Millennials, often the first generation to face significant financial challenges like student debt and a volatile job market, may wonder if life insurance is a necessary expense. However, understanding the basics of life insurance can be a crucial step in securing your future and that of your loved ones. This guide will explore why millennials should consider life insurance, how it works, and the various types available to help them make informed decisions about their financial well-being.

What You'll Learn

- Understanding Needs: Millennials should assess their financial obligations and future goals to determine the right life insurance coverage

- Cost vs. Benefits: Compare premiums with the value of coverage, considering term life for affordability

- Early Planning: Starting life insurance early can provide long-term financial security and peace of mind

- Customized Policies: Tailor policies to individual needs, including term life, whole life, or universal life

- Long-Term Financial Strategy: Integrate life insurance into a comprehensive financial plan for sustained wealth management

Understanding Needs: Millennials should assess their financial obligations and future goals to determine the right life insurance coverage

Millennials, often the target audience for life insurance companies, should approach this topic with a thoughtful and proactive mindset. Understanding your needs is the first step towards making an informed decision about life insurance. This generation, known for their tech-savviness and financial awareness, has unique considerations when it comes to securing their future and the well-being of their loved ones.

The first step in assessing your life insurance needs is to evaluate your financial obligations. This includes a comprehensive list of expenses and commitments. For millennials, this might encompass student loan debt, rent or mortgage payments, car loans, and any other regular financial outgoings. It's crucial to consider the potential impact of your death on these obligations. For instance, if you have a substantial student loan, life insurance can ensure that the lender is compensated, preventing your loved ones from inheriting a financial burden. Similarly, if you're the primary breadwinner in a family, life insurance can provide financial security for your spouse or partner, covering expenses like mortgage payments, groceries, and other daily costs.

Future goals also play a significant role in determining the right life insurance coverage. Millennials often have ambitious plans for their careers and personal lives, such as starting a business, buying a home, or having a family. These goals should be considered when deciding on the type and amount of life insurance. For example, if you're planning to start a family, life insurance can provide financial support for your children's education or daily needs if something happens to you. Additionally, if you have a significant amount of personal savings or investments, life insurance can ensure that these assets are protected and passed on to your beneficiaries.

Assessing your health and lifestyle is another critical aspect of understanding your life insurance needs. Millennials, like any generation, should be aware of their health status and any pre-existing conditions. These factors can influence the cost and availability of life insurance. Additionally, lifestyle choices such as smoking, excessive drinking, or engaging in extreme sports can impact your insurance premiums. Being honest and transparent about your health and lifestyle will help you secure the best possible coverage.

In conclusion, millennials should take the time to evaluate their financial obligations, future goals, and personal circumstances to determine the appropriate life insurance coverage. This process involves a thorough understanding of one's needs and a realistic assessment of potential risks. By doing so, millennials can ensure that they and their loved ones are protected, providing peace of mind and financial security for the future. It is a responsible step towards long-term financial well-being and a valuable consideration for anyone at the beginning of their adult lives.

Selling Annuities: Do You Need a Life Insurance License?

You may want to see also

Cost vs. Benefits: Compare premiums with the value of coverage, considering term life for affordability

Millennials, often seen as the insurance-averse generation, might be surprised to learn that life insurance can be a valuable tool for their financial well-being. When considering life insurance, it's essential to evaluate the cost-benefit ratio, especially for those on a tight budget. Term life insurance, in particular, offers a cost-effective solution for millennials looking to secure their family's financial future without breaking the bank.

The primary advantage of term life insurance is its affordability. This type of policy provides coverage for a specified term, typically 10, 20, or 30 years, and is generally more budget-friendly than permanent life insurance. Millennials often have a long-term financial outlook, and term life insurance can be tailored to their specific needs during this period. For instance, if a young millennial is starting a family or has recently purchased a home, term life insurance can provide a safety net for their loved ones in the event of an unforeseen tragedy.

