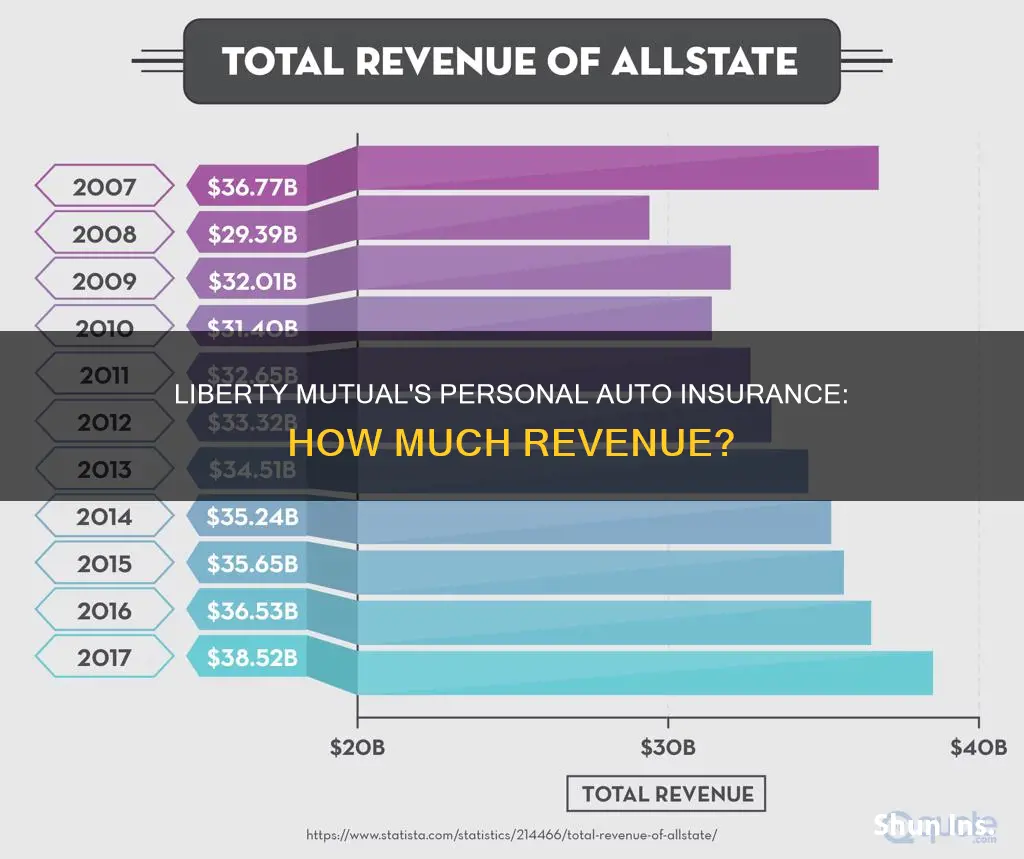

Liberty Mutual is a global insurer, offering a wide range of insurance products and services, including personal automobile insurance. The company is based in Boston, Massachusetts, and is the sixth-largest property and casualty insurer in the world. It has over 45,000 employees in more than 900 locations worldwide and is worth billions of dollars in terms of revenue and assets.

Liberty Mutual offers a variety of insurance products, including personal automobile, homeowners, workers' compensation, commercial, life, and many more. The company has a strong financial standing, ranking 71st on the Fortune 100 list of largest corporations in the US.

In terms of personal auto insurance, Liberty Mutual offers a range of coverage options and add-ons, such as accident forgiveness, better car replacement, and teachers' auto endorsement. The company also provides several discounts, including for safe driving habits, multi-car policies, and early shopping.

While Liberty Mutual has received recognition for its workplace culture, it has also received some negative reviews and customer complaints. The company ranked below average in J.D. Power's 2023 Auto Claims Satisfaction Study and has higher-than-average customer complaints registered with the National Association of Insurance Commissioners (NAIC) for private passenger auto insurance.

