In Connecticut, gap insurance is an optional add-on to your auto policy that covers the difference between what you owe on a loan and your car's worth if your vehicle is deemed a total loss. While gap insurance is not taxable in Connecticut, it is important to note that it is separate from your deductible. The cost of gap insurance is typically affordable, ranging from $20 to $30 per year. This small price provides significant financial protection, especially for those driving late-model or expensive vehicles.

What You'll Learn

What does gap insurance cover?

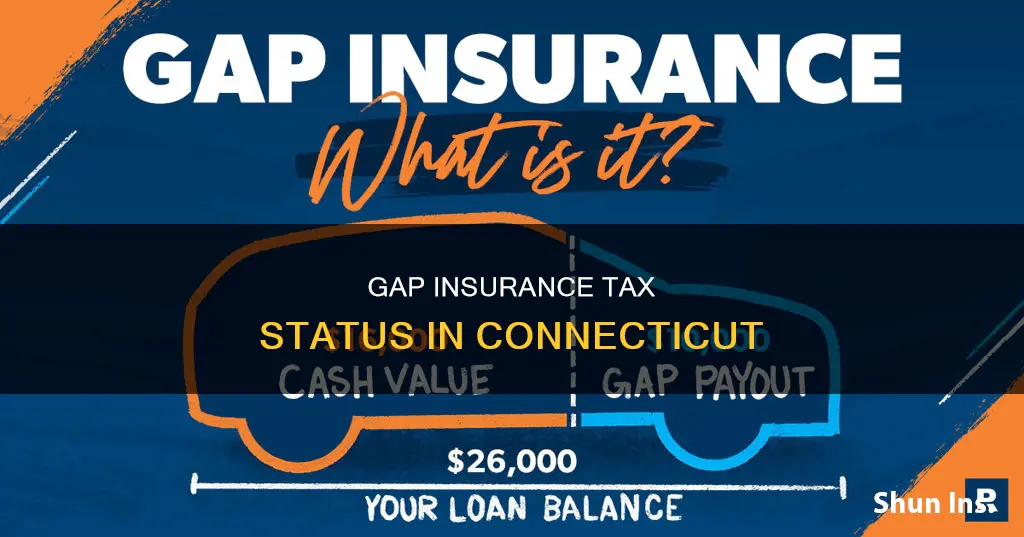

Gap insurance, or Guaranteed Asset Protection (GAP), is an optional product that covers the difference between the amount you owe on your auto loan and the amount the insurance company pays if your car is stolen or totaled. This type of insurance is intended for people who finance or lease their vehicles.

Gap insurance covers the gap between a vehicle's actual cash value and the outstanding balance on a loan or lease. It is designed to protect you from paying out of pocket if your car is stolen or totaled and you owe more on your loan than the car is valued at. In this scenario, gap insurance would cover the remaining amount you'd otherwise have to pay.

For example, if you finance a $25,000 car and a few months later it is in an accident and declared a total loss, your standard insurance will cover the loss. However, if the insurance adjuster determines the actual cash value of your car to be $20,000, but your loan balance is $24,000, you would owe more on your loan than the car is worth. In this case, gap insurance would cover the remaining $4,000.

Gap insurance does not cover costs related to vehicle repairs, personal injuries, or other accident-related expenses. It also does not cover damages to someone else's property or vehicle rentals/replacements.

Gap insurance is not required by law in Connecticut or any other state. However, lenders and lessors often require borrowers to obtain this coverage to protect their investment in financed vehicles. It is particularly useful for drivers with financed vehicles who made a small down payment or have a car that depreciates quickly.

Gap Insurance: New Car Essential?

You may want to see also

When should you carry gap insurance?

Gap insurance is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it is stolen or totaled. This type of insurance is useful in the following situations:

- You have a car loan or lease: Gap insurance is only necessary if you are currently paying off your vehicle. If you own your car outright, you don't need gap insurance.

- You have a long payoff period: Gap insurance makes sense if you choose a long loan term, as you may owe more than your car's current value.

- You made no down payment or a small down payment: If you put no money down or made a small down payment, your auto loan balance will be higher, increasing your risk.

- You have a long-term loan: If your loan duration is four years or longer, you are at higher risk as depreciation may outpace your loan payoff schedule.

