For individuals living with sickle cell disease, finding the right life insurance can be a crucial step in securing financial protection and peace of mind. Sickle cell disease is a genetic disorder that can lead to various health complications, and it's important to consider these factors when evaluating life insurance options. This paragraph will explore the unique considerations and challenges faced by those with sickle cell disease, highlighting the importance of understanding the impact on insurance eligibility and coverage. It will also provide insights into the types of life insurance policies that may be more suitable, ensuring individuals with sickle cell disease can make informed decisions about their financial future.

What You'll Learn

- Understanding Sickle Cell Disease: Learn how sickle cell impacts life expectancy and insurance eligibility

- Life Insurance Options: Explore term life, whole life, and universal life policies for sickle cell patients

- Underwriting Challenges: Understand how insurers assess risk and determine premiums for sickle cell patients

- Financial Planning: Create a financial plan considering sickle cell treatment costs and insurance coverage

- Specialized Insurance Providers: Discover companies offering tailored policies for sickle cell patients with competitive rates

Understanding Sickle Cell Disease: Learn how sickle cell impacts life expectancy and insurance eligibility

Sickle cell disease is a genetic disorder that affects the shape and function of red blood cells, leading to a variety of health complications. It is caused by a mutation in the hemoglobin gene, which results in the production of abnormal hemoglobin known as hemoglobin S. This condition is inherited in an autosomal recessive pattern, meaning an individual must inherit two copies of the mutated gene, one from each parent, to have the disease. Understanding the impact of sickle cell disease on life expectancy and insurance eligibility is crucial for those affected and their families.

The disease can significantly reduce life expectancy due to various health issues. Sickle cell anemia, the most common form, causes episodes of pain, organ damage, and an increased risk of infections. These episodes, known as sickle cell crises, can be life-threatening and often require hospitalization. Over time, the disease can lead to severe complications such as acute chest syndrome, stroke, organ failure, and an increased risk of certain cancers. The severity of these complications can vary widely among individuals, and some may experience a more rapid decline in health compared to others.

Life expectancy for individuals with sickle cell disease has improved in recent decades due to better medical care and management. However, it remains lower than the general population. On average, people with sickle cell anemia have a life expectancy of around 40 to 45 years, but this can vary. Factors such as the presence of other genetic mutations, the severity of symptoms, and access to quality healthcare play a significant role in determining life expectancy. It is important to note that with proper management and treatment, some individuals with sickle cell disease can live into their 50s or beyond.

When it comes to life insurance, sickle cell disease can impact eligibility and premium costs. Insurance companies often consider the severity of the condition, medical history, and the presence of any complications when assessing risk. Individuals with sickle cell anemia may face challenges in obtaining standard life insurance policies, as the disease is typically considered a pre-existing condition. However, there are specialized insurance options available, such as term life insurance or whole life insurance with a guaranteed acceptance period. These policies may offer coverage with certain conditions or exclusions related to sickle cell disease.

For those with sickle cell disease, it is essential to disclose their condition to insurance providers accurately. Providing detailed medical information, including the type and severity of the disease, any complications, and the frequency of medical visits, can help insurance companies assess the risk accurately. Some insurance companies may offer tailored policies or additional benefits to support individuals with chronic illnesses like sickle cell disease. Consulting with independent insurance advisors or brokers who specialize in pre-existing conditions can provide valuable guidance in finding suitable coverage options.

Term Life Insurance: Worth the Cost?

You may want to see also

Life Insurance Options: Explore term life, whole life, and universal life policies for sickle cell patients

When considering life insurance for individuals with sickle cell disease, it's important to understand the unique challenges and considerations that come with this condition. Sickle cell patients often face specific health concerns that can impact their ability to secure traditional life insurance coverage. However, several life insurance options are available, each with its own advantages and disadvantages. Here's an exploration of term life, whole life, and universal life policies tailored to those with sickle cell:

Term Life Insurance: This type of policy provides coverage for a specified term, typically 10, 20, or 30 years. For sickle cell patients, term life insurance can be an excellent choice as it offers a straightforward and affordable way to secure financial protection for a defined period. The key advantage is that the premium remains consistent throughout the term, and the coverage amount is guaranteed for the agreed-upon duration. This policy is particularly beneficial for individuals who want to ensure their family's financial stability during a specific life stage, such as covering mortgage payments, children's education, or other long-term financial commitments. When applying for term life insurance, it's crucial to disclose your sickle cell status to the insurance provider. They will assess your overall health and medical history to determine the premium and eligibility. While some insurers may offer coverage, the premium might be higher due to the increased health risks associated with sickle cell disease.

