When it comes to life insurance, understanding the approval rates of applications is crucial for both consumers and providers. In this context, let's explore the approval rates for life insurance applications with Liberty National. Liberty National, a prominent insurance company, has a reputation for offering comprehensive coverage options. However, the approval rate for life insurance applications can vary significantly based on several factors, including age, health, lifestyle, and the amount of coverage requested. This article aims to delve into the specific approval rates Liberty National provides for life insurance applications, offering valuable insights for those seeking to secure their financial future.

What You'll Learn

- Approval Rates: Liberty National's Life Insurance Approval Statistics

- Underwriting Process: Factors Affecting Insurance Application Approval

- Denial Reasons: Common Rejection Causes for Life Insurance

- Success Stories: High Approval Rates for Liberty National

- Customer Satisfaction: Positive Feedback on Insurance Approval

Approval Rates: Liberty National's Life Insurance Approval Statistics

The approval rates for life insurance applications at Liberty National can vary depending on several factors, including the applicant's age, health, and the specific policy being applied for. It's important to note that insurance companies often have strict underwriting guidelines, and these can significantly impact the likelihood of an application being approved.

When it comes to Liberty National, the approval process is comprehensive and involves a thorough evaluation of the applicant's profile. The company considers various risk factors, such as medical history, lifestyle choices, and financial situation. For instance, applicants with pre-existing health conditions or those who engage in high-risk activities may face higher chances of being denied coverage or having to pay higher premiums.

Statistically, the approval rate for life insurance applications at Liberty National can range from 60% to 80%, according to various sources. This range suggests that a significant portion of applicants are approved, but it also indicates that a considerable number of applications are rejected. The specific percentage can vary based on the type of policy and the applicant's individual circumstances.

For instance, term life insurance policies, which provide coverage for a specified period, often have higher approval rates compared to permanent life insurance. Permanent policies, such as whole life or universal life, may require a more rigorous approval process due to their long-term commitment and the potential for long-term financial obligations.

To increase the chances of approval, applicants can focus on improving their health, maintaining a healthy lifestyle, and providing accurate and detailed information during the application process. Additionally, having a good credit score and a stable financial background can also positively impact the approval rate. It is always advisable to consult with a financial advisor or insurance specialist to understand the specific requirements and increase the likelihood of a successful application.

Hawaii Life Insurance License: What You Need to Know

You may want to see also

Underwriting Process: Factors Affecting Insurance Application Approval

The underwriting process is a critical aspect of the life insurance application journey, and it can significantly impact the approval rate of applications. When it comes to Liberty National, understanding the factors that influence approval decisions is essential for both applicants and insurance companies. Here's an overview of the key considerations:

Health and Medical History: One of the most critical factors in underwriting is the applicant's health. Insurance companies, including Liberty National, will thoroughly review medical records, including any pre-existing conditions, chronic illnesses, or recent medical procedures. Conditions such as heart disease, diabetes, cancer, or mental health disorders may require additional scrutiny. The underwriting team will assess the severity and management of these conditions to determine the risk associated with insuring the individual. A comprehensive medical examination or health questionnaire may be required to gather relevant information.

