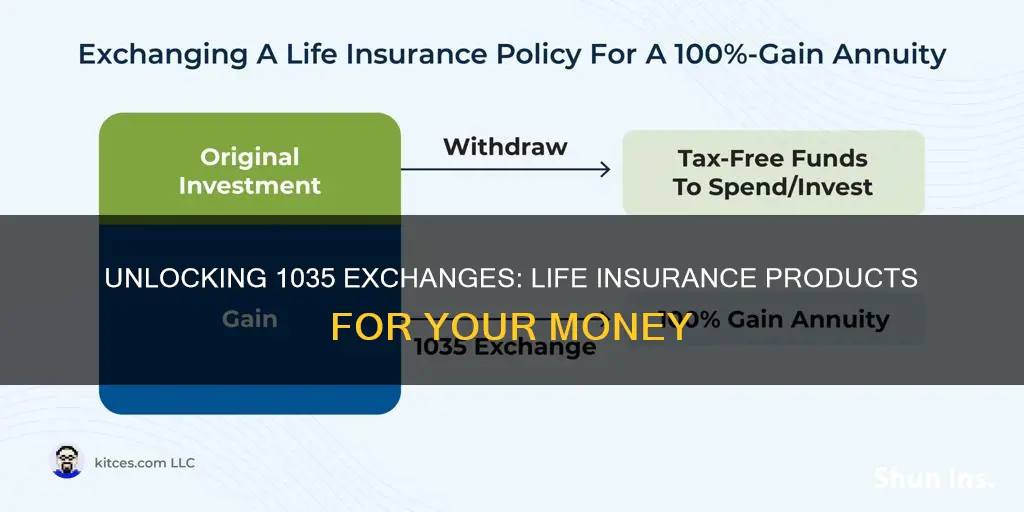

Life insurance products offer a range of options for policyholders looking to maximize their financial security and flexibility. One such option is the 1035 exchange, which allows individuals to swap their existing life insurance policy for a new one without paying taxes on the proceeds. This exchange can be used to convert money into various investment options, such as fixed annuities, variable annuities, or even mutual funds. Understanding these options is crucial for policyholders to make informed decisions about their financial future and ensure their life insurance policy aligns with their evolving needs and goals.

| Characteristics | Values |

|---|---|

| Annuities | Fixed, variable, indexed, immediate, deferred |

| Bonds | Fixed income, variable rate, zero coupon |

| Stocks | Common, preferred, exchange-traded funds (ETFs) |

| Mutual Funds | Equity, bond, balanced, money market |

| Real Estate | Single-family homes, multi-family properties, commercial real estate |

| Business Interests | Ownership stakes in businesses |

| Collectibles | Fine art, antiques, rare coins, precious metals |

| Cryptocurrencies | Bitcoin, Ethereum, and other digital currencies |

| Savings Accounts | High-yield savings, money market accounts |

| Retirement Accounts | 401(k), 403(b), 457, 401(a), Roth IRA, Traditional IRA |

| Education Savings | 529 plans, Coverdell Education Savings Accounts |

| Health Savings Accounts | HSAs, FSA |

| Annuity Settlements | Single-sum, joint and survivor, income-for-life |

| Annuity Exchanges | Direct rollovers, 1035 exchanges |

| Tax-Free Accounts | Roth IRAs, Roth 401(k)s |

| Tax-Deferred Accounts | Traditional IRAs, 401(k)s, 403(b)s |

| Tax-Efficient Strategies | Tax-loss harvesting, charitable giving, tax-efficient investing |

What You'll Learn

- Investment Options: Convert 1035 exchange funds into stocks, bonds, or mutual funds

- Annuities: Use 1035 exchange to purchase fixed or variable annuities for income

- Real Estate: Invest in real estate through 1035 exchange, buying or selling properties

- Business Interests: Convert 1035 exchange money into ownership stakes in businesses

- Education Funds: Use 1035 exchange to fund education savings plans or scholarships

Investment Options: Convert 1035 exchange funds into stocks, bonds, or mutual funds

When considering investment options for your 1035 exchange funds, it's important to understand the various avenues available to grow your money. One of the most common and accessible choices is to invest in stocks, which represent ownership in a company. By purchasing stocks, you become a shareholder and are entitled to a portion of the company's profits and assets. This investment strategy can offer significant returns over time, especially if you invest in companies with a strong track record of growth and innovation. However, it's crucial to research and diversify your stock portfolio to manage risk effectively.

Bonds are another attractive investment option for 1035 exchange funds. These financial instruments are essentially loans made to governments or corporations. When you buy a bond, you are essentially lending money to the issuer, who promises to pay you back with interest over a specified period. Bonds are generally considered less risky than stocks, making them an excellent choice for risk-averse investors. They provide a steady income stream through regular interest payments, and their value can increase over time, especially in a rising interest rate environment.

