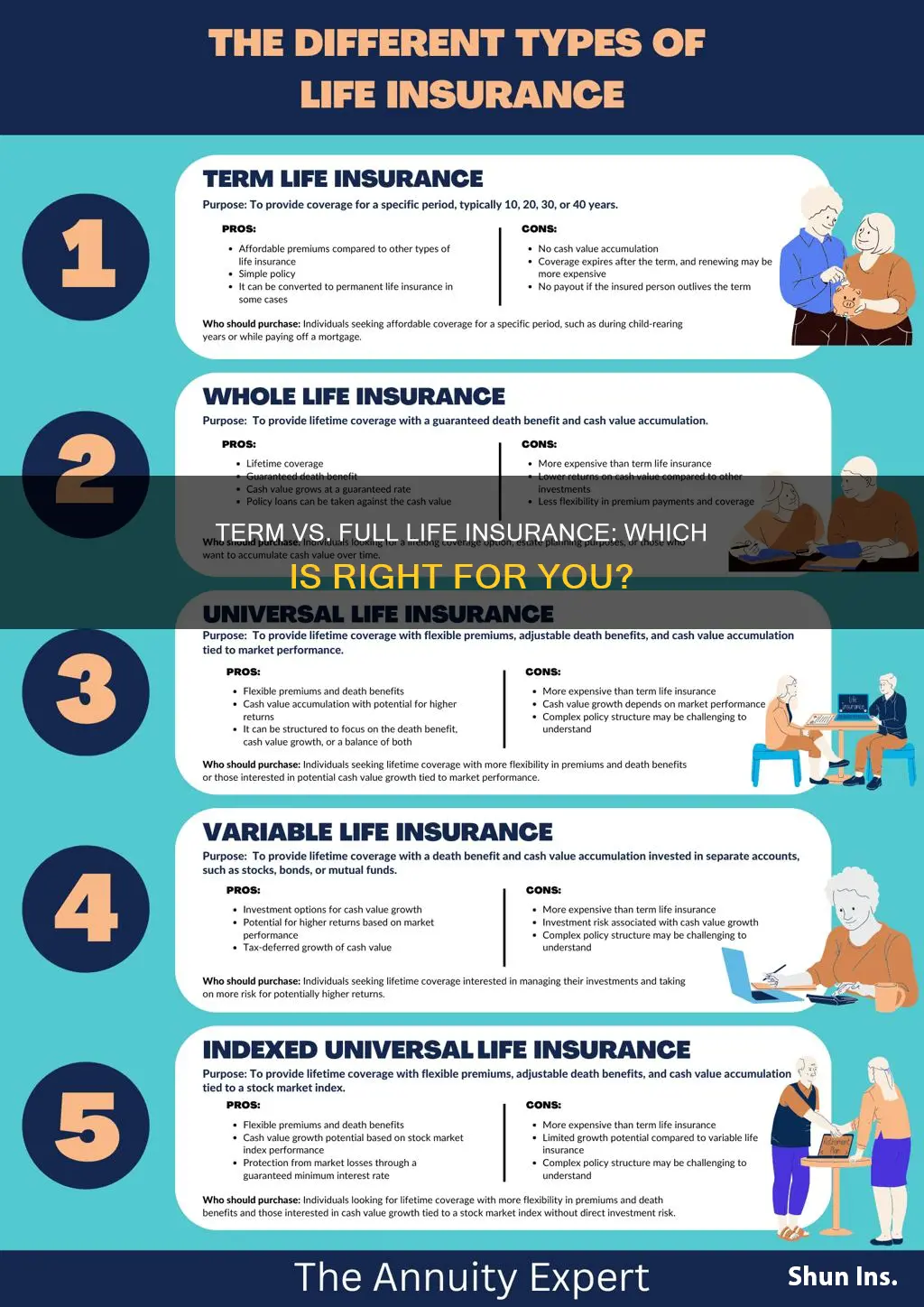

When it comes to choosing between term and full life insurance, it's important to understand the key differences and benefits of each. Term insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable and tailored to short-term needs, such as covering mortgage payments or providing financial security for a family. On the other hand, full life insurance, also known as permanent insurance, offers lifelong coverage and includes an investment component, allowing the policy to grow over time. This type of insurance is more expensive but provides long-term financial security and can be a valuable asset for estate planning and wealth accumulation. Understanding these distinctions can help individuals make an informed decision based on their specific financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Coverage Duration | Term insurance provides coverage for a specific period, typically 10, 15, 20, or 30 years. Full life insurance offers coverage for the entire life of the insured individual. |