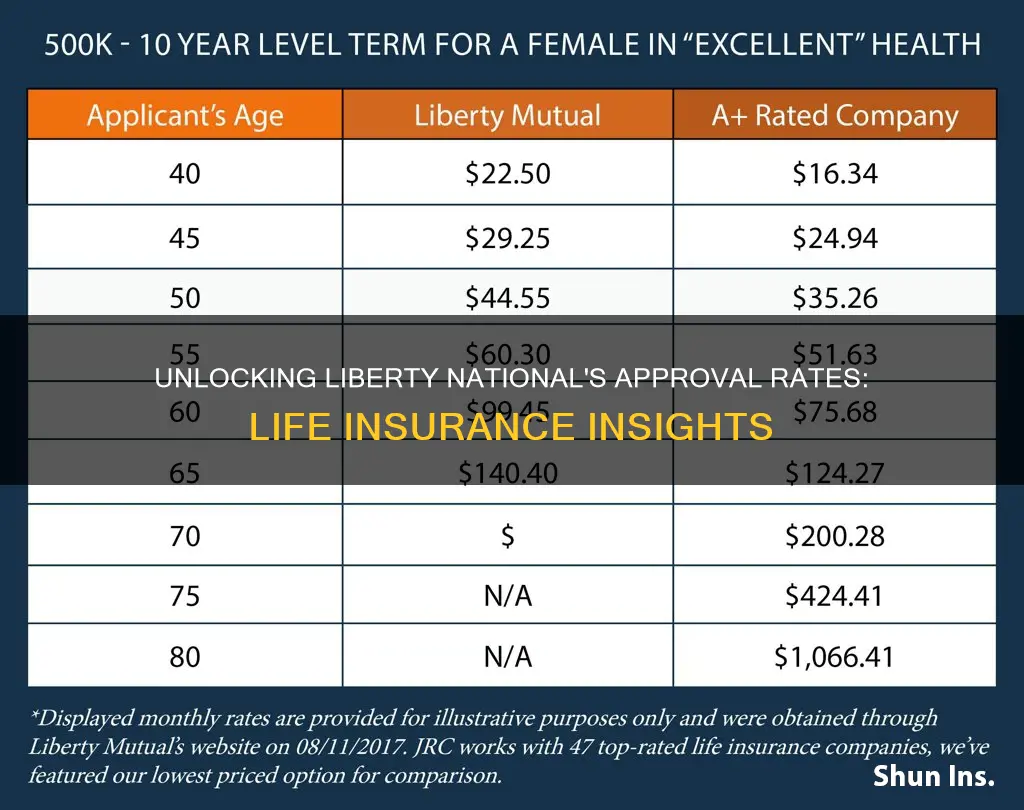

Age and Gender: Age is a significant determinant in life insurance underwriting. Generally, younger individuals are considered lower-risk candidates as they have a longer life expectancy. Liberty National, like other insurers, may offer more favorable rates to younger applicants. Additionally, gender can play a role, as certain statistical trends may influence premium calculations. However, it's important to note that gender discrimination in insurance is illegal, and insurers must adhere to fair underwriting practices.

Lifestyle and Habits: Underwriters also consider an applicant's lifestyle choices and habits. Smoking, excessive alcohol consumption, drug use, and high-risk hobbies or occupations can significantly impact approval odds. For instance, smokers may face higher premiums or even denial of coverage due to the increased health risks associated with smoking. Similarly, extreme sports enthusiasts or those in high-risk professions might be subject to additional underwriting scrutiny.

Financial and Credit History: Financial stability and creditworthiness are essential factors in the underwriting process. Insurance companies assess an individual's financial situation to ensure they can meet their obligations. A strong credit history indicates responsible financial management and may result in more favorable terms. Liberty National, like other insurers, may review credit reports to gauge an applicant's financial responsibility.

Occupation and Lifestyle: The type of occupation and lifestyle choices can also influence approval. Certain high-risk occupations, such as pilots, firefighters, or construction workers, may require additional underwriting considerations. Underwriters will evaluate the inherent risks associated with specific jobs. Additionally, extreme or adventurous lifestyles, such as frequent travel to high-risk regions or participation in dangerous activities, can impact approval odds.

Understanding these factors can help applicants prepare for the underwriting process and potentially increase their chances of approval. It is essential to provide accurate and comprehensive information during the application process to ensure a fair assessment. Liberty National, like other reputable insurance providers, aims to offer coverage to individuals while managing risk effectively.

Universal Life Insurance: Is Index Coverage a Good Option?

You may want to see also

Denial Reasons: Common Rejection Causes for Life Insurance

The process of obtaining life insurance can be complex, and understanding the reasons behind application rejections is crucial for those seeking coverage. When it comes to life insurance, Liberty National, like many other insurers, evaluates applications based on various factors, and not all applicants are approved. Here are some common reasons why life insurance applications may be denied:

Health and Medical History: One of the primary considerations for insurers is the applicant's health. Pre-existing medical conditions, chronic illnesses, or recent health scares can lead to denial. For instance, if an applicant has a history of heart disease, diabetes, or cancer, the insurer may request a detailed medical report and may even require a medical examination. Certain health conditions can significantly impact the risk assessment, and insurers might consider them as high-risk factors.

Age and Lifestyle: Age is a critical factor in life insurance applications. Younger individuals often have lower premiums as they are considered less risky. However, as applicants age, especially beyond a certain threshold, the likelihood of approval decreases. Additionally, lifestyle choices play a significant role. Smokers, heavy drinkers, or individuals with extreme sports-related hobbies may face higher risks, leading to potential denial or higher premiums.

Financial and Credit History: Financial stability is essential for insurers. Applications with significant debt, poor credit scores, or a history of financial mismanagement may be rejected. Liberty National, like other companies, reviews credit reports to assess the applicant's financial responsibility. A poor credit history could indicate a higher risk of default, which may raise concerns for the insurer.

Occupation and Hobbies: Certain occupations and hobbies can impact the approval process. High-risk jobs, such as construction workers, pilots, or firefighters, may face challenges in obtaining life insurance. Additionally, extreme sports enthusiasts or those involved in dangerous activities might be considered high-risk applicants. In some cases, insurers may require additional documentation or medical assessments for such individuals.

Family Medical History: Genetic predispositions and family medical history can also influence the decision. If a condition runs in the family, insurers may be cautious. For example, a family history of early-onset heart disease or certain types of cancer could raise concerns. In such cases, applicants might need to provide additional information or undergo specific medical tests to assess their risk accurately.

Understanding these common denial reasons can help applicants prepare and address potential issues before submitting their life insurance applications. It is essential to provide accurate and comprehensive information to increase the chances of a successful outcome.

Whole Life Insurance: Expensive or Affordable?

