When it comes to life insurance, understanding the differences between term life and whole life policies is crucial for making an informed decision. One of the key distinctions lies in the coverage period and cost. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable during the initial years. In contrast, whole life insurance offers lifelong coverage and accumulates cash value over time, making it more expensive. The question of what percentage of people choose term life insurance versus whole life insurance is an interesting one, as it reflects individual financial goals, risk tolerance, and long-term planning.

| Characteristics | Values |

|---|---|

| Percentage of Americans with Term Life Insurance | 30-40% |

| Percentage of Americans with Whole Life Insurance | 10-15% |

| Age Group with Higher Term Life Insurance Ownership | Younger adults (ages 25-34) |

| Age Group with Higher Whole Life Insurance Ownership | Older adults (ages 55-64) |

| Gender Difference | Men are more likely to have term life insurance, while women are more likely to have whole life insurance. |

| Income and Education Impact | Higher-income individuals and those with a college education are more likely to have whole life insurance. |

| Geographic Variations | Urban areas tend to have higher rates of term life insurance, while rural areas may have higher rates of whole life insurance. |

| Duration of Coverage | Term life insurance typically covers a specific period, while whole life insurance provides lifelong coverage. |

| Cost Comparison | Term life insurance is generally more affordable for shorter-term needs, while whole life insurance offers a guaranteed death benefit and potential cash value accumulation. |

| Tax Advantages | Both types of insurance may offer tax benefits, but the specifics vary. |

What You'll Learn

- Demographic Differences: Age, income, and marital status impact term vs. whole life insurance adoption rates

- Cost Comparison: Term life is generally cheaper, making it more accessible to younger, healthier individuals

- Long-Term Needs: Whole life provides lifelong coverage, suitable for those seeking long-term financial security

- Flexibility: Term life offers flexibility to adjust coverage as needs change, while whole life is fixed

- Tax Advantages: Whole life insurance builds cash value, offering tax-advantaged growth, unlike term life's pure coverage

Demographic Differences: Age, income, and marital status impact term vs. whole life insurance adoption rates

Age, income, and marital status are key demographic factors that significantly influence the adoption of term life insurance versus whole life insurance. These factors play a crucial role in determining an individual's insurance needs, preferences, and financial capabilities, ultimately shaping their choice of insurance coverage.

Age is a critical factor in insurance decisions. Younger individuals often opt for term life insurance due to its affordability and coverage tailored to specific needs, such as providing financial security for a family during the breadwinner's working years. As individuals age, they may transition to whole life insurance, which offers lifelong coverage and a cash value component, providing a sense of security and potential financial benefits over time. This shift is often driven by the desire for long-term financial planning and the understanding that whole life insurance can serve as an asset for future financial goals.

Income level also plays a significant role in insurance choices. Higher-income earners may have more financial resources and may opt for whole life insurance, which provides comprehensive coverage and potential investment opportunities. The ability to afford the higher premiums associated with whole life insurance is a key consideration. Conversely, those with lower incomes might prefer term life insurance, which offers a cost-effective solution for a specific period, ensuring financial protection without the burden of long-term premiums.

Marital status is another important demographic factor. Married individuals often have different insurance needs compared to singles. Term life insurance is commonly chosen by those who want to provide financial security for their spouse and children. It ensures that the family is protected during the years when financial responsibilities are most significant. On the other hand, married individuals with children might opt for whole life insurance to ensure long-term coverage and build a financial legacy for their family. Singles, especially those without dependents, may find term life insurance sufficient and more affordable, allowing them to allocate funds to other financial priorities.

In summary, age, income, and marital status are powerful determinants of the term life insurance vs. whole life insurance choice. Younger individuals and those with lower incomes often prefer term life for its affordability and targeted coverage. As demographics change, so do insurance preferences, with older individuals and higher-income earners potentially favoring whole life insurance for its lifelong coverage and financial benefits. Understanding these demographic differences is essential for insurance providers to tailor their products and marketing strategies effectively to meet the diverse needs of their customers.

