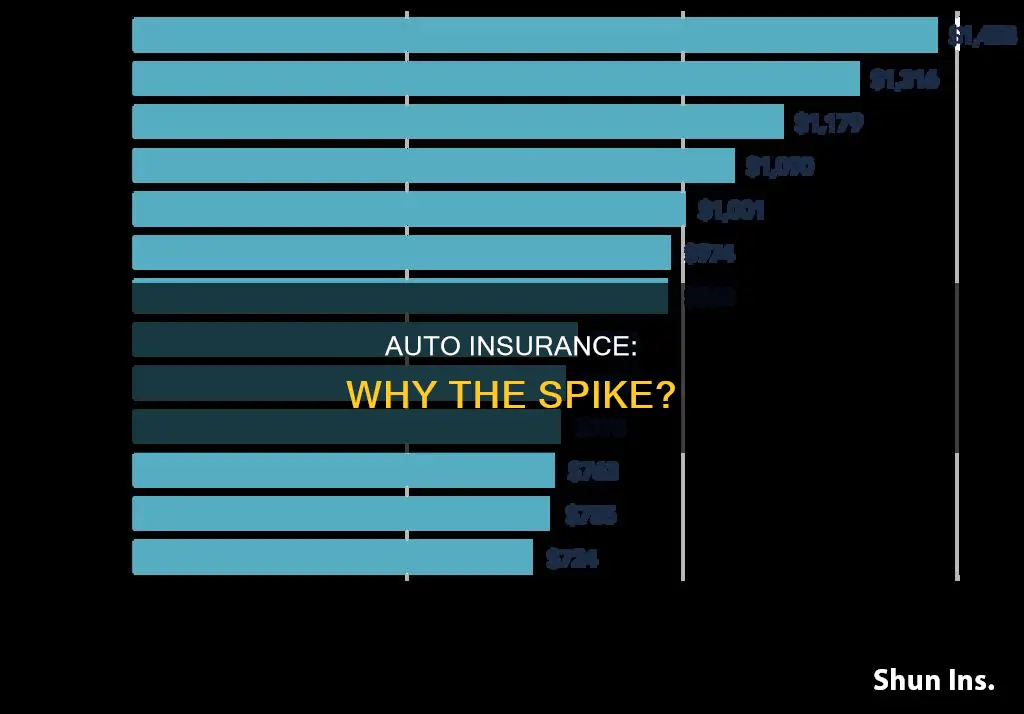

There are several factors that can cause auto insurance rates to increase. Some of these factors are within the control of the policyholder, such as traffic violations, accidents, and claims. For example, speeding tickets, driving under the influence, or causing an accident can lead to a significant increase in insurance rates. Additionally, adding a new vehicle or driver to the policy, especially a teenage or inexperienced driver, can also drive up costs.

On the other hand, there are external factors beyond the policyholder's control that can impact rates. These include increases in repair and replacement costs, medical and legal costs, and the number of crashes in the area. The location of the insured vehicle can play a significant role, with drivers in metropolitan areas or areas with high theft or vandalism rates often paying more. Insurance companies also take into account the number of claims in a particular ZIP code or neighborhood when setting rates.

It's important to note that insurance premiums are not raised arbitrarily, and any increase is typically tied to insurance risk. Policyholders can take proactive steps to reduce their insurance costs, such as practicing safe driving habits, taking advantage of discounts, and comparing rates from different insurance providers.