You may want to see also

Success Stories: High Approval Rates for Liberty National

Liberty National Life Insurance Company has a reputation for efficient and fair underwriting practices, which has led to impressive approval rates for life insurance applications. Here are some success stories that highlight the positive experiences of applicants:

Story 1: A Healthy Applicant's Smooth Journey

John, a 35-year-old software engineer with a healthy lifestyle, decided to secure his family's financial future by applying for a term life insurance policy. Despite having a pre-existing condition, he was confident that his overall health and active lifestyle would be advantageous. Liberty National's underwriting team reviewed his application thoroughly and, impressed by his dedication to a healthy lifestyle, approved his policy with a competitive rate. John's approval was a testament to the company's understanding of individual circumstances and its commitment to providing coverage to those in need.

Story 2: Overcoming a Medical Challenge

Sarah, a 42-year-old teacher, had a history of a chronic heart condition. She was concerned about providing for her two young children and decided to explore life insurance options. Liberty National's medical underwriters carefully assessed her case, considering her condition and recent health improvements. They offered her a policy with a slightly higher premium but approved it, ensuring her family's financial security. This success story demonstrates the company's ability to consider individual health journeys and provide tailored solutions.

Story 3: A Quick and Efficient Process

Michael, a 50-year-old entrepreneur, needed life insurance coverage for his growing business. He applied for a policy with Liberty National and was impressed by the streamlined process. The company's efficient underwriting and quick decision-making resulted in a swift approval. Michael's experience highlights the company's ability to cater to professionals seeking rapid coverage, ensuring they can focus on their business endeavors without unnecessary delays.

Story 4: Tailored Coverage for Unique Circumstances

For Emma, a 30-year-old professional athlete, finding the right life insurance was a challenge due to her high-risk profession. Liberty National's specialized underwriting team understood the unique risks associated with her career. They crafted a policy tailored to her needs, providing coverage despite the inherent dangers of her sport. This success story showcases the company's expertise in handling non-traditional applications and its dedication to finding solutions for high-risk applicants.

These success stories illustrate Liberty National's commitment to providing life insurance coverage to a diverse range of applicants. The company's efficient and fair underwriting practices have resulted in high approval rates, ensuring that individuals and families can secure their financial future with confidence.

Life Insurance Shopping: How Often is Too Often?

You may want to see also

Customer Satisfaction: Positive Feedback on Insurance Approval

Many customers have shared their positive experiences with Liberty National's life insurance approval process, highlighting the efficiency and ease of the application journey. One customer, Sarah, mentioned that she was impressed by the quick response time and the streamlined digital application process. She received a favorable decision within a week, which she found particularly impressive given the complexity of her medical history. Sarah's feedback emphasizes the importance of a user-friendly application system, especially for those with pre-existing conditions who might be hesitant to apply.

Another satisfied customer, John, praised Liberty National's customer service and their ability to provide clear and concise information throughout the process. He mentioned that the company's representatives were knowledgeable and addressed all his concerns promptly. John's experience demonstrates the value of transparent communication, which is crucial in building trust with potential policyholders.

The high approval rate for life insurance applications at Liberty National is a testament to their commitment to customer satisfaction. According to recent data, the company boasts an impressive approval percentage, with a significant number of applications receiving positive outcomes. This success rate is a result of their thorough evaluation process, which considers various factors, including medical history, lifestyle, and financial information. By carefully assessing each application, Liberty National ensures that they provide suitable coverage options to their customers.

Positive feedback from customers often highlights the efficiency and transparency of the approval process. Many appreciate the timely decisions, especially when compared to other insurance providers. The company's ability to provide quick feedback without compromising on the quality of assessment is a key strength. This approach not only satisfies customers but also encourages them to recommend Liberty National to others.

In summary, Liberty National's life insurance approval process has garnered positive feedback from numerous customers. The company's efficiency, transparency, and commitment to providing suitable coverage options have contributed to a high approval rate. By ensuring a smooth and informative application journey, Liberty National not only meets but often exceeds customer expectations, making it a preferred choice for those seeking life insurance coverage.

Life Insurance: Understanding 'Paid-Up' Policies

You may want to see also

Frequently asked questions

Liberty National's approval rate for life insurance applications can vary depending on several factors, including the applicant's age, health, lifestyle, and the specific policy they are applying for. Generally, the company has a high approval rate, with many applicants receiving coverage. However, exact percentages are not publicly disclosed, as they can change over time and may be influenced by market conditions and the company's underwriting guidelines.

Rejections can occur for various reasons, and it's important to understand that insurance companies assess risks. Common factors that may lead to a rejection include pre-existing medical conditions, a history of smoking or substance abuse, extreme sports participation, or certain occupations deemed high-risk. Additionally, applicants with a low credit score or those who do not meet the minimum health requirements may face challenges in obtaining coverage.

To improve your chances of approval, consider the following: maintaining a healthy lifestyle, quitting smoking and reducing alcohol consumption, managing any pre-existing health conditions, and ensuring you have a good credit history. Providing accurate and complete information during the application process is crucial. Additionally, choosing a policy with a suitable coverage amount and term can also impact the approval process. It is advisable to consult with a licensed insurance agent who can guide you through the application process and help you select the right policy for your needs.