Whole Life Insurance: Whole life insurance provides permanent coverage, offering both death benefit protection and a cash value component. For sickle cell patients, this policy can be a valuable long-term financial tool. The death benefit amount is guaranteed and remains the same throughout the policy's duration, providing peace of mind. Additionally, the cash value component grows over time, allowing policyholders to borrow against it or withdraw funds for various purposes. This type of insurance is a more complex commitment, as the premiums are typically higher and may increase over time. However, the guaranteed death benefit and the potential for cash value accumulation make it an attractive option for those seeking long-term financial security. When considering whole life insurance, it's essential to carefully review the policy terms and ensure that the insurer is aware of your sickle cell diagnosis to avoid any potential issues with coverage.

Universal Life Insurance: This policy offers flexibility and adaptability, allowing policyholders to adjust their coverage and premium payments over time. For sickle cell patients, universal life insurance can provide a tailored solution. Policyholders can initially opt for a lower premium and a higher death benefit, and as their health improves or their financial situation changes, they can increase the premium to maintain or enhance coverage. This policy type is particularly suitable for those who want the option to customize their insurance plan as their needs evolve. Universal life insurance also accumulates cash value, which can be used to pay premiums or take out loans. However, it's crucial to carefully manage the policy to ensure it remains in force and provides the desired level of coverage. When applying for universal life insurance, disclose your sickle cell status and any related medical history to ensure accurate premium calculations and coverage.

In summary, sickle cell patients have several life insurance options to consider, each with its own benefits and considerations. Term life insurance offers affordable, temporary coverage, while whole life provides permanent protection with a guaranteed death benefit and cash value. Universal life insurance provides flexibility and the option to customize coverage. When exploring these options, it's essential to disclose your sickle cell diagnosis to insurance providers to ensure accurate assessments and coverage. Additionally, seeking professional advice from financial advisors or insurance brokers can help you navigate the process and choose the best policy to meet your specific needs and financial goals.

Life Insurance: Fact or Fiction?

You may want to see also

Underwriting Challenges: Understand how insurers assess risk and determine premiums for sickle cell patients

When considering life insurance for individuals with sickle cell disease, it's important to understand the underwriting challenges that insurers face. Sickle cell disease is a genetic disorder that affects the shape and function of red blood cells, leading to various health complications. Insurers must carefully assess the risks associated with this condition to determine appropriate coverage and premium rates.

Underwriters evaluate the likelihood of future claims and potential health risks. For sickle cell patients, this assessment can be complex due to the unpredictable nature of the disease. The primary challenge lies in predicting the severity and frequency of health issues related to sickle cell, as each individual's experience can vary significantly. Insurers need to consider the potential for acute sickle cell crises, chronic pain, organ damage, and other complications that may arise.

One of the key factors in underwriting is the patient's medical history and current health status. Insurers will review past and present medical records, including hospital visits, surgeries, and any previous or ongoing treatments. They may also consider the patient's age, overall health, and family medical history, as sickle cell disease can have genetic links. The more comprehensive and detailed the medical information, the better the insurer can understand the individual's risk profile.

In addition to medical history, insurers often consider the patient's lifestyle and environmental factors. This includes assessing smoking status, alcohol consumption, occupation, and any potential exposure to hazardous substances. These factors can influence the likelihood of developing further health complications, which are crucial in determining the risk associated with sickle cell disease.

Determining premiums for sickle cell patients involves a careful calculation of these risks. Insurers may use statistical models and data to estimate the potential costs of providing coverage. They might also consider offering specialized policies with higher premiums to account for the increased risks. It is essential for individuals with sickle cell disease to be transparent about their medical history and current health status to ensure accurate risk assessment and fair premium determination.

Life Insurance in Canada: Getting Covered

You may want to see also

Financial Planning: Create a financial plan considering sickle cell treatment costs and insurance coverage

When it comes to financial planning for individuals with sickle cell disease, it's crucial to consider the potential treatment costs and insurance coverage options. Sickle cell disease is a genetic disorder that can lead to various health complications, and managing these conditions often requires long-term medical care and specialized treatments. Here's a comprehensive financial planning guide tailored to this specific need:

Understand Treatment Costs: Begin by researching the financial implications of sickle cell disease. Treatment costs can vary widely depending on the severity of the condition and the specific health issues experienced by the individual. Common expenses include regular medical visits, blood transfusions, pain management medications, and specialized treatments like hydroxyurea, which is often prescribed to reduce the frequency of sickle cell crises. Additionally, consider the costs associated with hospital stays, emergency room visits, and potential surgeries. It's essential to gather detailed information from healthcare providers and medical facilities to estimate these expenses accurately.

Evaluate Insurance Coverage: Insurance coverage plays a pivotal role in managing the financial burden of sickle cell treatment. Here's how to approach this aspect:

- Health Insurance: Review your current health insurance policy to understand the extent of coverage for sickle cell-related treatments. Check if the policy includes hospitalization, doctor visits, prescription drugs, and specialized treatments. Understand the insurance company's policies regarding pre-existing conditions and any limitations or exclusions related to sickle cell disease.

