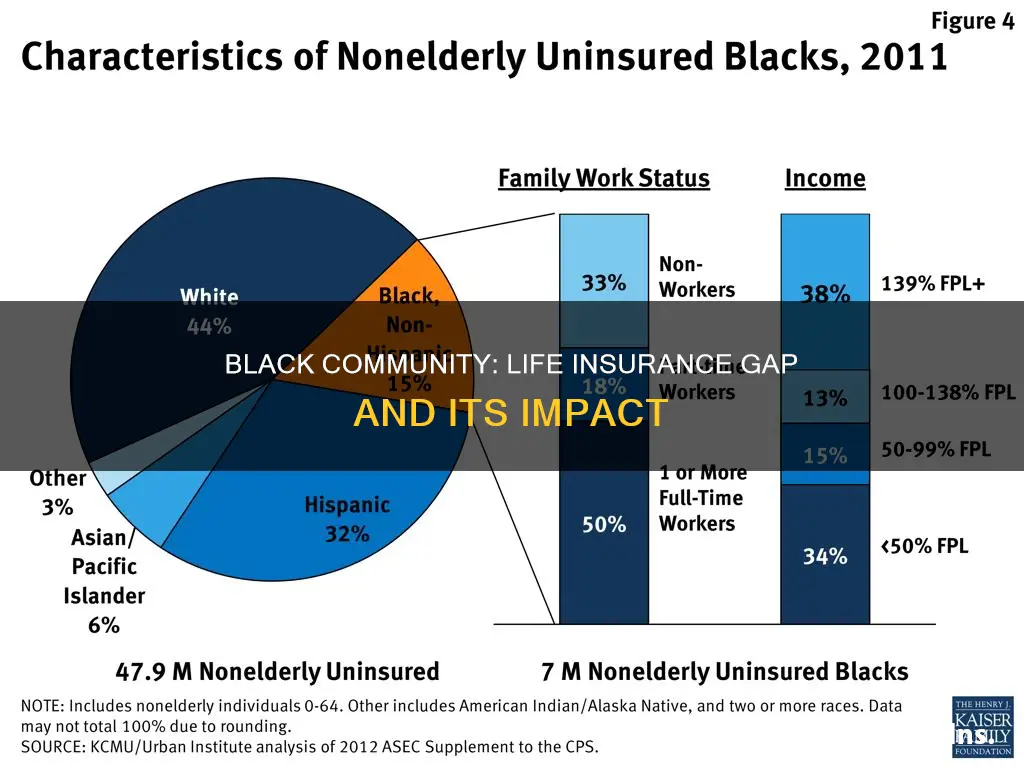

Black individuals in the United States are significantly underrepresented in the life insurance market, with a startling statistic revealing that a large percentage of Black people do not have life insurance. This lack of coverage is a critical issue, as life insurance provides financial security for families and can be a powerful tool for wealth-building and protection against unforeseen circumstances. The reasons for this disparity are multifaceted and often rooted in historical and systemic barriers, including economic disparities, lack of financial literacy, and limited access to insurance products tailored to the Black community. Understanding these factors is essential to addressing the gap and ensuring that Black families have the necessary financial protection.

What You'll Learn

- Income Disparity: Low-income Black individuals often lack life insurance due to financial constraints

- Education Gap: Limited financial literacy may hinder Black people's understanding of insurance benefits

- Historical Context: Historical racial disparities in wealth contribute to lower insurance coverage

- Access to Resources: Black communities may face barriers to accessing life insurance providers

- Cultural Norms: Traditional values and beliefs might influence Black individuals' insurance decisions

Income Disparity: Low-income Black individuals often lack life insurance due to financial constraints

The issue of income disparity and its impact on life insurance coverage among Black individuals is a critical aspect of financial inequality. Low-income Black families often face significant financial challenges, which can lead to a lack of access to essential financial products, including life insurance. This is a pressing concern as life insurance plays a vital role in providing financial security and peace of mind for individuals and their loved ones.

Financial constraints are a primary reason why low-income Black people might not have life insurance. The cost of life insurance premiums can be a burden for those with limited financial resources. Basic life insurance policies, which offer a death benefit to beneficiaries, typically require regular payments, and these payments can be substantial, especially for those with lower incomes. For instance, a 30-year-old Black man earning $30,000 annually might find it challenging to afford a standard life insurance policy, which could cost several hundred dollars per year. As a result, they may opt for no coverage at all, leaving their families vulnerable in the event of their untimely demise.

Furthermore, the lack of financial literacy and access to financial services exacerbates the problem. Many low-income individuals may not fully understand the importance of life insurance or the available options. They might not be aware of the different types of life insurance policies, such as term life, whole life, or universal life, and how these policies can provide financial protection. Without proper guidance and education, they may miss out on the opportunity to secure their families' financial future.