Getting a Life Insurance License: How Long Does It Take?

You may want to see also

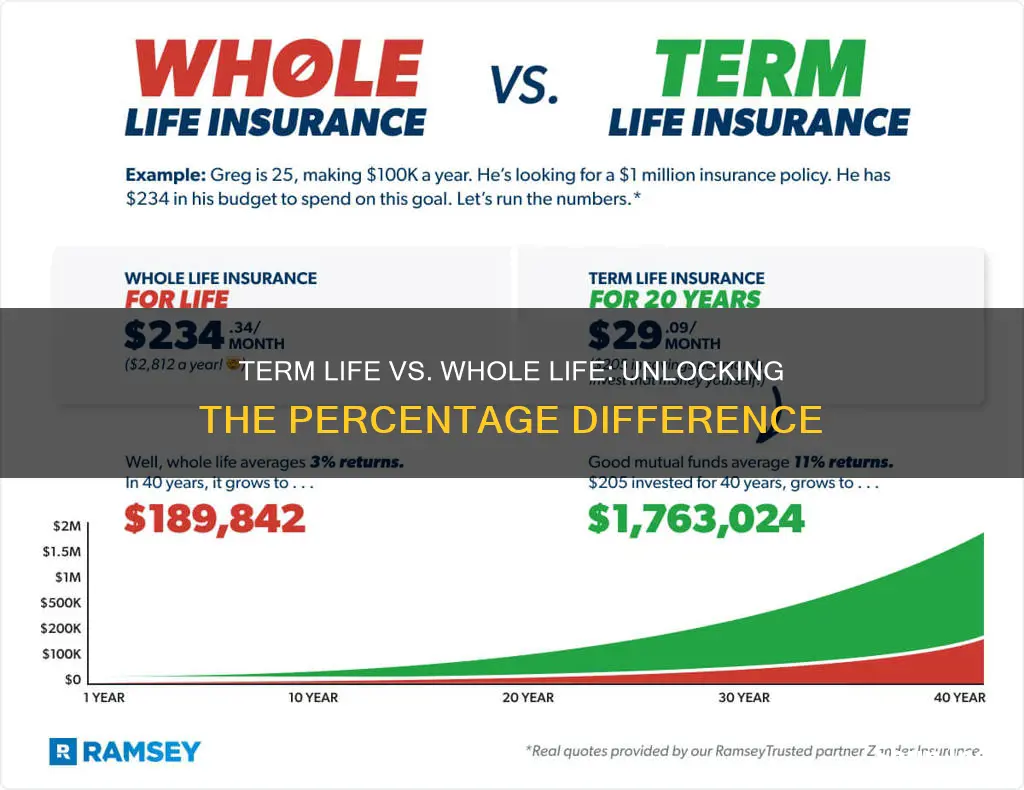

Cost Comparison: Term life is generally cheaper, making it more accessible to younger, healthier individuals

Term life insurance is often the more affordable option, especially for younger and healthier individuals. This is primarily due to the nature of term life policies, which are designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, the insurance company guarantees a death benefit if the insured individual passes away. The cost of term life insurance is calculated based on several factors, including age, health, lifestyle, and the desired coverage amount.

For younger individuals, the cost of term life insurance is relatively low because they are considered lower-risk candidates. Insurance companies assess that younger people are less likely to develop severe health conditions or face significant lifestyle changes that could increase their insurance premiums. As a result, they can offer competitive rates for term life insurance policies. This affordability factor makes term life insurance an attractive choice for those who want coverage without breaking the bank, especially when building a family or establishing a financial foundation.

In contrast, whole life insurance, also known as permanent life insurance, offers lifelong coverage and a cash value component. While it provides more comprehensive protection, it comes at a higher cost. Whole life insurance premiums are typically higher because they are designed to build a cash value over time, which can be borrowed against or withdrawn. This feature makes whole life insurance more suitable for individuals who want long-term financial security and are willing to pay for it.