- Medicare and Medicaid: If eligible, consider enrolling in Medicare or Medicaid, as these programs often provide comprehensive coverage for individuals with chronic illnesses. They can help cover a significant portion of treatment costs, especially for those with limited income and resources.

- Specialist Referrals: Ensure that your insurance plan covers specialist referrals for sickle cell disease management. This may include hematologists, pain management specialists, and other healthcare professionals who play a crucial role in treating sickle cell-related complications.

Create a Financial Plan: Develop a financial plan that accounts for the identified treatment costs and insurance coverage. Here are some steps to follow:

- Budgeting: Create a detailed budget that includes estimated treatment expenses, regular medical costs, and any anticipated future expenses related to sickle cell disease management. Allocate funds accordingly to ensure you can cover essential healthcare costs.

- Emergency Fund: Build an emergency fund specifically for sickle cell-related expenses. This fund should cover unexpected medical bills, hospital stays, or treatments that may not be fully covered by insurance. Aim to save enough to cover at least six months' worth of estimated treatment costs.

- Long-Term Care Planning: Consider long-term care options, especially as the individual ages. Sickle cell disease can lead to various health complications, and planning for potential future care needs is essential. Explore long-term care insurance or explore government-funded programs that provide support for chronic illnesses.

- Regular Review: Financial planning is an ongoing process. Regularly review and update your financial plan to account for any changes in treatment costs, insurance coverage, or personal circumstances. This ensures that your financial strategy remains effective and adaptable.

Life Insurance Considerations: When it comes to life insurance for individuals with sickle cell disease, it's important to choose a policy that provides adequate coverage while being mindful of potential health-related exclusions. Here's a brief overview:

- Term Life Insurance: Consider term life insurance, which offers coverage for a specified period. This type of policy can provide financial security for your loved ones and help cover outstanding debts or future expenses. Ensure that you disclose your sickle cell status to the insurance company to obtain accurate quotes and understand any limitations.

- Whole Life Insurance: Whole life insurance provides lifelong coverage and includes an investment component. It can be a valuable option, but the premium costs may be higher due to pre-existing health conditions. Shop around and compare quotes from different insurance providers to find the best rates.

Remember, financial planning for sickle cell disease requires a proactive approach. By understanding treatment costs, evaluating insurance coverage, and creating a comprehensive financial strategy, individuals with sickle cell can better manage their healthcare expenses and ensure financial security for the long term. It is advisable to consult with financial advisors and healthcare professionals who specialize in chronic illness management to tailor a plan that meets specific needs.

Suicide and Life Insurance: What Cover Does My Dad Have?

You may want to see also

Specialized Insurance Providers: Discover companies offering tailored policies for sickle cell patients with competitive rates

