Life insurance contracts are financial instruments that provide coverage and financial security to individuals and their beneficiaries. One of the key aspects of these contracts is their investment strategy, which involves allocating premiums into various assets to generate returns. In the context of life insurance, these investments often include a mix of stocks and bonds. Stocks, representing ownership in companies, offer the potential for higher returns but also carry greater risk. Bonds, on the other hand, are debt instruments that provide a steady income stream and are generally considered less risky. The investment in stocks and bonds within life insurance contracts is carefully managed to balance risk and return, ensuring the policyholder's financial security and the insurer's ability to meet their obligations.

What You'll Learn

- Stock Market Allocation: Life insurance companies invest in stocks to grow capital and generate returns

- Bond Portfolio Management: Bonds provide stable income and are a key asset class

- Diversification Strategies: Diversifying investments in stocks and bonds reduces risk and maximizes returns

- Investment Risk Assessment: Regular evaluation of stock and bond investments is essential for financial stability

- Long-Term Investment Planning: Life insurance policies focus on long-term investments for policyholder benefits

Stock Market Allocation: Life insurance companies invest in stocks to grow capital and generate returns

Life insurance companies play a crucial role in the financial industry by providing a safety net for individuals and families. One of their primary functions is to offer financial protection and security through various insurance products. Among their investment strategies, life insurance companies often allocate a significant portion of their assets to the stock market, which involves investing in stocks. This approach is known as stock market allocation and serves multiple purposes.

The primary goal of investing in stocks is to grow the capital of the insurance company over time. Stocks represent ownership in companies, and when life insurers purchase these stocks, they become shareholders. By holding stocks, the company can benefit from the growth and success of these businesses. As the companies expand and generate profits, the value of the stocks increases, providing a potential return on investment for the insurance provider. This growth in capital is essential for the long-term sustainability and profitability of the insurance company.

Stock market allocation allows life insurance companies to generate returns and enhance their financial performance. When investing in stocks, insurers can take advantage of the potential for higher returns compared to other investment options. Stocks have historically shown the ability to outperform other asset classes over the long term. By carefully selecting a diverse range of stocks across various sectors and industries, insurance companies can minimize risk and maximize the potential for capital appreciation. This strategic allocation enables them to meet their financial obligations to policyholders while also growing their own assets.

Furthermore, investing in stocks provides life insurance companies with an opportunity to diversify their investment portfolio. Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and industries. By allocating a portion of their funds to stocks, insurers can reduce the overall risk of their portfolio. Stocks offer a different risk-return profile compared to bonds or fixed-income securities, and this diversification can help smooth out the volatility of the investment returns.

In summary, stock market allocation is a critical strategy for life insurance companies to grow their capital and generate returns. By investing in stocks, these insurers can benefit from the potential for higher returns, diversify their portfolio, and ensure the long-term financial stability of the business. It is a calculated approach that allows them to fulfill their obligations to policyholders while also building a robust and resilient financial foundation. Understanding the role of stock investments in life insurance contracts is essential for both the industry and its stakeholders.

Borrowing from Your ATT Retirement Insurance: Is it Possible?

You may want to see also

Bond Portfolio Management: Bonds provide stable income and are a key asset class

Bonds are a fundamental component of a well-rounded investment portfolio, especially for those seeking stable income and long-term wealth preservation. Bond portfolio management is a strategic approach to investing in fixed-income securities, offering a more conservative alternative to stocks while still providing the potential for growth. This asset class is a cornerstone of many financial strategies, including those employed by life insurance companies, as it offers a reliable source of income and a means to diversify investment portfolios.

The primary appeal of bonds lies in their ability to generate a steady stream of income through regular interest payments. These payments, known as coupon payments, are typically made semi-annually or annually, providing a consistent cash flow for investors. Bondholders receive these payments until the bond's maturity date, at which point the principal amount is returned. This predictable income stream is particularly attractive to risk-averse investors and those seeking a more stable investment option.

In the context of bond portfolio management, investors aim to optimize their bond holdings to meet specific financial objectives. This involves a careful selection process, where various factors are considered to ensure the bonds' suitability for the portfolio. These factors include credit quality, maturity dates, and interest rates. For instance, government bonds are often seen as a safe haven due to their low default risk, making them a popular choice for risk-averse investors. Corporate bonds, on the other hand, offer higher yields but may carry more risk, requiring careful assessment of the issuing company's financial health.

