Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. One aspect of life insurance that often goes unnoticed is the potential for dividends. Life insurance dividends are a portion of the company's profits that are distributed to policyholders. Understanding how these dividends work and how they can benefit you is essential for making informed financial decisions. In this paragraph, we will explore the concept of life insurance dividends, their significance, and how they can impact your financial well-being.

What You'll Learn

- Understanding Dividends: How life insurance companies distribute profits to policyholders

- Dividend Payouts: Regular payments made to policyholders, often as a percentage of premiums

- Dividend Growth: Historical trends and factors influencing dividend increases over time

- Dividend Options: Choices available to policyholders regarding dividend reinvestment or withdrawal

- Tax Implications: Tax treatment of dividends and its impact on policyholder finances

Understanding Dividends: How life insurance companies distribute profits to policyholders

Life insurance companies operate in a complex financial landscape, and understanding how they generate and distribute profits is essential for policyholders. Dividends are a crucial aspect of this process, offering policyholders a share of the company's success. When you purchase a life insurance policy, you're essentially investing in a contract that promises financial security for your loved ones upon your passing. Over time, the insurance company invests the premiums you pay into various assets, such as stocks, bonds, and real estate, aiming to generate returns. These returns are then distributed to policyholders in the form of dividends.

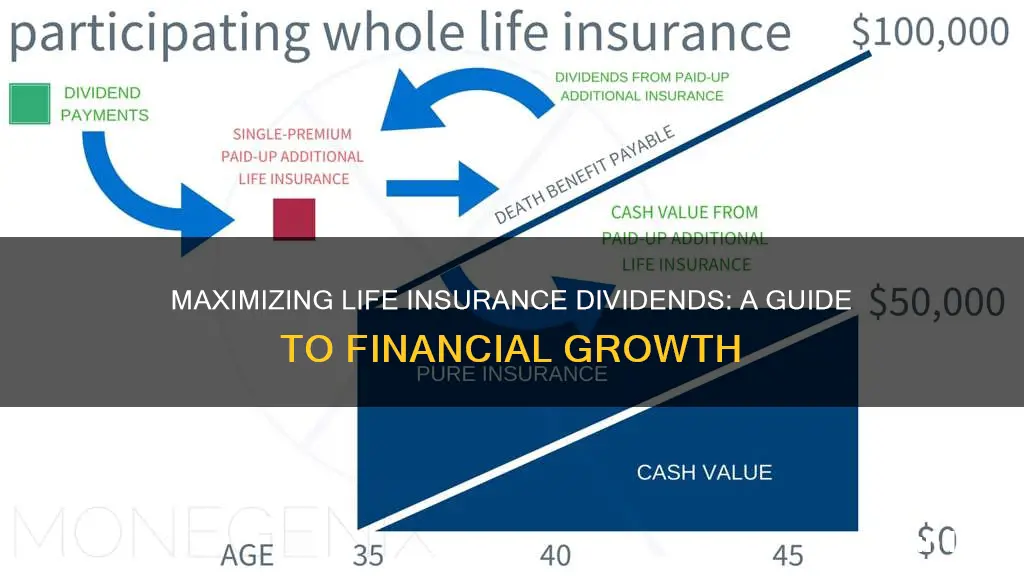

Dividends in the context of life insurance are essentially a portion of the company's net income allocated to policyholders. They are a way for insurance companies to share the benefits of their successful investments with those who have entrusted them with their financial well-being. The distribution of dividends can vary depending on the type of life insurance policy and the company's financial performance. Whole life insurance policies, for instance, often have a guaranteed death benefit and may accumulate cash value over time, which can be used to pay dividends.

The process of receiving dividends is straightforward. Insurance companies typically declare dividends annually or semi-annually, and these dividends are paid out to policyholders in the form of additional cash value or reduced premiums. For whole life insurance policies, dividends can contribute to the policy's cash value, which grows tax-deferred. This growing cash value can be borrowed against or withdrawn, providing policyholders with a financial resource that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses.

It's important to note that not all life insurance policies offer dividends. Term life insurance, which provides coverage for a specified period, typically does not accumulate cash value and, therefore, does not pay dividends. However, term life insurance is generally more affordable and can be a strategic choice for those seeking temporary coverage without the long-term investment aspect.

Understanding dividends is a crucial aspect of managing your life insurance policy effectively. By grasping how and why dividends are distributed, policyholders can make informed decisions about their financial strategies. Additionally, being aware of the potential dividend payments can help individuals plan for their financial goals and ensure that their life insurance policies remain a valuable asset in their overall financial portfolio.

Life Insurance Proceeds: Taxable in Michigan?