Overall, Liberty Mutual is a large and established insurer with a comprehensive range of products, including personal auto insurance. However, customers should also be aware of the company's mixed reviews and rankings when considering their insurance options.

| Characteristics | Values |

|---|---|

| Global Ranking | Sixth-largest property and casualty insurer in the world |

| Revenue in 2020 | $48.2 billion |

| Number of Employees | Over 45,000 |

| Number of Locations | Over 900 |

| Number of Countries in Operation | 29 |

| Number of Years in Operation | 111 |

| Number of Insurance Types Offered | 10 |

| J.D. Power 2023 U.S. Auto Insurance Study Rating | Below-average |

| AM Best Financial Strength Rating | A |

| NAIC Complaint Index | 3.95 |

What You'll Learn

Liberty Mutual's telematics program

The RightTrack program offers discounts of up to 30% on auto insurance premiums for safe driving. The discount is determined based on data collected on driver behaviour, including acceleration, braking, distance, and time of day. The program also offers a sign-up discount of 5-10% for enrolling, and this discount is guaranteed even if the driver's final score is lower than the initial discount. The final discount is applied either at the completion of the program or at renewal, depending on the state.

In addition to the RightTrack program, Liberty Mutual also offers the HighwayHero app, which tracks and scores driving behaviour, providing feedback after trips. The app includes city leaderboards and achievement badges to encourage safe driving. Liberty Mutual also offers a "pay as you drive" insurance program called ByMile, which offers lower premiums for those who drive their car less.

Finding Auto Insurance: A Quick Guide

You may want to see also

Liberty Mutual's RightTrack app

Liberty Mutual is an American global insurer and the sixth-largest property and casualty insurer in the world. It offers a wide range of insurance products and services, including personal automobile insurance.

The Liberty Mutual RightTrack app is a usage-based insurance program that uses telematics to track a driver's performance and reward safe driving with discounts of up to 30% on car insurance premiums. The app is free, but it uses data, and any applicable data charges will be the responsibility of the smartphone owner.

Here's how it works:

Enrolling in RightTrack

First, make sure to enroll in RightTrack when you join Liberty Mutual. You will receive an email with instructions on how to get started. You will need to download the Liberty Mutual Mobile app and encourage all drivers on your policy to do the same. Make sure to forward the activation codes to all drivers. You can register using your Liberty Mutual online account information or the activation code from your welcome email.

Driving for 90 Days

Once you've enrolled and registered, just drive as you normally would for 90 days. The app will track your trips and progress. Some specific behaviours observed by RightTrack include braking, acceleration, and the time of day that you drive. It's important to monitor your trip categorization to ensure that only trips where you are the driver count toward your score.

Receiving Your Final Score

After the 90-day review period, Liberty Mutual will confirm your final score and apply it to your premium either at completion of the program or at renewal, depending on the state you live in. Your final RightTrack score will be applied to your premium for the life of your policy.

Eligibility and Availability

To participate in RightTrack, you need a smartphone with GPS location capabilities and an accelerometer, gyroscope, and proximity sensors. Some Android phones don't have these features, and iPads, tablets, and Windows phones are not compatible.

RightTrack is available in several states, including Alabama, Arizona, Arkansas, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Hampshire, New Jersey, New Mexico, Nevada, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Wisconsin, West Virginia, and Washington, D.C.

New York customers can participate in the RightTrack Plug-in program.

Instant Auto Insurance: Fact or Fiction?

You may want to see also

Liberty Mutual's car insurance discounts

Liberty Mutual offers a long list of car insurance discounts. The company is the sixth-largest auto insurer in the nation and offers a wide range of insurance products and services.

- Safe driver discounts: Accident-Free Discount, Violation-Free Discount, and RightTrack Discount.

- Vehicle safety feature discounts: Anti-Theft Device Discount, Advanced Safety Features Discount, and Alternative Energy Discount.

- Customer detail discounts: Homeowner Discount, Military Discount, Early Shopper Discount, Good Student Discount, and Student Away-at-School Discount.

- Customer loyalty discounts: Multi-Car Discount, Multi-Policy Discount, Preferred Payment Discount, Pay-in-Full Discount, Online Purchase Discount, and Paperless Policy Discount.

The availability and eligibility criteria for each discount vary by state, and the discount amounts are not always disclosed. However, Liberty Mutual's discounts can save drivers up to 30% on their car insurance, and those who qualify for multiple discounts can save even more.

Understanding Auto Insurance: What Does 'Tort' Really Mean?

You may want to see also

Liberty Mutual's home insurance discounts

Liberty Mutual is an American insurance company that offers a wide range of insurance products and services, including homeowners insurance. The company is the sixth-largest property and casualty insurer in the world and ranks 71st on the Fortune 100 list of largest corporations in the United States.

