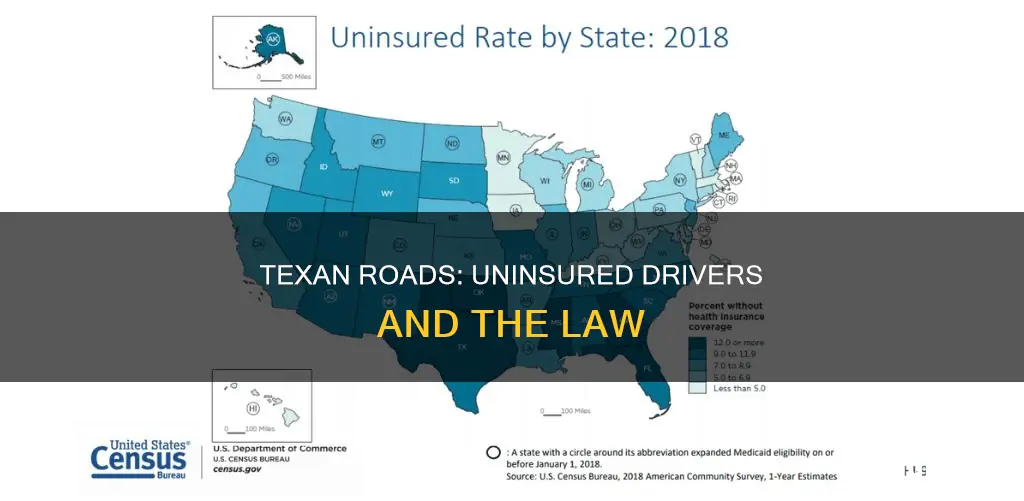

Texas law requires drivers to show proof that they can pay for any accidents they cause. This is usually done by purchasing auto liability insurance. In 2022, 14% of motorists in the US were uninsured, meaning about one in seven drivers did not have car insurance. While the rate of uninsured motorists in Texas is not known, the state is one of the few that has seen a decrease in uninsured motorists in recent years.

| Characteristics | Values |

|---|---|

| % of Texan drivers uninsured | 14% or 1 in 7 drivers (2022 figure) |

| % of Texan drivers uninsured (in context) | 20 states and the District of Columbia have higher rates of uninsured drivers |

| Penalty for driving without insurance (first offence) | $175–$350 fine |

| Penalty for driving without insurance (second offence) | $350–$1,000 fine |

| Penalty for driving without insurance (subsequent offences) | Fine of up to $1,000, vehicle impounded for up to 180 days, driving privileges suspended for up to two years |

| Penalty for driving without insurance in an accident | Fine of up to $4,000, potential jail time of one year, file an SR-22 form for three years, vehicle registration and license suspended for up to two years, liable for all physical injuries and property damage |

What You'll Learn

The TexasSure Vehicle Insurance Verification program

Texas has a problem with uninsured drivers, with an estimated 1 in 5 drivers uninsured. This costs insured Texans almost $900 million a year in protection against those with no coverage. To address this, Texas introduced the TexasSure Vehicle Insurance Verification program.

TexasSure is a state-funded electronic database designed to reduce the number of uninsured motorists in Texas. It is a partnership between the Texas Department of Insurance, the Texas Department of Public Safety, the Texas Department of Motor Vehicles, and the Texas Department of Information Resources.

The program allows authorized users to confirm whether a Texas-registered passenger vehicle has a valid auto liability insurance policy. All 254 county Tax Assessor-Collectors and the DPS Texas Highway Patrol use TexasSure, and it is available to all Texas local law enforcement.

Insurance companies in Texas are required to report their full book of business to the TexasSure vendor every week. Commercial auto policies are reported on an optional basis. The TexasSure vendor uses a matching algorithm to link the reported insurance policies to a Texas-registered vehicle. All data is updated weekly.

TexasSure sends two types of notices to Texas consumers: Unmatched and Uninsured.

