Life insurance is a vital financial tool that provides a safety net for individuals and their families. Transocean, a leading insurance provider, offers a comprehensive range of life insurance products tailored to meet diverse needs. From term life insurance, which provides coverage for a specified period, to permanent life insurance, which offers lifelong protection, Transocean ensures that individuals can find the right policy to secure their loved ones' financial future. These policies not only provide financial support in the event of the insured's passing but also offer other benefits such as cash value accumulation and investment opportunities, making Transocean a trusted name in the insurance industry.

What You'll Learn

- Financial Security: Life insurance provides a financial safety net for beneficiaries in the event of the insured's death

- Peace of Mind: It offers reassurance and reduces stress by ensuring loved ones are protected

- Debt Management: Policies can help pay off debts and mortgages, preventing financial strain for survivors

- Income Replacement: Tranont's policies may replace lost income, covering living expenses and daily needs

- Legacy Planning: Life insurance can be used to create a financial legacy for future generations

Financial Security: Life insurance provides a financial safety net for beneficiaries in the event of the insured's death

Life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones. It is a contract between an individual (the insured) and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the insured's death. This financial security is particularly important as it ensures that the family or dependents of the deceased are provided for, even in the face of tragedy.

When an individual purchases life insurance, they essentially make a promise to the insurance company, agreeing to pay regular premiums in exchange for the insurer's commitment to provide financial support. The policyholder can choose the amount of coverage, known as the death benefit, which will be paid out when the insured passes away. This benefit can be a significant financial cushion, allowing beneficiaries to cover various expenses and maintain their standard of living. For example, it can help with funeral costs, outstanding debts, mortgage payments, or even provide a lump sum for future investments or education expenses.

The beauty of life insurance lies in its ability to provide peace of mind and financial stability during challenging times. It ensures that the insured's family is not left with the overwhelming burden of financial responsibilities after their passing. By having a life insurance policy, individuals can protect their loved ones from potential financial hardships and provide a sense of security that the future is taken care of. This is especially valuable for those with dependents, such as children or a spouse, who rely on the insured's income and support.