Mutual funds are a popular investment vehicle that allows you to pool your money with other investors to purchase a diversified portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you gain instant diversification, reducing the risk associated with individual stock or bond investments. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the shareholders, making it an excellent choice for those who prefer a hands-off approach to investing. These funds can be further categorized into various types, such as equity funds, bond funds, and balanced funds, each offering different levels of risk and potential returns.

In addition to these traditional investment options, you might also consider exchange-traded funds (ETFs). ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and can be bought and sold throughout the trading day. ETFs often track specific market indexes, sectors, or asset classes, providing investors with a convenient way to gain exposure to a broad market or a particular industry. This investment strategy allows you to benefit from the overall performance of a market or sector without having to select individual securities.

Before making any investment decisions, it is crucial to assess your risk tolerance, investment goals, and time horizon. Diversification is key to managing risk, so consider spreading your 1035 exchange funds across different asset classes and investment types. Additionally, consult with a financial advisor who can provide personalized guidance based on your unique circumstances and help you navigate the complex world of investing to make informed choices.

Life Insurance for Babies: Is It Necessary?

You may want to see also

Annuities: Use 1035 exchange to purchase fixed or variable annuities for income

Annuities can be an attractive option for individuals looking to maximize the value of their 1035 exchange, especially when considering the potential for guaranteed income. A 1035 exchange allows you to swap your existing life insurance policy for a new one, often with tax-free proceeds. When it comes to annuities, this exchange can be a strategic move, offering both flexibility and security.

There are two primary types of annuities you can consider: fixed and variable. Fixed annuities provide a consistent, predetermined interest rate over the term of the contract, ensuring a steady income stream. This type of annuity is ideal for those seeking stability and predictability in their retirement planning. On the other hand, variable annuities offer more flexibility, allowing you to invest in various sub-accounts that may provide higher returns over time. This option is suitable for individuals who are comfortable with market volatility and are willing to take on more risk for potentially higher rewards.

When using a 1035 exchange to purchase an annuity, you can choose between a single-premium immediate annuity (SPIA) or a deferred annuity. A SPIA provides income immediately, making it a good choice for those who need a steady stream of cash flow in retirement. Deferred annuities, on the other hand, allow you to defer the income payments for a specified period, potentially growing your money tax-deferred until you start receiving payments.

The key advantage of using a 1035 exchange for annuities is the ability to lock in a guaranteed interest rate, which can be particularly beneficial in a low-interest-rate environment. This ensures that your income stream is secure and predictable, providing peace of mind for your retirement years. Additionally, annuities can offer a range of features, such as guaranteed minimum withdrawals, death benefits, and the option to pass on a portion of the death benefit to beneficiaries.

In summary, annuities are a powerful tool for individuals looking to optimize their 1035 exchange, offering both income and potential wealth accumulation. Whether you opt for a fixed or variable annuity, this exchange strategy can provide a reliable and secure financial foundation for your retirement, ensuring you have a steady income stream to support your future needs.

Short-Term Life Insurance: Cashing In and Claiming Benefits

You may want to see also

Real Estate: Invest in real estate through 1035 exchange, buying or selling properties

The 1035 exchange provision in the Internal Revenue Code allows for a seamless transfer of funds from one qualified retirement plan to another, often used in conjunction with life insurance policies. This strategy can be particularly beneficial for investors looking to diversify their portfolios and explore real estate investments. Here's how you can leverage the 1035 exchange to invest in real estate:

Understanding the Process: When you own a life insurance policy, you have the option to 1035 exchange the cash value of that policy into another qualified retirement plan. This exchange can be a powerful tool for real estate investors as it provides a tax-efficient way to access funds for property purchases. The key is to identify a suitable retirement plan that allows for real estate investments, such as a self-directed IRA or a real estate investment trust (REIT) within a retirement account.

Investing in Real Estate: With the 1035 exchange, you can strategically buy or sell properties using the funds from your life insurance policy. Here's a step-by-step approach:

- Identify the Property: Research and select a real estate investment that aligns with your financial goals. This could be a residential or commercial property, a fix-and-flip opportunity, or even a development project.

- Structure the Exchange: Contact your insurance company and retirement plan administrator to initiate the 1035 exchange process. They will guide you through the necessary paperwork and ensure compliance with IRS regulations. The exchange typically involves transferring the cash value of your life insurance policy to the new retirement plan, which can then be used to purchase the property.

- Complete the Purchase: Once the exchange is finalized, you can proceed with the real estate transaction. This may involve hiring a real estate agent, conducting due diligence, and finalizing the purchase agreement. The funds from the 1035 exchange can be used to make the down payment and cover associated closing costs.