You may want to see also

Dividend Payouts: Regular payments made to policyholders, often as a percentage of premiums

Dividend Payouts: A Key Feature of Life Insurance Policies

Life insurance policies often offer a unique and attractive feature known as dividend payouts, which can provide additional financial benefits to policyholders. These payouts are regular payments made by the insurance company to the policyholder, typically as a percentage of the premiums paid. Understanding how dividend payouts work can be an essential aspect of managing your life insurance policy effectively.

When you purchase a life insurance policy, you essentially invest in a contract with the insurance company. Over time, the company's investments and the overall market performance can influence its profitability. If the insurance company's investments perform well, they may generate surplus earnings. Dividend payouts are a way for the company to share these surplus earnings with the policyholders. The amount of dividend paid out is often a percentage of the total premiums paid, and it can vary depending on the policy type and the company's financial performance.

These regular payments can be particularly beneficial for policyholders as they provide a steady income stream. This income can be used for various purposes, such as supplementing retirement savings, funding education expenses, or simply providing financial security. Dividend payouts are often tax-advantaged, meaning they may be exempt from income tax, making them an attractive long-term investment strategy. Policyholders can choose to reinvest the dividends to grow their policy's cash value or opt to receive them as regular payments.

It's important to note that not all life insurance policies offer dividend payouts, and the availability and terms can vary. Some policies may have specific conditions or caps on the dividend amount, ensuring that the insurance company maintains a healthy financial position. Policyholders should carefully review their policy documents to understand the terms and conditions related to dividend payments.

In summary, dividend payouts are a valuable feature of certain life insurance policies, offering regular payments to policyholders as a share of the premiums paid. This can provide an additional source of income and financial security, especially during retirement or other significant life events. Understanding the terms and conditions of your policy regarding dividend payouts can help you make informed decisions about your life insurance investment.

Life Insurance: A Smart Retirement Strategy?

You may want to see also

Dividend Growth: Historical trends and factors influencing dividend increases over time

Dividend growth is a critical aspect of the life insurance industry, reflecting the financial health and stability of insurance companies. Over time, the trend of increasing dividends has been a significant indicator of a company's performance and its commitment to rewarding shareholders. This article delves into the historical trends and factors that have influenced dividend increases in the life insurance sector.

Historically, life insurance companies have been known for their consistent dividend payments, often providing a steady income stream for policyholders. The trend of increasing dividends has been particularly prominent in the last few decades. For instance, many leading life insurance companies have consistently raised their dividends annually, with some achieving double-digit growth rates. This growth is not merely a result of market fluctuations but is often a strategic decision made by companies to maintain and enhance their shareholder value.

Several factors contribute to the historical trend of dividend increases. Firstly, a strong financial performance is a key driver. Life insurance companies that have consistently demonstrated profitability and strong capital positions are more likely to increase dividends. These companies often have a robust investment portfolio, which generates substantial returns, enabling them to allocate more funds to dividend payments. Secondly, regulatory environments play a crucial role. In many countries, insurance regulators encourage companies to maintain a high level of capital adequacy, which often translates to increased dividends as companies aim to meet these regulatory standards.

Market conditions also significantly influence dividend growth. During economic expansions, life insurance companies often experience higher investment returns, leading to increased dividends. Conversely, in economic downturns, companies may opt for dividend stability or even reductions to preserve capital. However, over the long term, the industry has shown resilience, and dividend growth has generally outpaced economic cycles.

Another factor is the strategic decision-making of company management. Forward-thinking insurance companies often focus on sustainable growth, which includes maintaining a healthy dividend policy. They may invest in innovative products, expand into new markets, or adopt cost-saving measures to ensure long-term profitability, all while maintaining or increasing dividends. This approach not only benefits shareholders but also contributes to the overall stability and growth of the life insurance industry.

In summary, the historical trend of increasing dividends in the life insurance sector is a result of a combination of strong financial performance, favorable regulatory environments, market conditions, and strategic management decisions. Understanding these factors is essential for investors and policyholders alike, as it provides insights into the financial health and future prospects of life insurance companies.

Munich Re's Life Insurance: What You Need to Know

You may want to see also

Dividend Options: Choices available to policyholders regarding dividend reinvestment or withdrawal

When it comes to life insurance, understanding the concept of dividends and the options available to policyholders is crucial. Dividends in life insurance refer to the portion of the company's profits that are allocated to policyholders. These dividends can be reinvested or withdrawn, providing policyholders with flexibility and control over their investment. Here's an overview of the dividend options available:

Dividend Reinvestment: One of the primary choices policyholders have is to reinvest their dividends back into the life insurance policy. This option allows the policy to grow over time, potentially increasing its value. By reinvesting, policyholders can take advantage of the power of compounding, where the earnings from the dividends are used to purchase additional policy units or shares. This strategy is particularly beneficial for long-term growth and can help build a substantial cash value within the policy. Policyholders can choose to reinvest a fixed percentage of their dividends or allocate a specific amount each time they receive a dividend payment.