When comparing premiums, millennials should consider their individual circumstances. Factors such as age, health, lifestyle, and occupation influence the cost of life insurance. Younger individuals and those in good health may qualify for lower premiums. For example, a 30-year-old non-smoker with a healthy lifestyle might find that term life insurance is more affordable than an older individual with health concerns. Additionally, millennials can explore the option of increasing their coverage as their financial situation improves, ensuring they have the right amount of protection without overpaying.

The value of term life insurance lies in its ability to provide financial security during critical life stages. It ensures that your loved ones are taken care of if something happens to you, covering essential expenses like mortgage payments, children's education, or daily living costs. For millennials, this can be a crucial aspect of building a stable future for themselves and their families. Moreover, term life insurance can be a more flexible option, allowing policyholders to adjust their coverage as their needs change over time.

In summary, millennials should approach life insurance with a strategic mindset, focusing on the cost-benefit analysis. Term life insurance offers an affordable and valuable solution, providing financial security without straining their budgets. By understanding their individual needs and exploring different insurance options, millennials can make informed decisions to protect their loved ones and build a more secure future. It is a wise investment that ensures peace of mind and financial stability for the long term.

Cancerwise: Chesapeake Life Insurance Explained

You may want to see also

Early Planning: Starting life insurance early can provide long-term financial security and peace of mind

Millennials, often referred to as the generation that came of age in the early 21st century, are at a unique point in their lives where starting to think about life insurance can be incredibly beneficial. While it might seem like a long way off, especially if you're in your 20s or early 30s, early planning for life insurance can offer numerous advantages that contribute to your long-term financial security and overall well-being.

One of the primary benefits of starting life insurance early is the opportunity to secure long-term financial protection. Life insurance is a tool that ensures your loved ones are financially secure in the event of your untimely passing. By initiating this planning process early, you can take advantage of lower premiums, as rates tend to increase with age. Younger individuals are generally considered lower-risk by insurance companies, making it more affordable to secure a substantial death benefit. This financial safety net can provide peace of mind, knowing that your family's financial future is protected, even if you're not around.

Additionally, early planning allows you to explore various life insurance options and find the best fit for your needs. There are different types of life insurance policies, such as term life, whole life, and universal life, each with its own advantages. Term life insurance, for instance, provides coverage for a specified period, while whole life offers lifelong coverage and a cash value component. By starting early, you have the time to research and understand these options, ensuring you make an informed decision that aligns with your long-term goals and financial situation.

Another advantage of early life insurance planning is the ability to build a substantial death benefit over time. As you age, your life insurance coverage can grow, providing a more significant financial cushion for your beneficiaries. This is particularly important if you have financial dependents, such as a spouse, children, or a mortgage, who would rely on your income in the event of your death. By starting early, you can build a substantial policy that adequately covers these potential expenses.

Furthermore, early planning allows you to take advantage of the compounding effect of interest and investment growth. Many life insurance policies, especially whole life and universal life, offer investment components. By starting early, you can let these investments grow over several decades, potentially accumulating a substantial amount of cash value. This cash value can be borrowed against or withdrawn, providing financial flexibility and a source of emergency funds if needed.

In conclusion, starting life insurance early is a strategic move for millennials to secure their financial future and provide long-term security for their loved ones. It offers lower premiums, the opportunity to explore various policy options, and the potential for substantial death benefits and investment growth. By taking this proactive approach, millennials can ensure they are prepared for life's unexpected twists and turns, giving them peace of mind and financial stability for the future.

Understanding Volunteer Life Insurance: A Comprehensive Guide

You may want to see also

Customized Policies: Tailor policies to individual needs, including term life, whole life, or universal life

Millennials, a generation often associated with technological savvy and financial awareness, are at a crucial stage in life where understanding and prioritizing life insurance can be transformative. When it comes to life insurance, one size does not fit all, especially for this generation that values customization and personal fit. Here's a breakdown of why tailored policies are essential for millennials and how they can benefit from this approach.