- You drive a lot: High mileage will speed up depreciation.

- You own an expensive vehicle: If you drive a late-model or luxury car, especially one that depreciates quickly, you should consider gap insurance.

- You rolled over negative equity from a previous loan: If you rolled over negative equity from an old car loan into your new loan, gap insurance can protect you.

In general, gap insurance is a good idea if you can't afford to pay the difference between the amount you owe on your car loan and its current value in the event of a total loss. This type of insurance can give you peace of mind and protect you from financial stress in the event of an accident or theft.

Comparing Vehicle Insurance: A Quick Guide

You may want to see also

How much does gap insurance cost?

The cost of gap insurance depends on where and how you purchase it. If you buy gap insurance from a dealership, it can cost hundreds of dollars a year. If you add it to an existing car insurance policy, it typically costs $20 to $40 per year. This option only increases your comprehensive and collision insurance cost by about five to six percent on average. If you want to buy a standalone gap insurance policy, you can expect to pay between $200 and $300.

When you buy gap insurance through your regular auto insurer, the price is usually just $20 per year. If you take out a loan to purchase your car, lenders may offer the option to add gap insurance to the agreement for a one-time flat rate, usually between $500 and $700. This is the most expensive option and you will pay interest on the sum since it will be rolled into your loan.

Gap insurance is relatively inexpensive because it is only needed for one to three years, or until your vehicle is worth more than you still owe on your loan or lease.

Insurance Companies: Vehicle Value Determinants

You may want to see also

Is gap insurance mandatory in Connecticut?

Gap insurance is not mandatory in Connecticut or any other US state. However, auto lenders and lessors often require borrowers to have gap insurance to protect their investment in financed vehicles.

Gap insurance is an optional add-on to your auto policy that covers the difference between what you owe on a loan and what your car is worth if it is deemed a total loss. This is particularly useful for drivers with financed vehicles who made a small down payment or have a car that depreciates quickly.

In Connecticut, a car is considered a total loss when the vehicle's actual cash value is equal to or less than the cost of repairs plus the salvage value. Actual cash value refers to how much the car was worth immediately before the damage, while the salvage value is the car's worth in its damaged state.

Gap insurance is also known as "Guaranteed Auto Protection" or "Guaranteed Asset Protection". It is not included in your standard auto policy.

Vehicle Registration: Proof of Insurance?

You may want to see also

How does gap insurance work?

Gap insurance, also known as Guaranteed Asset Protection (GAP) insurance, is an optional add-on to your auto insurance policy. It covers the difference between the amount you owe on your auto loan and the amount your insurance company pays if your car is stolen or deemed a total loss.

Here's how gap insurance works:

When You Need Gap Insurance

Gap insurance is designed for situations where your loan amount is more than your vehicle's worth. This can happen due to depreciation, high-interest rates, or a small down payment. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 difference, minus your deductible.

What Gap Insurance Covers

Gap insurance covers the "gap" between what you still owe on your auto loan and the actual cash value (ACV) of your vehicle. If your car is stolen or deemed a total loss, your standard auto insurance will typically only pay you the ACV of your car, less any deductible. Gap insurance ensures that you receive enough money to pay off the remaining loan balance.

Cost of Gap Insurance

The cost of gap insurance can vary. It typically ranges from $2 to $30 per month, depending on whether you purchase it from a dealership, a car manufacturer, or your insurance provider. It's important to note that gap insurance is usually only needed for one to three years, or until your vehicle's value exceeds the amount you owe on your loan.

Where to Buy Gap Insurance

You can purchase gap insurance from your auto insurance company, a company specializing in gap insurance, or as part of your auto loan from a dealership or lender. When buying gap insurance, be sure to compare prices and coverage options to find the best value.

Eligibility and Requirements

To be eligible for gap insurance, you must have comprehensive and collision coverage on your auto insurance policy. Additionally, some lenders or leasing companies may require you to purchase gap insurance to protect their investment in financed vehicles.

In summary, gap insurance is a valuable option for drivers with financed or leased vehicles who want protection against the financial gap that can occur between their car's value and the amount they owe on their loan. By purchasing gap insurance, you can ensure you're not left with a significant financial burden if your vehicle is stolen or totaled.

Unlicensed Vehicles: Need Insurance?

You may want to see also