Community-based organizations and financial institutions can play a crucial role in addressing this issue. These entities can offer financial literacy programs, workshops, and resources to help low-income Black individuals understand the value of life insurance and navigate the process of obtaining coverage. Additionally, insurance companies can develop tailored products and payment plans to make life insurance more accessible and affordable for this demographic. By providing financial education and tailored solutions, these stakeholders can empower low-income Black families to make informed decisions about their financial well-being.

In conclusion, the income disparity faced by low-income Black individuals often results in a lack of life insurance coverage due to financial constraints. Addressing this issue requires a multi-faceted approach, including financial education, accessible insurance products, and community support. By taking these steps, we can work towards ensuring that more Black individuals have the financial security that life insurance provides, ultimately reducing the percentage of the Black population without this essential protection.

Flat Extra: Life Insurance's Hidden Cost Explained

You may want to see also

Education Gap: Limited financial literacy may hinder Black people's understanding of insurance benefits

The lack of financial literacy among Black communities can significantly impact their ability to secure and understand life insurance benefits. This knowledge gap often stems from systemic barriers and a lack of access to quality financial education, which can leave Black individuals vulnerable to making poor insurance decisions. As a result, many Black people may not fully grasp the importance of life insurance or the specific advantages it offers, leading to potential financial insecurity for their families.

Financial literacy is a critical skill that empowers individuals to make informed choices about their money and investments. It involves understanding basic financial concepts, such as budgeting, saving, investing, and managing debt. When it comes to life insurance, limited financial literacy can result in several detrimental outcomes. For instance, policyholders might struggle to comprehend the terms and conditions of their insurance policies, making it challenging to know what coverage they have and how to maximize its benefits. This can lead to situations where individuals might not be aware of their rights or the extent of their coverage, potentially resulting in financial losses or inadequate protection for their loved ones.

The education gap in financial literacy disproportionately affects Black communities due to historical and systemic factors. Historically, Black individuals have faced barriers to quality education, including limited access to resources, underfunded schools, and a lack of representation in financial education programs. These factors contribute to a cycle of financial vulnerability, where Black families may struggle to build wealth and secure their financial future. As a result, they might be less likely to have the necessary knowledge to navigate the complexities of life insurance and other financial products.

To address this issue, it is crucial to implement comprehensive financial education programs tailored to the specific needs of Black communities. These programs should focus on providing practical knowledge about insurance, including the different types of life insurance policies, their benefits, and how to choose the right coverage. By offering accessible and culturally relevant financial literacy resources, organizations can empower Black individuals to make informed decisions about their insurance needs. This may involve community workshops, online courses, or partnerships with financial institutions to create targeted educational initiatives.

Furthermore, financial institutions and insurance companies play a vital role in bridging the education gap. They can contribute by offering simplified explanations of insurance products, providing clear policy documents, and ensuring that their representatives are trained to explain complex concepts in a straightforward manner. By doing so, they can help Black individuals better understand their insurance options and make choices that align with their financial goals and circumstances. Ultimately, addressing the education gap in financial literacy is essential to ensuring that Black communities have the tools and knowledge to make informed decisions about life insurance, thereby securing their financial well-being and that of their families.

Reinstating Your Life and Health Insurance License: A Guide

You may want to see also

Historical Context: Historical racial disparities in wealth contribute to lower insurance coverage

The historical context of racial disparities in wealth accumulation has played a significant role in shaping the insurance landscape for Black individuals in the United States. For decades, systemic barriers and discriminatory practices have contributed to a wealth gap between Black and white families, which has had a direct impact on insurance coverage.

One of the primary reasons for lower insurance coverage among Black people is the historical lack of access to financial resources and opportunities. Throughout the 20th century, Black communities faced discrimination in various sectors, including housing, education, and employment. This systemic racism resulted in limited access to quality education, well-paying jobs, and affordable housing, all of which are crucial factors in building wealth. As a result, Black families often started from a much lower economic base, making it challenging to accumulate assets and secure financial stability.

The wealth gap has had a profound effect on insurance ownership. Life insurance, for instance, is often seen as a tool for financial security and a means to provide for one's family in the event of death. However, the high cost of life insurance policies and the complexity of the insurance market can be intimidating and inaccessible to those with limited financial resources. Black families, due to their historical disadvantage, may not have had the means to invest in such insurance products, leaving them vulnerable and increasing the likelihood of being underinsured.

Historically, insurance companies have also engaged in discriminatory practices that disproportionately affected Black individuals. Redlining, a practice where insurance companies denied coverage or charged higher premiums in certain neighborhoods, often targeted Black and minority communities. This practice not only limited access to insurance but also contributed to the perpetuation of financial disparities. As a result, Black families may have been priced out of the insurance market or faced higher costs, making it even more challenging to secure adequate coverage.

Addressing these historical disparities is crucial in ensuring that Black individuals have equal opportunities to protect their families and build financial security. Efforts to close the wealth gap and improve access to insurance products should be a priority. This includes promoting financial literacy, providing affordable insurance options, and implementing policies that combat systemic racism in the insurance industry. By understanding and addressing the historical context, we can work towards a more equitable insurance landscape for all.