Diversification is a key principle in bond portfolio management. By investing in a range of bonds with different characteristics, investors can reduce the overall risk of their portfolio. This can include a mix of short-term and long-term bonds, investment-grade and high-yield bonds, and bonds from various sectors and regions. Diversification helps smooth out the volatility of bond prices and provides a more consistent income stream, even during economic downturns.

Effective bond portfolio management also involves regular monitoring and adjustment. As market conditions change, bond prices fluctuate, and investors must stay informed to make timely decisions. This may include selling bonds that have appreciated significantly or buying new bonds to maintain the desired level of exposure. Additionally, investors should consider the tax implications of bond investments, as municipal bonds, for example, offer tax-free income, making them an attractive option for certain investors.

In summary, bond portfolio management is a strategic approach to investing in fixed-income securities, offering stable income and long-term wealth preservation. It involves a careful selection process, diversification, and regular monitoring to optimize the portfolio's performance. Bonds, particularly those issued by governments and well-managed corporations, provide a reliable source of income and are a crucial component of a balanced investment strategy, especially for life insurance companies aiming to meet their policyholders' financial needs.

Life Insurance Policies: Can You Sell Them?

You may want to see also

Diversification Strategies: Diversifying investments in stocks and bonds reduces risk and maximizes returns

Diversification is a key strategy in managing investment portfolios, especially when it comes to stocks and bonds. This approach involves spreading your investments across various assets to minimize risk and optimize returns. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio, ensuring a more stable and consistent growth trajectory.