| Cost | Term insurance is generally more affordable, especially for younger individuals, as it only covers a specific period. Full life insurance premiums are higher and increase over time as the insured ages. |

| Flexibility | Term insurance allows policyholders to choose the duration of coverage, making it flexible for various life stages. Full life insurance provides lifelong coverage, ensuring financial protection for the entire life of the insured. |

| Premiums | Premiums for term insurance are typically fixed and predictable, making budgeting easier. Full life insurance premiums can vary and may increase with age and health changes. |

| Death Benefit | Both term and full life insurance offer a death benefit, which is paid out upon the insured's death. The amount is predetermined for term insurance, while full life insurance provides a higher benefit that increases over time. |

| Investment Component | Some full life insurance policies include an investment component, allowing policyholders to grow their money over time. Term insurance does not typically have this feature. |

| Tax Advantages | Both types of insurance may offer tax benefits, but the specifics vary. Full life insurance can provide tax-deferred growth, while term insurance may be more suitable for tax-efficient savings. |

| Suitable For | Term insurance is ideal for individuals who want coverage for a specific period, such as to cover mortgage payments or provide financial security for children's education. Full life insurance is suitable for long-term financial planning and leaving a legacy. |

| Risk Assessment | Term insurance is based on the risk of the insured individual's death within the specified period. Full life insurance considers the risk of death at any age, making it more comprehensive. |

| Medical History | Full life insurance may require a more detailed medical examination and may be more challenging to obtain for individuals with pre-existing health conditions. Term insurance is often more accessible and less complex. |

What You'll Learn

- Cost-Effectiveness: Term insurance is generally more affordable for younger buyers

- Coverage Duration: Term policies offer fixed coverage periods, ideal for specific needs

- Flexibility: Convertible term policies allow switching to permanent coverage later

- Tax Implications: Permanent life insurance may offer tax advantages over term

- Long-Term Needs: Consider permanent insurance if you need coverage for a lifetime

Cost-Effectiveness: Term insurance is generally more affordable for younger buyers

When considering the cost-effectiveness of insurance options, term insurance often emerges as a more affordable choice, especially for younger individuals. This is primarily due to the nature of term insurance and the demographics it caters to.

Younger buyers typically have a lower risk profile compared to older individuals. They are more likely to have a longer life expectancy, which is a crucial factor in insurance pricing. Insurance companies calculate premiums based on the likelihood of an event occurring, and younger people generally have a reduced chance of experiencing the insured event, such as death or critical illness, during the term period. As a result, insurance providers offer lower premiums for term insurance policies to younger individuals, making it a more cost-effective option.

The affordability of term insurance is further emphasized by the fact that younger buyers often have a higher disposable income. They might be saving for long-term goals, such as buying a home or starting a family, and have more financial flexibility. By opting for term insurance, they can allocate their resources efficiently, ensuring adequate coverage without straining their budgets. This is in contrast to permanent life insurance, which, while providing lifelong coverage, often comes with higher premiums due to its comprehensive nature and the extended coverage period.

Additionally, term insurance is designed for specific periods, often 10, 20, or 30 years. This structured approach allows younger buyers to match the policy duration with their financial goals and needs. For instance, a young professional might choose a 20-year term policy to cover the period when they are most likely to have a mortgage or other significant financial commitments. Once these commitments are met, they can reassess their insurance needs and potentially transition to a different type of policy or terminate the coverage, further optimizing the cost-effectiveness.

In summary, term insurance is a more cost-effective choice for younger buyers due to its lower risk profile, affordability, and flexibility. It allows individuals to secure coverage during critical periods without incurring excessive costs, making it a practical and sensible option for those seeking insurance solutions tailored to their specific life stages and financial circumstances.

Factors Affecting Life Insurance Rates: Understanding the Basics

You may want to see also

Coverage Duration: Term policies offer fixed coverage periods, ideal for specific needs

When it comes to choosing between term life insurance and whole life insurance, understanding the coverage duration is crucial. Term life insurance provides a straightforward and focused approach to coverage, offering a fixed period of protection. This type of policy is designed to meet specific financial needs and goals, making it an excellent choice for certain situations.

