Life insurance is a crucial financial tool for single mothers to ensure their children's well-being and financial security in the event of their untimely demise. Choosing the right life insurance policy can be challenging, as it involves balancing coverage, cost, and the specific needs of a single parent. This article will explore the various types of life insurance available to single mothers, including term life, whole life, and universal life policies, and provide insights into how to select the best coverage to protect their families.

What You'll Learn

- Term Life Insurance: Affordable coverage for a specific period, ideal for single mothers

- Whole Life Insurance: Permanent coverage with a savings component, providing long-term financial security

- Universal Life Insurance: Flexible policy with adjustable premiums, offering both coverage and investment options

- Riders and Add-ons: Enhance coverage with additional benefits like accidental death or critical illness

- Budget and Needs: Assess financial needs and choose a policy that fits your budget and provides adequate protection

Term Life Insurance: Affordable coverage for a specific period, ideal for single mothers

Term life insurance is a practical and cost-effective solution for single mothers seeking financial protection for their families. This type of insurance provides a straightforward and temporary coverage option, which is particularly beneficial for those with specific financial goals and a defined period of need. Here's why it could be the ideal choice for single mothers:

Affordability and Simplicity: Term life insurance is known for its affordability, making it accessible to a wide range of individuals. It offers a fixed period of coverage, typically 10, 15, or 20 years, during which the premiums remain consistent. This predictability in pricing allows single mothers to plan and budget effectively. By choosing a term that aligns with the duration of their children's dependency, they can ensure that their financial obligations are covered during the critical years. For instance, if a single mother's primary concern is providing for her children's education until they turn 18, a 10-year term policy could be a suitable and economical choice.

Financial Security: The primary purpose of life insurance is to provide financial security to loved ones in the event of the insured's death. For single mothers, this can be a crucial aspect of ensuring their children's well-being. In the event of an unforeseen tragedy, the term life insurance policy will pay out a lump sum, providing immediate financial support to the family. This financial cushion can help cover essential expenses, such as funeral costs, outstanding debts, and ongoing living expenses, ensuring that the family's financial stability is maintained during a challenging time.

Flexibility and Customization: Term life insurance offers flexibility in terms of coverage amount and duration. Single mothers can choose the amount of coverage that aligns with their specific needs. For instance, they might opt for a higher coverage amount if they have multiple financial responsibilities or if they wish to leave a substantial inheritance for their children. Additionally, the temporary nature of term insurance allows single mothers to reassess their needs over time and adjust their policy accordingly without incurring significant costs.

Peace of Mind: Knowing that their family is financially protected can provide single mothers with valuable peace of mind. This type of insurance ensures that their loved ones will have the necessary financial resources to maintain their standard of living and cover essential expenses, even in the mother's absence. It allows them to focus on their children's well-being and future without the constant worry of financial uncertainty.

In summary, term life insurance is an excellent choice for single mothers due to its affordability, simplicity, and ability to provide tailored financial protection. By selecting a term that aligns with their specific needs, single mothers can ensure that their families are safeguarded during the critical years, offering both financial security and peace of mind. It is a practical step towards securing a stable future for their children.

Life Insurance Maturity: Taxable in the US?

You may want to see also

Whole Life Insurance: Permanent coverage with a savings component, providing long-term financial security

Whole life insurance is an excellent choice for single mothers seeking long-term financial security and peace of mind. This type of permanent insurance policy offers a range of benefits that can be particularly valuable in the context of single parenthood. Firstly, whole life insurance provides guaranteed coverage for the entire life of the policyholder, ensuring that your loved ones will receive a death benefit when you pass away. This is especially crucial for a single mother who may rely on a steady income to support her children. The policy's permanent nature means that the coverage remains in force as long as the premiums are paid, providing a stable financial foundation for your family.

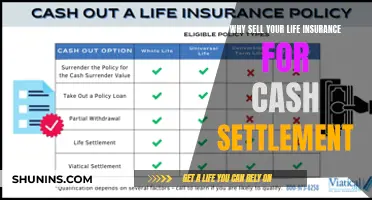

One of the key advantages of whole life insurance is its savings component. As you pay premiums, a portion of the money goes into a cash value account, which grows over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. For a single mother, this feature can be a valuable asset, allowing her to access funds for various purposes, such as covering unexpected expenses, funding her children's education, or even starting a business to generate additional income. The savings aspect of whole life insurance can help build a financial safety net, ensuring that your family's financial goals and needs are met even in your absence.