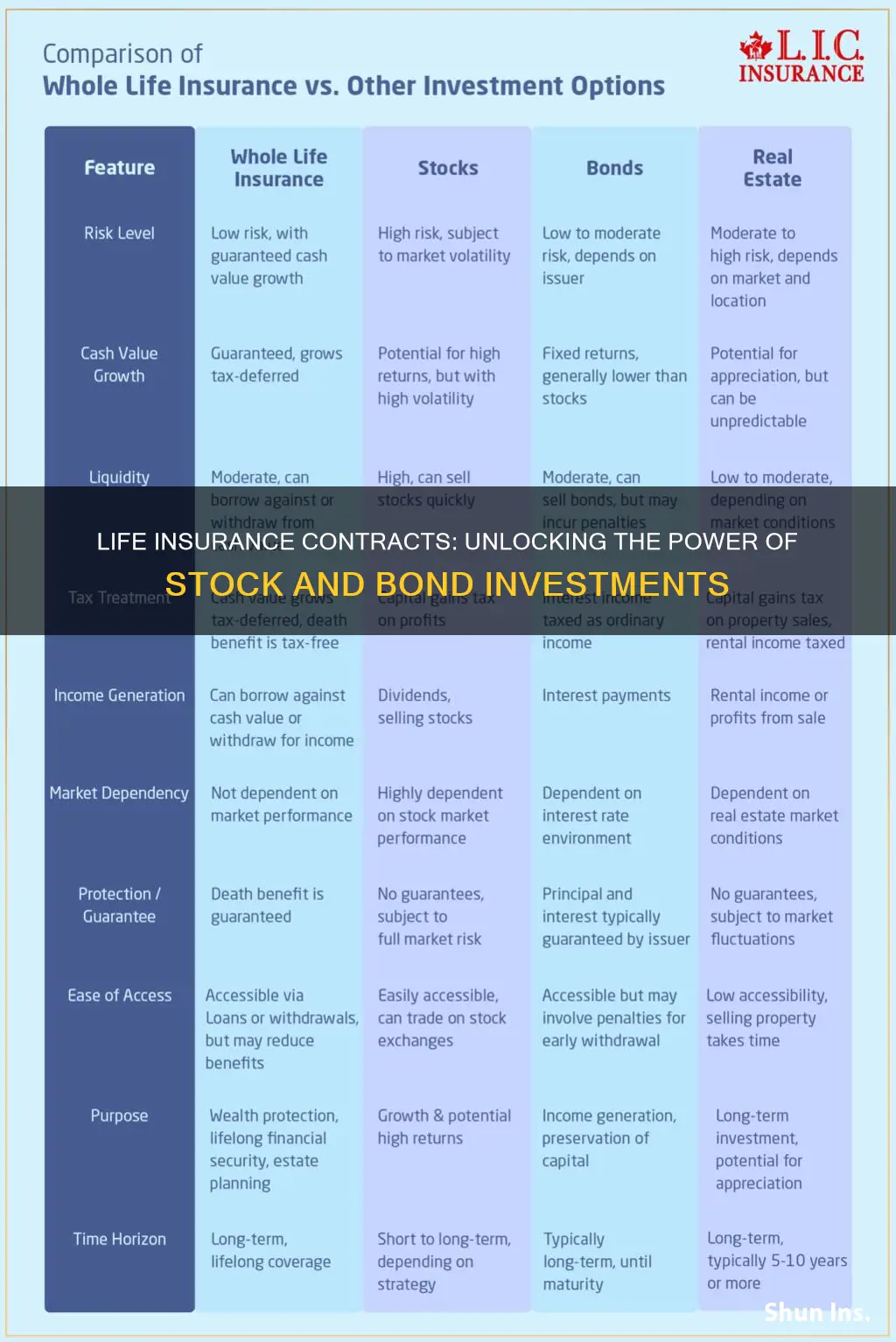

In the context of life insurance contracts, these investment strategies are often employed to ensure the financial security of policyholders. Life insurance companies invest the premiums collected from policyholders in a diverse range of assets, including stocks and bonds. This is a prudent approach as it allows them to generate returns while also providing a safety net for policyholders. Stocks, representing ownership in companies, offer the potential for higher returns but also carry higher risk. Bonds, on the other hand, are considered less risky but provide more stable returns.

The diversification strategy in this context involves allocating a portion of the investment portfolio to stocks and the rest to bonds. This allocation is carefully determined based on the insurance company's risk tolerance, the policyholder's investment goals, and the current market conditions. For instance, a more aggressive investment strategy might allocate a larger portion to stocks, aiming for higher returns, while a more conservative approach would favor bonds to minimize risk.

By diversifying, life insurance companies can achieve a balance between risk and return. Stocks provide the potential for significant growth, especially over the long term, while bonds offer a steady income stream and act as a buffer during market downturns. This balanced approach ensures that the policyholder's investment grows over time, providing financial security and potentially increasing the value of the life insurance policy.

In summary, diversification in the context of life insurance contracts is a strategic approach to investing in stocks and bonds. It involves a careful allocation of assets to manage risk and maximize returns. This strategy is essential for insurance companies to fulfill their financial obligations to policyholders while also ensuring the long-term growth and stability of the investment portfolio.

Client ID in Reliance Life Insurance: All You Need to Know

You may want to see also

Investment Risk Assessment: Regular evaluation of stock and bond investments is essential for financial stability

The concept of investment risk assessment is crucial for individuals and financial institutions, especially when it comes to the investments made by life insurance companies. These companies often have a diverse portfolio of assets, including stocks and bonds, which are subject to various risks that can impact their financial stability. Regular evaluation of these investments is essential to ensure that the insurance company's financial health remains robust and that policyholders' interests are protected.

Stock investments, in particular, carry a higher level of risk compared to bonds. Stocks represent ownership in a company, and their value can fluctuate based on market conditions, industry performance, and company-specific factors. For instance, a company's stock price might drop significantly if it faces financial difficulties, a change in management, or a decline in its industry's performance. Investors need to assess the risk associated with each stock, considering factors like market volatility, company fundamentals, and industry trends.

Bonds, on the other hand, are considered a more stable investment, but they still carry risks. Bond prices can be affected by changes in interest rates, creditworthiness, and market sentiment. When interest rates rise, bond prices typically fall, and vice versa. Additionally, the creditworthiness of the bond issuer is crucial; if a company or government defaults on its bond payments, investors face the risk of losing their principal investment.

Regular evaluation of these investments involves monitoring market trends, analyzing financial statements, and staying updated on economic indicators. Investment risk assessment should consider both quantitative and qualitative factors. Quantitative analysis includes studying historical performance, volatility, and correlation with other assets. Qualitative assessments involve understanding the underlying business, industry dynamics, and potential risks associated with specific investments.

By conducting thorough investment risk assessments, life insurance companies can make informed decisions regarding their asset allocation. This process ensures that the portfolio is diversified, and the risk is managed effectively. Regular reviews also help identify potential issues early on, allowing for timely adjustments to the investment strategy. Ultimately, this practice contributes to the financial stability of the insurance company and the security of the policyholders' investments.