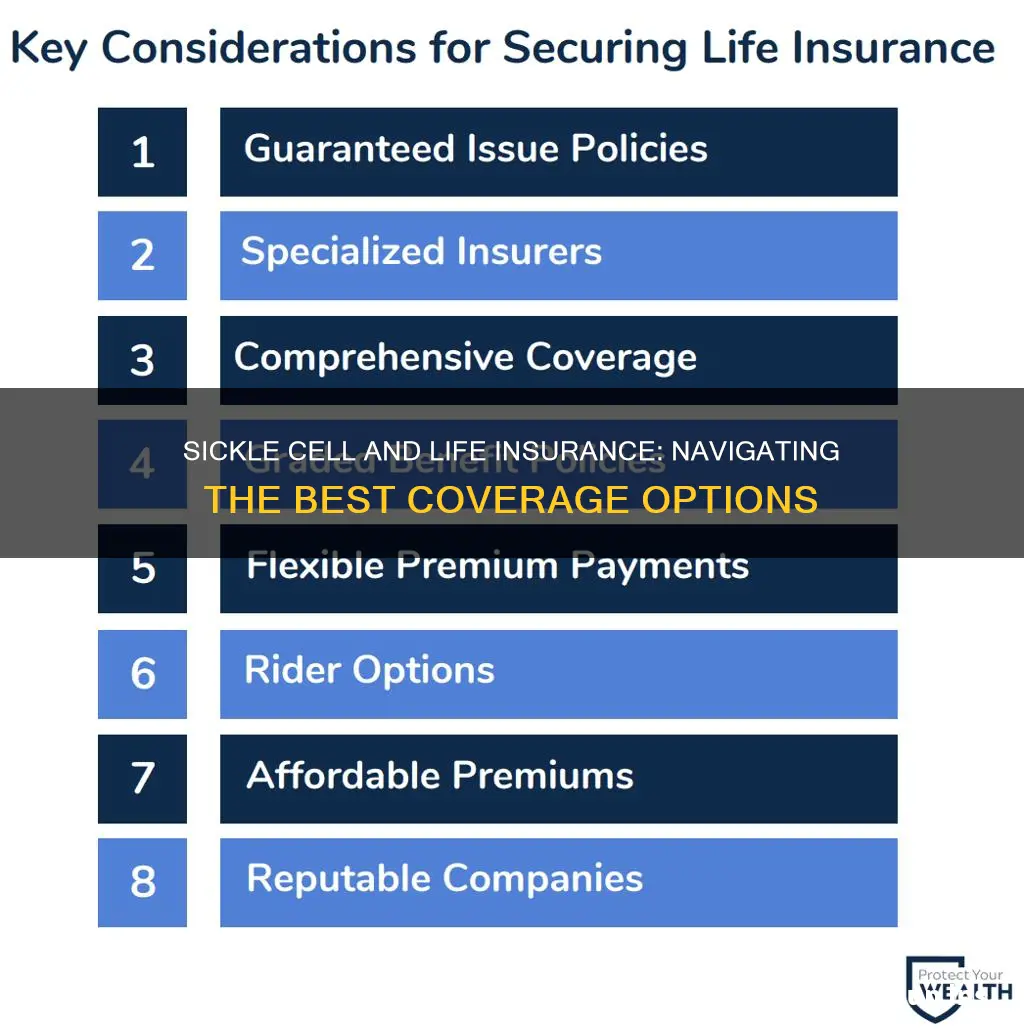

When it comes to finding life insurance suitable for individuals with sickle cell disease, it's essential to explore options provided by specialized insurance providers who understand the unique challenges and risks associated with this condition. These companies offer tailored policies designed specifically for sickle cell patients, ensuring competitive rates and comprehensive coverage.

One such specialized insurance provider is [Company A]. They recognize that sickle cell patients may face higher health risks and have developed policies to accommodate these concerns. Their offerings include extended coverage periods, allowing for long-term financial protection. Additionally, [Company A] provides customizable benefits, enabling policyholders to choose the level of coverage that best suits their needs. By understanding the specific health challenges of sickle cell patients, they can offer competitive rates without compromising on the quality of coverage.

Another notable company is [Company B], known for its commitment to providing affordable and comprehensive life insurance solutions for individuals with pre-existing conditions. They have tailored policies specifically for sickle cell patients, considering their unique medical history and potential health risks. [Company B]'s approach involves a thorough assessment of the individual's health, allowing them to offer competitive rates and personalized coverage options. This company's focus on accessibility and understanding of sickle cell-related health concerns makes it an excellent choice for those seeking specialized insurance.

Furthermore, [Company C] stands out for its dedication to supporting individuals with sickle cell disease. They offer a range of life insurance products designed to cater to the specific needs of this community. Their policies often include coverage for potential complications associated with sickle cell, ensuring that patients and their families are protected. [Company C]'s competitive rates and comprehensive coverage options make it an attractive choice for those seeking specialized insurance providers.

In your search for the best life insurance, consider reaching out to these specialized insurance providers. They will guide you through the process, ensuring you find a policy that suits your unique circumstances. Remember, finding the right insurance provider is crucial, as it can provide the necessary financial security and peace of mind for you and your loved ones.

Straight Life Insurance: Accumulating Cash Value and More

You may want to see also

Frequently asked questions

Sickle cell disease is a genetic disorder that affects the shape and function of red blood cells, causing them to become sickle-shaped and rigid. This condition can lead to various health complications and a reduced life expectancy. Insurance companies often consider sickle cell disease when assessing life insurance applications due to the potential health risks associated with it.

Yes, it is possible for people with sickle cell disease to obtain life insurance coverage, but the process may be more complex. Insurance providers typically offer different types of policies, and the best option will depend on the individual's specific health status and the severity of their sickle cell disease.

Insurance companies may consider several factors, including the patient's overall health, frequency and severity of sickle cell crises, current medications, and any other medical conditions. They might also assess the individual's lifestyle, occupation, and family medical history to determine the level of risk associated with providing coverage.

Term life insurance is often a popular choice for individuals with sickle cell disease as it provides coverage for a specific period, typically 10, 20, or 30 years. This type of policy offers a straightforward and cost-effective solution, ensuring financial protection for beneficiaries during the years when the insured individual is most likely to face health challenges.

Sickle cell patients can enhance their chances of approval by maintaining a healthy lifestyle, managing their condition effectively, and keeping regular medical appointments. Providing detailed medical records and being transparent about their sickle cell disease can also help insurance companies make more informed decisions regarding their coverage options.