Dividend Withdrawal: Alternatively, policyholders can opt to withdraw their dividends instead of reinvesting them. This provides immediate access to the cash value accumulated in the policy. Withdrawals can be made in various ways, such as taking a lump sum payment or receiving regular installments. Withdrawing dividends can be advantageous if policyholders need immediate funds for financial goals or unexpected expenses. It offers a level of liquidity that reinvestment may not provide. However, it's important to consider the potential impact on the policy's overall growth and long-term value.

The decision to reinvest or withdraw dividends depends on the policyholder's financial objectives, risk tolerance, and future plans. Some individuals may prefer the long-term growth potential of reinvestment, while others might prioritize having accessible funds for immediate needs. Life insurance companies often provide policyholders with detailed information and guidance regarding these dividend options, allowing them to make informed choices. It is recommended to carefully review the policy documents and consult with a financial advisor to understand the implications of each decision.

In summary, life insurance policies offer policyholders the freedom to choose between reinvesting dividends for long-term growth or withdrawing them for immediate financial needs. Both options have their advantages, and the choice should be aligned with the individual's financial strategy and goals. Understanding these dividend options is essential for making informed decisions regarding life insurance investments.

Canada Life Insurance: Is It Worth the Hype?

You may want to see also

Tax Implications: Tax treatment of dividends and its impact on policyholder finances

The tax implications of life insurance dividends can significantly impact policyholders' finances, and understanding these effects is crucial for making informed financial decisions. When a life insurance company generates profits, it often distributes a portion of these earnings to its policyholders in the form of dividends. These dividends can be a source of additional income for policyholders, but they are subject to specific tax regulations that policyholders should be aware of.

Dividends received from life insurance policies are generally considered taxable income. The tax treatment of these dividends can vary depending on the jurisdiction and the specific insurance policy. In many countries, dividends from life insurance are taxed at the same rate as regular income, which means they are taxed at the policyholder's marginal tax rate. This rate can be relatively high, especially for those in higher income brackets, as it includes federal, state, and sometimes local taxes. For example, in the United States, dividends from life insurance are typically taxed as ordinary income, which can result in a significant tax liability for policyholders.

The impact of these taxes on policyholder finances can be substantial. When a policyholder receives dividends, they may initially perceive it as a bonus or additional income. However, a significant portion of this income is then taken away in taxes, leaving the policyholder with a net gain that is lower than expected. This can affect the overall financial benefits of the policy, especially over time, as the cumulative effect of these taxes can reduce the policyholder's overall savings or investment returns.

Furthermore, the tax treatment of life insurance dividends can also influence policyholder behavior. Some policyholders might be tempted to withdraw dividends to avoid future tax liabilities, which could impact the policy's long-term growth. Others might consider investing the dividends in tax-efficient vehicles, such as tax-deferred accounts or tax-free savings options, to minimize the tax impact. Understanding the tax rules and seeking professional advice can help policyholders make strategic decisions regarding their life insurance policies and dividend distribution.

In summary, the tax implications of life insurance dividends are an essential aspect of policyholder finances. Dividends are taxable income, and the tax rates applied can be substantial. Policyholders should be aware of these tax treatments to fully understand the financial impact on their policies. By considering the tax implications, policyholders can make informed choices to optimize their financial outcomes and potentially minimize the tax burden associated with life insurance dividends.

Term Life Insurance: Can It Be Denied for Renewal?

You may want to see also

Frequently asked questions

Life insurance dividends are a portion of the company's profits that are distributed to policyholders. These dividends are typically paid out as additional benefits or returns on the policy's cash value. They are a way for insurance companies to share their financial success with policyholders and can provide an extra source of income or investment growth.

If your policy has dividends, your insurance company will usually notify you annually or semi-annually. They will provide a statement showing the dividend amount and how it has been allocated to your policy. It's important to review these statements regularly to understand the impact of dividends on your policy's value and to ensure you are aware of any changes in the dividend distribution.

In some cases, you may have the option to withdraw the dividends as cash. However, this is not always the case, and the terms and conditions regarding dividend withdrawals can vary. It's best to consult your insurance provider to understand the specific options available to you and the potential implications of withdrawing dividends from your policy.