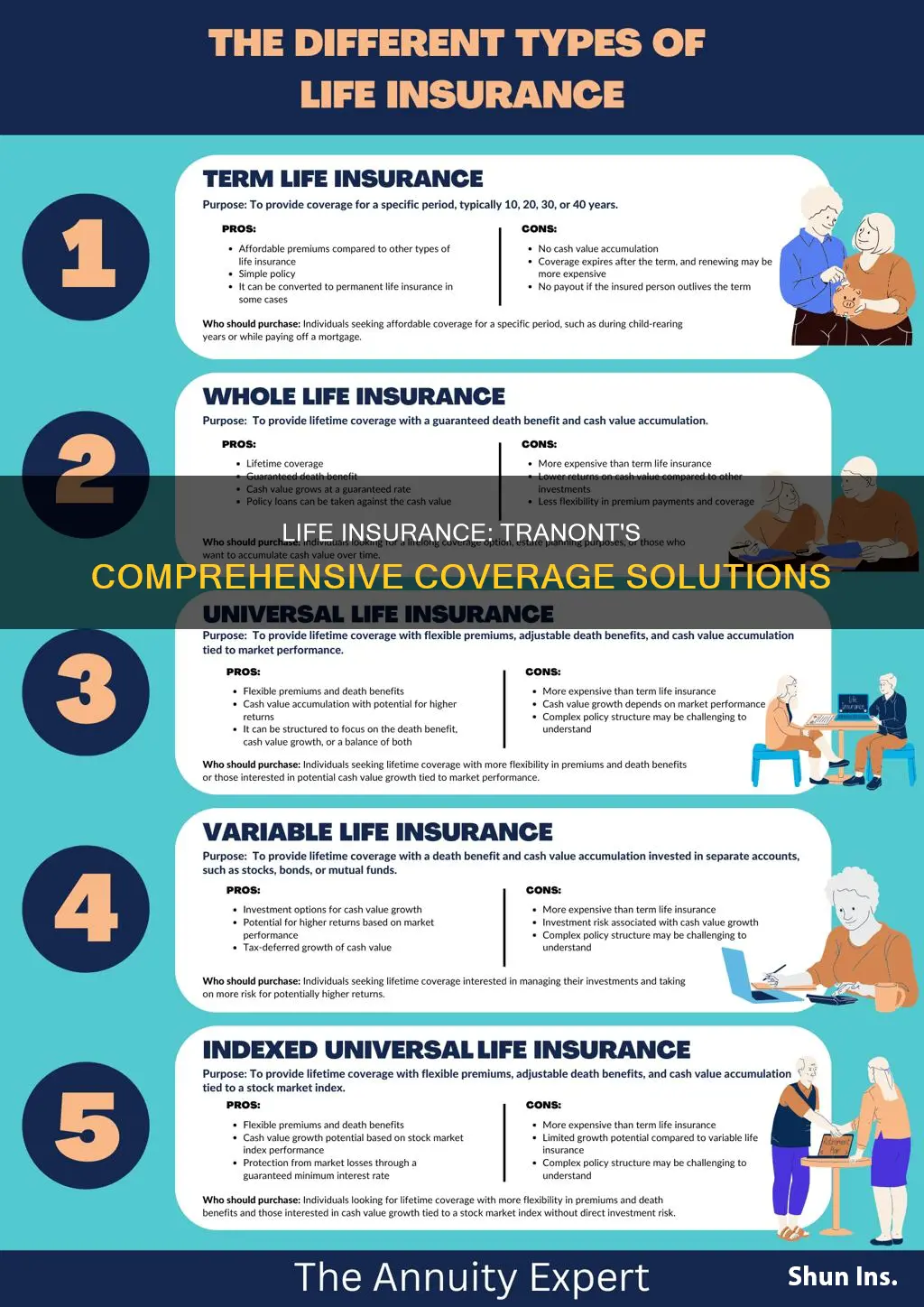

Furthermore, life insurance can be tailored to individual needs and circumstances. There are various types of policies, including term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong coverage. Policyholders can also choose between different payout options, such as a lump sum or regular payments, depending on their financial goals and preferences. This flexibility ensures that individuals can find a plan that suits their unique requirements and provides the necessary financial security.

In summary, life insurance is a powerful tool for financial security, offering a safety net that can significantly impact the lives of beneficiaries. It provides a means to protect loved ones from financial strain and ensures that the insured's family can maintain their lifestyle and well-being even in the face of death. By understanding the various types of policies and their benefits, individuals can make informed decisions to secure their future and the future of their loved ones.

Life Insurance Traps: Can Benefits Be Revoked?

You may want to see also

Peace of Mind: It offers reassurance and reduces stress by ensuring loved ones are protected

Life insurance is a powerful tool that provides peace of mind and a sense of security to individuals and their families. It is a financial safety net that ensures your loved ones are protected in the event of your passing. When you purchase life insurance, you are making a commitment to your family's well-being, offering them a sense of reassurance and a plan for the future. This type of insurance is a wise investment, as it allows you to take control of a potentially stressful situation and provide for your family's financial needs.

The primary benefit of life insurance is the peace it brings to your loved ones. Knowing that your family will be financially secure in your absence can significantly reduce stress and anxiety. It provides a sense of stability and comfort, allowing your loved ones to focus on grieving and healing during a difficult time. With life insurance, you can ensure that your family's essential expenses are covered, such as mortgage payments, education costs, or daily living expenses, providing them with the means to maintain their standard of living and well-being.

This insurance policy also offers a sense of security for your beneficiaries. Beneficiaries are the individuals or entities named in your policy who will receive the death benefit upon your passing. By having a life insurance policy, you are providing them with a guaranteed financial resource, ensuring they have the funds to cover any outstanding debts, make necessary lifestyle adjustments, or pursue their goals. This financial support can be a lifeline, helping them navigate the challenges of life without the added burden of financial worry.