The long-term financial security offered by whole life insurance is particularly beneficial for single parents. It provides a consistent and reliable source of income replacement, which can be essential for a single mother who may have limited earning potential or rely on a single income. With whole life insurance, the death benefit can help cover daily living expenses, mortgage or rent payments, and other essential costs, ensuring that your children's financial needs are met even if you are no longer there to provide directly. This type of insurance also allows for customization, enabling you to choose the coverage amount and term that best suit your family's requirements.

When considering whole life insurance, it's important to evaluate your specific circumstances and financial goals. Single mothers should assess their ability to afford the premiums and ensure that the policy's benefits align with their long-term financial objectives. Consulting with a financial advisor or insurance professional can provide valuable guidance in choosing the right policy and understanding the various options available. They can help tailor the coverage to your unique needs, ensuring that your family's financial future is protected.

In summary, whole life insurance offers single mothers a powerful tool for achieving long-term financial security. Its permanent coverage and savings component provide a reliable safety net, ensuring that your family's financial stability is maintained even in the face of life's uncertainties. By carefully considering your options and seeking professional advice, you can make an informed decision about whole life insurance, giving yourself and your children the peace of mind that comes with knowing they are protected.

Life Insurance: Medical Check-ups and Their Importance

You may want to see also

Universal Life Insurance: Flexible policy with adjustable premiums, offering both coverage and investment options

Universal life insurance is a versatile and adaptable policy that can be an excellent choice for single mothers seeking comprehensive coverage and financial security. This type of insurance offers a unique blend of protection and investment opportunities, making it a powerful tool for those who want to provide for their families and plan for the future.

One of the key advantages of universal life insurance is its flexibility. Unlike traditional term life insurance, where premiums are fixed for a specific period, universal life policies allow policyholders to adjust their premiums and death benefits over time. This flexibility is particularly beneficial for single mothers who may experience changes in their financial situation or life circumstances. For instance, if a single mother's income increases, she can opt to increase her policy's coverage and premiums to ensure her family is adequately protected. Conversely, if her financial situation changes and she needs to reduce expenses, she can lower the premiums without compromising the policy's value.

The adjustable nature of universal life insurance also provides investment options. Policyholders can allocate a portion of their premiums to an investment account, allowing their money to grow over time. This investment component can offer higher returns compared to traditional savings accounts, providing an opportunity to build a substantial financial cushion. The investment growth is tax-deferred, and the earnings can be used to increase the policy's cash value, which can be borrowed against or withdrawn to meet financial needs. This feature is especially valuable for single mothers who may want to save for their children's education or future financial goals.

Furthermore, universal life insurance provides a guaranteed death benefit, ensuring that the policyholder's beneficiaries receive a specified amount upon their passing. This aspect of the policy offers financial security, knowing that the loved ones of the single mother will be taken care of, regardless of economic fluctuations. The policy can also be customized to fit specific needs, allowing for tailored coverage and investment strategies.

In summary, universal life insurance is a flexible and powerful financial tool for single mothers. Its adjustable premiums and investment options provide a level of control and security that can help protect their families and plan for the future. By choosing this type of insurance, single mothers can ensure that their loved ones are provided for and that their financial goals are met, even in the face of life's uncertainties.

Unlocking Your Life Insurance: Cash Value Explained

You may want to see also

Riders and Add-ons: Enhance coverage with additional benefits like accidental death or critical illness

When considering life insurance for a single mother, it's important to explore the various riders and add-ons available to enhance coverage and provide additional benefits. These add-ons can provide extra financial security and peace of mind, ensuring that your loved ones are protected in the event of unforeseen circumstances. Here's a detailed look at how riders and add-ons can be valuable:

Accidental Death Benefit: One of the most common riders is the accidental death benefit. This rider provides an additional payout if the insured person dies as a result of an accident. For a single mother, this can be particularly crucial as it ensures that her financial responsibilities are covered even if her death is caused by an accident, which might not be covered under the standard life insurance policy. This add-on provides an extra layer of protection, knowing that your family will be financially secure in the event of a tragic accident.

Critical Illness Rider: Life insurance can also be enhanced with a critical illness rider. This rider offers financial support if the insured person is diagnosed with a critical illness, such as cancer, heart attack, or stroke. For a single mother, this can be a significant benefit as it provides the means to cover medical expenses, loss of income, and other related costs during a challenging time. The critical illness rider ensures that your family can focus on recovery and healing while having the financial support to manage the practical aspects of life.