Understanding Individual Needs: Life insurance is not a one-time purchase but a long-term commitment. For millennials, who are often navigating significant life changes, such as starting a career, buying a home, or starting a family, the need for insurance can vary greatly. A customized policy takes into account these unique circumstances. For instance, a young millennial starting a career might opt for a term life insurance policy, which provides coverage for a specific period, such as 10, 20, or 30 years, ensuring financial security for their family during this critical phase. As they progress in their career and life stage, they can adjust the policy accordingly.

Term Life Insurance: A Millennial's Best Friend: This type of policy is an excellent choice for millennials due to its affordability and flexibility. It offers high coverage amounts at lower premiums compared to permanent life insurance. For those in the early stages of their careers, it provides a safety net for their loved ones without the long-term financial burden. The term can be extended or reduced as the individual's needs and financial situation evolve, making it a dynamic solution.

Whole Life and Universal Life Insurance: Long-Term Benefits: These permanent life insurance policies offer lifelong coverage, providing financial security for the long haul. Whole life insurance guarantees a fixed premium and death benefit, making it a stable choice. Universal life insurance, on the other hand, offers more flexibility, allowing policyholders to adjust the death benefit and premium payments over time. For millennials planning for the long term, these policies can be valuable, especially when considering future financial goals and the potential for increased earnings and wealth accumulation.

Tailoring to Specific Goals: Customized policies can be designed to align with specific millennial goals. For example, a young couple planning to start a family might want to ensure their children's future education is financially secure. A tailored policy could include a whole life insurance component to guarantee a fixed death benefit, ensuring their children's financial needs are met even if one parent passes away. Similarly, a millennial entrepreneur might opt for a policy that provides coverage for business-related risks, protecting their startup's future.

In conclusion, millennials should embrace the idea of customized life insurance policies to ensure they receive the right coverage at the right time. By understanding their unique life stages and goals, they can make informed decisions about insurance, providing peace of mind and financial security for themselves and their loved ones. It's a smart financial move that empowers millennials to take control of their future.

Unlocking Life Insurance: Age Limits and Benefits Explained

You may want to see also

Long-Term Financial Strategy: Integrate life insurance into a comprehensive financial plan for sustained wealth management

Millennials, often seen as the digital natives, are navigating a complex financial landscape as they strive to build a secure future. One crucial aspect of their financial strategy that deserves attention is life insurance, a tool that can significantly impact their long-term financial well-being. Here's why integrating life insurance into a comprehensive financial plan is essential for millennials:

Protecting Your Assets and Loved Ones: Life insurance is a powerful financial tool that provides a safety net for your loved ones in the event of your untimely demise. It ensures that your family is financially secure, covering essential expenses like mortgage payments, education costs, or daily living expenses. By having a life insurance policy, millennials can create a financial cushion, allowing their beneficiaries to maintain their standard of living and achieve their financial goals without the added stress of sudden financial burdens.

Wealth Accumulation and Transfer: This is not just about protection; it's also a strategy for wealth accumulation and transfer. Millennials can utilize various life insurance products, such as whole life or universal life policies, which offer a combination of insurance coverage and investment components. These policies allow you to build cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, life insurance can be a strategic tool for wealth transfer, ensuring that your beneficiaries receive a tax-efficient inheritance, thus helping to minimize the tax impact on your estate.

Long-Term Financial Planning: Integrating life insurance into a long-term financial strategy is a forward-thinking approach. It encourages millennials to consider their future needs and goals. For instance, term life insurance can provide coverage for a specific period, such as until a child's education is funded or a mortgage is paid off. This ensures that your financial obligations are met during critical life stages. Moreover, as your financial situation evolves, you can adjust your life insurance coverage accordingly, ensuring it remains aligned with your changing needs.