| Characteristics | Values |

|---|---|

| Accidents | Both at-fault and not-at-fault accidents can cause insurance rates to increase |

| Traffic violations | Minor violations (e.g. following too closely) and major violations (e.g. driving under the influence) can lead to higher insurance rates |

| Comprehensive claims | Filing a claim for incidents like car theft, vandalism, or weather-related damage may increase rates |

| Age | Insurance rates tend to increase for drivers over 65 |

| Lapse in auto insurance | A gap in insurance coverage can result in higher rates |

| Credit score | A drop in credit score can cause insurance rates to rise |

| Location | Living in an area with high accident rates, theft, or severe weather can increase insurance costs |

| Additional drivers and vehicles | Adding teenage or inexperienced drivers, or insuring multiple vehicles, can be more expensive |

| Driving experience | Inexperienced or newer drivers often pay higher insurance rates |

| Mileage | Higher mileage can increase insurance rates due to the increased risk of accidents |

| Vehicle choice | The type of car, its safety features, and repair costs can impact insurance rates |

| Leased or financed car | Leasing or financing a car may result in higher insurance costs |

| Thefts and claims in the area | Higher rates of thefts and claims in the neighbourhood can drive up insurance rates |

| Insurance company | Different insurance companies use varying formulas for setting rates |

What You'll Learn

Traffic violations and accidents

Minor traffic violations, such as following too closely or failing to obey a traffic sign, can lead to increased insurance rates. However, the impact is usually less severe compared to major violations. Major traffic violations include driving under the influence (DUI), driving the wrong way, driving with a suspended license, passing a school bus, and fleeing from the police. These violations pose a significant risk and can result in substantial spikes in insurance premiums. In some cases, insurance companies may even cancel the coverage of a high-risk driver.

The severity and frequency of traffic violations play a crucial role in determining insurance rates. For example, a single speeding ticket may not significantly impact your insurance if your driving record is clean. On the other hand, multiple violations within a short period can lead to substantial rate increases. The specific violation, the number of tickets, and the time elapsed since the last offense are all factors considered by insurance companies when determining rate adjustments.

Accidents, whether at-fault or not-at-fault, can also contribute to higher insurance rates. Insurance companies view accidents as indicators of future risk, and even if you are not at fault, your rates may still increase, especially in states that allow it. Comprehensive claims, such as those for car theft, vandalism, or weather-related damage, can also lead to higher premiums, depending on the insurance company and state regulations.

It is important to note that the impact of traffic violations and accidents on insurance rates can vary by state and insurance company. Additionally, insurance companies may offer accident forgiveness coverage, which allows for a claim without a premium increase, but this often comes at an additional cost. Understanding your insurance policy and taking proactive measures, such as enrolling in defensive driving courses, can help mitigate the impact of traffic violations and accidents on your auto insurance rates.

Vehicle Insurance: Due Date Reminder

You may want to see also

Claims in your area

If you live in an area where drivers make frequent insurance claims, you will likely face higher insurance costs. Insurance companies assume that you are more likely to be involved in an accident or have your car stolen simply because of the area you live in. This is because car insurance premiums form a collective pot from which every claim is paid. Your insurer has to charge you enough so that they can cover all their customers who live in your area.

The number of crashes, and the cost of these crashes, are a component of auto insurance pricing in every state. For example, drivers living in large metropolitan areas are likely to pay more. This is because more cars on the road lead to more crowded roadways, increasing the number of car crashes in those cities.

Additionally, if your area has a high rate of theft, accident, or weather-related claims, it becomes riskier for an insurance company to cover drivers there. That risk can lead to an auto insurance price increase, even if you have a perfect driving record. Changing the address where your car is kept overnight is a rare instance where your rate could increase mid-policy without making changes to your coverages, vehicles, or covered drivers. If you're moving out of state, you'll need a new auto policy. However, if you're remaining in the same state, your rate could go up based on claims in your new ZIP code.

Wells Fargo: Gap Insurance Options

You may want to see also

Vehicle value and repair costs

The cost of your car is a major factor in determining the cost of insuring it. The likelihood of theft, the cost of repairs, the engine size, and the overall safety record of the car are all variables that impact the cost of insurance. If you purchase a more expensive car, your insurance rate is likely to go up as your new car may be more likely to be stolen and will cost more to repair or replace than your previous vehicle.

