

You may want to see also

Discounts and Savings: Ways to reduce costs and save money on insurance

When it comes to life insurance for teens, finding affordable coverage can be a challenge, but there are several strategies to reduce costs and save money. Here are some ways to consider:

Review and Compare Policies: Start by researching and comparing different insurance providers and their offerings. Teenagers often face higher insurance premiums due to their age and perceived risk. By gathering quotes from multiple companies, you can identify the most competitive rates. Look for insurers that specialize in providing insurance for young adults, as they might offer tailored plans with better pricing.

Consider Term Life Insurance: Term life insurance is a cost-effective option for teens, especially if they are not yet financially independent. This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. Since the risk of death is lower during these years, insurers often offer lower premiums. Once the term ends, the teen can decide whether to renew the policy or explore other options.

Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies together. For example, combining life insurance with auto insurance can lead to significant savings. If your teen is a driver, consider adding their life insurance policy to an existing auto insurance policy to take advantage of potential discounts.

Good Student Discounts: Educational achievements can translate into insurance savings. Many insurers provide discounts to students who maintain a certain grade point average (GPA). Encourage your teen to excel academically, as this could result in reduced insurance premiums. Additionally, some companies offer good student discounts specifically for teens who are enrolled in full-time courses at a college or university.

Safe Driving Incentives: For teen drivers, safe driving habits can lead to lower insurance costs. Some insurance providers offer usage-based insurance programs that monitor driving behavior through installed devices or apps. If your teen practices safe driving, they may be eligible for discounts based on their performance. This can include rewards for maintaining a clean driving record, completing defensive driving courses, or achieving a certain number of accident-free miles.

Review and Adjust Coverage: Regularly review the policy to ensure it remains appropriate for your teen's changing circumstances. As they grow older and their financial responsibilities increase, you might need to adjust the coverage accordingly. It's a good practice to reassess the policy at least once a year or whenever there are significant life changes. This proactive approach can help you avoid paying for unnecessary coverage and potentially save money.

Bank-Sold Credit Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

For teenagers, term life insurance is often the most suitable option. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable for young individuals. It offers a straightforward way to ensure financial protection for your loved ones if something happens to the insured during the term.

The amount of coverage needed for a teenager depends on various factors, including their financial responsibilities, such as supporting a family or having dependents. As a general rule, a teenager's life insurance policy should cover at least 10 times their annual income. For example, if a teenager earns $10,000 per year, a policy with a coverage amount of $100,000 might be appropriate.

While whole life insurance is a permanent policy that provides coverage for the entire life of the insured, it is typically more expensive and may not be the best choice for teenagers. Whole life insurance is often recommended for individuals who want long-term financial security and are committed to long-term savings. Teenagers might benefit more from the simplicity and affordability of term life insurance.

Life insurance for teenagers can provide several advantages. Firstly, it offers financial protection to the insured's family in the event of their untimely death. This can help cover expenses like funeral costs, outstanding debts, or the daily living expenses of dependents. Additionally, life insurance can be a valuable teaching tool, encouraging responsible financial planning and awareness from a young age.