Building a Comprehensive Financial Plan: A comprehensive financial plan should consider various aspects of life, including insurance, investments, retirement planning, and tax strategies. By integrating life insurance, millennials can create a holistic approach to wealth management. This involves assessing your risk tolerance, understanding your family's financial goals, and selecting appropriate insurance products. A financial advisor can guide this process, helping millennials make informed decisions about coverage amounts, policy types, and premium payments to ensure a sustainable and tailored financial strategy.

In summary, life insurance is a vital component of a millennial's long-term financial strategy, offering protection, wealth-building opportunities, and a means to secure the financial future of their loved ones. By incorporating life insurance into their overall financial plan, millennials can make informed choices, adapt to life changes, and build a robust foundation for sustained wealth management. It empowers them to take control of their financial destiny and make the most of their hard-earned money.

Increasing Term Life Insurance: How is it Sold?

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool for millennials to consider as it provides a safety net for their loved ones in the event of their untimely passing. It ensures that their family can maintain their standard of living, cover essential expenses, and achieve financial goals, even if they are no longer around.

For young adults, life insurance typically offers two main types of policies: Term Life Insurance and Permanent Life Insurance. Term life insurance provides coverage for a specific period, often 10, 20, or 30 years, and is generally more affordable. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, allowing policyholders to build cash value over time. Millennials can choose a term life policy to cover debts, mortgage payments, or any financial obligations they may have, ensuring their family's financial security.

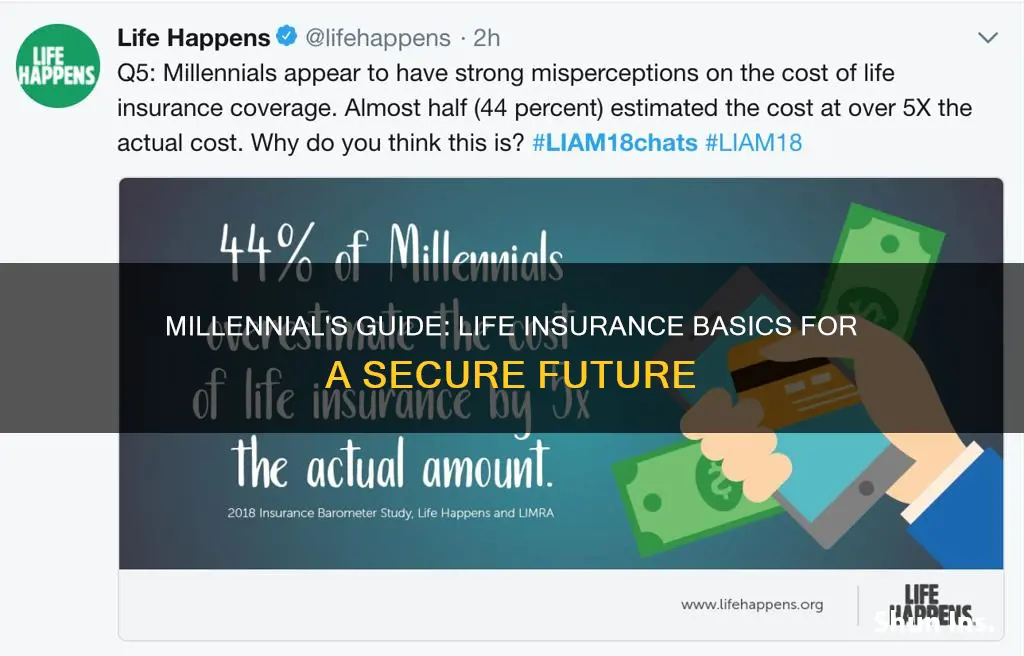

Absolutely! Life insurance is more affordable for millennials compared to older generations due to their younger age and longer life expectancy. Younger individuals typically have lower premiums because they are considered less risky by insurance companies. Additionally, many life insurance providers offer flexible payment options, allowing millennials to choose a plan that fits their budget. It's a wise investment to secure their family's future and gain peace of mind.