Cars with high-quality safety equipment might qualify for premium discounts. Insurers look at how safe a particular vehicle is to drive and how well it protects its occupants, but they also consider how much potential damage it could inflict on another car. If a specific vehicle model has a higher chance of inflicting damage when in an accident, an insurer may charge more for liability insurance.

After an accident, it is up to your insurer to decide whether to pay for repairing your car or to declare it a total loss and pay you its book value. Most standard auto policies will not pay to repair a vehicle if it is "totaled," meaning that the repairs cost more than the cash value assigned to the car. However, you may be able to argue that the parts of the car were worth more than the book value and thus increase your settlement. To do this, you will need to submit evidence such as mileage records, service history, and affidavits from mechanics to show that your car was worth more than a typical car of its make and model.

One factor that could reduce the amount of your claim for a repair job is what insurance companies call "betterment." If your old car is repaired with brand-new parts, your insurer may argue that the repairs have enhanced the car's value and therefore reduce your claim by the difference between a used part and a new one.

Auto Insurance: Owner's Name Essential?

You may want to see also

Your age and driving experience

Auto insurance companies consider your age and driving experience when calculating your insurance rates. Inexperienced drivers are considered a higher risk to insure and are therefore charged more for their auto insurance. This is because they are more likely to be involved in car crashes, even if they have never been in an accident before.

Young drivers have less experience than older drivers and are more likely to display unsafe driving behaviours. As a result, they are charged higher insurance costs. However, older drivers may also pay more for insurance as insurers may become concerned about their ability to operate a car safely. Generally, drivers under the age of 25 and over the age of 65 tend to pay more for auto coverage.

The cost of auto insurance typically decreases as drivers gain more experience and enter adulthood. However, insurance rates may start to increase again around the age of 70. This is due to several age-related factors that can influence one's driving abilities, such as compromised vision or hearing, or slower reaction times.

In addition to age, insurance companies also consider driving history when determining insurance rates. A solid driving record, free of accidents, traffic violations, or claims, can help to lower insurance premiums. Conversely, violations, accidents, and claims can cause insurance rates to increase.

Gap Insurance Tax Status in Connecticut

You may want to see also

Adding extra drivers and vehicles

When to Add a Driver

You should add any licensed driver who lives in your household and has access to your vehicle to your insurance policy. This includes teenage children who have obtained their driver's licenses, college-aged children who drive your vehicle when they return home, and a partner who moves in. Some states may allow you to exclude a driver from being covered by the policy if you don't want them to drive your car.

How to Add a Driver

Most major auto insurance providers let you add a driver to your policy by logging into your account online or calling the company. You will typically need to provide the driver's name, date of birth, driving history, license information, and their vehicle identification number (VIN) if you plan to share one policy covering both vehicles.

Cost of Adding a Driver

While some insurance companies may charge a small administration fee to update policies, others may not charge anything at all for adding a driver. However, your premiums will likely increase, especially if you add an inexperienced or high-risk driver with a history of insurance claims and traffic violations. On the other hand, adding a more experienced driver with a clean driving record may make your premiums more affordable.

Adding a Vehicle

Adding a new vehicle to your insurance policy will also increase your premium, especially if it is more expensive than your previous car. This is because pricier cars are more likely to be stolen and cost more to repair or replace.

Auto Insurance: Driving Record Impact

You may want to see also

Frequently asked questions

Adding a new driver to your existing policy could drive up your price, especially if the new driver is a teenager or someone with a poor driving record.

The location where your car is garaged can impact your insurance rate. If you move to a high-risk area, your rate will likely increase.

The rate of your auto insurance is influenced by the cost of repairing or replacing your vehicle. If you purchase a more expensive car, your insurance rate will likely increase.

Speeding tickets and other moving violations indicate to insurance companies that you're more likely to get into an accident. As a result, your insurance rate will probably go up.

There are several factors outside of your control that can cause your auto insurance rate to increase, such as an increase in the number of crashes, the cost of repairs, and medical and auto body repair costs.