An Unmatched Notice is sent to insured customers that TexasSure has been unable to match to a Texas-registered vehicle for at least 60 days. Customers are provided with the insurance information submitted by their company and specific guidance to help them determine the reason for the non-match. There is no penalty for not responding.

An Uninsured Notice is sent to owners of Texas-registered vehicles that appear to be uninsured. Customers are provided with the vehicle registration information on file and specific guidance to help them correct the situation. Again, there is no penalty associated with this notice.

Texas law requires drivers to show proof that they can pay for any accidents they cause. Most drivers do this by buying auto liability insurance. After purchasing insurance, the insurance company will report this to TexasSure.

Get Auto Settlement: Tips for Home Insurance Policyholders

You may want to see also

The cost of uninsured motorists to Texans

Texas law requires drivers to show proof of their ability to pay for any accidents they cause. This is usually done by purchasing auto liability insurance. However, according to a 2023 study by the Insurance Research Council (IRC), about one in seven drivers in the US were uninsured in 2022, and in Texas, this figure is even higher, with one in five drivers uninsured. This has significant financial implications for Texans.

Firstly, for those who choose to drive without insurance, there are serious penalties. Driving without insurance in Texas can result in a fine of up to $1,000, an impounded vehicle for up to 180 days, and a suspended license for up to two years. If an uninsured driver is involved in a collision, they could face fines of up to $4,000 and a year in jail if serious injuries or death occur. In addition, their vehicle registration and license will be automatically suspended for up to two years, and they will be 100% liable for any physical injuries and property damage resulting from the accident.

Secondly, for insured Texans, the presence of so many uninsured motorists on the roads can lead to increased insurance costs. Texans are already paying relatively high insurance premiums due to factors such as their location in a city, the type of car they drive, and their credit score. With a high number of uninsured drivers, insured Texans may also need to purchase additional uninsured/underinsured motorist coverage to protect themselves financially in the event of an accident. This extra coverage typically comes at an additional cost, adding to the overall expense of owning a vehicle in the state.

Finally, uninsured motorists can impact the cost of healthcare in Texas. If an uninsured driver is involved in an accident that results in injuries, the financial burden of medical treatment falls on the healthcare system and insured drivers. This can lead to increased healthcare costs for all Texans, as the cost of treating uninsured patients is passed on to insured patients and taxpayers.

In conclusion, the presence of uninsured motorists on Texas roads has significant financial implications for Texans, including penalties for driving without insurance, increased insurance costs for those who are insured, and higher healthcare costs for the state. Texans must carefully consider their insurance coverage and financial responsibilities when operating a vehicle in the state to avoid costly consequences.

Affordable Insurance: Cheaper Alternatives to Safe Auto

You may want to see also

The named driver policy loophole

In Texas, drivers are required to show proof that they can pay for any accidents they cause. This is usually done by purchasing auto liability insurance. However, it is estimated that 1 in 5 drivers in the state are uninsured.

A named driver is a person who is covered by an insurance policy to drive a car that has a different main driver. The named driver has the same level of cover as the main driver but is not the policyholder. The main driver is the person who drives the car the most, and the registered keeper is responsible for ensuring the MOT is valid, the vehicle is taxed and insured, and dealing with parking fines or speeding violations.

Adding a named driver can be beneficial for young or new drivers, as insurance providers often view them as riskier to insure than older, more experienced drivers. By including a named driver, particularly a parent or older sibling, insurance providers consider the risk reduced and will often offer a lower premium.

However, it is important to choose your named driver carefully. If the named driver gets into an accident, the main driver is considered at fault, even if they were not in the vehicle. This can negatively impact the main driver's no-claims bonus and increase the cost of insuring their vehicle.

It is worth noting that the rules regarding named drivers vary between insurance providers, and there may be situations where it is not possible to add someone as a named driver. In such cases, the individual would need to take out their own insurance policy to drive.

When to File an Auto Insurance Claim

You may want to see also

The consequences of driving without insurance in Texas

Texas has strict penalties for driving without insurance. Driving without insurance in Texas is illegal, and those who choose to do so are violating the law. Texas law requires drivers to show proof that they can pay for any accidents they cause, and most drivers do this by purchasing auto liability insurance.