Homeowner Discounts

- Claims-Free History Discount: If you have not filed a claim with your previous insurance carrier for five years or more, you are eligible for a discount on your policy.

- Safe Homeowner Program: If your policy remains claims-free with Liberty Mutual for three years, you will receive a discount on your premium.

- Early Shopper Discount: If you get a quote and sign up for a new policy with Liberty Mutual before your current policy expires, you will save on your new policy.

Discounts for Your Home

- Newly Purchased Home Discount: If you are a new homeowner, Liberty Mutual offers a discount on your policy.

- New/Renovated Home Discount: If your home was built or substantially renovated recently, you are eligible for savings on your insurance.

- New Roof Discount: A discount is available if you have a new roof, as it is considered a smart investment that helps mitigate damage.

- Wind Mitigation Credit: You can receive a discount if your home has construction features that help mitigate damage, such as wind mitigation measures.

Discounts for Your Home Insurance Policy

- Multi-Policy Discount: One of Liberty Mutual's most popular discounts, you will save on your premium if you have more than one policy with them (e.g., bundling home and auto insurance).

- Insured to Value Discount: You can receive a discount when you insure up to 100% of the cost to replace your home, which is usually different from the market value or selling price.

- Preferred Payment Discount: You will save on your premium if you enrol in automatic payments linked to your bank account.

- Paperless Policy Discount: Liberty Mutual offers a discount if you choose to go paperless and sign up for electronic communication.

The availability and amount of these discounts may vary by state, and certain discounts only apply to specific coverages. It is always worth checking with Liberty Mutual customer service to see what discounts you may qualify for.

Understanding Rated Drivers: Auto Insurance Explained

You may want to see also

Liberty Mutual's life insurance

Liberty Mutual is an American global insurer and the sixth-largest property and casualty insurer in the world. It offers a wide range of insurance products and services, including life insurance.

Types of Life Insurance Offered by Liberty Mutual

Liberty Mutual offers three main types of life insurance: term life insurance, whole life insurance, and guaranteed acceptance whole life insurance.

Term Life Insurance

Term life insurance is designed to meet temporary needs. It provides coverage for a specific term, and the beneficiaries receive a death benefit if the insured person passes away during that period. Term life insurance offers the following benefits:

- No medical exam is required; you only need to answer a few health questions.

- You can apply online in minutes.

- The coverage amount never decreases during the term.

- It can be converted to whole life insurance.

Whole Life Insurance

Whole life insurance provides permanent coverage and offers additional benefits, including:

- Level premiums that remain the same throughout the policy.

- The potential to build cash value, which can be accessed through loans. This cash value grows tax-deferred.

Guaranteed Acceptance Whole Life Insurance

This type of life insurance is designed to provide lifetime coverage regardless of the insured person's health condition. It offers guaranteed acceptance and a locked-in rate for the life of the policy. Additionally, the payout is income-tax free.

Managing Your Liberty Mutual Life Insurance Policy

Liberty Mutual provides several convenient ways to manage your life insurance policy:

- Online Account: You can access your online account to view and manage your policy, make changes, and get insurance help 24/7. The online portal allows you to review coverage, update contact and billing information, and access policy documents and ID cards.

- Mobile App: Liberty Mutual offers a mobile app for iOS and Android devices, which provides fast and easy access to your policy information. You can use the app to file and manage claims, view policy documents, and obtain your ID cards.

- Customer Support: Liberty Mutual also offers customer support through text, phone, and mail. You can contact them for policy, billing, or service questions, as well as for claims assistance.

Opening an Umbrella Auto Insurance Policy: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The average cost of Liberty Mutual car insurance is $284 per month for full coverage and $198 for liability-only insurance.

You can get a quote on the insurer’s website, call the company directly at 800-295-2723 or contact a local agent.

Whether a company is good depends on your specific needs, budget, and other factors. The company earned an A financial strength rating from A.M. Best, which indicates an ability to pay claims, but online customer reviews skew more negative than positive. For people who want a high degree of customization and can afford to pay potentially higher prices, Liberty Mutual can be a good choice.

Pros

- Wide variety of available discounts

- Ability to customize coverage

- Accident forgiveness program

Cons

- Higher average premiums than many competitors

- Below-average J.D. Power customer service ratings

- Many negative online customer reviews