Furthermore, life insurance provides an opportunity to plan for the future. It allows you to set aside a sum of money that can be used for various purposes. For example, the death benefit can be used to pay for your final expenses, such as funeral costs and burial arrangements, ensuring your wishes are respected and your family is not burdened with these expenses. Additionally, the policy can be structured to provide a lump sum or regular payments, offering flexibility and allowing your beneficiaries to use the funds according to their needs.

In summary, life insurance is a valuable asset that offers peace of mind and reassurance. It ensures your loved ones are protected financially, reducing stress and providing a sense of security. With life insurance, you can leave a lasting legacy, knowing that your family will be taken care of, and they will have the resources to build a bright future. It is a thoughtful and responsible decision that demonstrates your commitment to the well-being of your loved ones.

Credit Trust: Term Life Insurance Beneficiary?

You may want to see also

Debt Management: Policies can help pay off debts and mortgages, preventing financial strain for survivors

Life insurance is a powerful tool that can provide financial security and peace of mind, especially when it comes to managing debts and mortgages. It offers a safety net for individuals and their families, ensuring that financial obligations are met even in the event of the policyholder's passing. This is particularly crucial for those who have significant debts or mortgages, as it can prevent the surviving family members from facing financial strain and potential loss of assets.

One of the key benefits of life insurance in this context is the ability to pay off debts. When an individual purchases a life insurance policy, they can name beneficiaries who will receive the death benefit upon their passing. This benefit can be utilized to settle any outstanding debts, such as credit card balances, personal loans, or even larger financial obligations like student loans. By doing so, the insurance proceeds can provide a swift and efficient way to clear debts, ensuring that the surviving family members are not burdened with additional financial responsibilities.

For homeowners with mortgages, life insurance can be a lifeline. The death benefit from a life insurance policy can be used to pay off the remaining mortgage balance, providing immediate relief to the family. This prevents the family from potentially losing their home due to the financial strain of continuing mortgage payments after the primary breadwinner's passing. Moreover, it allows the family to maintain their living situation and avoid the stress of selling a property or facing financial difficulties.

The process of utilizing life insurance for debt management is straightforward. Policyholders can work with their insurance providers to ensure that the death benefit is designated to cover specific debts or mortgages. This can be done by naming the respective creditors or financial institutions as beneficiaries. Upon the insured individual's death, the insurance company will promptly release the death benefit, providing the necessary funds to settle the designated debts.

In summary, life insurance policies offer a practical and efficient solution for managing debts and mortgages. By utilizing the death benefit, individuals can ensure that their surviving family members are protected from financial strain and potential debt-related losses. This aspect of life insurance is often overlooked but can significantly contribute to long-term financial stability and peace of mind for those with substantial financial obligations. It is a valuable consideration for anyone looking to safeguard their loved ones' financial future.

Juvenile Life Insurance: Payouts for Minors?

You may want to see also

Income Replacement: Tranont's policies may replace lost income, covering living expenses and daily needs

When considering life insurance, it's essential to understand the various aspects it can provide, especially in the context of income replacement. Tranont's policies are designed with a unique focus on ensuring financial security for individuals and their families, particularly in the event of the policyholder's untimely demise. One of the key benefits of these policies is the ability to replace lost income, which can significantly impact one's financial stability.

Income replacement is a critical feature of Tranont's life insurance plans. It aims to provide a steady stream of financial support to the policyholder's dependents, ensuring that their daily living expenses and essential needs are met even after the policyholder's passing. This is particularly crucial for families who rely on a primary income earner, as the loss of that income can lead to financial strain and a reduced quality of life. By opting for income replacement coverage, policyholders can have peace of mind, knowing that their loved ones will be financially secure during a challenging time.

The process of income replacement typically involves calculating the policyholder's annual income and determining an appropriate payout amount. This amount is then paid out regularly, often monthly or annually, to cover various expenses such as mortgage or rent, utilities, groceries, transportation, and other daily necessities. The policy's flexibility allows for customization, ensuring that the coverage aligns with the specific needs of the policyholder's family.

Tranont's policies often offer various options to tailor the income replacement benefit. These may include choosing the duration of the payout, such as a fixed period or until a certain age, and deciding on the frequency of payments. Some policies might also provide an option to increase the payout amount over time, accounting for inflation and the rising cost of living. This level of customization ensures that the policyholder's family can maintain their standard of living and financial stability even in the absence of the primary income earner.