The fixed coverage period of term life insurance is one of its key advantages. It allows individuals to secure financial protection for a predetermined length of time, such as 10, 20, or 30 years. During this term, the policy provides a death benefit if the insured individual passes away. This structured approach ensures that the insurance coverage aligns with the specific needs of the policyholder, often related to major financial commitments or responsibilities. For example, a young family might opt for a 20-year term policy to cover mortgage payments or provide financial security for their children's education.

Term life insurance is particularly beneficial when the need for coverage is time-sensitive or tied to a particular event. It is an ideal solution for individuals who want to protect their loved ones during a specific period, such as when starting a family or when there are significant financial obligations. The fixed nature of term policies ensures that the coverage remains relevant and appropriate as the policyholder's circumstances change over time.

One of the strengths of term life insurance is its affordability. Since the coverage is limited to a specific duration, the premiums are generally lower compared to whole life insurance. This makes term policies more accessible to a broader range of individuals, allowing them to secure essential protection without a long-term financial commitment. Moreover, the flexibility of term insurance enables policyholders to adjust their coverage as their needs evolve, ensuring that the insurance remains relevant throughout their lives.

In summary, term life insurance offers a well-defined and focused approach to coverage, making it an excellent choice for individuals seeking a specific duration of protection. Its fixed coverage periods, affordability, and flexibility make it a practical and sensible option for those with particular financial needs and goals. By understanding the duration of coverage, individuals can make informed decisions about their insurance choices, ensuring they have the right level of protection when it matters most.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

Flexibility: Convertible term policies allow switching to permanent coverage later

Convertible term life insurance policies offer a unique advantage that can be a game-changer for those seeking flexibility in their insurance coverage. This type of policy is designed with the understanding that individuals' needs and financial situations can change over time. One of the key benefits is the ability to convert the term policy into a permanent life insurance plan, providing long-term financial security.

When you purchase a term policy, it typically covers a specific period, often 10, 20, or 30 years. During this term, the policy offers a guaranteed death benefit if the insured individual passes away. However, what sets convertible term policies apart is the option to switch to a permanent life insurance plan after the term ends. This conversion feature allows policyholders to ensure their loved ones' financial security for an extended period without the need to re-qualify for a new policy.

The flexibility of convertible term insurance is particularly appealing to those who want to start with a cost-effective solution during their working years. Term policies are generally more affordable because they only provide coverage for a limited time. By converting to permanent insurance, individuals can lock in a guaranteed death benefit and continue to have coverage for life, ensuring that their family's financial needs are met even in the long term. This option is especially valuable for those who may have outgrown their initial coverage needs but still require comprehensive protection.

During the conversion process, the policyholder can choose the type of permanent insurance they prefer, such as whole life or universal life. This customization ensures that the insurance plan aligns with their evolving financial goals and preferences. For instance, whole life insurance offers a fixed premium and a cash value accumulation, providing a sense of security and potential financial benefits. On the other hand, universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage as their circumstances change.

In summary, convertible term life insurance provides a flexible and adaptable approach to long-term financial planning. It empowers individuals to start with a cost-effective term policy and, when the time is right, convert it into a permanent solution, ensuring their loved ones' financial well-being for years to come. This feature is a significant advantage for those who value the ability to adapt their insurance coverage as their life progresses.

Switching Life Insurance: Is It Possible to Change Providers?

You may want to see also

Tax Implications: Permanent life insurance may offer tax advantages over term

When considering the tax implications of life insurance, it's important to understand the differences between term and permanent life insurance policies. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and it does not accumulate cash value. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn, providing financial flexibility.

One of the key tax advantages of permanent life insurance is that the cash value growth within the policy is generally tax-deferred. This means that the earnings on the cash value are not subject to income tax as they accumulate. As a result, the policyholder can build a substantial cash value over time, which can be used for various purposes, such as funding education expenses, starting a business, or providing financial security for retirement. This tax-deferred growth can be particularly beneficial for long-term financial planning.