Canceling Modern Woodman Life Insurance: A Step-by-Step Guide

You may want to see also

Long-Term Investment Planning: Life insurance policies focus on long-term investments for policyholder benefits

Life insurance policies are not just about providing financial protection to beneficiaries in the event of the insured's death; they also serve as powerful long-term investment vehicles. This aspect of life insurance is often overlooked, but it can be a valuable tool for those seeking to grow their wealth over time. Here's an in-depth look at how life insurance contracts can be structured to focus on long-term investments and the benefits they offer.

Understanding the Investment Component:

Life insurance policies, particularly those with a cash value component, often include an investment aspect. When you purchase a life insurance policy, a portion of your premium goes towards building a cash value, which can grow over time. This cash value is typically invested in a diversified portfolio of assets, including stocks, bonds, and other securities. The investment strategy is carefully managed by the insurance company to ensure it aligns with the policyholder's long-term financial goals.

Long-Term Investment Strategies:

- Stock Market Participation: Life insurance contracts may invest in stocks, allowing policyholders to benefit from the potential growth of the stock market. Over the long term, stocks have historically provided higher returns compared to other asset classes. This investment strategy can be particularly attractive for those seeking to build substantial wealth over time.

- Bond Investments: Bonds are another critical component of long-term investment strategies. Life insurance companies may invest in government bonds, corporate bonds, or a mix of both. Bonds provide a steady income stream through interest payments and are considered a more conservative investment compared to stocks. This diversification helps balance risk and reward.

- Asset Allocation: Insurance companies often employ asset allocation strategies to optimize the investment performance of the policy's cash value. This involves regularly reviewing and adjusting the portfolio to ensure it aligns with the policyholder's risk tolerance and financial objectives. A well-managed asset allocation can lead to consistent growth and potential tax advantages.

Benefits of Long-Term Investment in Life Insurance:

- Wealth Accumulation: Life insurance policies with investment components can help accumulate wealth over time. The combination of death benefits and growing cash value can provide a substantial financial cushion for policyholders and their beneficiaries.

- Tax Advantages: Long-term investments within life insurance policies may offer tax benefits. In some jurisdictions, the growth of the cash value in certain types of life insurance policies is tax-deferred, allowing it to compound without immediate tax implications.

- Financial Security: By investing in life insurance, individuals can ensure financial security for their loved ones, even in the event of their passing. The death benefit can provide a lump sum or regular income to cover expenses and achieve financial goals.

- Flexibility: Policyholders can often customize their investment strategy within the life insurance policy. They can choose the level of risk they are comfortable with and adjust their investments accordingly, providing a degree of control over their financial future.

In summary, life insurance policies with investment features offer a unique opportunity for individuals to engage in long-term investment planning. By strategically investing in stocks, bonds, and other assets, policyholders can build wealth, achieve financial goals, and provide security for their beneficiaries. Understanding the investment aspects of life insurance is essential for anyone looking to make the most of their financial resources over an extended period.

Understanding Life Insurance: Mortality Charges and Their Impact

You may want to see also

Frequently asked questions

Life insurance companies, particularly those offering investment-linked policies, often invest in a diverse range of assets to grow the policyholder's money. These investments can include stocks, bonds, and other securities. Stocks are shares in companies, which can provide capital appreciation and dividends. Bonds, on the other hand, are debt instruments where the insurance company lends money to governments or corporations and receives interest payments in return.

Stocks and bonds are fundamental components of investment-based life insurance policies. Stocks offer the potential for higher returns over the long term, which can help increase the policy's cash value. Bonds provide a more stable and predictable income stream, ensuring regular interest payments. This combination of investments allows insurance companies to offer competitive returns while also managing risk.

Yes, investing in stocks and bonds carries certain risks. Stock prices can be volatile and may decrease, impacting the policy's value. Bond prices can also fluctuate, and if interest rates rise, bond prices may fall. Additionally, there are risks associated with the financial health of the companies or governments issuing the securities. Diversification is a key strategy to manage these risks, ensuring that the policyholder's money is spread across various investments.

Policyholders can benefit from the growth of their life insurance policies through increased cash value, which can be borrowed against or withdrawn. If the investments perform well, the policy's value may grow, providing a financial safety net for the policyholder and their beneficiaries. Additionally, some policies offer guaranteed minimum death benefits, ensuring a certain payout regardless of investment performance.