Becoming a Life Insurance Agent in Louisiana: A Guide

You may want to see also

Access to Resources: Black communities may face barriers to accessing life insurance providers

Black communities often encounter significant obstacles when attempting to secure life insurance, which can have far-reaching consequences for their financial well-being and overall stability. One of the primary barriers is the lack of financial literacy and resources within these communities. Many individuals may not be aware of the various life insurance options available or the importance of having such coverage. This knowledge gap can lead to a reluctance or inability to make informed decisions about life insurance, resulting in a higher percentage of Black people not having this essential protection.

The historical context of racial discrimination in the insurance industry also plays a crucial role in this issue. Historically, Black individuals have faced systemic barriers to equal access to insurance products. This includes discriminatory practices by insurance companies, such as higher premiums for Black policyholders and limited coverage options. These discriminatory tactics have contributed to a cycle of financial disadvantage, where Black families may struggle to build wealth and secure their future due to the lack of adequate life insurance.

Another challenge lies in the limited availability of life insurance providers in predominantly Black neighborhoods. Insurance companies often have fewer local offices or representatives in these areas, making it more difficult for residents to seek information and assistance. As a result, Black individuals might have to rely on online resources or limited local options, which may not provide the necessary guidance and support to navigate the complex world of life insurance.

Furthermore, the economic disparities within Black communities can also hinder access to life insurance. Lower-income families may face financial constraints that make it challenging to afford life insurance premiums. This is particularly true when considering the higher costs associated with life insurance for individuals with pre-existing health conditions, which are more prevalent in certain Black demographic groups. As a result, these individuals might be forced to opt for less comprehensive coverage or even go without life insurance altogether.

To address these barriers, it is essential to implement targeted initiatives. Financial education programs tailored for Black communities can empower individuals to make informed choices about life insurance. Additionally, increasing the number of local insurance providers and representatives in these areas can improve accessibility. Government and community organizations should also work towards promoting financial literacy and providing resources to help Black families understand their options and make the best decisions for their long-term financial security.

Key Employee Life Insurance Proceeds: Taxable or Not?

You may want to see also

Cultural Norms: Traditional values and beliefs might influence Black individuals' insurance decisions

Cultural norms and traditional values within the Black community can significantly impact insurance decisions, particularly regarding life insurance. These cultural factors often shape financial behaviors and attitudes, which can result in lower insurance coverage among Black individuals.

In many Black communities, there is a strong emphasis on oral traditions and a focus on passing down wealth and resources through family members. This cultural practice may lead to a reluctance to purchase life insurance, as individuals might believe that their loved ones will be taken care of through other means. The idea of providing for one's family through inheritance or other traditional methods can make insurance seem less appealing or necessary.

Additionally, historical and systemic factors have contributed to financial disparities within the Black community. Past discriminatory practices in the insurance industry, such as redlining and discriminatory underwriting, have likely left a lasting impact. These experiences may have fostered a sense of skepticism or distrust towards insurance companies, making Black individuals more cautious about purchasing insurance products.

Furthermore, cultural beliefs and values related to risk and mortality can also play a role. Some Black communities may have a higher acceptance of risk, believing that life is uncertain and that one's time is limited. This perspective might lead individuals to prioritize immediate financial needs over long-term financial security, potentially resulting in a lower demand for life insurance.

Addressing these cultural influences is essential in promoting insurance awareness and literacy within the Black community. Educating individuals about the benefits of insurance, dispelling myths, and providing culturally sensitive financial advice can help bridge the gap in insurance coverage. By understanding and respecting these cultural norms, insurance providers can develop more effective strategies to encourage and support Black individuals in making informed decisions about their insurance needs.

Life Insurance and Skydiving: What's Covered in Accidents?

You may want to see also

Frequently asked questions

According to a 2022 study by LIMRA and the Society of Human Resource Management, approximately 43% of black adults in the U.S. do not have life insurance. This is significantly higher than the overall national average of 31%.

There are several factors contributing to this disparity. Historically, black communities have faced barriers to financial services, including insurance. Additionally, lower average household wealth and income levels among black families can make purchasing life insurance more challenging. Cultural and educational factors may also play a role, as awareness and understanding of the benefits of life insurance can vary within these communities.

The absence of life insurance can have severe consequences for black families. In the event of a primary breadwinner's death, life insurance can provide financial security, covering expenses like funeral costs, outstanding debts, mortgage payments, and daily living expenses. Without this safety net, families may struggle financially, potentially leading to long-term debt or a decline in their standard of living.

Yes, several organizations and financial institutions are working to address this issue. These include community-based organizations, financial advisors, and insurance companies that offer targeted programs and educational resources. Some initiatives focus on financial literacy, helping individuals understand the importance of life insurance and how to choose suitable policies.

To bridge the gap, a multi-faceted approach is necessary. This includes increasing financial literacy, providing accessible and affordable insurance options, and addressing the historical and systemic barriers that have prevented equal access to financial services. Community engagement, partnerships with local leaders, and targeted marketing campaigns can also help raise awareness and encourage life insurance adoption among black adults.