The cost difference between term and whole life insurance becomes more pronounced as individuals age. As people get older, their health may deteriorate, and they may face increased health risks, leading to higher insurance premiums. Additionally, older individuals might have already built a substantial financial foundation, and the need for long-term coverage may be less critical. Therefore, term life insurance becomes a more appealing and cost-effective option for those who want coverage during specific life stages without the long-term financial commitment of whole life insurance.

In summary, term life insurance is generally cheaper, making it more accessible to younger, healthier individuals who want affordable coverage for a defined period. This affordability factor allows them to allocate their financial resources to other aspects of their lives, such as education, retirement savings, or building an emergency fund. By choosing term life insurance, these individuals can ensure their loved ones are protected without incurring significant financial burdens.

Life Insurance: USAA's Comprehensive Coverage Options

You may want to see also

Long-Term Needs: Whole life provides lifelong coverage, suitable for those seeking long-term financial security

When it comes to life insurance, understanding the different types and their benefits is crucial for making an informed decision. Term life insurance and whole life insurance are two popular options, each catering to distinct needs and preferences. While term life insurance offers a temporary safety net, whole life insurance provides a more comprehensive and long-term solution.

For individuals seeking long-term financial security, whole life insurance is an excellent choice. This type of policy offers lifelong coverage, ensuring that your loved ones are protected even in the long run. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains in force as long as the premiums are paid. This feature is particularly valuable for those who want to build a financial safety net that will grow and adapt over time. As your financial needs evolve, whole life insurance can provide the necessary coverage to support your goals, whether it's funding your child's education, securing a comfortable retirement, or ensuring your family's financial stability.

The beauty of whole life insurance lies in its ability to offer both coverage and an investment component. With each premium payment, a portion goes towards building a cash value, which can be borrowed against or withdrawn. This cash value grows over time, providing a tax-deferred asset that can be utilized for various financial purposes. For instance, you can use the accumulated cash value to pay for your child's college tuition or to supplement your retirement savings. This dual benefit of insurance and investment makes whole life insurance a powerful tool for long-term financial planning.

Furthermore, whole life insurance provides a sense of stability and peace of mind. Knowing that your loved ones will be financially protected in the event of your passing can be incredibly reassuring. The lifelong coverage ensures that your family's financial obligations are met, even if your income is no longer available. This aspect is especially crucial for those with long-term financial commitments, such as mortgage payments or business ventures, as it provides a reliable safety net.

In summary, for individuals with long-term needs and a desire for financial security, whole life insurance is a superior choice. Its lifelong coverage, combined with the potential for cash value accumulation, offers a comprehensive solution. By choosing whole life insurance, you can ensure that your family's financial future is protected, and your long-term goals are achieved, providing a sense of security and confidence.

Who Can Receive a Life Insurance Check?

You may want to see also

Flexibility: Term life offers flexibility to adjust coverage as needs change, while whole life is fixed

When it comes to life insurance, one of the key considerations for individuals is the flexibility and adaptability of the policy to their changing circumstances. This is where term life insurance and whole life insurance differ significantly, and understanding these differences can help you make an informed decision about your insurance needs.

Term life insurance is designed to provide coverage for a specific period, often 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay out a death benefit to the designated beneficiaries if the insured person passes away within that term. The beauty of term life insurance lies in its flexibility. As your life circumstances evolve, you may find that your insurance needs change. For instance, you might start a family and realize you need higher coverage to ensure your loved ones' financial security. Or, as you approach retirement, you may feel that your coverage can be reduced to reflect the changing nature of your financial obligations. With term life insurance, you can easily adjust the policy by increasing or decreasing the coverage amount, ensuring that your insurance remains relevant and appropriate for your current situation.