If you are caught driving without insurance in Texas, you could face a fine of up to $1,000 for a second or subsequent offence, and your vehicle may be impounded for up to 180 days. You will also have to pay daily storage fees for your vehicle, which can add up to a significant amount. Additionally, your driving privileges may be suspended for up to two years, and you will be required to file an SR-22 form for three years after the incident. If you are in an accident and are found to be at fault, you will be 100% liable for any physical injuries and property damage caused by the accident.

If you are responsible for a collision that results in serious injuries or death, the consequences are even more severe. You could face a fine of up to $4,000 and up to one year in jail. Your vehicle registration and license will be automatically suspended for up to two years, and you will be required to file an SR-22 form for three years.

It is important to note that even if you have insurance, your policy may not cover all the costs associated with an accident. For example, if you have a deductible, you will need to pay that amount out of pocket before your insurance company covers the remaining costs. Additionally, if you have insufficient liability coverage, you may have to pay out of pocket for any damages or injuries that exceed your policy limit.

To avoid these consequences, it is crucial to have valid auto insurance when driving in Texas. It is also important to understand the details of your insurance policy, including any exclusions or limitations, to ensure that you are adequately covered in the event of an accident.

Auto Insurance: Can You Trust the Seller?

You may want to see also

How to protect yourself from uninsured motorists

In Texas, around one in five drivers are uninsured. This means that if you are in an accident with an uninsured driver, you could be at risk of substantial financial losses. Here are some ways to protect yourself:

- Understand your insurance policy: It is important to know what is covered by your insurance policy and what is not. Make sure you understand the basics of insurance policies and uninsured drivers. Check if your policy covers uninsured motorist protection and, if not, consider adding it.

- Know what to do in an accident: If you are in an accident with an uninsured driver, it is important to know what to do. Get the other driver's information, including their name, address, contact number, license plate number, and insurance details (if they have it). Also, take note of the time, date, location, and any relevant circumstances, such as weather and road conditions. Take photos of the accident scene and get the contact information of any witnesses.

- File a claim: If you are in an accident with an uninsured driver, contact your insurance company and file a claim under your uninsured motorist coverage (if you have it). You may be able to claim for medical expenses and damage to your vehicle.

- Consider the benefits of uninsured motorist coverage: Uninsured motorist coverage can protect you financially if you are in an accident with an uninsured driver. It can cover medical expenses, lost wages, and damage to your vehicle. It is mandatory in many states and highly recommended for all drivers.

- Shop around for insurance: To ensure you are getting the best coverage for your needs, shop around and compare prices and coverage options from different insurance companies. Some states have programs to assist lower-income drivers in obtaining car insurance, so be sure to check with your state's insurance division.

- Understand the risks of driving without insurance: Driving without insurance is not only illegal but also financially risky. If you are caught driving without insurance in Texas, you could face fines, impoundment of your vehicle, and suspension of your driving privileges.

Understanding Comprehensive Auto Insurance Coverage and Its Definition

You may want to see also

Frequently asked questions

In 2024, Texas was among the states with the biggest decrease in uninsured motorists. In 2019, the national average of uninsured drivers was 12.6%, meaning about one in eight drivers didn't have car insurance. While the percentage of uninsured drivers in Texas is not stated, it is known that the state has a law requiring drivers to carry proof of liability insurance with at least 30/60/25 coverage.

Driving without insurance in Texas can result in a fine of up to $1,000, your vehicle being impounded for up to 180 days, and your driving privileges being suspended for up to two years. If you are in an accident and are found to be at fault, you could face additional fines, impoundment of your vehicle, suspension of your driving privileges, and be held 100% liable for any and all physical injuries and property damage resulting from the accident.

Uninsured motorist coverage is a type of insurance that covers you in the event of an accident with an uninsured or underinsured driver. In Texas, insurance companies must offer this coverage when you purchase auto insurance. It is important to have this coverage because it can help protect you financially if you are in an accident with a driver who does not have enough insurance to cover the cost of repairs and medical bills.