In contrast, term life insurance does not offer the same tax benefits. Since term policies do not have a cash value component, there are no earnings to grow or accumulate. As a result, the premiums paid for term life insurance are typically not tax-deductible, unlike the contributions made to permanent life insurance policies. This distinction is essential for individuals who are looking to maximize their tax efficiency and optimize their overall financial strategy.

For those seeking tax advantages, permanent life insurance can be a valuable tool. The tax-deferred growth of the cash value can provide a significant financial benefit, especially when compared to other investment vehicles that may be subject to higher tax rates. Additionally, the ability to borrow against or withdraw funds from the cash value can offer a sense of financial security and flexibility, allowing individuals to adapt to changing financial needs and goals.

In summary, permanent life insurance's tax-deferred cash value growth sets it apart from term life insurance. This feature can provide long-term tax advantages and financial flexibility, making permanent life insurance an attractive option for individuals who want to optimize their tax strategy and build a comprehensive financial plan. Understanding these tax implications is crucial when deciding between term and permanent life insurance to ensure that your financial decisions align with your overall goals.

Understanding Whole Life Insurance: A Comprehensive Guide to Coverage

You may want to see also

Long-Term Needs: Consider permanent insurance if you need coverage for a lifetime

When it comes to choosing the right insurance plan, understanding your long-term needs is crucial. If you're seeking coverage that will provide financial protection throughout your entire life, then permanent life insurance is the way to go. This type of insurance is designed to offer lifelong coverage, ensuring that your loved ones are financially secure even after your passing.

Permanent life insurance, also known as whole life insurance, provides a sense of stability and peace of mind. Unlike term life insurance, which has a limited coverage period, permanent insurance remains in force as long as you make the required premium payments. This means that your beneficiaries will receive a death benefit regardless of your age or health status at the time of your passing. The cash value accumulation within the policy can also be utilized for various purposes, such as loaning money to yourself or your beneficiaries, or even taking out a tax-free withdrawal when you no longer need the coverage.

One of the key advantages of permanent insurance is its ability to provide long-term financial security. As your needs and circumstances change over time, having a permanent policy ensures that your coverage remains relevant and adaptable. For instance, if you start a family or experience a career change, your insurance needs may evolve, and permanent insurance can be adjusted accordingly. Additionally, the cash value component allows you to build a savings account within your policy, providing a source of funds that can be used for various financial goals.

Another benefit of permanent life insurance is its potential to act as an investment. The cash value in your policy grows over time, and you can access this value through policy loans or withdrawals. This feature can be particularly useful if you're looking to build a substantial financial cushion or if you want to have funds available for future expenses, such as education costs or retirement savings. By carefully managing the cash value, you can maximize its growth while still benefiting from the insurance coverage.

In summary, if you're seeking long-term financial protection and want coverage that will last a lifetime, permanent life insurance is an excellent choice. It provides unwavering support for your loved ones and offers the flexibility to adapt to changing circumstances. With its combination of insurance and investment features, permanent insurance ensures that you and your family are well-prepared for the future, no matter what life may bring.

Finding Life Insurance Buyers: Strategies for Success

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, while whole life insurance offers lifelong coverage. Term insurance is generally more affordable and provides a fixed death benefit if the insured dies during the term. Whole life insurance, on the other hand, has an investment component and accumulates cash value over time, providing a higher death benefit and other benefits like dividends and loan features.

Term life insurance is ideal when you have specific financial obligations or dependents that need financial support for a limited time. For example, if you're financing a home, have young children, or have a mortgage, term insurance can provide peace of mind and financial security for your family during these years. It's a cost-effective way to ensure your loved ones are protected without the long-term commitment of whole life insurance.

Yes, whole life insurance offers several benefits. It provides guaranteed death benefit coverage for the entire life of the insured, ensuring your family receives the intended financial support. Additionally, the investment component allows your money to grow over time, and you can access the cash value through loans or withdrawals. Whole life insurance also offers stability and predictability, as premiums remain level for life, providing long-term financial security.

The decision depends on your personal financial goals, risk tolerance, and long-term plans. If you need coverage for a specific period and want a more affordable option, term life insurance is a good choice. If you prefer the security of lifelong coverage, the potential for cash value accumulation, and other benefits, whole life insurance might be more suitable. It's essential to assess your financial needs, consult with an insurance advisor, and understand the terms and conditions of each policy before making a decision.