On the other hand, whole life insurance offers a different level of commitment and, consequently, less flexibility. This type of policy is a permanent insurance solution, providing coverage for the entire lifetime of the insured individual. Once you purchase whole life insurance, the death benefit and the premium remain fixed for the rest of your life. While whole life insurance provides long-term financial security, it may not be as adaptable as term life. If your circumstances change, you might find that the coverage is either too high or too low for your current needs. For example, if you've paid off your mortgage and your children have moved out, you may no longer require the same level of coverage as when you first purchased the policy. In such cases, you would need to consider other options or additional policies to adjust your coverage, which can be more complex and costly.

The flexibility of term life insurance allows you to make changes to your policy without incurring significant penalties or fees. This is particularly advantageous for those who anticipate significant life changes in the near future, such as starting a family, changing careers, or purchasing a home. By choosing term life, you can ensure that your insurance policy remains relevant and aligned with your evolving financial situation.

In summary, term life insurance provides a flexible and adaptable solution, allowing you to adjust coverage as your life circumstances change. This is in contrast to whole life insurance, which offers a fixed and permanent coverage option. Understanding the flexibility aspect of these insurance types can help you make a choice that best suits your current and future needs, ensuring that your insurance remains a valuable asset throughout your life's journey.

Life Changes: When to Update Your Insurance Coverage

You may want to see also

Tax Advantages: Whole life insurance builds cash value, offering tax-advantaged growth, unlike term life's pure coverage

When it comes to insurance, understanding the tax implications of different policies can be crucial for making informed financial decisions. One area where this becomes particularly evident is in the comparison between term life insurance and whole life insurance. While term life insurance provides pure coverage for a specified period, whole life insurance offers a unique feature that sets it apart: the accumulation of cash value.

Whole life insurance is designed to provide long-term financial security and offers a range of tax advantages. As the policyholder, you can benefit from tax-advantaged growth on the cash value portion of the policy. This means that the money accumulated in the policy's cash value account can grow tax-free until you decide to access it. Unlike term life, where the focus is solely on coverage, whole life insurance allows your money to work for you in a tax-efficient manner.

The tax benefits of whole life insurance become more apparent when considering the investment aspect. The cash value in a whole life policy can be invested in various options, such as stocks, bonds, or mutual funds. As the investment grows, the earnings can compound, providing a substantial return over time. This growth is often exempt from federal income taxes, allowing your money to grow faster and potentially accumulate a larger sum.

In contrast, term life insurance does not offer this tax-advantaged growth. Term policies are designed for a specific period, providing coverage without the accumulation of cash value. While term life is generally more affordable, it does not provide the same long-term financial benefits as whole life insurance. The primary purpose of term life is to offer pure coverage, ensuring financial protection during a defined period.

Understanding the tax implications is essential when evaluating insurance options. Whole life insurance's ability to build cash value and offer tax-advantaged growth can be a significant advantage for those seeking long-term financial planning. It provides a unique opportunity to grow your money while also ensuring a level of coverage that can be tailored to your specific needs. By considering these tax advantages, individuals can make more informed choices when deciding between term life and whole life insurance policies.

Colonial Penn Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the insured passes away during this term. Whole life insurance, on the other hand, is a permanent policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit and also includes a cash value component that grows over time.

Term life insurance is generally more affordable and cost-effective, especially for younger and healthier individuals. The premiums are typically lower because the coverage is limited to a specific term. Whole life insurance, due to its permanent nature and the inclusion of cash value, usually has higher premiums. The cost of whole life insurance increases over time as the cash value grows, making it more expensive in the long run.

Yes, both term and whole life insurance policies offer tax benefits. Premiums paid for term life insurance are generally tax-deductible in the year they are paid. Similarly, for whole life insurance, the premiums paid can be deducted, and the cash value growth may be tax-deferred until it is withdrawn. However, it's important to note that the death benefit received upon the insured's passing is typically tax-free.