- Manage Your Investment: After the purchase, you can decide on the best course of action for your real estate holding. This could include holding the property for long-term appreciation, renting it out, or even flipping it for a quick profit. Regularly review and assess your investment strategy to ensure it aligns with your financial objectives.

By utilizing the 1035 exchange, investors can unlock the potential of their life insurance policies and tap into the real estate market. This strategy offers a unique opportunity to diversify investments, potentially generate higher returns, and provide a more stable financial future. It is essential to consult with financial advisors and tax professionals to ensure compliance with regulations and to make informed decisions throughout the process.

Understanding End-of-Life Insurance: A Comprehensive Guide

You may want to see also

Business Interests: Convert 1035 exchange money into ownership stakes in businesses

The 1035 exchange rule allows for the transfer of money from an annuity contract to another qualified retirement plan or annuity without triggering immediate tax consequences. This provision is particularly useful for individuals looking to diversify their investments and potentially gain exposure to the business world. One attractive option for 1035 exchange funds is investing in ownership stakes in businesses. Here's how this strategy can be approached:

When considering business interests as an investment, the 1035 exchange provides an opportunity to acquire ownership in privately held companies. This can be done by exchanging the proceeds from your annuity contract for shares or ownership interests in these businesses. This strategy allows you to potentially benefit from the growth and success of privately held enterprises, which may offer higher returns compared to traditional investments. By investing in businesses, you become a part-owner, sharing in the company's profits and potentially increasing your wealth over time.

To initiate this process, you would need to identify suitable businesses that align with your investment goals and risk tolerance. This might involve researching and analyzing various companies, considering their industry, growth potential, and financial health. Due diligence is crucial to ensure the business's stability and long-term prospects. Once you've identified potential targets, you can work with your financial advisor or a qualified professional to structure the 1035 exchange accordingly. They can assist in negotiating the terms of the exchange and ensuring compliance with tax regulations.

It's important to note that investing in businesses carries risks, including the potential for loss and the illiquid nature of ownership stakes. Therefore, careful consideration and a well-diversified investment strategy are essential. Additionally, tax implications should be thoroughly understood, as the 1035 exchange rules may have specific requirements and limitations for business investments. Consulting with tax professionals can help ensure that your investment strategy remains compliant and advantageous.

In summary, converting 1035 exchange money into business ownership stakes can be a strategic move for those seeking alternative investments. It allows individuals to potentially benefit from the growth of privately held companies while also diversifying their portfolios. However, thorough research, due diligence, and professional guidance are necessary to navigate this investment path successfully.

Life Insurance Payments: When Do They End?

You may want to see also

Education Funds: Use 1035 exchange to fund education savings plans or scholarships

The 1035 exchange provision in the Internal Revenue Code offers a unique opportunity for individuals to leverage their existing life insurance policies for various financial goals, including education funding. This strategy allows policyholders to reinvest the proceeds from a life insurance policy into an eligible replacement policy, often with favorable tax treatment. When it comes to education funds, this exchange can be a powerful tool to secure a child's educational future.

One approach is to utilize the 1035 exchange to fund education savings plans. These plans, such as 529 plans or Coverdell Education Savings Accounts (ESA), are specifically designed to help families save for qualified education expenses. By exchanging the cash value of a life insurance policy for a new policy, you can contribute to these education savings vehicles. This strategy provides a tax-efficient way to build a substantial fund for college, graduate school, or other educational pursuits. The proceeds from the exchange can be invested, allowing the savings to grow over time, and the earnings can be tax-free when used for qualified education expenses.

Another option is to consider funding scholarships through a 1035 exchange. Many educational institutions and organizations offer scholarships to students with financial need or exceptional academic achievement. By exchanging your life insurance policy, you can create a dedicated fund to support your child's educational journey. This approach provides a direct financial benefit to the student, ensuring they have the resources needed to pursue their educational goals. The flexibility of the 1035 exchange allows you to structure the policy in a way that aligns with the specific scholarship requirements, ensuring a seamless transfer of funds.

When implementing this strategy, it's crucial to work with a financial advisor or insurance professional who understands the intricacies of 1035 exchanges and education funding options. They can guide you through the process, ensuring that the exchange is executed correctly and that the new policy meets your specific needs. Additionally, they can help you navigate the various education savings plans and scholarship opportunities available, tailoring the strategy to your family's unique circumstances.

In summary, the 1035 exchange provides a valuable avenue for funding education by allowing policyholders to reinvest life insurance proceeds into suitable products. Whether it's contributing to education savings plans or directly supporting scholarships, this strategy offers a tax-efficient way to secure a child's educational future. By taking advantage of this provision, individuals can ensure that their life insurance policies become a powerful tool for achieving long-term financial goals.

Allstate's Multi-Policy Discount: Is Life Insurance Included?

You may want to see also