Disability Income Rider: Another valuable add-on is the disability income rider. This rider provides income replacement if the insured person becomes disabled and cannot work. For a single mother, this can be a lifeline, ensuring that she has the financial means to support her family even if she is unable to work due to illness or injury. The disability income rider offers long-term financial security, allowing your loved ones to maintain their standard of living and cover essential expenses during a difficult period.

Long-Term Care Rider: As you age, long-term care can become a significant concern. The long-term care rider offers coverage for nursing home or assisted living expenses, which can be substantial. For a single mother, this rider ensures that her family won't have to bear the financial burden of long-term care, providing peace of mind and financial protection.

When choosing life insurance, it's essential to review the available riders and add-ons to customize the policy to your specific needs. These add-ons provide an extra layer of security, ensuring that your single mother's family is protected in various life events. By carefully selecting the appropriate riders, you can create a comprehensive life insurance plan that offers both financial security and added benefits tailored to your circumstances.

Life Insurance Payouts: Minor Beneficiaries and Their Money

You may want to see also

Budget and Needs: Assess financial needs and choose a policy that fits your budget and provides adequate protection

When considering life insurance as a single mother, it's crucial to approach it with a clear understanding of your financial needs and priorities. The primary goal is to ensure your family's financial well-being in the event of your passing. Start by evaluating your current financial situation and identifying the specific needs that life insurance should address. This includes considering the costs associated with raising a child, such as education, healthcare, and general living expenses. It's essential to have a realistic estimate of these expenses to determine the appropriate coverage amount.

A common approach is to calculate the total cost of raising your child until they reach adulthood and then aim to secure a life insurance policy that can cover this amount. For instance, if you anticipate expenses of $50,000 per year for the next 18 years, you might consider a policy with a death benefit of around $180,000 to $200,000. This ensures that your family has the necessary financial resources to cover these costs. Additionally, consider any outstanding debts or loans you may have, as life insurance can help settle these obligations, providing further financial security for your loved ones.

Budgeting is key to making life insurance affordable. You can explore various policy options to find the best fit within your budget. Term life insurance, for instance, offers a cost-effective solution by providing coverage for a specified period, typically 10, 20, or 30 years. This type of policy is generally more affordable than permanent life insurance, which offers lifelong coverage. By choosing a term policy, you can ensure that your family is protected during the years when the financial burden is most significant without incurring long-term costs.

Another strategy to manage costs is to consider the payment options available. Many insurance providers offer flexible payment plans, allowing you to choose a frequency that suits your budget. Monthly, quarterly, or annual payments can be tailored to your financial capabilities, ensuring that the insurance premium remains manageable. It's also worth exploring any employer-provided benefits, as some companies offer group life insurance plans that can be more affordable and provide a solid foundation of coverage.

Lastly, when assessing your budget and needs, it's essential to be realistic and flexible. Life circumstances can change, and your financial obligations may evolve over time. Regularly review and adjust your life insurance policy to reflect any significant life events, such as marriages, births, or changes in income. This proactive approach ensures that your policy remains relevant and continues to provide the necessary protection for your family's well-being.

Understanding Indemnity Health Insurance: Philadelphia Life Coverage Explained

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool for a single mother to ensure her children's well-being and financial security in the event of her untimely passing. It provides a financial safety net, covering expenses like child support, education costs, and daily living expenses.

When selecting life insurance, a single mother should consider her specific needs and long-term goals. Term life insurance is often recommended as it offers high coverage at a lower cost, ensuring sufficient funds for the children's future. Additionally, she should evaluate her budget and choose a policy with a death benefit that aligns with her financial obligations.

Yes, single mothers may want to opt for a policy with a higher death benefit to cover potential future expenses, such as college tuition or other significant financial commitments. They should also consider the policy's flexibility, allowing for adjustments to the coverage amount as their financial situation changes.

In such cases, a larger life insurance policy is advisable to ensure the family's financial stability. The policy should be sufficient to cover not only the mother's income but also any additional costs associated with raising the children. Regular reviews of the policy are essential to keep it aligned with the family's evolving needs.

Absolutely. While the primary focus is on children's welfare, a life insurance policy can also be utilized to pay off debts, leave a legacy, or provide financial support to other dependents. It offers flexibility, allowing the policyholder to customize the benefits according to their unique circumstances.