In summary, Tranont's life insurance policies excel in providing income replacement, a vital aspect of financial planning. By offering tailored coverage, these policies ensure that the policyholder's family can meet their living expenses and daily needs, even after the policyholder's passing. This financial security is a powerful tool for individuals and families, allowing them to navigate life's challenges with confidence and peace of mind.

Life Insurance and High Blood Pressure: Understanding the Limits

You may want to see also

Legacy Planning: Life insurance can be used to create a financial legacy for future generations

Life insurance is a powerful tool for legacy planning, allowing individuals to secure their family's financial future and leave a lasting impact on their loved ones. By utilizing life insurance, you can ensure that your family is provided for in the event of your passing, and you can also create a financial legacy that will benefit future generations. Here's how:

Leaving a Financial Safety Net: One of the primary benefits of life insurance is providing financial security for your dependents. When you purchase a life insurance policy, you agree to pay a premium in exchange for a death benefit, which is a lump sum amount paid out upon your passing. This death benefit can be used to cover various expenses, such as mortgage payments, education costs, or daily living expenses, ensuring that your family's standard of living is maintained even after your departure. This financial safety net is especially crucial for families with young children or those with ongoing financial commitments.

Building Wealth for Future Generations: Life insurance can also be a strategic way to build wealth and create a financial legacy. Permanent life insurance policies, such as whole life or universal life insurance, offer an additional feature called cash value. This cash value grows over time, and it can be borrowed against or withdrawn, providing a source of funds that can be passed on to beneficiaries. By regularly investing a portion of the death benefit into the cash value component, you can accumulate a substantial amount of money that can be used to pay for your children's education, start a business, or provide financial support to your grandchildren.

Designating Beneficiaries: Another essential aspect of legacy planning with life insurance is the ability to designate beneficiaries. When you purchase a policy, you can choose who will receive the death benefit. This allows you to ensure that your financial legacy goes to the people you intend, such as your spouse, children, or other family members. You can also leave a portion of the death benefit to charitable organizations or trusts, further extending your impact on future generations. Proper beneficiary selection is crucial to avoid any legal complications and to ensure your wishes are honored.

Long-Term Financial Planning: Life insurance is a long-term financial strategy that can be integrated into your overall legacy planning. It is essential to consider your family's needs and goals when determining the appropriate coverage amount and type of policy. Consulting with a financial advisor or insurance professional can help you navigate the various options available, such as term life insurance for temporary coverage or permanent policies for long-term financial security. By making informed decisions, you can create a comprehensive legacy plan that includes life insurance as a vital component.

In summary, life insurance is a versatile tool for legacy planning, offering financial security and the potential to build wealth for future generations. By understanding the different types of policies and their benefits, you can make informed decisions to ensure your family's well-being and leave a lasting financial legacy. Remember, proper planning and consultation with professionals can make a significant difference in achieving your legacy goals.

Life Insurance Guide: The Approval Process Explained

You may want to see also

Frequently asked questions

Tranont Supply offers a comprehensive life insurance policy designed to provide financial security and peace of mind to individuals and their families. This policy covers various aspects of life, including accidental death, natural causes, and critical illnesses.

The policy provides a lump-sum death benefit to the designated beneficiaries upon the insured individual's passing. This benefit can be used to cover funeral expenses, outstanding debts, or any other financial obligations, ensuring the family's financial stability during a difficult time.

Tranont Supply offers competitive rates, customizable coverage options, and a range of additional benefits. These may include accelerated death benefits, waiver of premium provisions, and access to various resources for policyholders.

Absolutely! Tranont Supply understands that life events can impact insurance needs. Policyholders can review and adjust their coverage periodically to ensure it aligns with their current financial situation, family structure, and health status.

Yes, there may be a waiting period for certain benefits, especially for critical illness coverage. This waiting period allows for a thorough review of the insured's health and ensures that any pre-existing conditions are properly assessed before providing coverage.